Vulcan Materials trades at $311.18 per share and has stayed right on track with the overall market, gaining 10.4% over the last six months. At the same time, the S&P 500 has returned 10.2%.

Is there a buying opportunity in Vulcan Materials, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Vulcan Materials Not Exciting?

We're swiping left on Vulcan Materials for now. Here are three reasons you should be careful with VMC and a stock we'd rather own.

1. Decline in Tons Shipped Points to Weak Demand

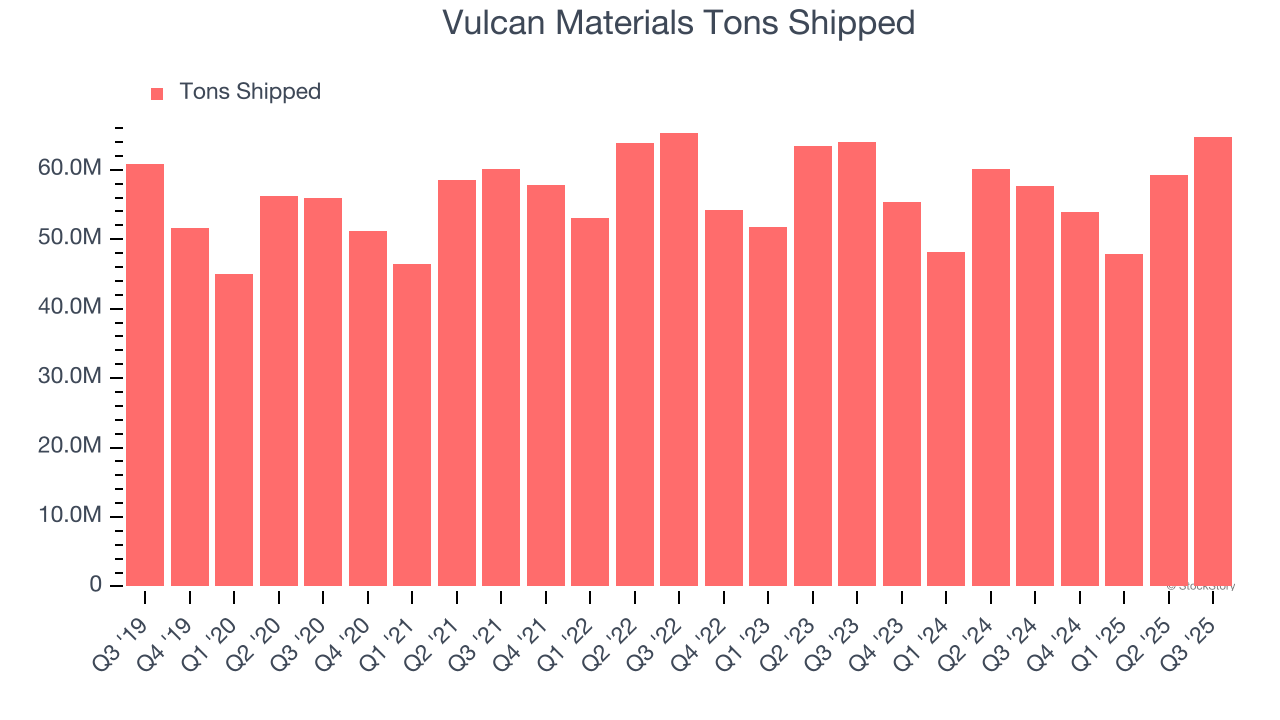

Revenue growth can be broken down into changes in price and volume (for companies like Vulcan Materials, our preferred volume metric is tons shipped). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Vulcan Materials’s tons shipped came in at 64.7 million in the latest quarter, and over the last two years, averaged 1.6% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Vulcan Materials might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Vulcan Materials’s revenue to rise by 4.3%. Although this projection indicates its newer products and services will spur better top-line performance, it is still below average for the sector.

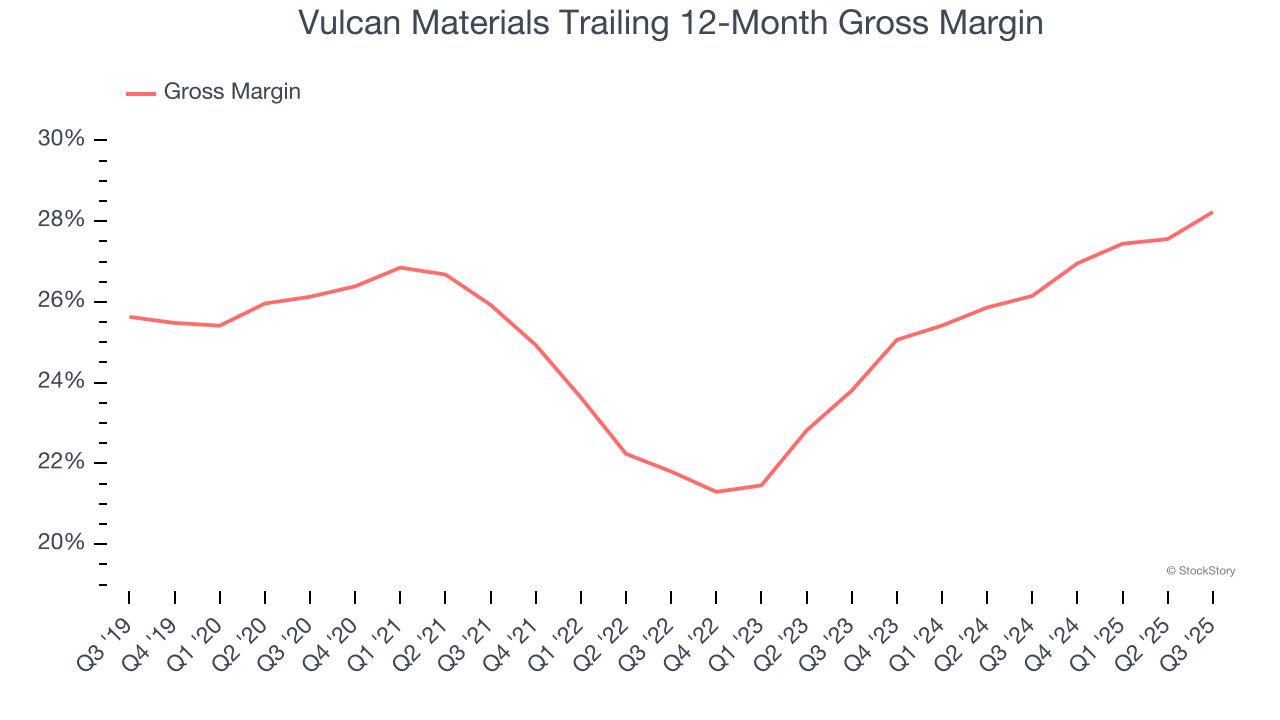

3. Low Gross Margin Reveals Weak Structural Profitability

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products and commands stronger pricing power.

Vulcan Materials has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 25.2% gross margin over the last five years. That means Vulcan Materials paid its suppliers a lot of money ($74.82 for every $100 in revenue) to run its business.

Final Judgment

Vulcan Materials isn’t a terrible business, but it isn’t one of our picks. That said, the stock currently trades at 32.7× forward P/E (or $311.18 per share). Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're fairly confident there are better investments elsewhere. Let us point you toward one of our top software and edge computing picks.

Stocks We Like More Than Vulcan Materials

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.