Advanced Drainage’s 26.2% return over the past six months has outpaced the S&P 500 by 13.3%, and its stock price has climbed to $148.94 per share. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Following the strength, is WMS a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free for active Edge members.

Why Does Advanced Drainage Spark Debate?

Originally started as a farm water drainage company, Advanced Drainage Systems (NYSE:WMS) provides clean water management solutions to communities across America.

Two Things to Like:

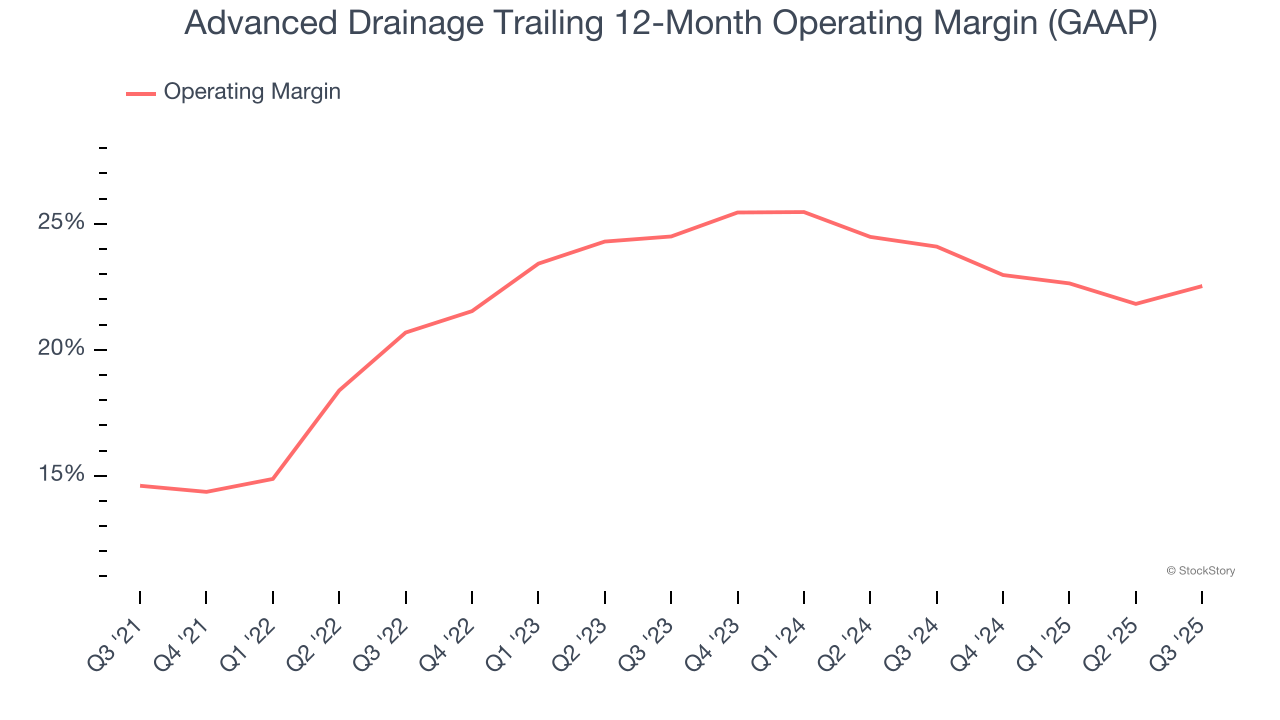

1. Operating Margin Reveals a Well-Run Organization

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Advanced Drainage has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 21.5%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

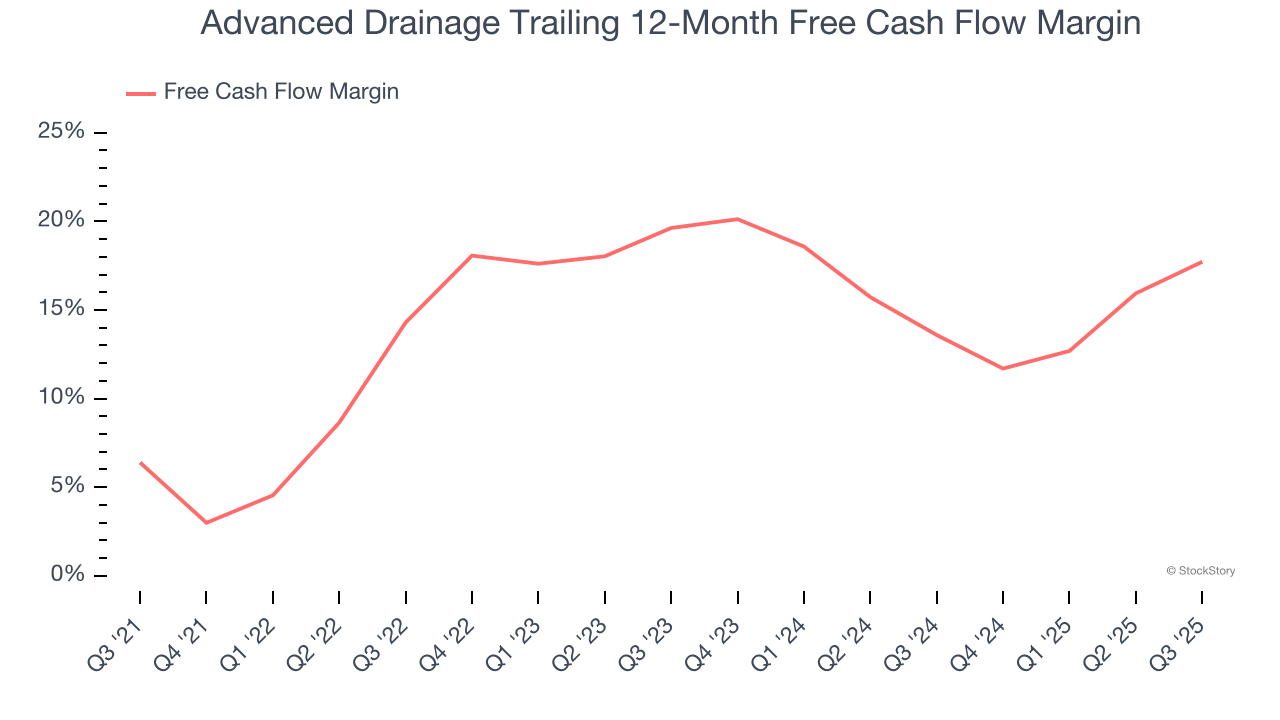

2. Increasing Free Cash Flow Margin Juices Financials

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Advanced Drainage’s margin expanded by 11.3 percentage points over the last five years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability. Advanced Drainage’s free cash flow margin for the trailing 12 months was 17.7%.

One Reason to be Careful:

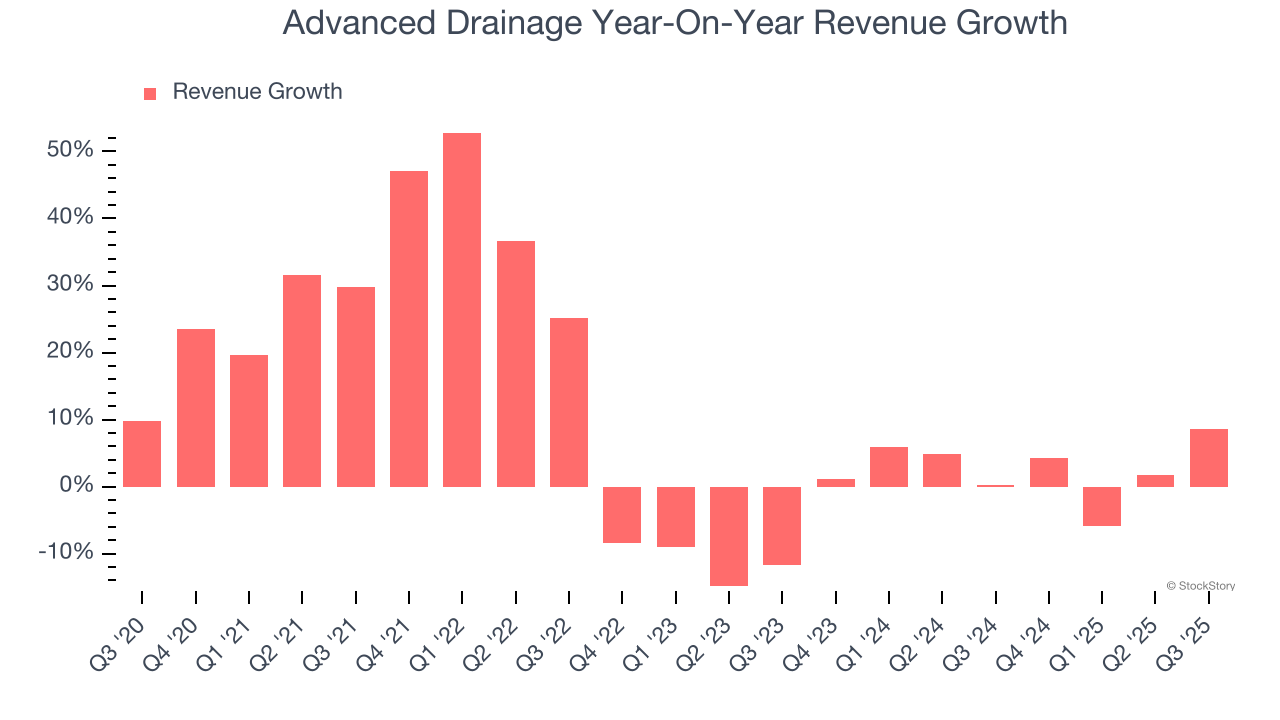

Lackluster Revenue Growth

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. Advanced Drainage’s recent performance shows its demand has slowed as its annualized revenue growth of 2.7% over the last two years was below its five-year trend.

Final Judgment

Advanced Drainage’s positive characteristics outweigh the negatives, and with its shares topping the market in recent months, the stock trades at 24.3× forward P/E (or $148.94 per share). Is now a good time to initiate a position? See for yourself in our comprehensive research report, it’s free for active Edge members .

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.