Warby Parker’s 26.4% return over the past six months has outpaced the S&P 500 by 15.1%, and its stock price has climbed to $29.08 per share. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Following the strength, is WRBY a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Is Warby Parker a Good Business?

Founded in 2010, Warby Parker (NYSE:WRBY) designs, manufactures, and sells eyewear, including prescription glasses, sunglasses, and contact lenses, through its e-commerce platform and physical retail locations.

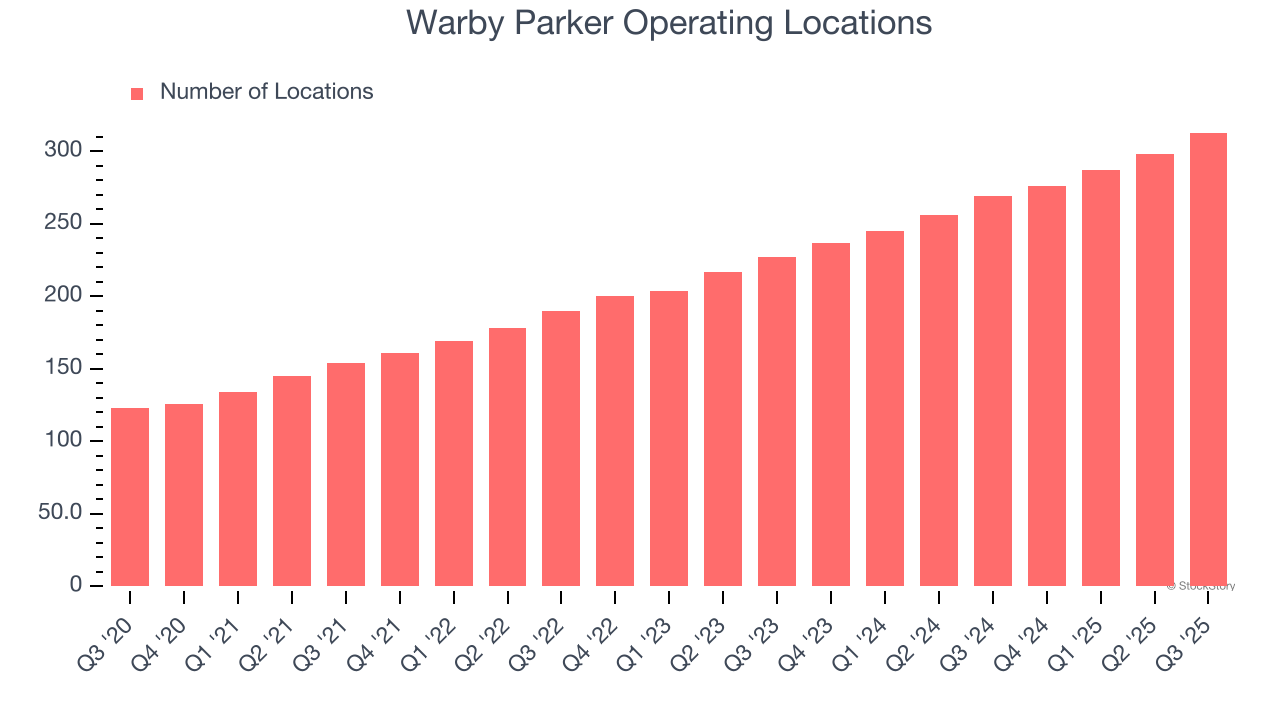

1. New Stores Opening at Breakneck Speed

A retailer’s store count often determines how much revenue it can generate.

Warby Parker operated 313 locations in the latest quarter. It has opened new stores at a rapid clip over the last two years, averaging 17.7% annual growth, much faster than the broader consumer retail sector. This gives it a chance to scale into a mid-sized business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

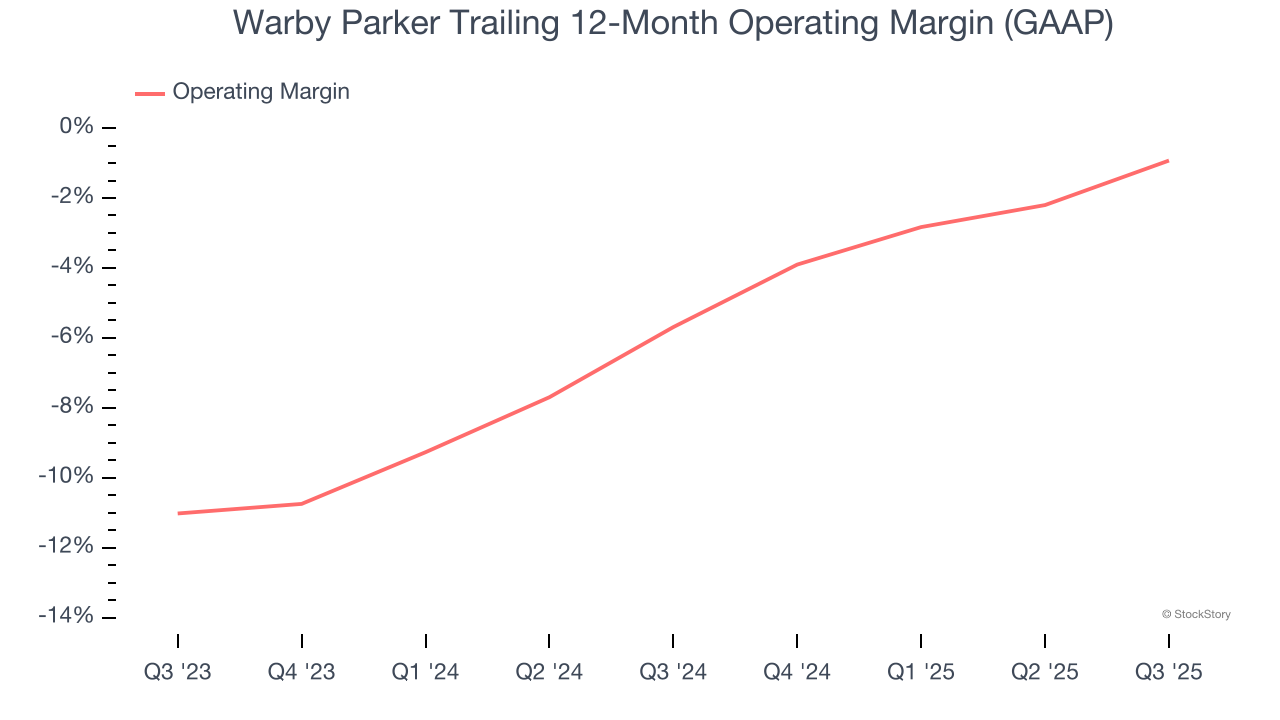

2. Operating Margin Rising, Profits Up

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Warby Parker’s operating margin rose by 4.8 percentage points over the last year, as its sales growth gave it operating leverage. Its operating margin for the trailing 12 months was breakeven.

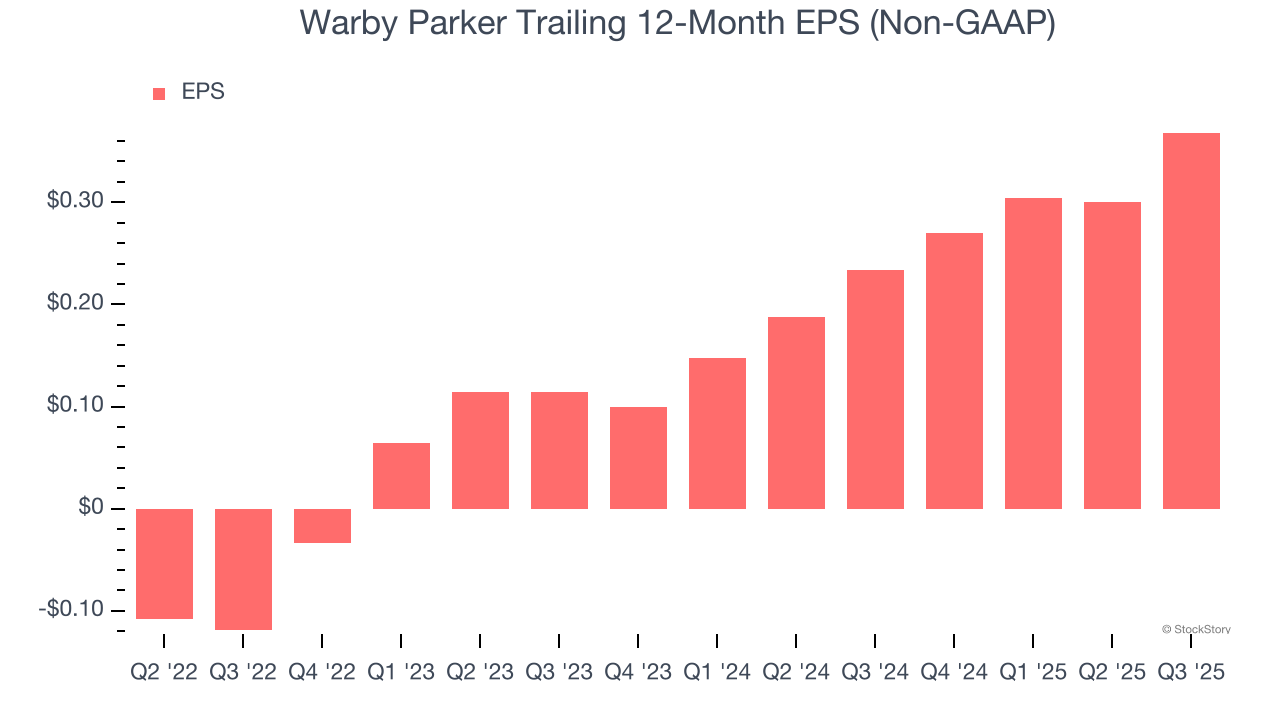

3. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Warby Parker’s full-year EPS flipped from negative to positive over the last three years. This is a good sign and shows it’s at an inflection point.

Final Judgment

These are just a few reasons why Warby Parker ranks highly on our list, and with its shares topping the market in recent months, the stock trades at 59.1× forward P/E (or $29.08 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Warby Parker

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.