Wrapping up Q3 earnings, we look at the numbers and key takeaways for the beauty and cosmetics retailer stocks, including Warby Parker (NYSE:WRBY) and its peers.

Beauty and cosmetics retailers understand that beauty is in the eye of the beholder, but a little lipstick, nail polish, and glowing skin also help the cause. These stores—which mostly cater to consumers but can also garner the attention of salon pros—aim to be a one-stop personal care and beauty products shop with many brands across many categories. E-commerce is changing how consumers buy cosmetics, so these retailers are constantly evolving to meet the customer where and how they want to shop.

The 4 beauty and cosmetics retailer stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 0.7%.

Luckily, beauty and cosmetics retailer stocks have performed well with share prices up 19.3% on average since the latest earnings results.

Warby Parker (NYSE:WRBY)

Founded in 2010, Warby Parker (NYSE:WRBY) designs, manufactures, and sells eyewear, including prescription glasses, sunglasses, and contact lenses, through its e-commerce platform and physical retail locations.

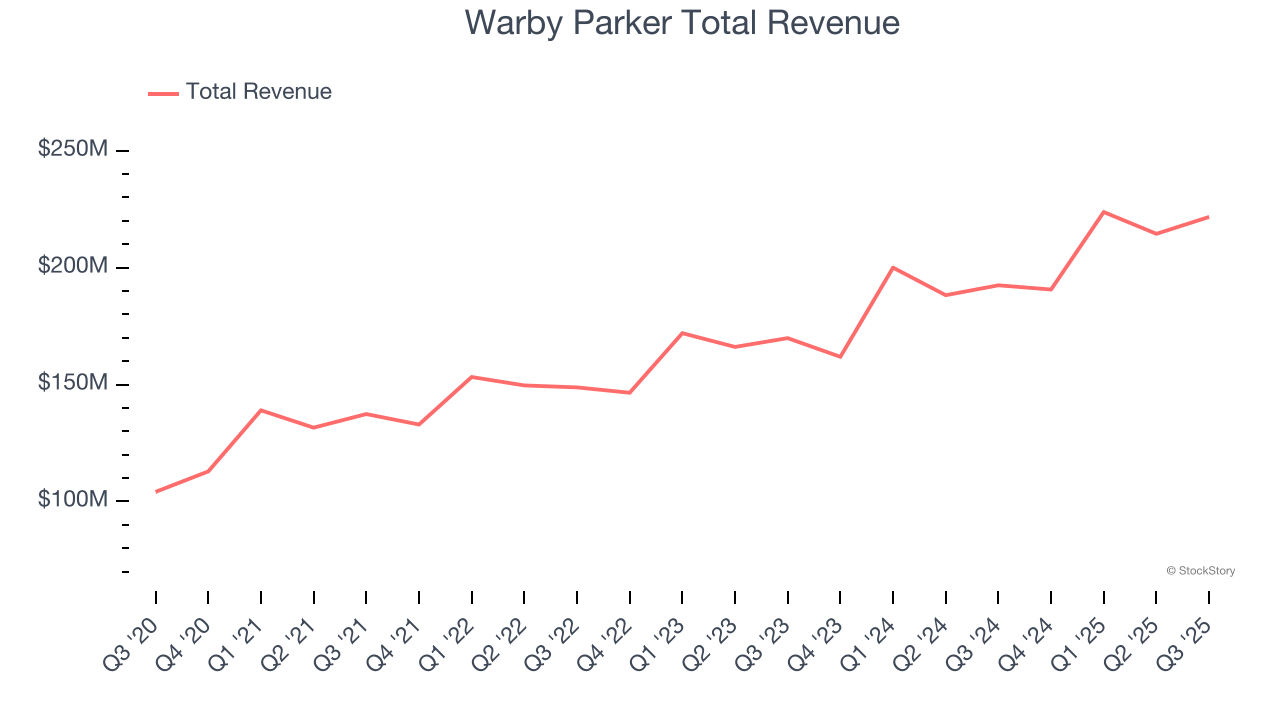

Warby Parker reported revenues of $221.7 million, up 15.2% year on year. This print fell short of analysts’ expectations by 1.2%, but it was still a satisfactory quarter for the company with a beat of analysts’ EPS estimates but full-year revenue guidance missing analysts’ expectations.

Warby Parker achieved the fastest revenue growth but had the weakest full-year guidance update of the whole group. The company reported 2.66 million active customers, up 9.5% year on year. Unsurprisingly, the stock is up 38.9% since reporting and currently trades at $26.45.

Is now the time to buy Warby Parker? Access our full analysis of the earnings results here, it’s free.

Best Q3: Ulta (NASDAQ:ULTA)

Offering high-end prestige brands as well as lower-priced, mass-market ones, Ulta Beauty (NASDAQ:ULTA) is an American retailer that sells makeup, skincare, haircare, and fragrance products.

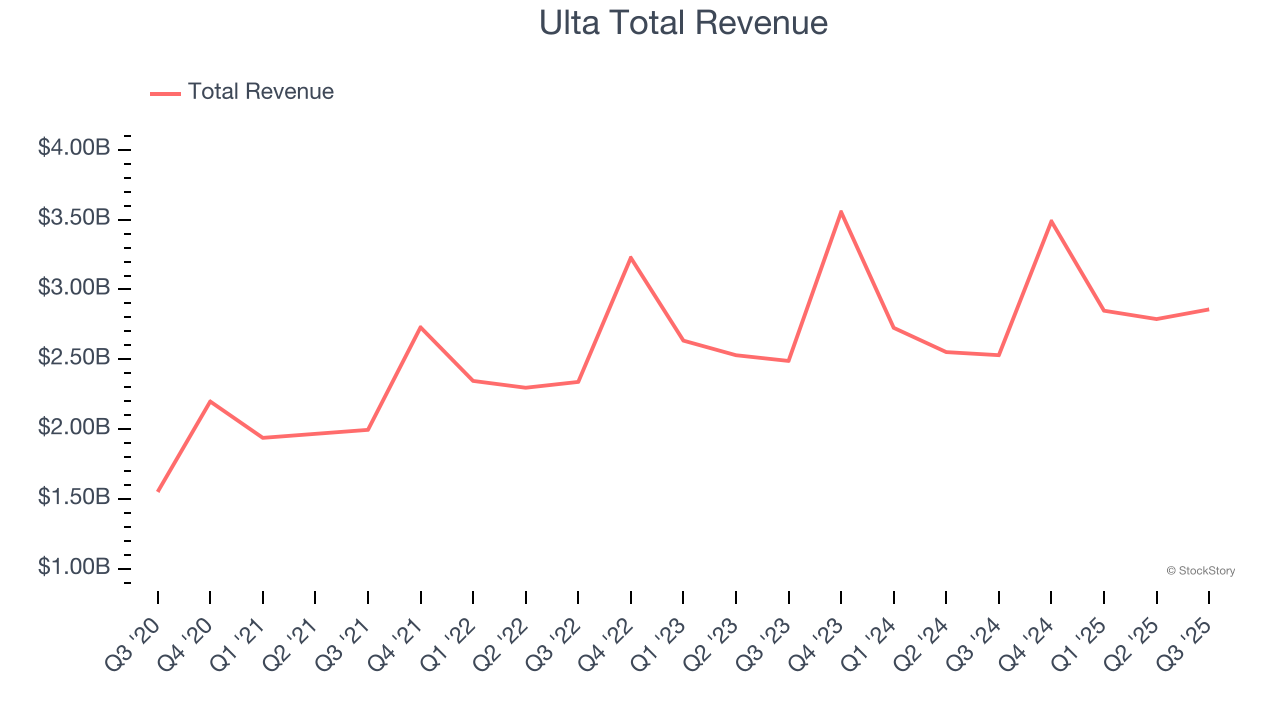

Ulta reported revenues of $2.86 billion, up 12.9% year on year, outperforming analysts’ expectations by 5.2%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ revenue estimates.

Ulta scored the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 28.3% since reporting. It currently trades at $685.06.

Is now the time to buy Ulta? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Bath and Body Works (NYSE:BBWI)

Spun off from L Brands in 2020, Bath & Body Works (NYSE:BBWI) is a personal care and home fragrance retailer where consumers can find specialty shower gels, scented candles for the home, and lotions.

Bath and Body Works reported revenues of $1.59 billion, flat year on year, falling short of analysts’ expectations by 2.7%. It was a disappointing quarter as it posted full-year EPS guidance missing analysts’ expectations significantly and a significant miss of analysts’ EBITDA estimates.

Bath and Body Works delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 5.4% since the results and currently trades at $22.17.

Read our full analysis of Bath and Body Works’s results here.

Sally Beauty (NYSE:SBH)

Catering to both everyday consumers as well as salon professionals, Sally Beauty (NYSE:SBH) is a retailer that sells salon-quality beauty products such as makeup and haircare products.

Sally Beauty reported revenues of $947.1 million, up 1.3% year on year. This result beat analysts’ expectations by 1.6%. It was a very strong quarter as it also logged a solid beat of analysts’ EBITDA and EPS estimates.

Sally Beauty scored the highest full-year guidance raise among its peers. The stock is up 4.9% since reporting and currently trades at $15.40.

Read our full, actionable report on Sally Beauty here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.