CLEAR Secure trades at $33.45 and has moved in lockstep with the market. Its shares have returned 12.9% over the last six months while the S&P 500 has gained 9.5%.

Is now the time to buy YOU? Find out in our full research report, it’s free.

Why Is YOU a Good Business?

Recognized by its signature blue lanes and biometric pods at airport checkpoints across America, CLEAR Secure (NYSE:YOU) provides biometric identity verification technology that allows subscribers to bypass regular security lines at airports and access secure experiences at various venues.

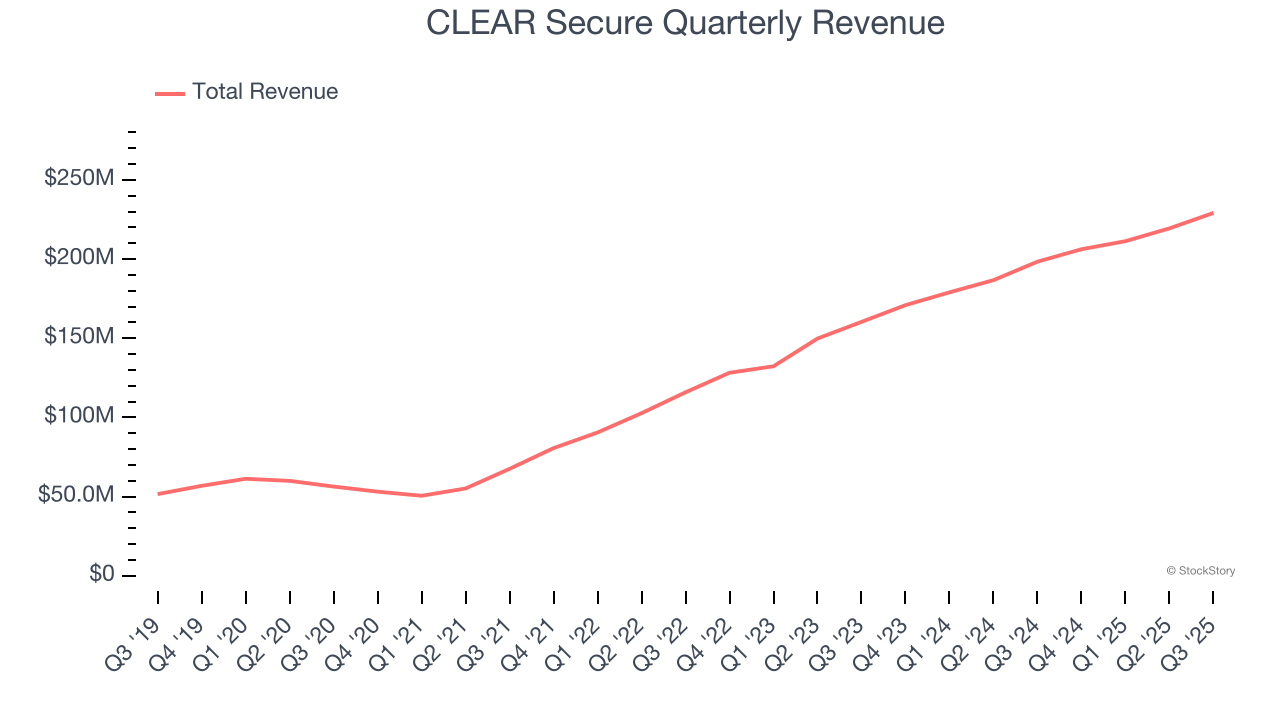

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, CLEAR Secure’s sales grew at an impressive 29.9% compounded annual growth rate over the last five years. Its growth surpassed the average software company and shows its offerings resonate with customers.

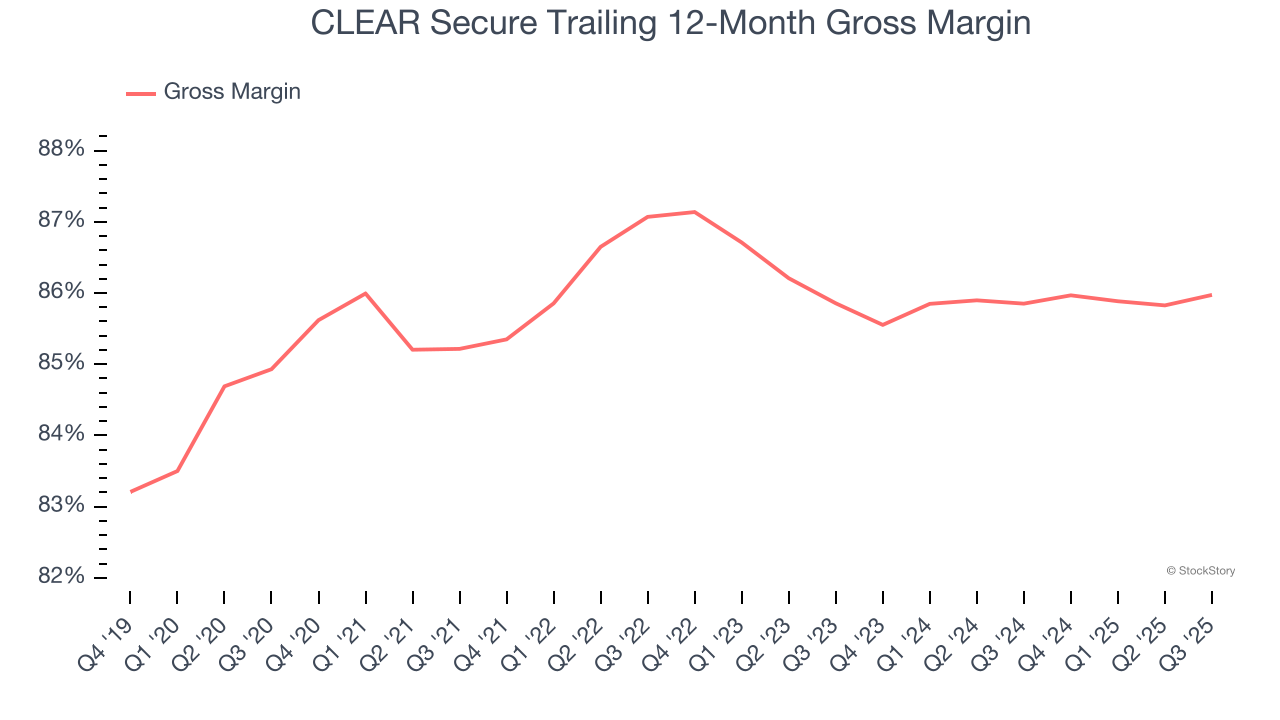

2. Elite Gross Margin Powers Best-In-Class Business Model

What makes the software-as-a-service model so attractive is that once the software is developed, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

CLEAR Secure’s gross margin is one of the best in the software sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and sales during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an elite 86% gross margin over the last year. Said differently, roughly $85.97 was left to spend on selling, marketing, and R&D for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. CLEAR Secure has seen gross margins improve by 0.1 percentage points over the last 2 year, which is slightly better than average for software.

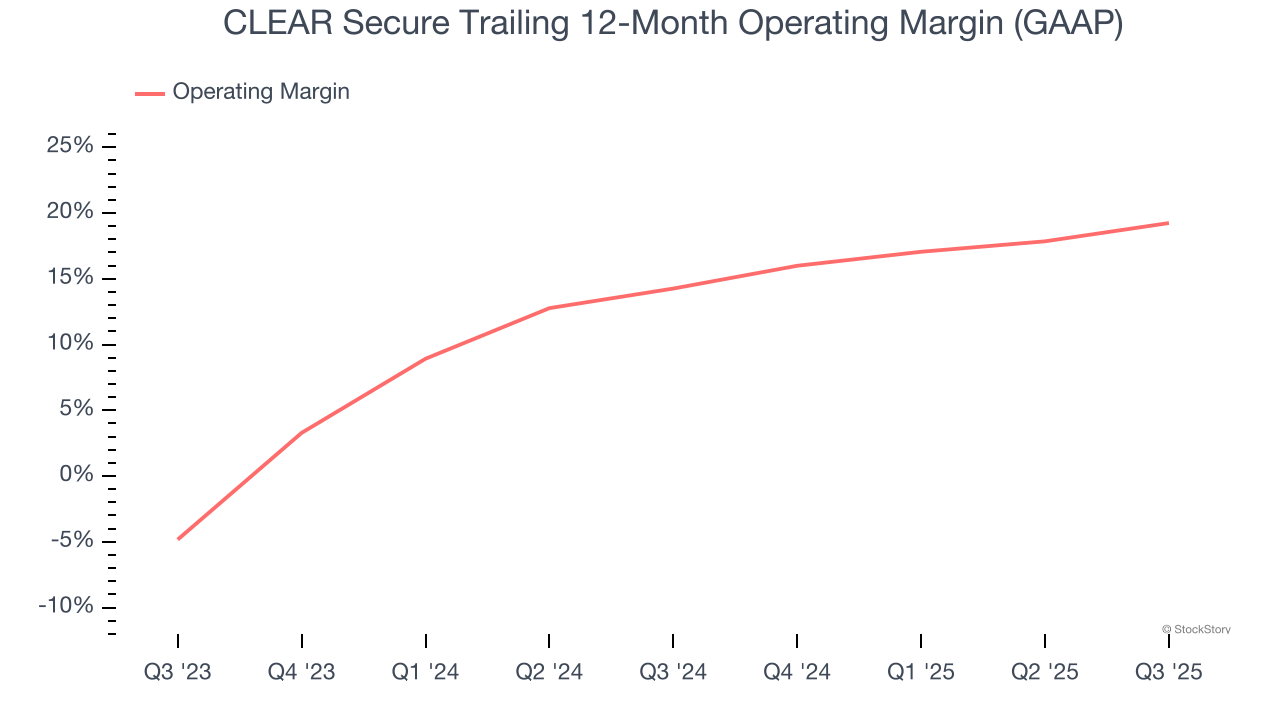

3. Operating Margin Reveals a Well-Run Organization

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

CLEAR Secure has been a well-oiled machine over the last year. It demonstrated elite profitability for a software business, boasting an average operating margin of 19.2%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Final Judgment

These are just a few reasons why we think CLEAR Secure is a high-quality business, but at $33.45 per share (or 3.4× forward price-to-sales), is now the right time to buy the stock? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than CLEAR Secure

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.