As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q2. Today we are looking at the vertical software stocks, starting with Adobe (NASDAQ:ADBE).

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, there are industries that have very specific needs. Whether it is life-sciences, education or banking, the demand for so called vertical software, addressing industry specific workflows, is growing, fueled by the pressures on improving productivity and quality of offerings.

The 11 vertical software stocks we track reported a weaker Q2; on average, revenues missed analyst consensus estimates by 0.01%, while on average next quarter revenue guidance was 4.51% under consensus. Tech multiples have reverted to the historical mean after reaching all time levels in early 2021 and vertical software stocks have not been spared, with share price down 16.3% since the previous earnings results, on average.

Adobe (NASDAQ:ADBE)

One of the most well-known Silicon Valley software companies around, Adobe (NASDAQ:ADBE) is a leading provider of software as service in the digital design and document management space.

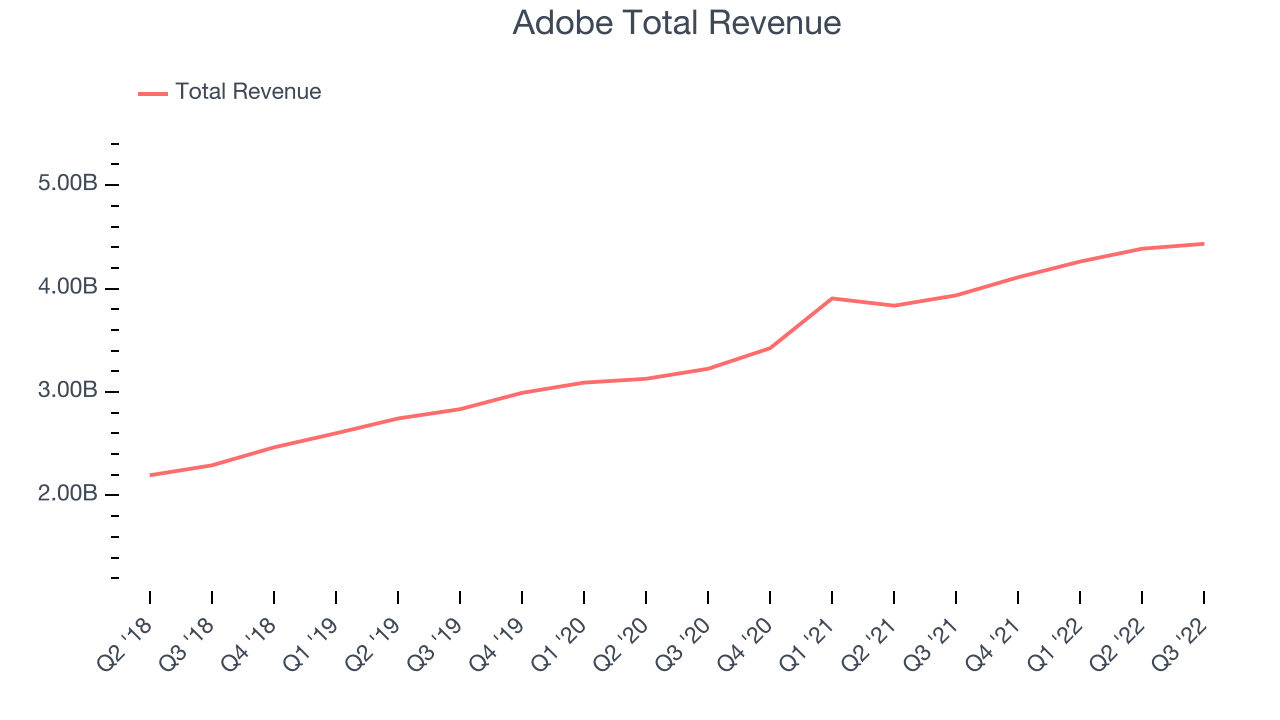

Adobe reported revenues of $4.43 billion, up 12.6% year on year, inline with analyst expectations. It was a weaker quarter for the company, with an underwhelming revenue guidance for the next quarter and a slow revenue growth.

“Fueled by our groundbreaking technology, track record of creating and leading categories and consistent execution, Adobe delivered another record quarter,” said Shantanu Narayen, chairman and CEO, Adobe.

The stock is down 20.3% since the results and currently trades at $295.85.

Adobe has announced it has entered into a definitive merger agreement to acquire Figma for ~$20 billion in cash and stock

Is now the time to buy Adobe? Access our full analysis of the earnings results here, it's free.

Best Q2: Toast (NYSE:TOST)

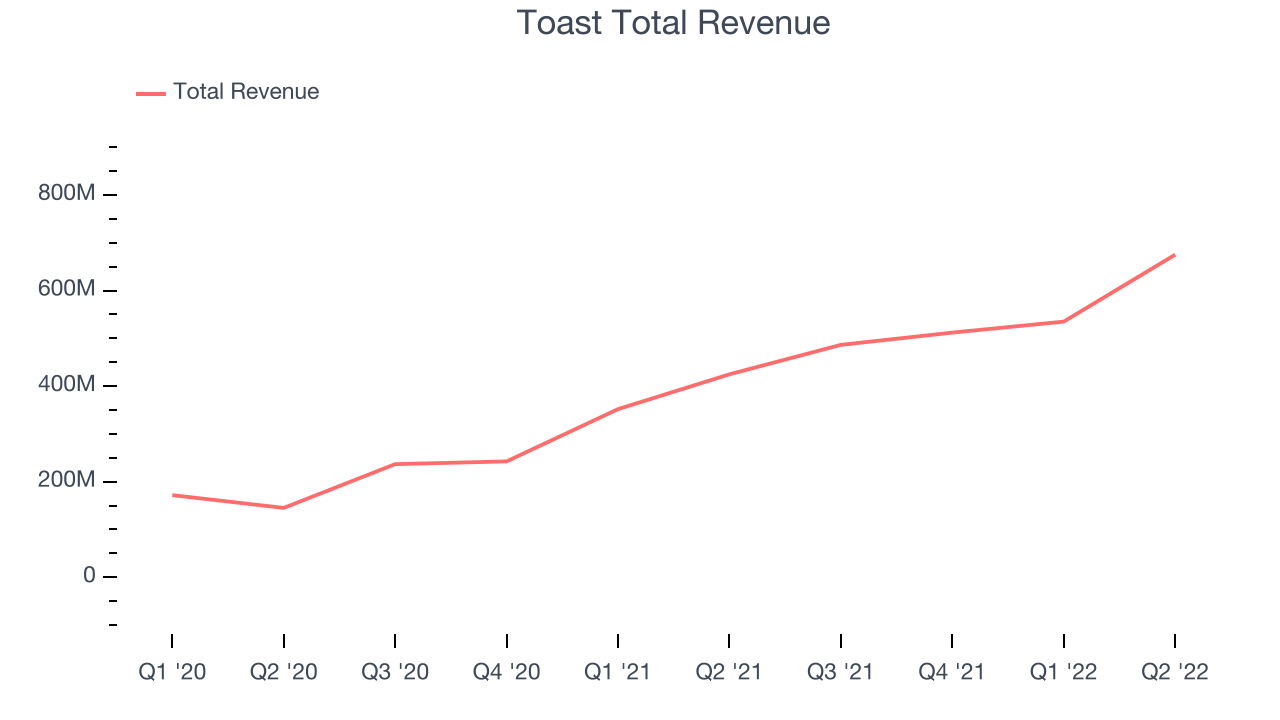

Founded by three MIT engineers at a local Cambridge bar, Toast (NYSE:TOST) provides integrated point of sale (POS) hardware, software, and payments solutions for restaurants.

Toast reported revenues of $675 million, up 58.9% year on year, beating analyst expectations by 4.22%. It was an impressive quarter for the company, with a very optimistic guidance for the next quarter and an exceptional revenue growth.

Toast pulled off the strongest analyst estimates beat, fastest revenue growth, and highest full year guidance raise among its peers. The stock is up 7.55% since the results and currently trades at $19.50.

Is now the time to buy Toast? Access our full analysis of the earnings results here, it's free.

Slowest Q2: Unity (NYSE:U)

Started as a game studio by three friends in a Copenhagen apartment, Unity (NYSE:U) is a software as a service platform that makes it easier to develop and monetize new games and other visual digital experiences.

Unity reported revenues of $297 million, up 8.58% year on year, missing analyst expectations by 0.67%. It was a weak quarter for the company, with guidance for both the next quarter and full year missing analysts' expectations.

The stock is down 26.1% since the results and currently trades at $37.02.

Read our full analysis of Unity's results here.

nCino (NASDAQ:NCNO)

Founded in 2011 in North Carolina, nCino (NASDAQ:NCNO) makes cloud-based operating systems for banks and provides that software as a service.

nCino reported revenues of $99.6 million, up 49.7% year on year, beating analyst expectations by 2.17%. It was a strong quarter for the company, with an exceptional revenue growth and guidance for the next quarter above analysts' estimates.

The stock is up 19% since the results and currently trades at $34.97.

Read our full, actionable report on nCino here, it's free.

Autodesk (NASDAQ:ADSK)

Founded in 1982 by John Walker and growing into one of the industry's behemoths, Autodesk (NASDAQ:ADSK) makes computer-aided design (CAD) software for engineering, construction, and architecture companies.

Autodesk reported revenues of $1.23 billion, up 16.7% year on year, in line with analyst expectations. It was a mixed quarter for the company, with an optimistic revenue guidance for the next quarter but a slow revenue growth.

The stock is down 7.31% since the results and currently trades at $198.56.

Read our full, actionable report on Autodesk here, it's free.

The author has no position in any of the stocks mentioned