As Q3 earnings season comes to a close, it’s time to take stock of this quarter's best and worst performers amongst the processors and graphics chips stocks, including AMD (NASDAQ:AMD) and its peers.

The biggest demand drivers for processors (CPUs) and graphics chips at the moment are secular trends related to 5G and Internet of Things, autonomous driving, and high performance computing in the data center space, specifically around AI and machine learning. Like all semiconductor companies, digital chip makers exhibit a degree of cyclicality, driven by supply and demand imbalances and exposure to PC and Smartphone product cycles.

The 7 processors and graphics chips stocks we track reported a weak Q3; on average, revenues beat analyst consensus estimates by 1.33%, while on average next quarter revenue guidance was 8.57% under consensus. There has been a stampede out of high valuation technology stocks as rising interest rates encourage investors to value profits over growth again, but processors and graphics chips stocks held their ground better than others, with the share prices up 5.62% since the previous earnings results, on average.

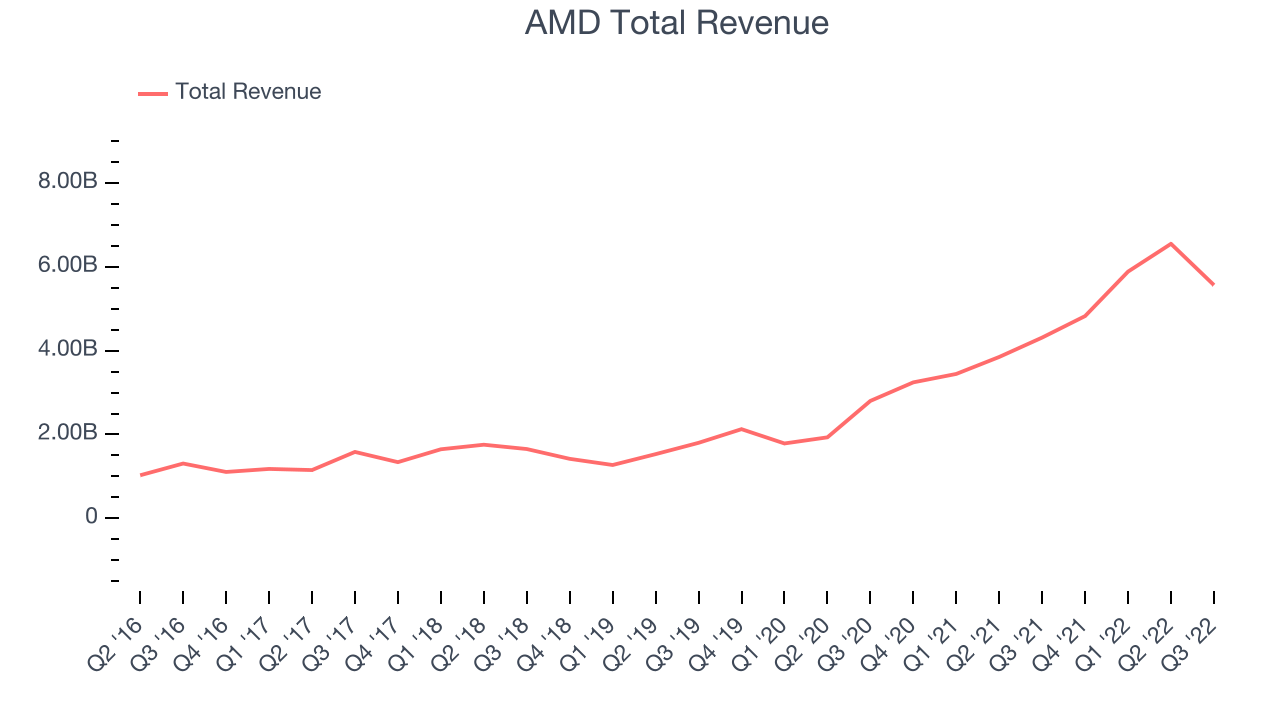

AMD (NASDAQ:AMD)

Founded in 1969 by a group of former Fairchild semiconductor executives led by Jerry Sanders, Advanced Micro Devices or AMD (NASDAQ:AMD) is one of the leading designers of computer processors and graphics chips used in PCs and data centers.

AMD reported revenues of $5.56 billion, up 29% year on year, missing analyst expectations by 1.48%. It was a weak quarter for the company, with a full year guidance missing analysts' expectations.

“Third quarter results came in below our expectations due to the softening PC market and substantial inventory reduction actions across the PC supply chain," said AMD Chair and CEO Dr. Lisa Su.

AMD scored the fastest revenue growth and highest full year guidance raise, but had the weakest performance against analyst estimates of the whole group. The stock is up 4.69% since the results and currently trades at $62.45.

Is now the time to buy AMD? Access our full analysis of the earnings results here, it's free.

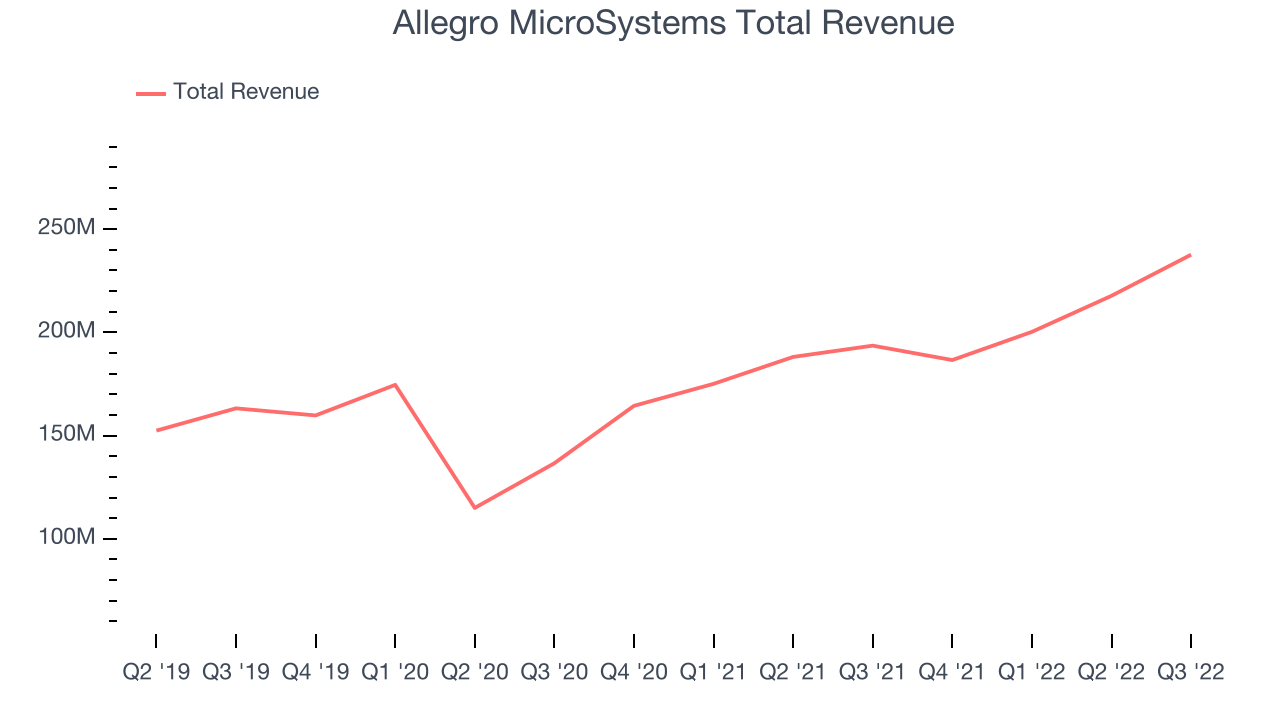

Best Q3: Allegro MicroSystems (NASDAQ:ALGM)

The result of a spinoff from Sanken in Japan, Allegro MicroSystems (NASDAQ:ALGM) is a designer of power management chips and distance sensors used in electric vehicles and data centers.

Allegro MicroSystems reported revenues of $237.6 million, up 22.7% year on year, beating analyst expectations by 5.61%. It was a very strong quarter for the company, with a beat on the bottom line and very optimistic guidance for the next quarter.

Allegro MicroSystems pulled off the strongest analyst estimates beat among its peers. The stock is up 31.4% since the results and currently trades at $29.79.

Is now the time to buy Allegro MicroSystems? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Nvidia (NASDAQ:NVDA)

Founded in 1993 by Jensen Huang and two former Sun Microsystems engineers, Nvidia (NASDAQ:NVDA) is a leading fabless designer of chips used in gaming, PCs, data centers, automotive, and a variety of end markets.

Nvidia reported revenues of $5.93 billion, down 16.5% year on year, beating analyst expectations by 1.91%. It was a weak quarter for the company, with slow revenue growth and underwhelming revenue guidance for the next quarter.

The stock is down 7.4% since the results and currently trades at $142.65.

Read our full analysis of Nvidia's results here.

Intel (NASDAQ:INTC)

Inventor of the x86 processor that powered decades of technological innovation in PCs, data centers, and numerous other markets, Intel (NASDAQ: INTC) is the leading manufacturer of computer processors and graphics chips.

Intel reported revenues of $15.3 billion, down 20% year on year, in line with analyst expectations. It was a weak quarter for the company, with full year guidance missing analysts' expectations.

Intel had declining revenue and the weakest full year guidance update among the peers. The stock is up 5.53% since the results and currently trades at $27.67.

Read our full, actionable report on Intel here, it's free.

Qorvo (NASDAQ:QRVO)

Formed by the merger of TriQuint and RF Micro Devices, Qorvo (NASDAQ: QRVO) is a designer and manufacturer of RF chips used in almost all smartphones globally, along with a variety of chips used in networking equipment and infrastructure.

Qorvo reported revenues of $1.15 billion, down 7.74% year on year, beating analyst expectations by 2.45%. It was a weak quarter for the company, with declining revenue and underwhelming revenue guidance for the next quarter.

The stock is up 7.26% since the results and currently trades at $91.00.

Read our full, actionable report on Qorvo here, it's free.

The author has no position in any of the stocks mentioned