Data analytics software provider Amplitude (NASDAQ:AMPL) announced better-than-expected results in Q2 CY2024, with revenue up 8.2% year on year to $73.3 million. The company expects next quarter's revenue to be around $74 million, in line with analysts' estimates. It made a non-GAAP loss of $0 per share, down from its profit of $0.02 per share in the same quarter last year.

Is now the time to buy Amplitude? Find out in our full research report.

Amplitude (AMPL) Q2 CY2024 Highlights:

- Revenue: $73.3 million vs analyst estimates of $71.99 million (1.8% beat)

- Adjusted Operating Income: -$3.73 million vs analyst estimates of -$3.97 million (6% beat)

- EPS (non-GAAP): $0 vs analyst estimates of -$0.01 ($0.01 beat)

- Revenue Guidance for Q3 CY2024 is $74 million at the midpoint, roughly in line with what analysts were expecting

- The company slightly lifted its revenue guidance for the full year from $294 million to $295.5 million at the midpoint

- Gross Margin (GAAP): 73.4%, down from 74.6% in the same quarter last year

- Free Cash Flow of $6.84 million is up from -$1.14 million in the previous quarter

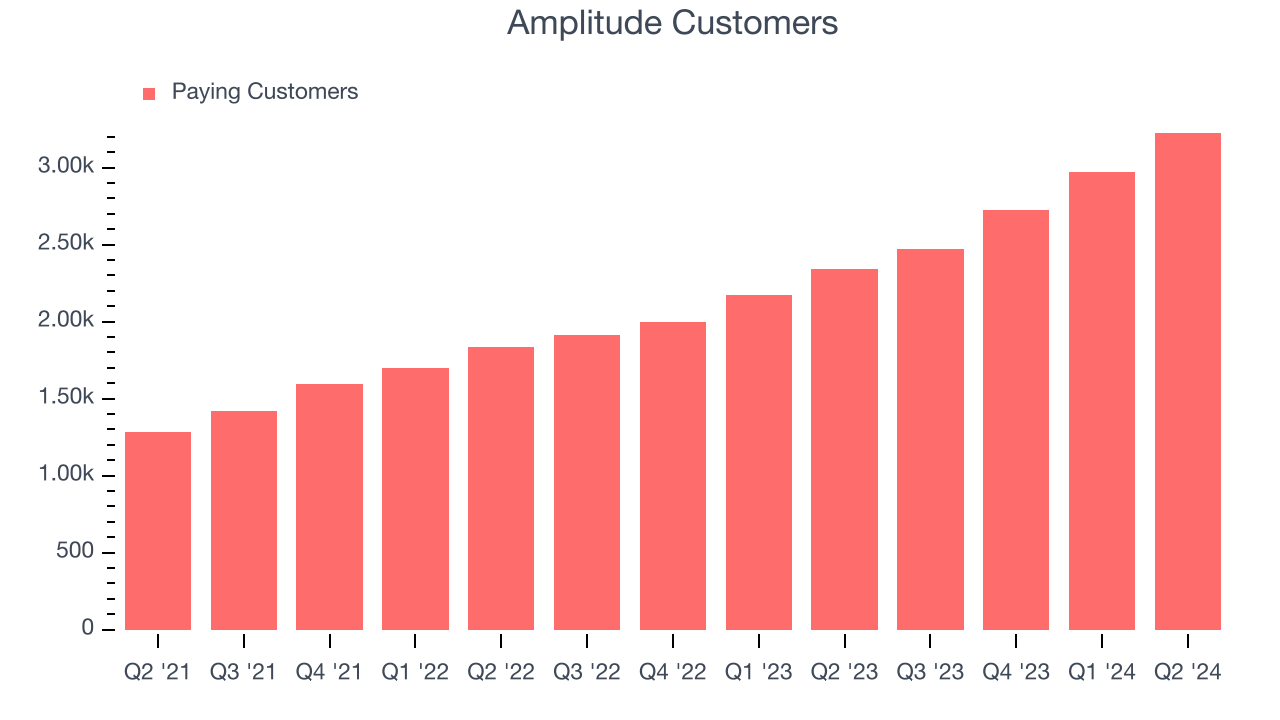

- Customers: 3,224, up from 2,970 in the previous quarter

- Market Capitalization: $947.9 million

"Today, companies win or lose based on their digital experience," said Spenser Skates, CEO and co-founder of Amplitude.

Born out of a failed voice recognition startup by founder Spenser Skates, Amplitude (NASDAQ:AMPL) is data analytics software helping companies improve and optimize their digital products.

Data Analytics

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the siloed data.

Sales Growth

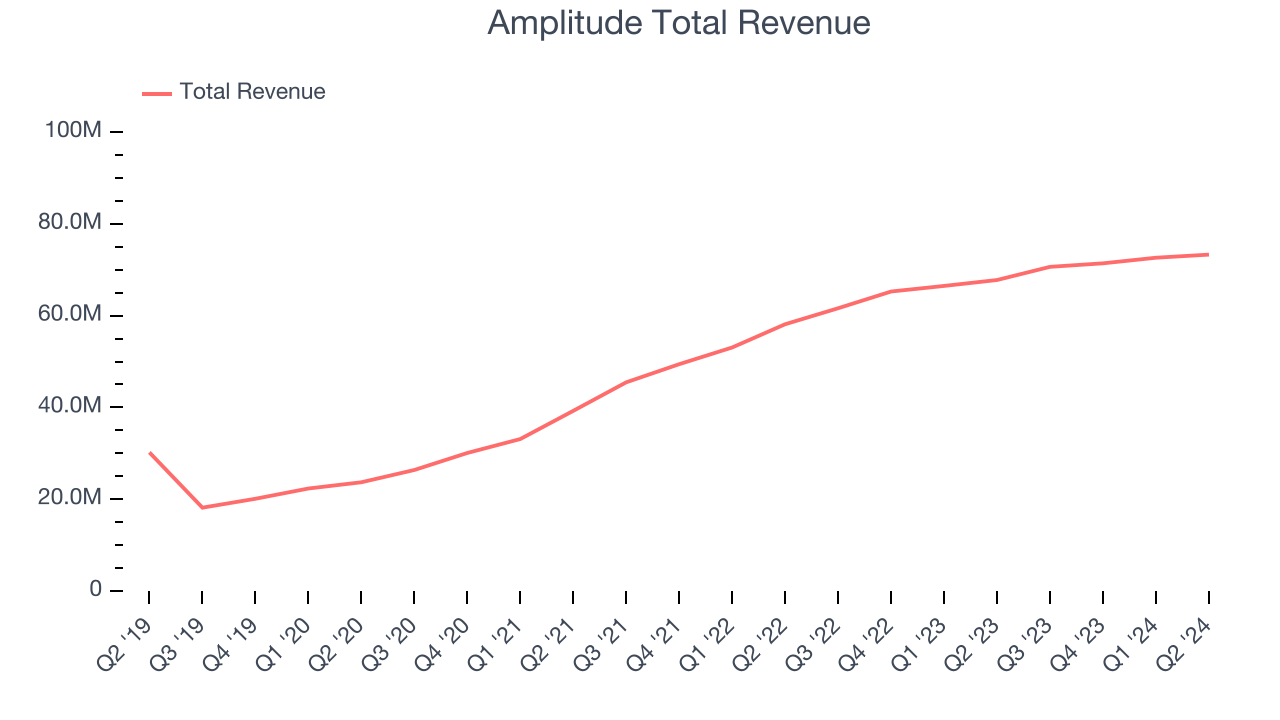

As you can see below, Amplitude's 30.8% annualized revenue growth over the last three years has been impressive, and its sales came in at $73.3 million this quarter.

Amplitude's quarterly revenue was only up 8.2% year on year, which might disappoint some shareholders. Additionally, its growth did slow down compared to last quarter as the company's revenue increased by just $676,000 in Q2 compared to $1.22 million in Q1 CY2024. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Amplitude is expecting revenue to grow 4.8% year on year to $74 million, slowing down from the 14.6% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 5.9% over the next 12 months before the earnings results announcement.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Customer Growth

Amplitude reported 3,224 customers at the end of the quarter, an increase of 254 from the previous quarter. That's roughly the same customer growth as we observed last quarter and quite a bit above what we've typically seen over the last year, confirming that the company is sustaining a good sales pace.

Key Takeaways from Amplitude's Q2 Results

It was encouraging to see Amplitude narrowly top analysts' revenue expectations this quarter. Zooming out, we think this was a fine quarter featuring some areas of strength but also some blemishes. The market seemed to focus on the negatives, and the stock traded down 7.2% to $7.40 immediately after reporting.

So should you invest in Amplitude right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.