As Q2 earnings season comes to a close, it’s time to take stock of this quarter's best and worst performers amongst the advertising software stocks, including AppLovin (NASDAQ:APP) and its peers.

The digital advertising market is large, growing and becoming more diverse, both in terms of audiences and media. This as a result drives a growing need for a software that enables advertisers to use data to automate and optimize ad placements.

The 6 advertising software stocks we track reported a decent Q2; on average, revenues beat analyst consensus estimates by 2.91%, while on average next quarter revenue guidance was 0.55% above consensus. Technology stocks have been hit hard on fears of higher interest rates as investors search for near-term cash flows and while some of the advertising software stocks have fared somewhat better than others, they have not been spared, with share prices declining 6.78% since the previous earnings results, on average.

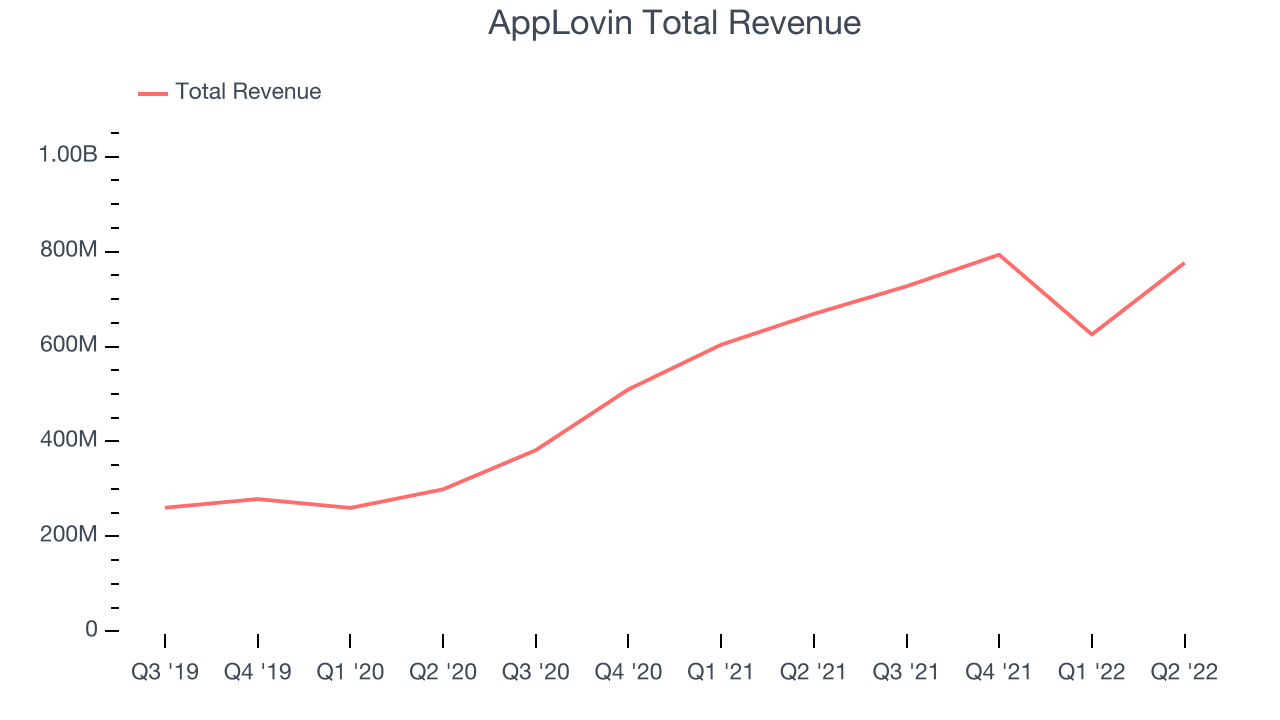

Weakest Q2: AppLovin (NASDAQ:APP)

Co-founded by Adam Foroughi who was frustrated with not being able to find a good solution to market his own dating app, AppLovin (NASDAQ:APP) is a provider of marketing and monetization tools for mobile app developers and also operates a portfolio of mobile games.

AppLovin reported revenues of $776.2 million, up 16% year on year, missing analyst expectations by 5.18%. It was a weak quarter for the company, with a full year guidance missing analysts' expectations and a miss of the top line analyst estimates.

AppLovin delivered the weakest performance against analyst estimates, slowest revenue growth, and weakest full year guidance update of the whole group. The stock is down 56.2% since the results and currently trades at $17.72.

Is now the time to buy AppLovin? Access our full analysis of the earnings results here, it's free.

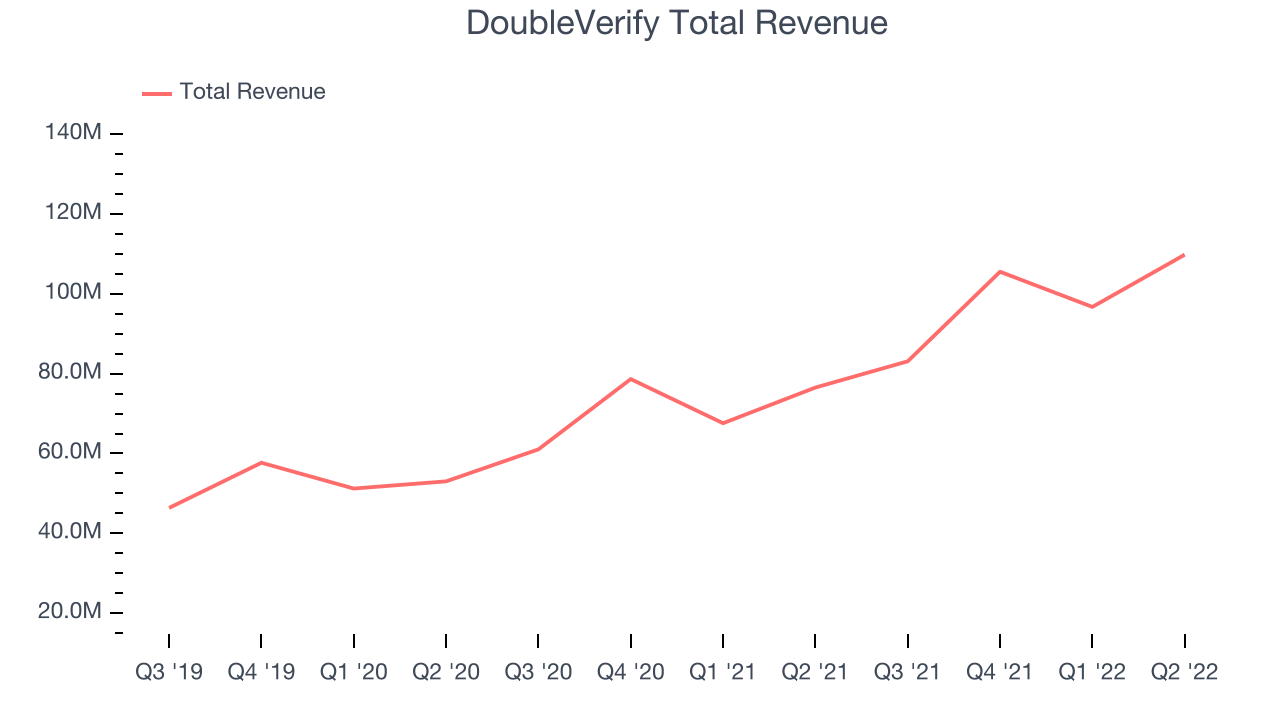

Best Q2: DoubleVerify (NYSE:DV)

When Oren Netzer saw a digital ad for US-based Target while sitting in his Tel Aviv apartment, he knew there was an unsolved problem, so he started DoubleVerify (NYSE: DV), a provider of advertising solutions to businesses that helps with ad verification, fraud prevention, and brand safety.

DoubleVerify reported revenues of $109.8 million, up 43.4% year on year, beating analyst expectations by 7.67%. It was a very strong quarter for the company, with exceptional revenue growth and an impressive beat of analyst estimates.

DoubleVerify achieved the strongest analyst estimates beat and fastest revenue growth among its peers. The stock is up 25.5% since the results and currently trades at $29.99.

Is now the time to buy DoubleVerify? Access our full analysis of the earnings results here, it's free.

LiveRamp (NYSE:RAMP)

Started in 2011 as a spin-out of RapLeaf, LiveRamp (NYSE:RAMP) provides software as a service that helps companies better target their marketing by merging offline and online data about their customers.

LiveRamp reported revenues of $142.2 million, up 19.4% year on year, beating analyst expectations by 2.35%. It was a weaker quarter for the company, with a full year guidance missing analysts' expectations and decelerating customer growth.

The stock is down 36.9% since the results and currently trades at $17.65.

Read our full analysis of LiveRamp's results here.

The Trade Desk (NASDAQ:TTD)

Founded by former Microsoft engineers Jeff Green and Dave Pickles, The Trade Desk (NASDAQ:TTD) offers cloud-based software that uses data to help advertisers better plan, place and target their online ads.

The Trade Desk reported revenues of $376.9 million, up 34.6% year on year, beating analyst expectations by 3.22%. It was a strong quarter for the company, with a meaningful improvement in gross margin.

The stock is up 2.16% since the results and currently trades at $55.67.

Read our full, actionable report on The Trade Desk here, it's free.

Zeta (NYSE:ZETA)

Co-Founded by former Apple CEO, John Scully, Zeta Global (NYSE:ZETA) provides software and data analytics tools that help companies market their products to billions of customers.

Zeta reported revenues of $137.3 million, up 28.4% year on year, beating analyst expectations by 5.58%. It was a strong quarter for the company, with a solid beat of analyst estimates.

The company added 14 enterprise customers paying more than $100,000 annually to a total of 373. The stock is up 22.6% since the results and currently trades at $7.64.

Read our full, actionable report on Zeta here, it's free.

The author has no position in any of the stocks mentioned