Fabless chip and software maker Broadcom (NASDAQ:AVGO) missed Wall Street’s revenue expectations in Q3 CY2024, but sales rose 51.2% year on year to $14.05 billion. Its GAAP profit of $0.90 per share was 28.2% above analysts’ consensus estimates.

Is now the time to buy Broadcom? Find out by accessing our full research report, it’s free.

Broadcom (AVGO) Q3 CY2024 Highlights:

- Revenue: $14.05 billion (51.2% year-on-year growth)

- Adjusted EPS: $0.90 vs analyst estimates of $0.70 (28.2% beat)

- Revenue Guidance for Q4 CY2024 is $14.6 billion at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 32.9%, down from 45.6% in the same quarter last year

- Free Cash Flow Margin: 39%, down from 50.8% in the same quarter last year

- Inventory Days Outstanding: 47, down from 55 in the previous quarter

- Market Capitalization: $835.8 billion

"Broadcom's fiscal year 2024 revenue grew 44% year-over-year to a record $51.6 billion, as infrastructure software revenue grew to $21.5 billion, on the successful integration of VMware," said Hock Tan, President and CEO.

Company Overview

Originally the semiconductor division of Hewlett Packard, Broadcom (NASDAQ:AVGO) is a semiconductor conglomerate that spans wireless, networking, data storage, and industrial end markets along with an infrastructure software business focused on mainframes and cybersecurity.

Processors and Graphics Chips

The biggest demand drivers for processors (CPUs) and graphics chips at the moment are secular trends related to 5G and Internet of Things, autonomous driving, and high performance computing in the data center space, specifically around AI and machine learning. Like all semiconductor companies, digital chip makers exhibit a degree of cyclicality, driven by supply and demand imbalances and exposure to PC and Smartphone product cycles.

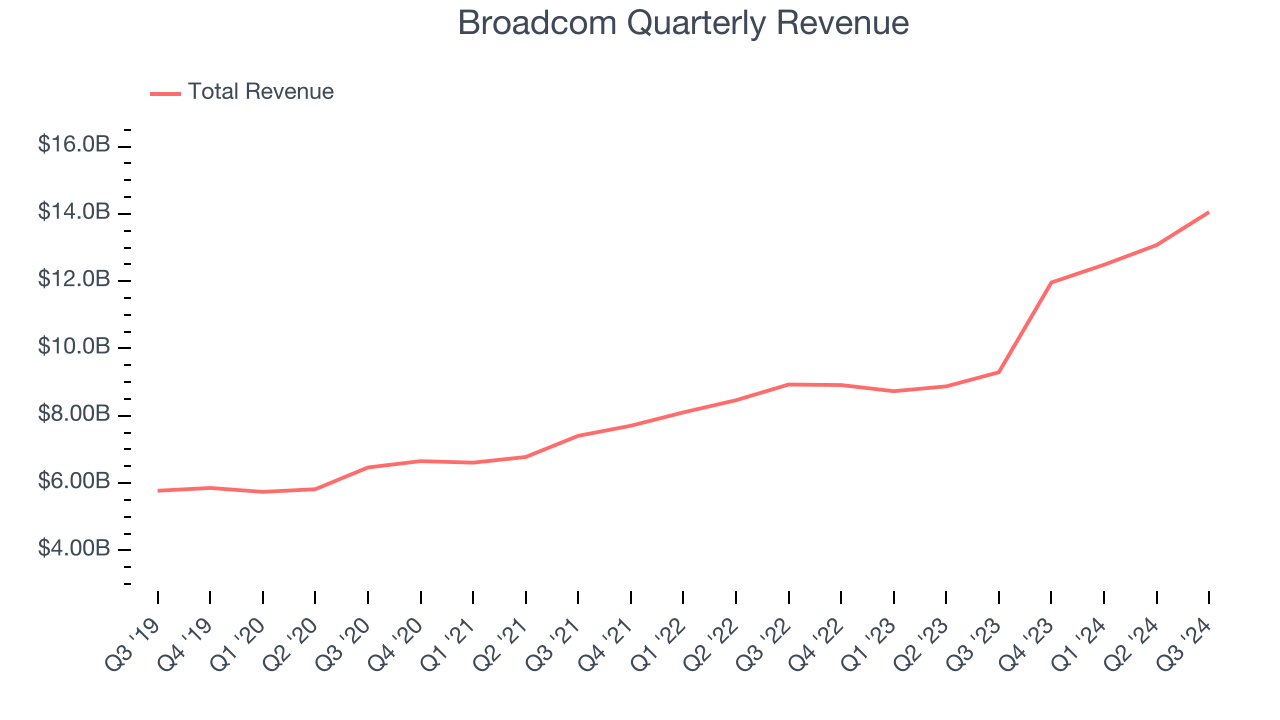

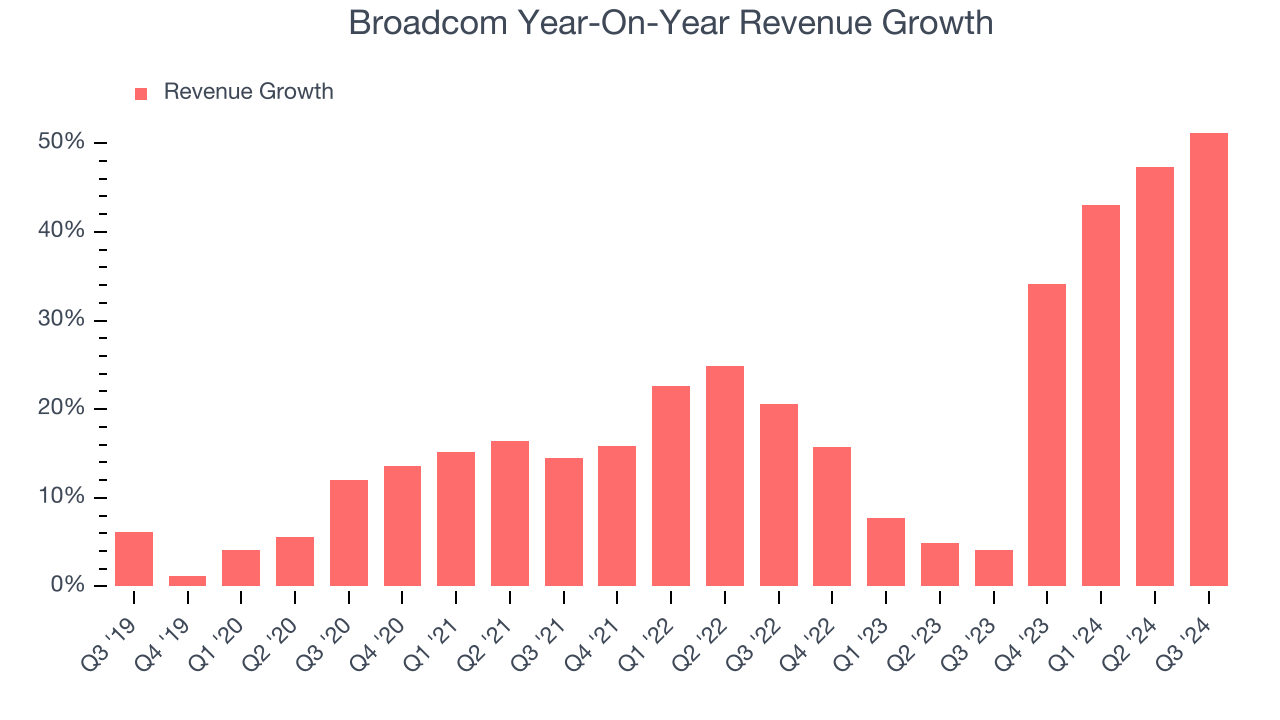

Sales Growth

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Broadcom’s 17.9% annualized revenue growth over the last five years was exceptional. Its growth surpassed the average semiconductor company and shows its offerings resonate with customers, a great starting point for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. Broadcom’s annualized revenue growth of 24.6% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Broadcom achieved a magnificent 51.2% year-on-year revenue growth rate, and its revenue reached $14.05 billion. Company management is currently guiding for a 22.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 15.9% over the next 12 months, a deceleration versus the last two years. We still think its growth trajectory is attractive given its scale and implies the market sees success for its products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

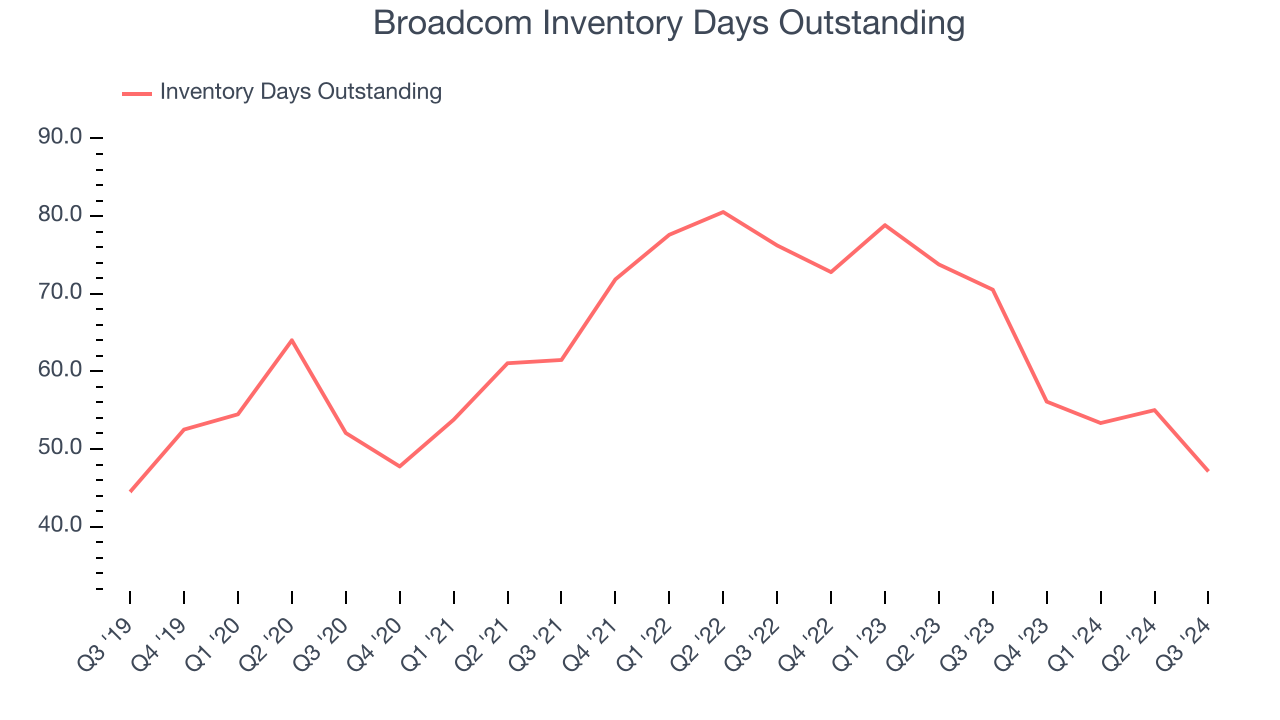

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Broadcom’s DIO came in at 47, which is 16 days below its five-year average. At the moment, these numbers show no indication of an excessive inventory buildup.

Key Takeaways from Broadcom’s Q3 Results

We were impressed by Broadcom’s strong improvement in inventory levels. We were also excited its EPS outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock traded up 4.3% to $188.75 immediately following the results.

Broadcom had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.