Communications platform as a service company Bandwidth (NASDAQ: BAND) beat analyst expectations in Q1 FY2021 quarter, with revenue up 65.6% year on year to $113 million. Bandwidth made a GAAP loss of $5.31 million, down on its loss of $1.05 million, in the same quarter last year.

Bandwidth (NASDAQ:BAND) Q1 FY2021 Highlights:

- Revenue: $113 million vs analyst estimates of $108 million (4.71% beat)

- EPS (non-GAAP): $0.30 vs analyst estimates of $0.01 ($0.29 beat)

- Revenue guidance for Q2 2021 is $116 million at the midpoint, above analyst estimates of $111 million

- The company lifted revenue guidance for the full year, from $462 million to $474 million at the midpoint, a 2.63% increase

- Free cash flow of $2.12 million, up from negative free cash flow of -$10.03 million in previous quarter

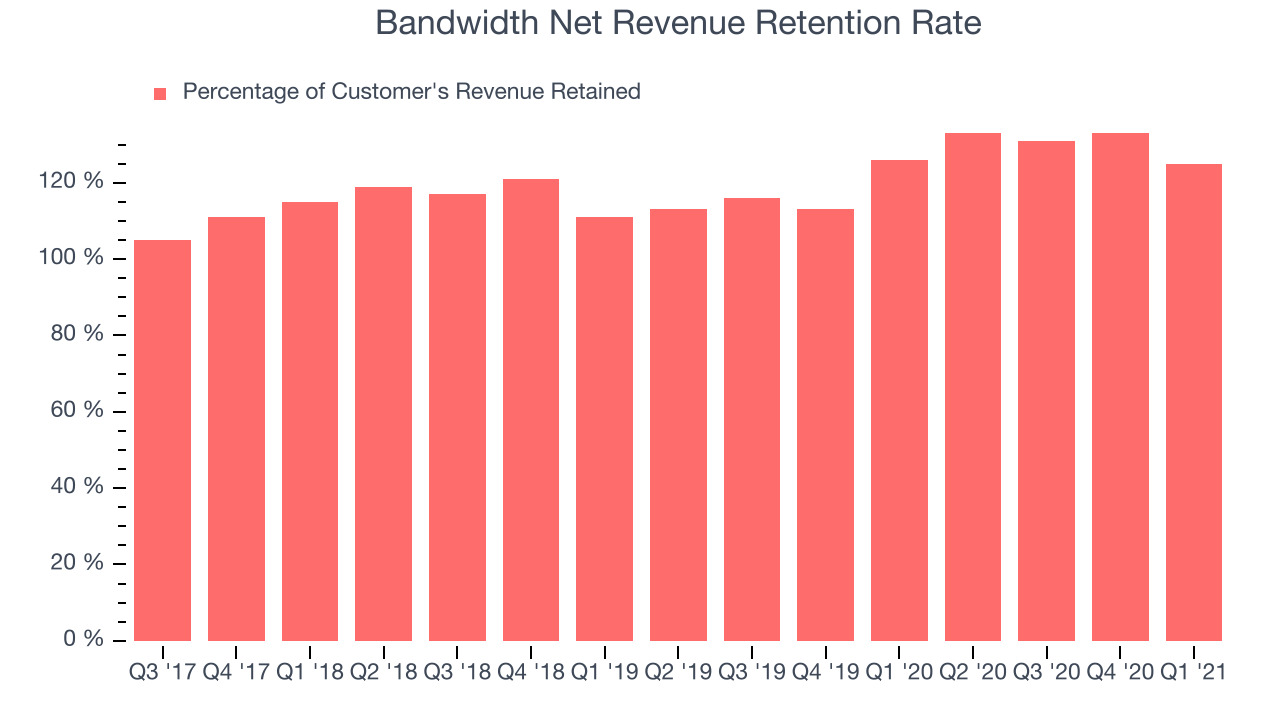

- Net Revenue Retention Rate: 125%, down from 133% previous quarter

- Customers: 2,959, up from 2,848 in previous quarter

- Gross Margin (GAAP): 45.9%, in line with previous quarter

"The first quarter marked a strong start to the year for Bandwidth, with CPaaS revenue growth of 69% year-over-year and dollar-based net retention rate of 125%. We are energized by our role enabling the innovation, creativity, and incredible scale unfolding in global enterprise communications, which we believe will drive Bandwidth's growth for years to come," stated David Morken, Chief Executive Officer of Bandwidth.

Riding The Internet Telephony Wave

Founder David Morken started Bandwidth in 1999, while on 90 days of paid leave from the Marine Corps. He moved into his parents house with his three children and wife in order to bootstrap the company. Today, Bandwidth (NASDAQ:BAND) provides thousands of customers with a software platform that uses its own global network to provide phone numbers, voice, and text connectivity.

Bandwidth might not be well known with consumers, but most of us would have used their services unknowingly either using online conferencing software, or contacting customer service representatives through a company’s website. Bandwidth’s core advantage is that it provides a software platform over its own telecommunications network, and is therefore able to better control the quality of the connection, all while providing cheaper prices than a legacy voice connection.

Even though Bandwidth competes with other well known CPaaS companies like Twilio, it mostly competes with legacy telecommunications companies such as Verizon (NYSE:VZ) and AT&T (NYSE:T), which lack the equivalent software layer over their own networks. As a result, the biggest tailwind is simply the shift towards more communication over the internet (VOIP), rather than traditional phone networks.

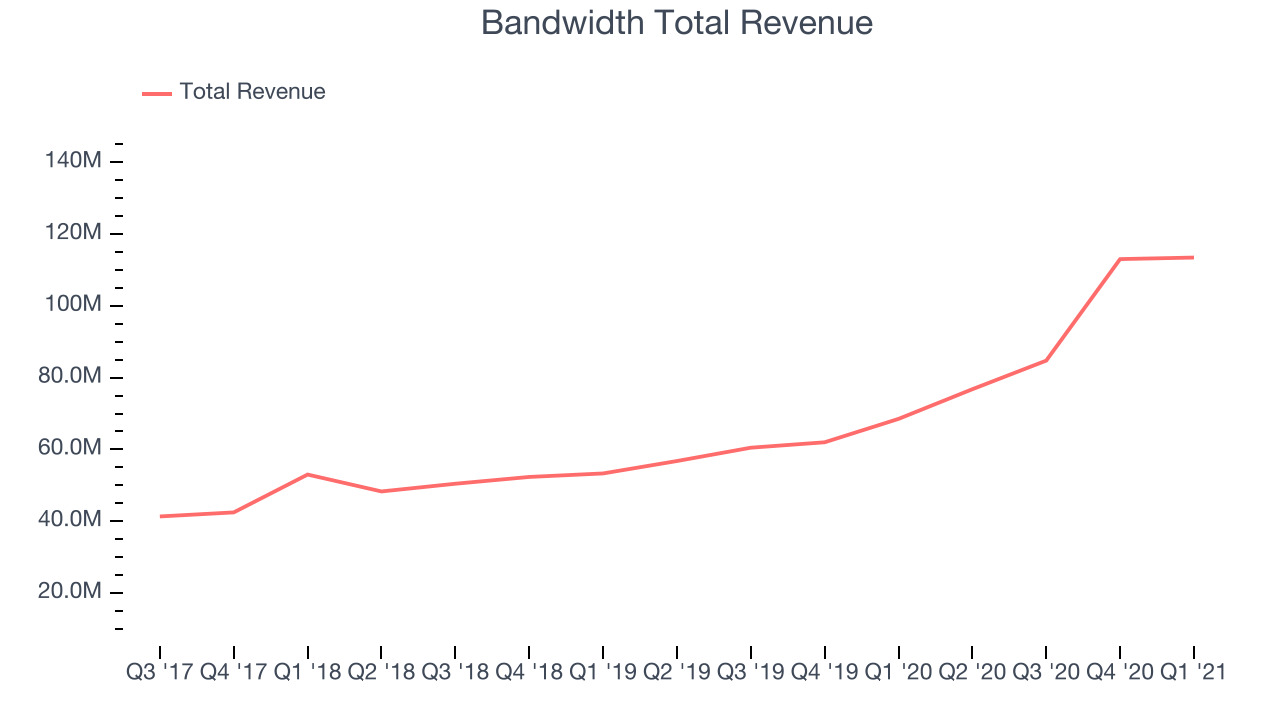

As you can see below, Bandwidth's revenue growth has been very strong over the last twelve months, growing from $68.5 million to $113 million.

This was a standout quarter for Bandwidth with quarterly revenue up an absolutely stunning 65.6% year on year, although we do want to mention that the growth has been boosted a little by Bandwidth's recent acquisition of Voxbone. But the growth did slow down compared to last quarter, as the revenue increased by just $432 thousand in Q1, compared to $28.2 million in Q4 2020. A one-off fluctuation is usually not concerning, but it is worth keeping in mind.

Bandwidth Grows With Its Customers

While pure software companies can generally achieve high margins, Bandwidth sells network connectivity over a software platform. As a result of network costs, its gross margins are much lower than pure software companies, and reasonably low for a tech stock.

The good news is that its gross margins should increase with scale as more internet traffic travels across the same network. Although customers can be acquired or won organically, we also want to see that customers are spending more money with the company over time, as evidence that they are satisfied with the service (and that growth is sustainable).

Bandwidth's net revenue retention rate, an important measure of how much customers from a year ago were spending at the end of the quarter, was at 125% in Q1. That means even if they didn't win any new customers, Bandwidth would have grown its revenue 25% year on year. Despite the recent drop this is still a good retention rate and a proof that Bandwidth's customers are satisfied with their software and are getting more value from it over time. That is good to see.

Key Takeaways from Bandwidth's Q1 Results

With market capitalisation of $3.04 billion Bandwidth is among smaller companies, but its more than $319 million in cash and positive free cash flow over the last twelve months give us confidence that Bandwidth has the resources it needs to pursue a high growth business strategy.

We were impressed by the exceptional revenue growth Bandwidth delivered this quarter. And we were also glad that the revenue guidance for the next quarter exceeded analysts' expectations. On the other hand, it was disappointing to see the deterioration in revenue retention rate. Overall, we think this was a really good quarter, that should leave shareholders feeling very positive. Therefore, we think Bandwidth will become more attractive to investors, compared to before these results.

PS. Have you noticed we published this analysis in less than 300 seconds since Bandwidth made their numbers public? We use technology until now only reserved for the top hedge funds to provide you with the fastest earnings analysis on the market. Get investing superpowers with StockStory. Signup here for early access.

The author has no position in any of the stocks mentioned.