As we reflect back on the just completed Q2 finance and HR software sector earnings season, we dig into the relative performance of BlackLine (NASDAQ:BL) and its peers.

The demand for easy to use, integrated cloud based finance software that integrates tax and accounting operations continues to rise in tandem with the difficulty workers find trying to use existing accounting tools like spreadsheets given the growing volume of finance data littered across a multitude of enterprise applications. A related demand driver is the secular increase of e-commerce and rising adoption of modern point of sales and payments platforms which easily integrate with backend financial software.

The 9 finance and HR software stocks we track reported a a strong Q2; on average, revenues beat analyst consensus estimates by 6.21%, while on average next quarter revenue guidance was 5.93% above consensus. The market rewarded the results with the average return the day after earnings coming in at 5.79%.

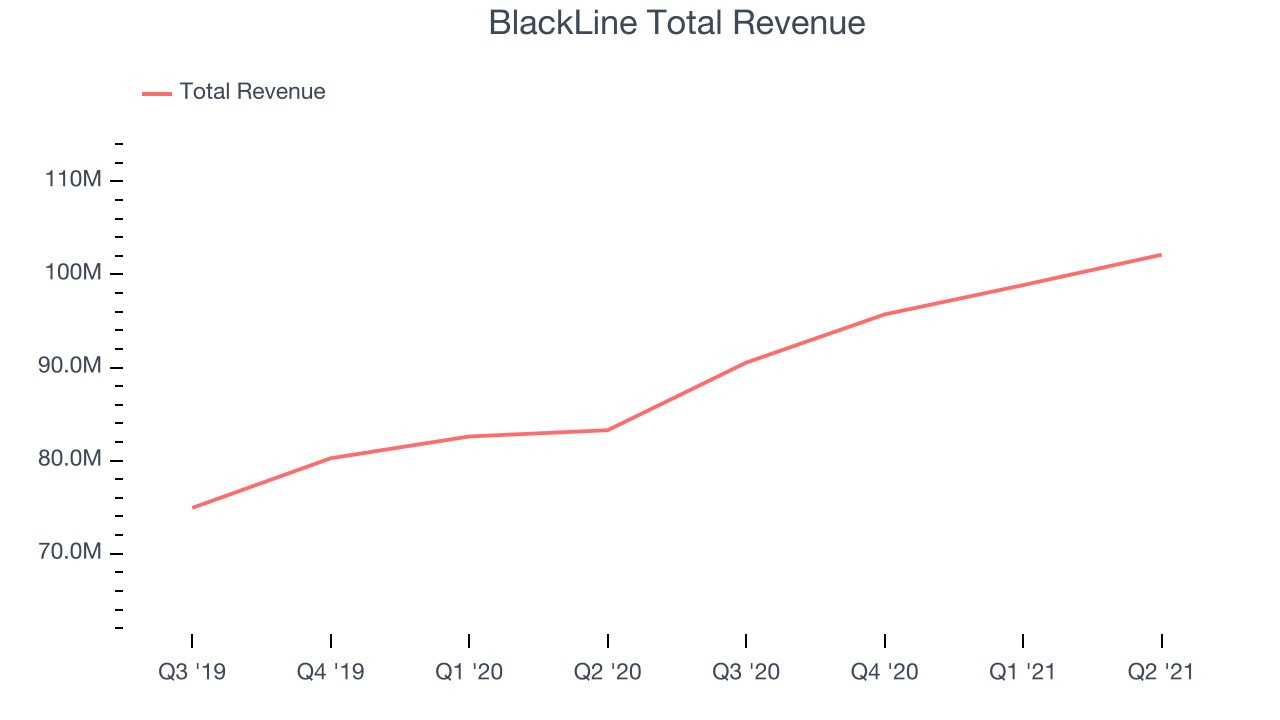

BlackLine (NASDAQ:BL)

Started in 2001 by software engineer Therese Tucker, one of the very few women founders who took their companies public, BlackLine (NASDAQ:BL) provides software for organizations to automate accounting and finance tasks.

BlackLine reported revenues of $102.1 million, up 22.6% year on year, beating analyst expectations by 1.03%. It was a decent quarter for the company, with accelerating customer growth.

Marc Huffman, CEO, commented, “We delivered an outstanding second quarter with strong performances across the business. Our results continue to build on our market leadership and the momentum we’re experiencing from organizations prioritizing digital finance transformation.”

BlackLine delivered the weakest full year guidance update of the whole group. The stock is up 5.21% since the results and currently trades at $122.02.

Is now the time to buy BlackLine? Access our full analysis of the earnings results here, it's free.

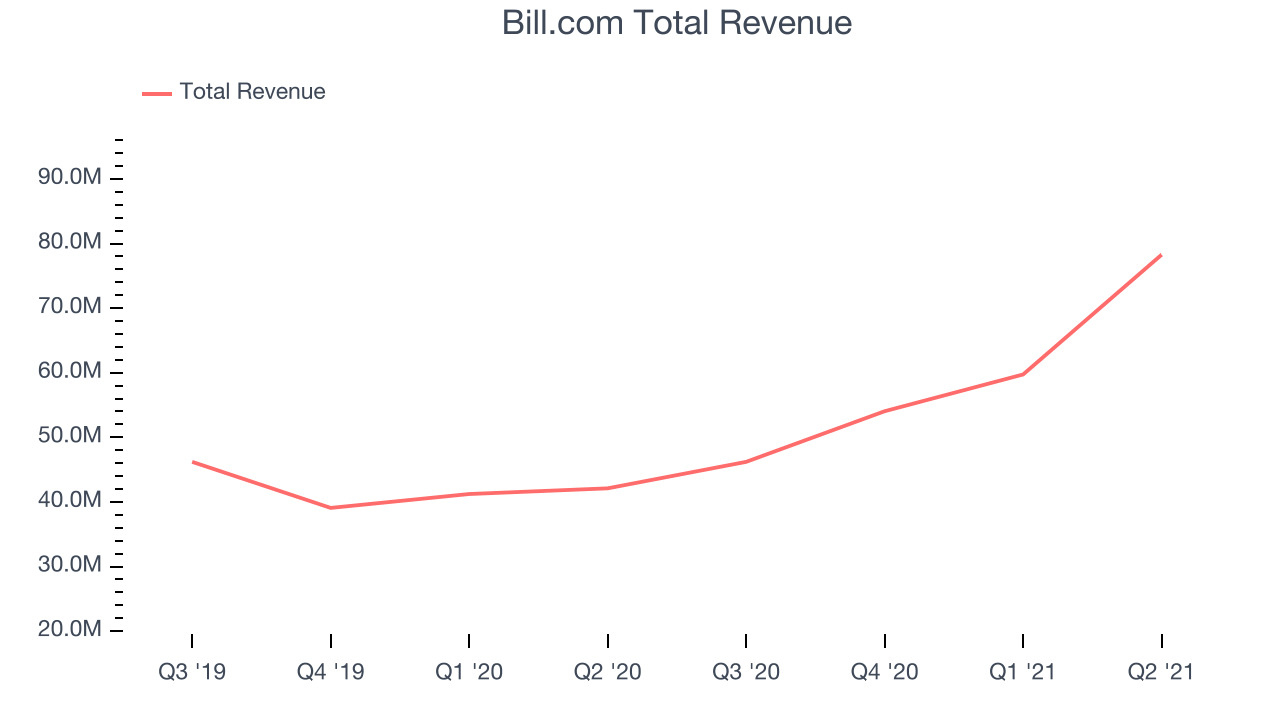

Best Q2: Bill.com (NYSE:BILL)

Started by René Lacerte in 2006 after selling his previous payroll and accounting software company PayCycle to Intuit, Bill.com (NYSE:BILL) is a software as a service platform that aims to make payments and billing processes easier for small and medium-sized businesses.

Bill.com reported revenues of $78.2 million, up 85.8% year on year, beating analyst expectations by 20.4%. It was an exceptional quarter for the company, with an impressive beat of analyst estimates and a very strong revenue growth.

Bill.com delivered the strongest analyst estimates beat, fastest revenue growth, and highest full year guidance raise among its peers. The stock is up 38.2% since the results and currently trades at $302.22.

Is now the time to buy Bill.com? Access our full analysis of the earnings results here, it's free.

Workday (NASDAQ:WDAY)

Founded by industry veterans Aneel Bushri and Dave Duffield after their former company PeopleSoft was acquired by Oracle in a hostile takeover, Workday (NASDAQ:WDAY) provides cloud-based software for organizations to manage and plan finance and human resources.

Workday reported revenues of $1.26 billion, up 18.6% year on year, beating analyst expectations by 1.61%. It was a decent quarter for the company, with a decent beat of analyst estimates.

The stock is up 9.98% since the results and currently trades at $271.45.

Read our full analysis of Workday's results here.

Slowest Q2: Zuora (NYSE:ZUO)

Founded in 2007, Zuora (NYSE:ZUO) offers software as a service platform that allows companies to bill and accept payments for recurring subscription products.

Zuora reported revenues of $86.4 million, up 15.3% year on year, beating analyst expectations by 3.69%. It was a solid quarter for the company, with accelerating large customer growth.

Zuora had the slowest revenue growth among the peers. The company added 17 enterprise customers paying more than $100,000 annually to a total of 694. The stock is up 19.1% since the results and currently trades at $19.50.

Read our full, actionable report on Zuora here, it's free.

Avalara (NYSE:AVLR)

Founded by Scott McFarlane in 2004, Avalara offers software as a service that provides companies with real-time information on how much tax to charge and automates tax compliance. Transactional taxes are complex, with thousands of rules set by local, regional, state, federal and international authorities.

Avalara reported revenues of $169 million, up 45.1% year on year, beating analyst expectations by 9.62%. It was a very strong quarter for the company, with a significant improvement in net revenue retention rate.

The stock is up 1.41% since the results and currently trades at $172.09.

Read our full, actionable report on Avalara here, it's free.

The author has no position in any of the stocks mentioned