School bus company Blue Bird (NASDAQ:BLBD) beat analysts' expectations in Q2 CY2024, with revenue up 13.3% year on year to $333.4 million. On the other hand, the company's full-year revenue guidance of $1.32 billion at the midpoint came in slightly below analysts' estimates. It made a non-GAAP profit of $0.91 per share, improving from its profit of $0.44 per share in the same quarter last year.

Is now the time to buy Blue Bird? Find out by accessing our full research report, it's free.

Blue Bird (BLBD) Q2 CY2024 Highlights:

- Revenue: $333.4 million vs analyst estimates of $326.7 million (2% beat)

- EPS (non-GAAP): $0.91 vs analyst estimates of $0.51 (77.2% beat)

- EBITDA guidance for the full year is $175 million at the midpoint, above analyst estimates of $159.6 million

- Gross Margin (GAAP): 20.8%, up from 15.5% in the same quarter last year

- EBITDA Margin: 14.5%, up from 9.5% in the same quarter last year

- Sales Volumes were flat year on year (23.8% in the same quarter last year)

- Market Capitalization: $1.57 billion

“I am incredibly proud of our team’s achievements in delivering another outstanding result and record profit in the third quarter,” said Phil Horlock, CEO of Blue Bird Corporation.

With around a century of experience, Blue Bird (NASDAQ:BLBD) is a manufacturer of school buses and complementary parts.

Heavy Transportation Equipment

Heavy transportation equipment companies are investing in automated vehicles that increase efficiencies and connected machinery that collects actionable data. Some are also developing electric vehicles and mobility solutions to address customers’ concerns about carbon emissions, creating new sales opportunities. Additionally, they are increasingly offering automated equipment that increases efficiencies and connected machinery that collects actionable data. On the other hand, heavy transportation equipment companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the construction and transport volumes that drive demand for these companies’ offerings.

Sales Growth

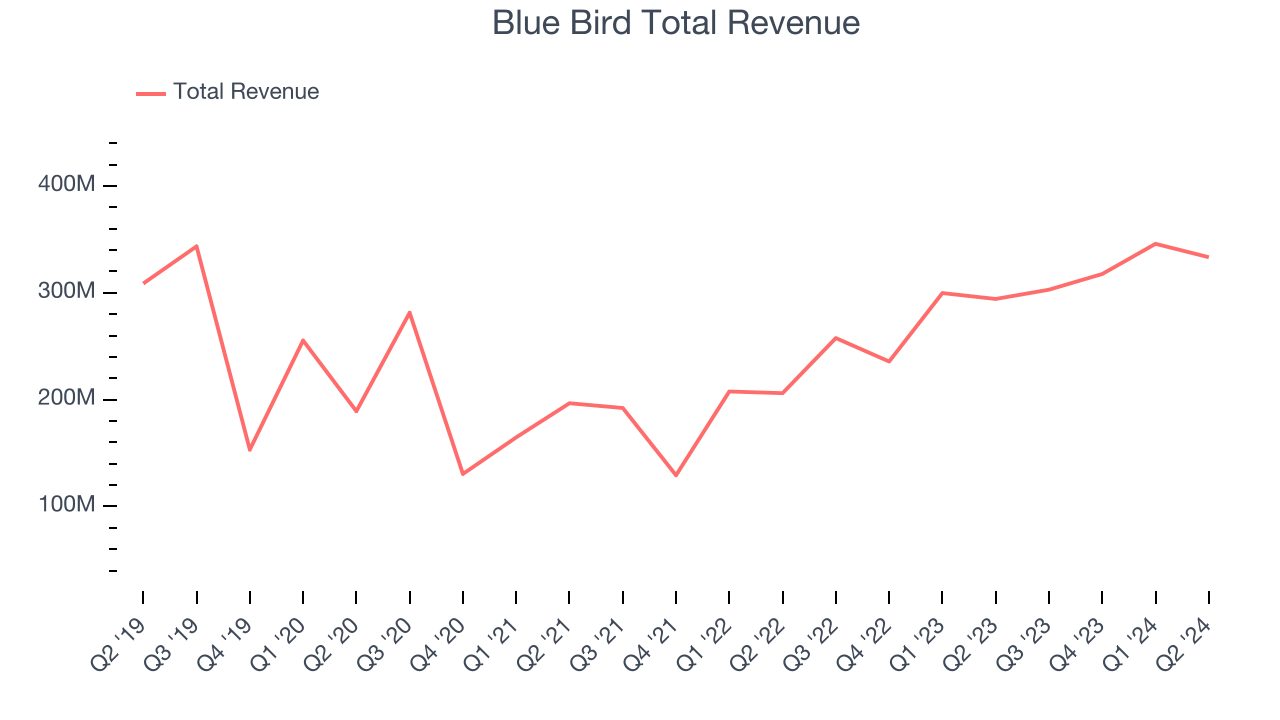

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones tend to grow for years. Over the last five years, Blue Bird grew its sales at a decent 7.9% compounded annual growth rate. This shows it was successful in expanding, a useful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Blue Bird's annualized revenue growth of 33% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

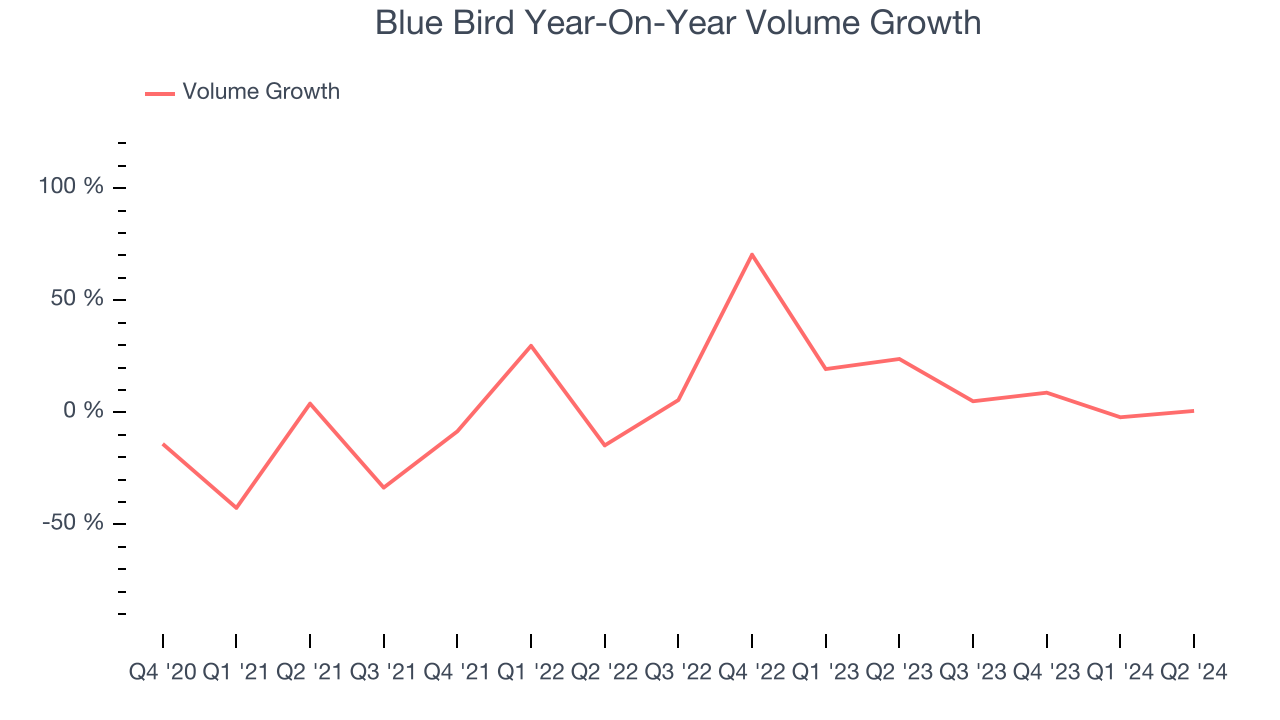

Blue Bird also reports its sales volumes, which reached 2,151 in the latest quarter. Over the last two years, Blue Bird's sales volumes averaged 16.4% year-on-year growth. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Blue Bird reported robust year-on-year revenue growth of 13.3%, and its $333.4 million of revenue exceeded Wall Street's estimates by 2%. Looking ahead, Wall Street expects sales to grow 8.4% over the next 12 months, a deceleration from this quarter.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

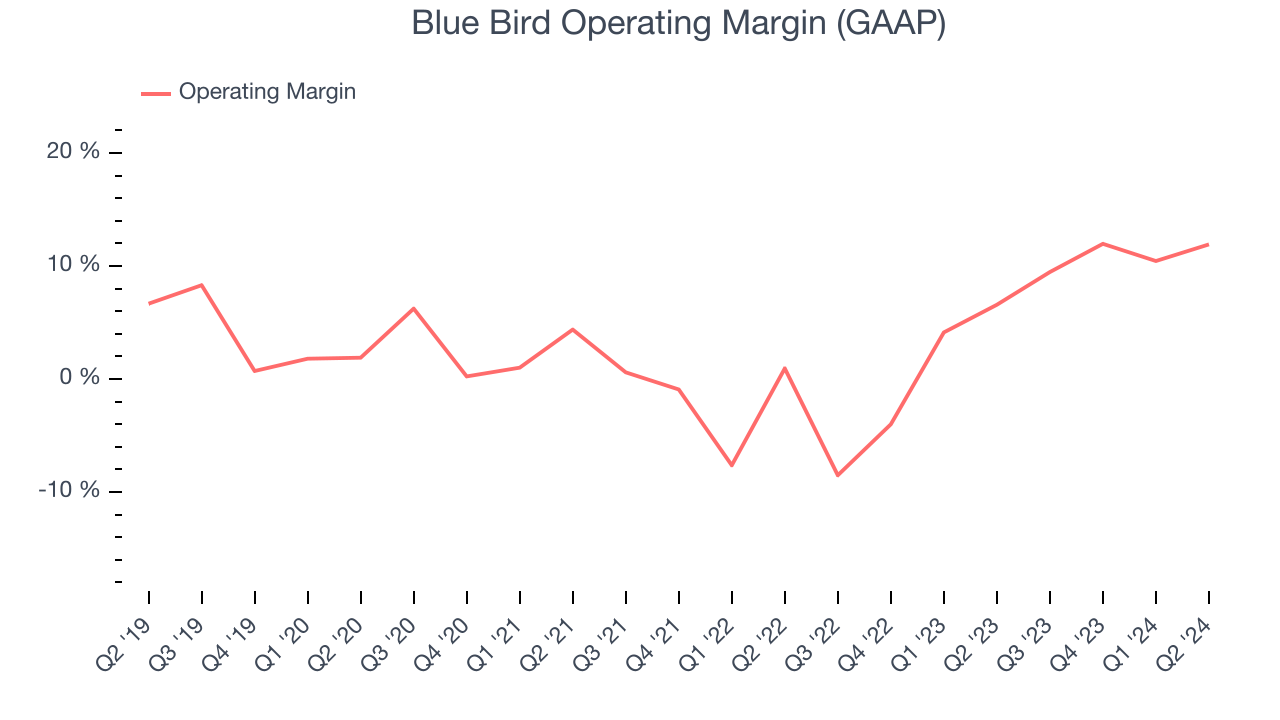

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling them, and, most importantly, keeping them relevant through research and development.

Blue Bird was profitable over the last five years but held back by its large expense base. It demonstrated lousy profitability for an industrials business, producing an average operating margin of 4%. This result isn't too surprising given its low gross margin as a starting point.

On the bright side, Blue Bird's annual operating margin rose by 7 percentage points over the last five years

In Q2, Blue Bird generated an operating profit margin of 11.9%, up 5.3 percentage points year on year. This increase was solid, and since the company's operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as sales, marketing, R&D, and administrative overhead.

EPS

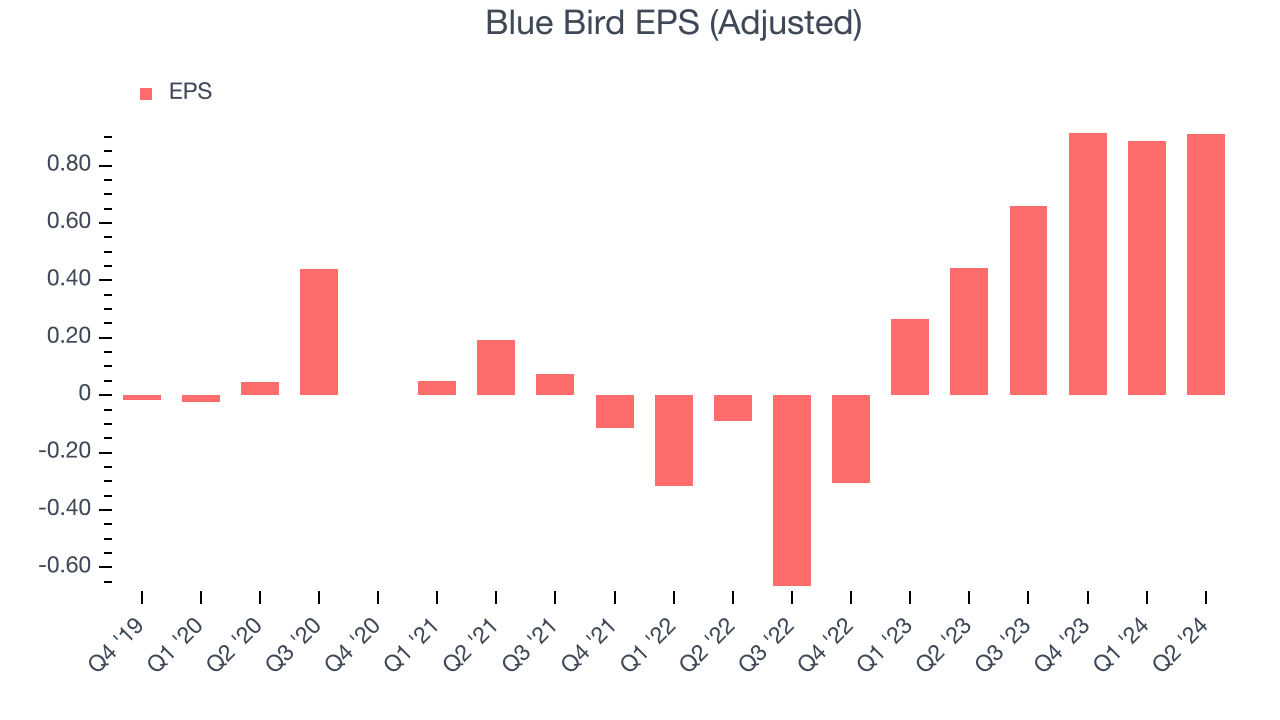

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Blue Bird's full-year EPS grew at an astounding 323% compounded annual growth rate over the last four years, better than the broader industrials sector.

In Q2, Blue Bird reported EPS at $0.91, up from $0.44 in the same quarter last year. This print easily cleared analysts' estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Blue Bird to perform poorly. Analysts are projecting its EPS of $3.37 in the last year to shrink by 16.9% to $2.80.

Key Takeaways from Blue Bird's Q2 Results

We were impressed by how significantly Blue Bird blew past analysts' revenue and EPS expectations this quarter. We were also glad it raised its full-year revenue and EBITDA guidance, which exceeded Wall Street's estimates. On the other hand, its sales volumes missed, meaning its top-line beat because of better-than-anticipated pricing. Overall, this quarter seemed fairly positive and shareholders should feel optimistic. The stock traded up 5.1% to $51 immediately after reporting.

Blue Bird may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.