Restaurant company Bloomin’ Brands (NASDAQ:BLMN) reported results in line with analysts' expectations in Q1 CY2024, with revenue down 4% year on year to $1.20 billion. It made a non-GAAP profit of $0.70 per share, down from its profit of $0.98 per share in the same quarter last year.

Is now the time to buy Bloomin' Brands? Find out by accessing our full research report, it's free.

Bloomin' Brands (BLMN) Q1 CY2024 Highlights:

- Revenue: $1.20 billion vs analyst estimates of $1.20 billion (small miss)

- EPS (non-GAAP): $0.70 vs analyst expectations of $0.74 (5.9% miss)

- EPS (non-GAAP) Guidance for Q2 CY2024 is $0.58 at the midpoint, below analyst estimates of $0.69

- Gross Margin (GAAP): 17.1%, down from 19% in the same quarter last year

- Same-Store Sales were down 1.6% year on year

- Store Locations: 1,451 at quarter end, decreasing by 46 over the last 12 months

- Market Capitalization: $2.17 billion

Owner of the iconic Australian-themed Outback Steakhouse, Bloomin’ Brands (NASDAQ:BLMN) is a leading American restaurant company that owns and operates a portfolio of popular restaurant brands.

Sit-Down Dining

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

Sales Growth

Bloomin' Brands is one of the larger restaurant chains in the industry and benefits from a strong brand, giving it customer mindshare and influence over purchasing decisions.

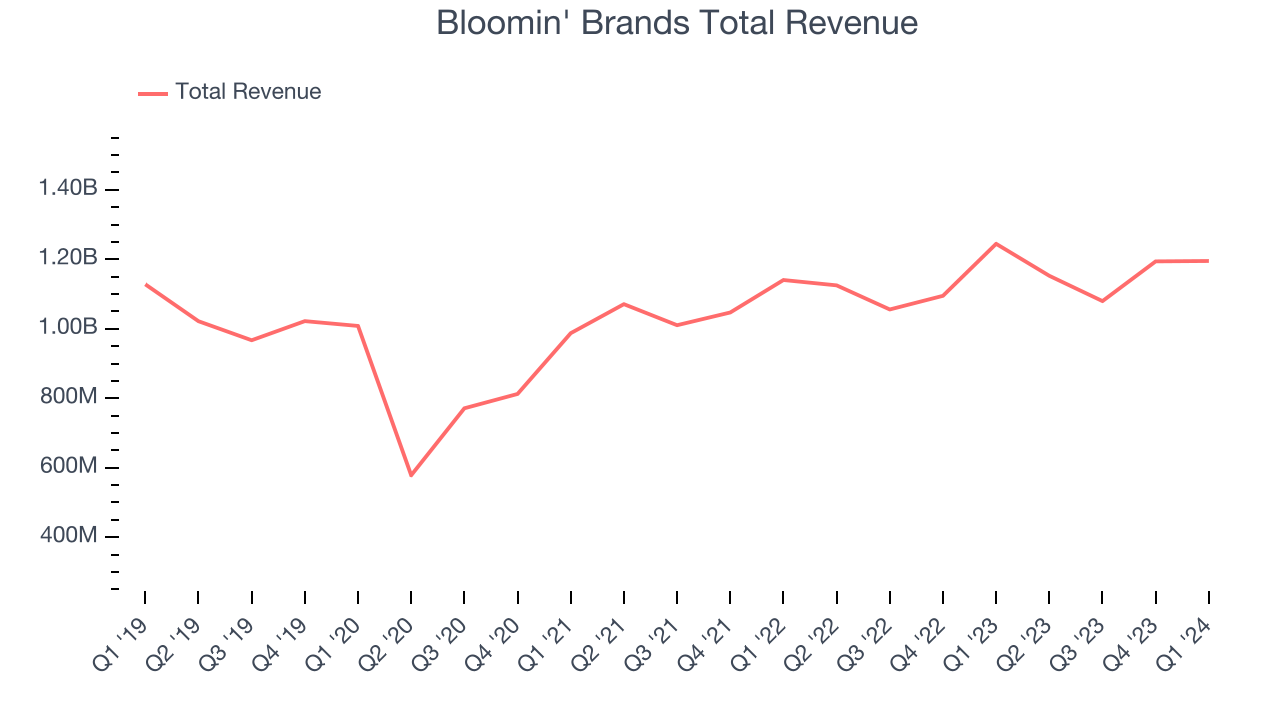

As you can see below, the company's annualized revenue growth rate of 2.2% over the last five years was weak as its restaurant footprint remained unchanged, implying that growth was driven by more sales at existing, established dining locations.

This quarter, Bloomin' Brands missed Wall Street's estimates and reported a rather uninspiring 4% year-on-year revenue decline, generating $1.20 billion in revenue. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Same-Store Sales

Same-store sales growth is a key performance indicator used to measure organic growth and demand for restaurants.

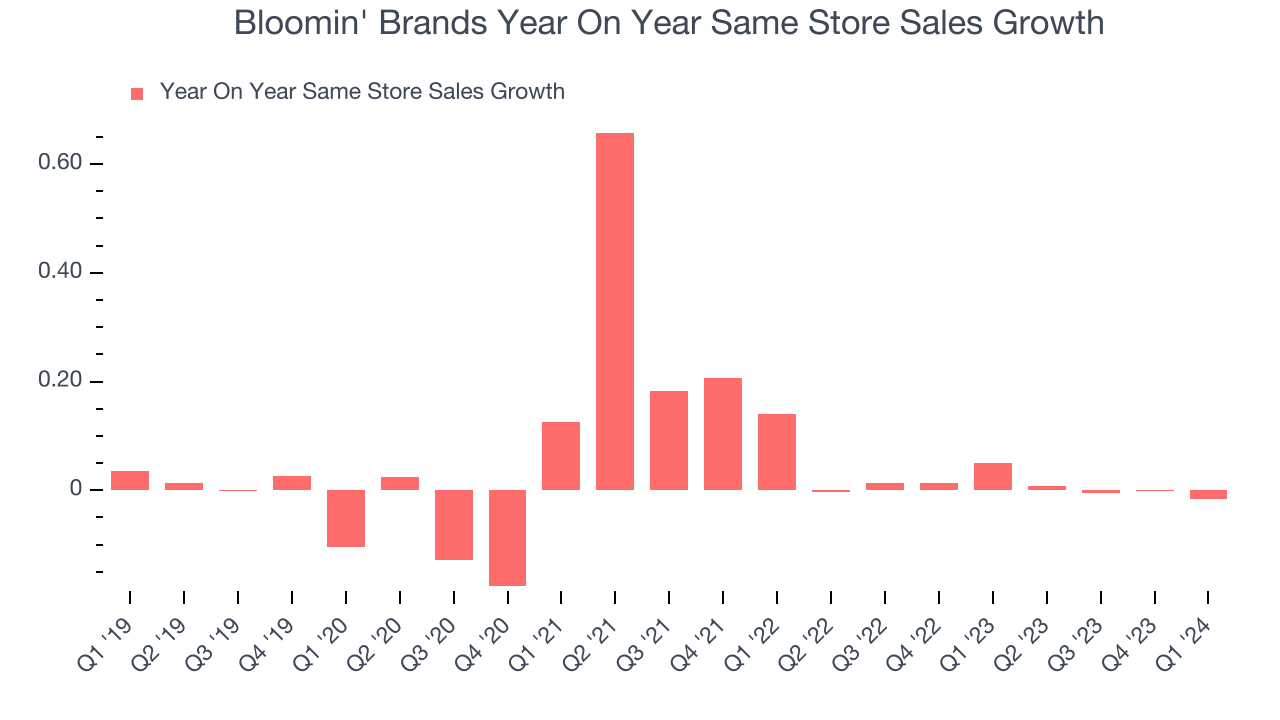

Bloomin' Brands's demand within its existing restaurants has barely risen over the last eight quarters. On average, the company's same-store sales growth has been flat.

In the latest quarter, Bloomin' Brands's same-store sales fell 1.6% year on year. This decline was a reversal from the 5.1% year-on-year increase it posted 12 months ago. We'll be keeping a close eye on the company to see if this turns into a longer-term trend.

Key Takeaways from Bloomin' Brands's Q1 Results

It was disappointing to see Bloomin' Brands miss analysts' revenue and EPS estimates this quarter as its same-store sales fell 1.6%. On the bright side, its gross margin outperformed while its full-year earnings guidance beat Wall Street's expectations. Overall, this was a mediocre quarter for Bloomin' Brands. The stock is flat after reporting and currently trades at $24.8 per share.

Bloomin' Brands may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.