Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Bumble (NASDAQ:BMBL) and the best and worst performers in the consumer subscription industry.

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

The 8 consumer subscription stocks we track reported a slower Q2. As a group, revenues beat analysts’ consensus estimates by 1.1% while next quarter’s revenue guidance was 2.9% below.

After much suspense, the Federal Reserve cut its policy rate by 50bps (half a percent) in September 2024. This marks the central bank’s first easing of monetary policy since 2020 and the end of its most pointed inflation-busting campaign since the 1980s. Inflation had begun to run hot in 2021 post-COVID due to a confluence of factors such as supply chain disruptions, labor shortages, and stimulus spending. While CPI (inflation) readings have been supportive lately, employment measures have prompted some concern. Going forward, the markets will debate whether this rate cut (and more potential ones in 2024 and 2025) is perfect timing to support the economy or a bit too late for a macro that has already cooled too much.

Thankfully, consumer subscription stocks have been resilient with share prices up 8.4% on average since the latest earnings results.

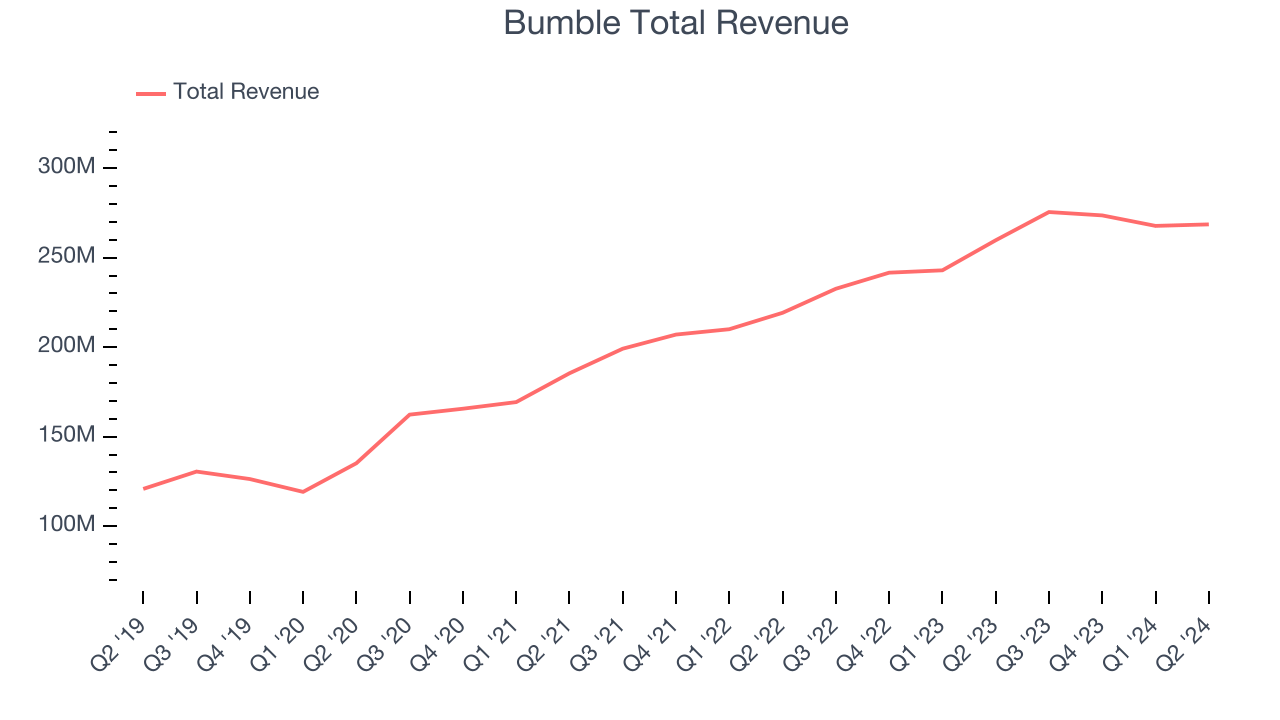

Bumble (NASDAQ:BMBL)

Founded by the co-founder of Tinder, Whitney Wolfe Herd, Bumble (NASDAQ:BMBL) is a leading dating app built with women at the center.

Bumble reported revenues of $268.6 million, up 3.4% year on year. This print fell short of analysts’ expectations by 1.6%. Overall, it was a softer quarter for the company with underwhelming revenue guidance for the next quarter and slow revenue growth.

Bumble delivered the weakest performance against analyst estimates of the whole group. The company reported 4.14 million active buyers, up 13.9% year on year. Unsurprisingly, the stock is down 13.2% since reporting and currently trades at $7.

Is now the time to buy Bumble? Access our full analysis of the earnings results here, it’s free.

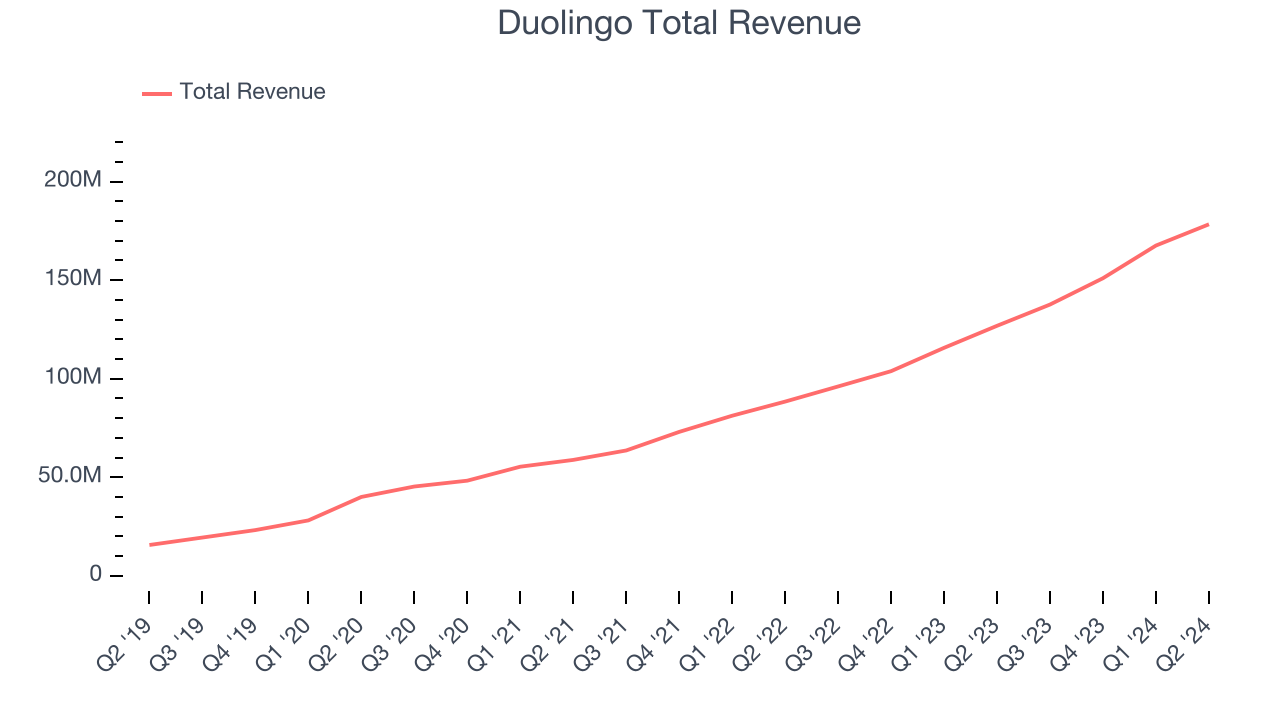

Best Q2: Duolingo (NASDAQ:DUOL)

Founded by a Carnegie Mellon computer science professor and his Ph.D. student, Duolingo (NASDAQ:DUOL) is a mobile app helping people learn new languages.

Duolingo reported revenues of $178.3 million, up 40.6% year on year, in line with analysts’ expectations. The business had a very strong quarter with full-year revenue guidance exceeding analysts’ expectations and impressive growth in its users.

Duolingo pulled off the fastest revenue growth among its peers. The company reported 103.6 million users, up 39.8% year on year. The market seems happy with the results as the stock is up 77.4% since reporting. It currently trades at $287.02.

Is now the time to buy Duolingo? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Chegg (NYSE:CHGG)

Started as a physical textbook rental service, Chegg (NYSE:CHGG) is now a digital platform addressing student pain points by providing study and academic assistance.

Chegg reported revenues of $163.1 million, down 10.8% year on year, exceeding analysts’ expectations by 2%. Still, it was a softer quarter as it posted a decline in its users and slow revenue growth.

Chegg delivered the slowest revenue growth in the group. The company reported 4.37 million users, down 9.1% year on year. As expected, the stock is down 46.6% since the results and currently trades at $1.57.

Read our full analysis of Chegg’s results here.

Coursera (NYSE:COUR)

Founded by two Stanford University computer science professors, Coursera (NYSE:COUR) is an online learning platform that offers courses, specializations, and degrees from top universities and organizations around the world.

Coursera reported revenues of $170.3 million, up 10.8% year on year. This result topped analysts’ expectations by 3.5%. Zooming out, it was a mixed quarter as it produced slow revenue growth.

Coursera pulled off the biggest analyst estimates beat among its peers. The company reported 155 million users, up 20.2% year on year. The stock is flat since reporting and currently trades at $7.47.

Read our full, actionable report on Coursera here, it’s free.

Netflix (NASDAQ:NFLX)

Launched by Reed Hastings as a DVD mail rental company until its famous pivot to streaming in 2007, Netflix (NASDAQ: NFLX) is a pioneering streaming content platform.

Netflix reported revenues of $9.56 billion, up 16.8% year on year. This result was in line with analysts’ expectations. Taking a step back, it was a weaker quarter as it recorded underwhelming revenue guidance for the next quarter and slow revenue growth.

Netflix had the weakest full-year guidance update among its peers. The company reported 277.6 million users, up 16.5% year on year. The stock is up 9.6% since reporting and currently trades at $704.70.

Read our full, actionable report on Netflix here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.