Egg company Cal-Maine Foods (NASDAQ:CALM) reported Q1 CY2024 results topping analysts' expectations, with revenue down 29.5% year on year to $703.1 million. It made a GAAP profit of $3 per share, down from its profit of $6.62 per share in the same quarter last year.

Is now the time to buy Cal-Maine? Find out in our full research report.

Cal-Maine (CALM) Q1 CY2024 Highlights:

- Revenue: $703.1 million vs analyst estimates of $692.4 million (1.5% beat)

- EPS: $3 vs analyst estimates of $2.45 (22.3% beat)

- Guidance: no specific figures given in the earnings release, but commentary on headwinds from highly pathogenic avian influenza (“HPAI”) and broader demand for eggs was encouraging

- Gross Margin (GAAP): 31.1%, down from 46.4% in the same quarter last year

- Market Capitalization: $2.87 billion

Sherman Miller, president and chief executive officer of Cal-Maine Foods, stated, “We are very pleased with Cal-Maine Foods’ strong financial and operating performance for the third quarter of fiscal 2024. Our sales reflect lower average selling prices compared to a year ago, when the shell egg industry experienced record high market prices due primarily to the impact of highly pathogenic avian influenza (“HPAI”) and other market factors resulting in a significant reduction in supply.

Known for brands such as Egg-Land’s Best and Land O’ Lakes, Cal-Maine (NASDAQ:CALM) produces, packages, and distributes eggs.

Perishable Food

Perishable Food

Sales Growth

Cal-Maine carries some recognizable brands and products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the other hand, Cal-Maine can still achieve high growth rates because its revenue base is not yet monstrous.

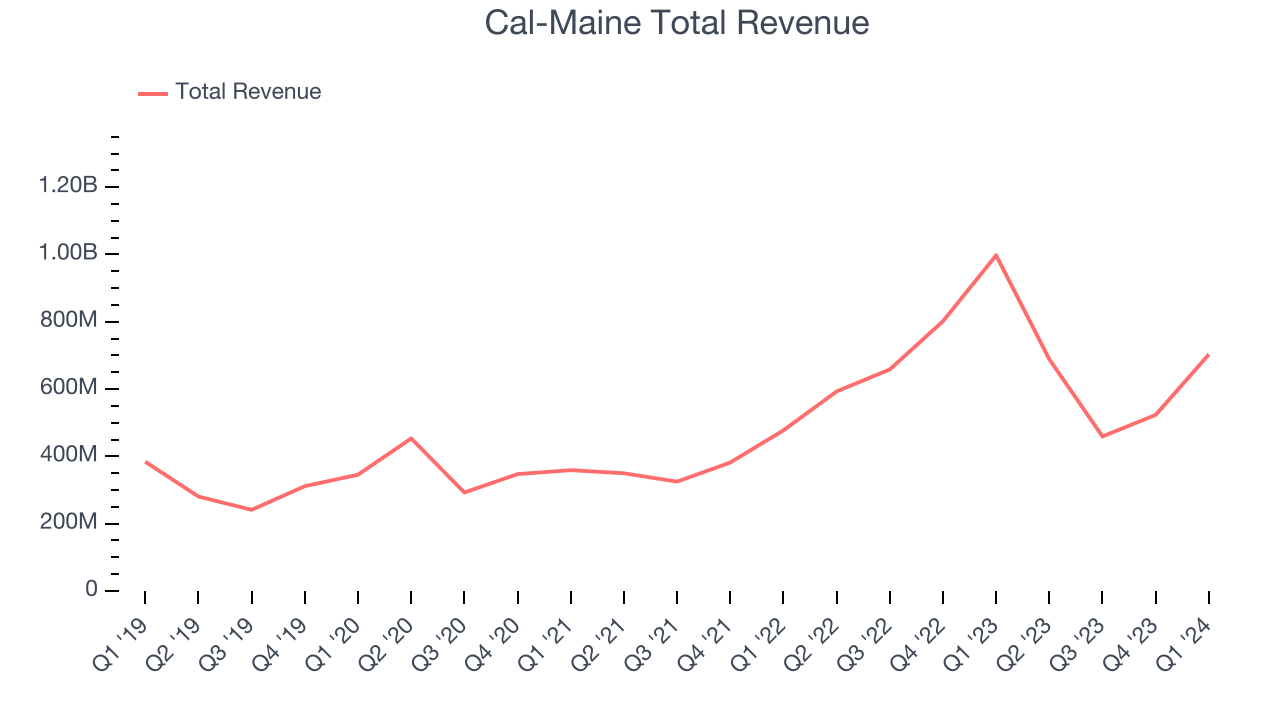

As you can see below, the company's annualized revenue growth rate of 17.8% over the last three years was impressive for a consumer staples business.

This quarter, Cal-Maine's revenue fell 29.5% year on year to $703.1 million but beat Wall Street's estimates by 1.5%. Looking ahead, Wall Street expects revenue to decline 12.5% over the next 12 months.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

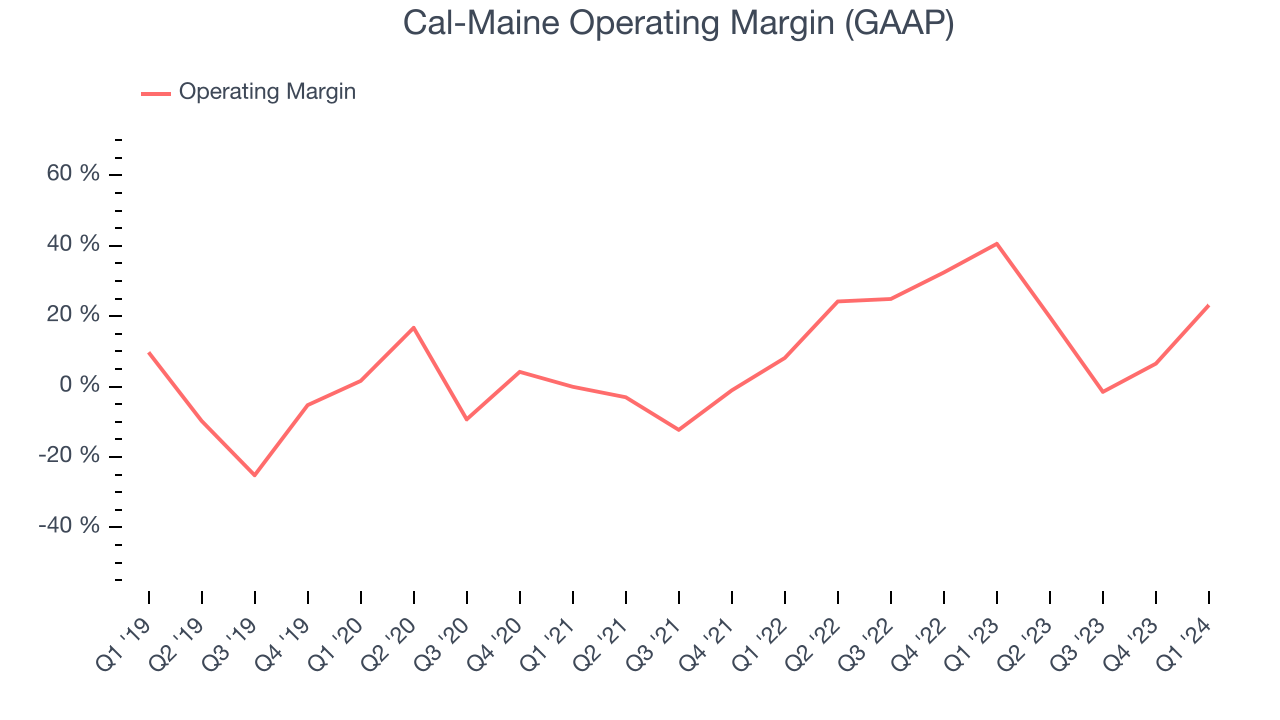

Operating margin is a key profitability metric for companies because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

This quarter, Cal-Maine generated an operating profit margin of 23.2%, down 17.4 percentage points year on year. Because Cal-Maine's operating margin decreased more than its gross margin, we can infer the company was less efficient and increased spending in discretionary areas like corporate overhead and advertising.

Zooming out, Cal-Maine has been a well-oiled machine over the last two years. It's demonstrated elite profitability for a consumer staples business, boasting an average operating margin of 23.9%. However, Cal-Maine's margin has declined by 18.1 percentage points on average over the last year. Although this isn't the end of the world, investors are likely hoping for better results in the future.

Zooming out, Cal-Maine has been a well-oiled machine over the last two years. It's demonstrated elite profitability for a consumer staples business, boasting an average operating margin of 23.9%. However, Cal-Maine's margin has declined by 18.1 percentage points on average over the last year. Although this isn't the end of the world, investors are likely hoping for better results in the future. Key Takeaways from Cal-Maine's Q1 Results

We enjoyed seeing Cal-Maine exceed analysts' EPS expectations this quarter by a large magnitude. We were also glad its revenue outperformed Wall Street's estimates. While no specific numerical guidance was given, commentary was positive. There have been fears of highly pathogenic avian influenza's impact on the industry, and the company stated that "While the more recent outbreaks of HPAI have also affected supply and caused market prices to move higher, the overall market impact has not been as severe." Additionally, it seems like the backdrop for eggs is strong, with Cal-Maine stating that "Demand for shell eggs has remained strong as consumers look for an affordable and nutritious protein option." Overall, this was a good quarter for Cal-Maine. The stock is up 8.2% after reporting and currently trades at $63.77 per share.

So should you invest in Cal-Maine right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.