Used-car retailer America’s Car-Mart (NASDAQ:CRMT) reported Q2 CY2024 results topping analysts’ expectations, with revenue down 4.9% year on year to $347.8 million. It made a GAAP loss of $0.15 per share, down from its profit of $0.65 per share in the same quarter last year.

Is now the time to buy America's Car-Mart? Find out in our full research report.

America's Car-Mart (CRMT) Q2 CY2024 Highlights:

- Revenue: $347.8 million vs analyst estimates of $343.7 million (1.2% beat)

- EPS: -$0.15 vs analyst estimates of $0.66 (-$0.81 miss)

- Gross Margin (GAAP): 18.9%, up from 17.9% in the same quarter last year

- EBITDA Margin: 6%, in line with the same quarter last year

- Locations: 155 at quarter end, in line with the same quarter last year

- Same-Store Sales fell 8.6% year on year (8.2% in the same quarter last year)

- Market Capitalization: $395.2 million

With a strong presence in the Southern and Central US, America’s Car-Mart (NASDAQ:CRMT) sells used cars to budget-conscious consumers.

Vehicle Retailer

Buying a vehicle is a big decision and usually the second-largest purchase behind a home for many people, so retailers that sell new and used cars try to offer selection, convenience, and customer service to shoppers. While there is online competition, especially for research and discovery, the vehicle sales market is still very fragmented and localized given the magnitude of the purchase and the logistical costs associated with moving cars over long distances. At the end of the day, a large swath of the population relies on cars to get from point A to point B, and vehicle sellers are acutely aware of this need.

Sales Growth

America's Car-Mart is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale. On the other hand, one advantage is that its growth rates can be higher because it’s growing off a small base.

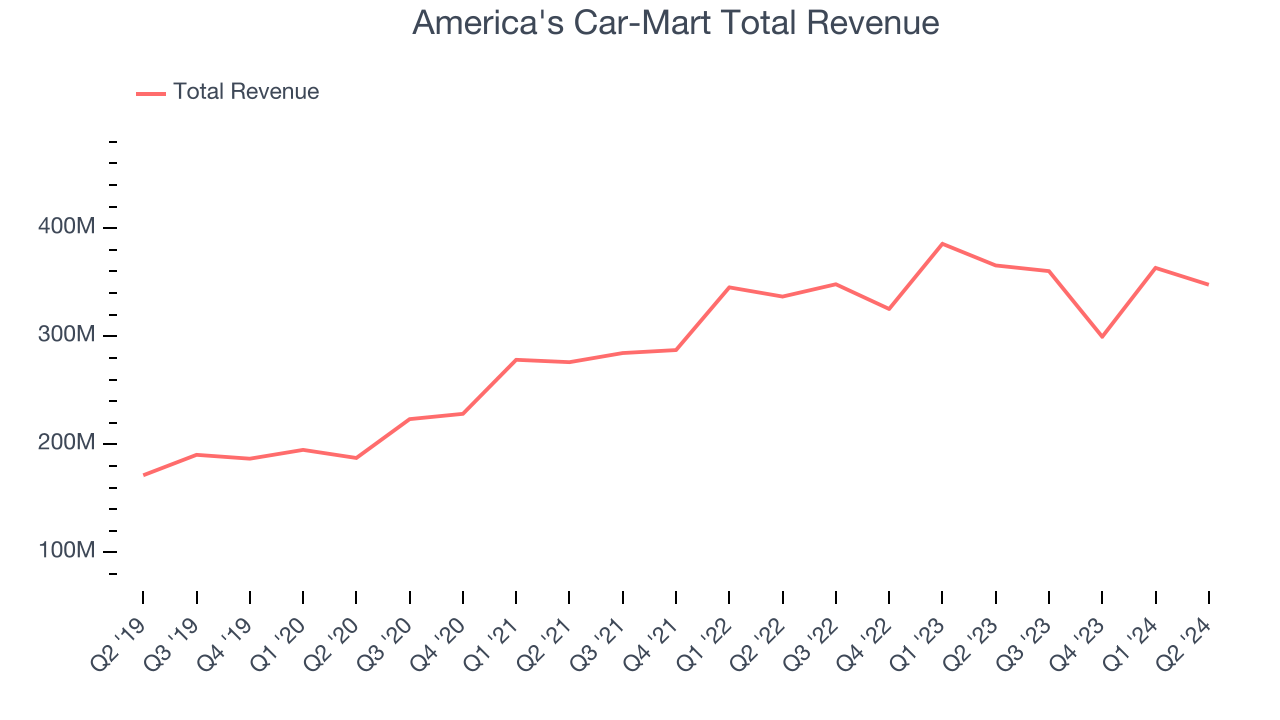

As you can see below, the company’s annualized revenue growth rate of 15.2% over the last five years was impressive despite not opening many new stores, implying that growth was driven by increased sales at existing, established stores.

This quarter, America's Car-Mart’s revenue fell 4.9% year on year to $347.8 million but beat Wall Street’s estimates by 1.2%. Looking ahead, Wall Street expects revenue to decline 1% over the next 12 months.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Same-Store Sales

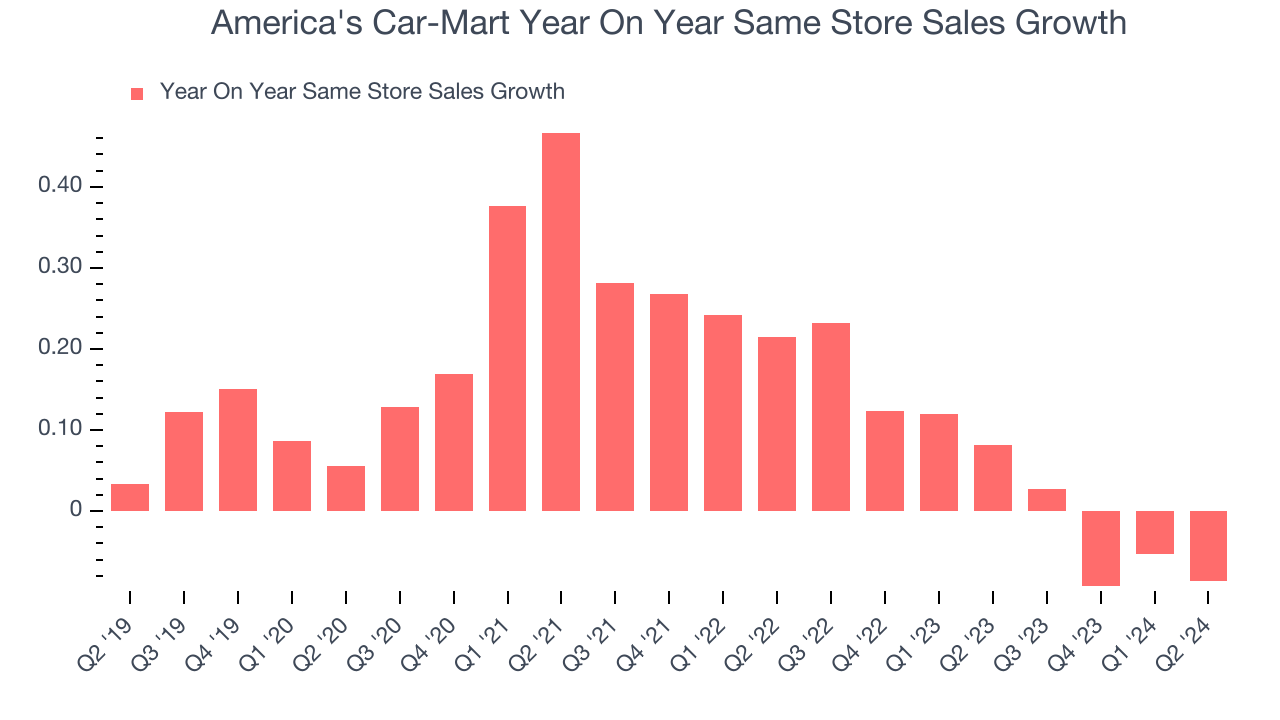

America's Car-Mart’s demand within its existing stores has generally risen over the last two years but lagged behind the broader consumer retail sector. On average, the company’s same-store sales have grown by 4.4% year on year. Given its flat store count over the same period, this performance stems from increased foot traffic at existing stores or higher e-commerce sales as the company shifts demand from in-store to online.

In the latest quarter, America's Car-Mart’s same-store sales fell 8.6% year on year. This decline was a reversal from the 8.2% year-on-year increase it posted 12 months ago. We’ll be keeping a close eye on the company to see if this turns into a longer-term trend.

Key Takeaways from America's Car-Mart’s Q2 Results

It was good to see America's Car-Mart beat analysts’ revenue expectations this quarter, though it did decline. Its EPS also significantly missed Wall Street’s estimates (analysts anticipated a net profit but it posted a net loss) as it failed to scale down its corporate expenses amidst the poor demand. Overall, this quarter could have been better. The stock traded down 7% to $55.84 immediately after reporting.

America's Car-Mart may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.