Cybersecurity company CrowdStrike (NASDAQ:CRWD) reported results in line with analysts’ expectations in Q2 CY2024, with revenue up 31.7% year on year to $963.9 million. On the other hand, next quarter’s revenue guidance of $982 million was less impressive, coming in 2.9% below analysts’ estimates. It made a non-GAAP profit of $1.04 per share, improving from its profit of $0.74 per share in the same quarter last year.

Is now the time to buy CrowdStrike? Find out by accessing our full research report, it’s free.

CrowdStrike (CRWD) Q2 CY2024 Highlights:

- Revenue: $963.9 million vs analyst estimates of $958.3 million (small beat)

- Adjusted Operating Income: $226.8 million vs analyst estimates of $206.4 million (9.9% beat)

- EPS (non-GAAP): $1.04 vs analyst estimates of $0.97 (7.7% beat)

- The company dropped its revenue guidance for the full year to $3.90 billion at the midpoint from $3.99 billion, a 2.4% decrease

- EPS (non-GAAP) guidance for the full year is $3.63 at the midpoint, missing analyst estimates by 7.2%

- Gross Margin (GAAP): 75.4%, in line with the same quarter last year

- Free Cash Flow Margin: 28.2%, down from 35% in the previous quarter

- Annual Recurring Revenue: $3.86 billion at quarter end, up 31.7% year on year (slight beat)

- Market Capitalization: $65.67 billion

Founded by George Kurtz, the former CTO of the antivirus company McAfee, CrowdStrike (NASDAQ:CRWD) provides cybersecurity software that protects companies from breaches and helps them detect and respond to cyber attacks.

Endpoint Security

Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks. As the volume of internet enabled devices grows, every device that employees use to connect to business networks represents a potential risk. Endpoint security software enables businesses to protect devices (endpoints) that employees use for work purposes either on a network or in the cloud from cyber threats.

Sales Growth

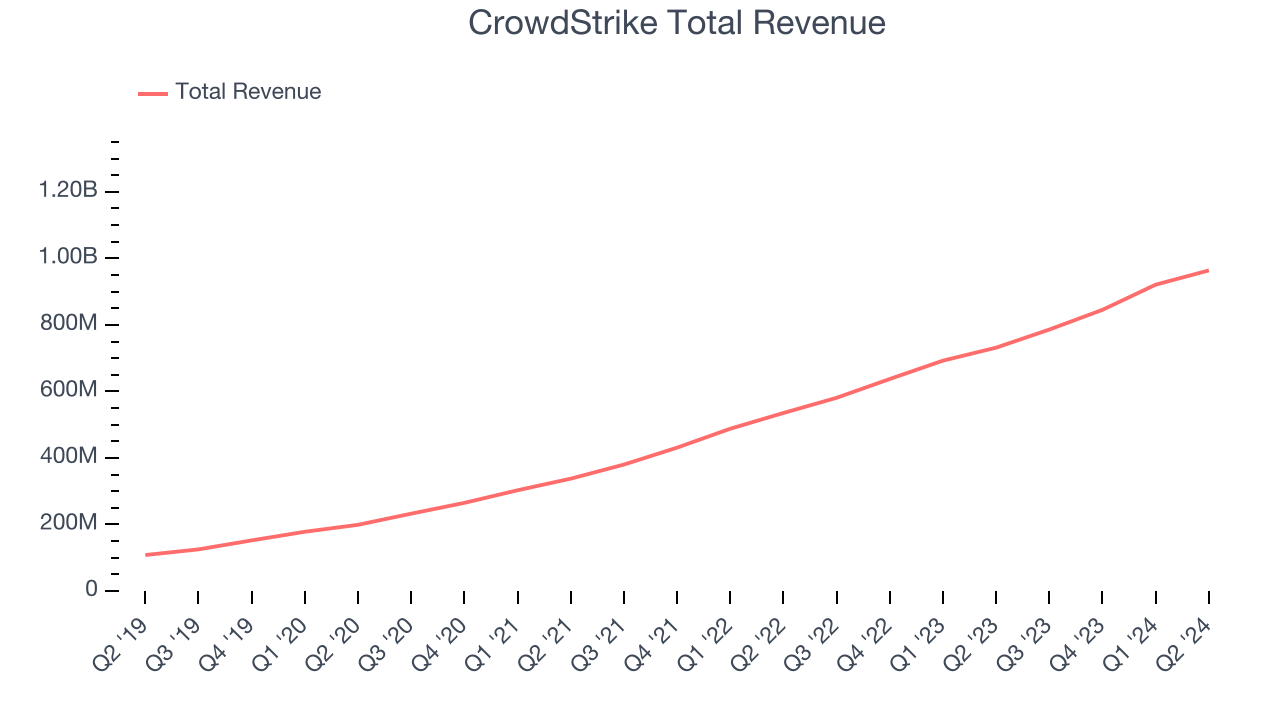

As you can see below, CrowdStrike’s 45.7% annualized revenue growth over the last three years has been incredible, and its sales came in at $963.9 million this quarter.

Unsurprisingly, this was another great quarter for CrowdStrike with revenue up 31.7% year on year. However, its growth did slow down compared to last quarter as the company’s revenue increased by just $42.84 million in Q2 compared to $75.7 million in Q1 CY2024. While we’d like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter’s guidance suggests that CrowdStrike is expecting revenue to grow 24.9% year on year to $982 million, slowing down from the 35.3% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 25.5% over the next 12 months before the earnings results announcement.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

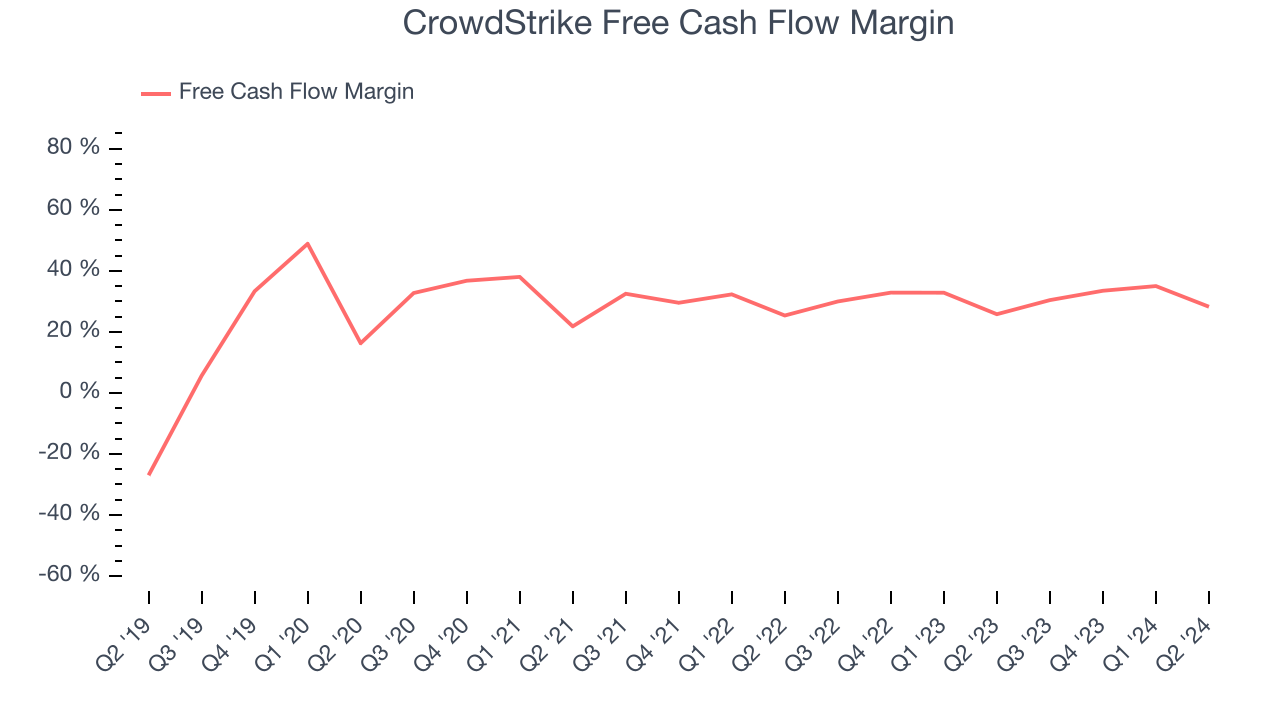

CrowdStrike has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the software sector, averaging an eye-popping 31.8% over the last year.

CrowdStrike’s free cash flow clocked in at $272.2 million in Q2, equivalent to a 28.2% margin. This quarter’s result was good as its margin was 2.5 percentage points higher than in the same quarter last year, but we note it was lower than its one-year cash profitability. Nevertheless, we wouldn’t read too much into a single quarter because investment needs can be seasonal, causing short-term swings. Long-term trends are more important.

Over the next year, analysts’ consensus estimates show they’re expecting CrowdStrike’s free cash flow margin of 31.8% for the last 12 months to remain the same.

Key Takeaways from CrowdStrike’s Q2 Results

The quarter itself was solid, with ARR (annual recurring revenue), revenue, and operating profit all beating. Guidance was underwhelming, though, as full-year revenue was lowered and revenue guidance for next quarter missed Wall Street’s estimates. However, this seems 'better than feared'. With the stock going from nearly $380 in mid-July to $265 now due to the massive outage from a flawed CrowdStrike Falcon update on Windows machines that wreaked havoc on airlines, hospitals, and other important parts of the global economy, the market feared that numbers could look quite bad in the near-term. These results prove that while there are headwinds from the outage, the headwinds aren't so bad (for the time being). As such, the stock traded up 2.9% to $271.89 immediately after reporting.

So should you invest in CrowdStrike right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.