As Q4 earnings season comes to a close, it’s time to take stock of this quarters’ best and worst performers amongst the productivity software stocks, including Dropbox (NASDAQ:DBX) and its peers.

Rising employee costs and the shift to more remote work has increased the ever-present pressure to improve corporate productivity, which in turn has driven rising demand for productivity software that enables remote work, streamline project management and automate business tasks.

The 16 productivity software stocks we track reported a decent Q4; on average, revenues beat analyst consensus estimates by 4.07%, while on average next quarter revenue guidance was 2.22% above consensus. Technology stocks have been hit hard on fears of higher interest rates , but productivity software stocks held their ground better than others, with share price down 3.62% since earnings, on average.

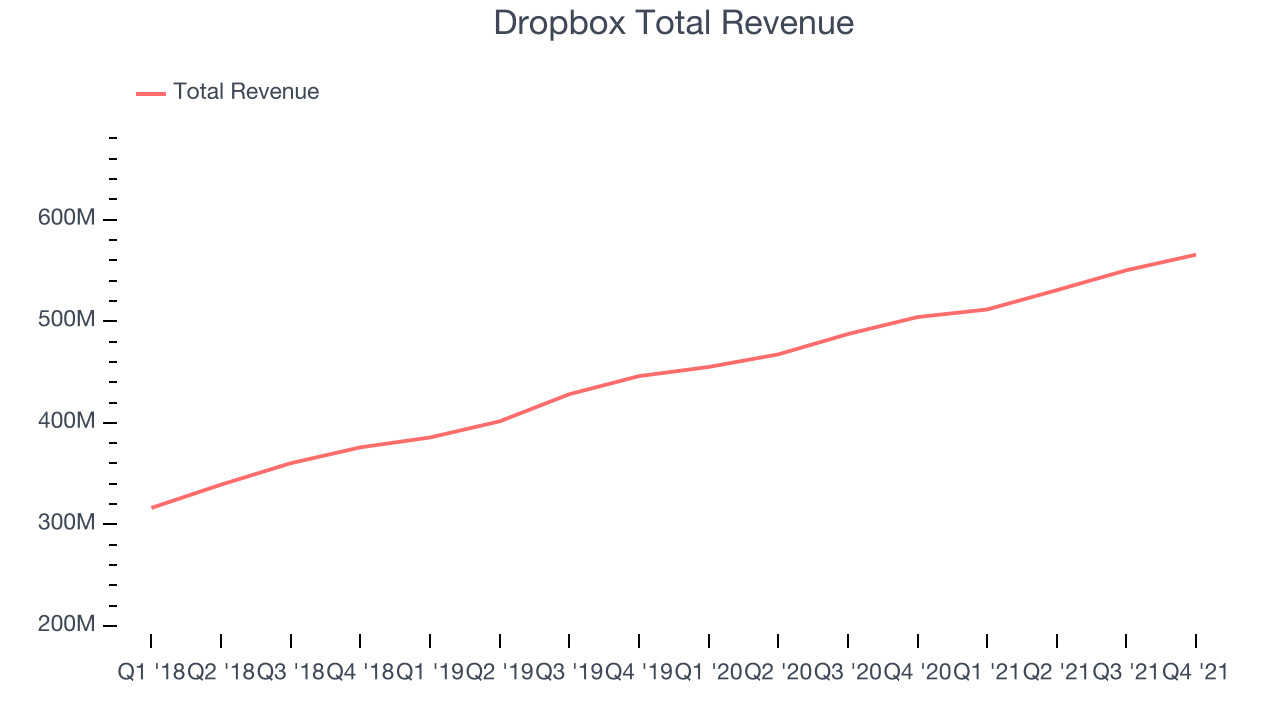

Dropbox (NASDAQ:DBX)

Founded by the long-serving CEO Drew Houston and Arash Ferdowsi in 2007, Dropbox (NASDAQ:DBX) provides a file hosting cloud platform that helps organizations collaborate and share documents.

Dropbox reported revenues of $565.5 million, up 12.1% year on year, beating analyst expectations by 1.27%. It was a mixed quarter for the company, with a decent beat of analyst estimates but slow revenue growth.

“2021 was a strong year for Dropbox. I’m proud of the progress our team made on evolving our core offerings and expanding our product portfolio to align to our customers’ growing needs, all during our first year as a Virtual First company,” said Dropbox Co-Founder and Chief Executive Officer Drew Houston.

Dropbox delivered the slowest revenue growth of the whole group. The company added 300,000 customers to a total of 16,790,000. The stock is down 0.57% since the results and currently trades at $23.43.

Read our full report on Dropbox here, it's free.

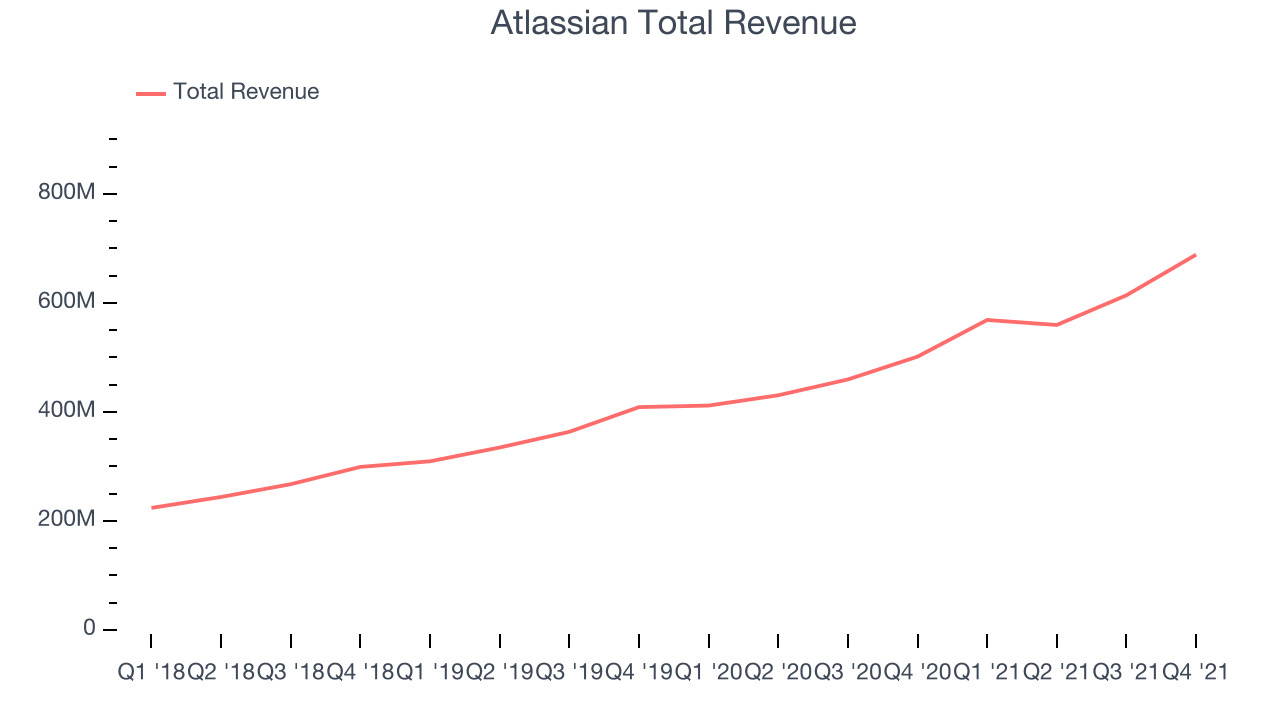

Best Q4: Atlassian (NASDAQ:TEAM)

Founded by Australian co-CEOs Mike Cannon-Brookes and Scott Farquhar in 2002, Atlassian (NASDAQ:TEAM) provides software as a service that makes it easier for large teams of software developers to manage projects, especially in software development.

Atlassian reported revenues of $688.5 million, up 37.3% year on year, beating analyst expectations by 7.16%. It was an impressive quarter for the company, with accelerating customer growth and a very optimistic guidance for the next quarter.

The stock is down 2.19% since the results and currently trades at $284.

Is now the time to buy Atlassian? Access our full analysis of the earnings results here, it's free.

Weakest Q4: Everbridge (NASDAQ:EVBG)

Founded as a reaction to the catastrophic events of 9/11, Everbridge (NASDAQ:EVBG) supplies software that helps governments and businesses keep people and infrastructure safe in emergencies.

Everbridge reported revenues of $102.8 million, up 36% year on year, in line with analyst expectations. It was a weaker quarter for the company, with the guidance for both the next quarter and the full year below analyst estimates.

The stock is down 9.92% since the results and currently trades at $41.75.

Read our full analysis of Everbridge's results here.

UiPath (NYSE:PATH)

Started in 2005 in Romania as a tech outsourcing company, UiPath (NYSE:PATH) makes software that helps companies automate repetitive computer tasks.

UiPath reported revenues of $220.8 million, up 49.9% year on year, beating analyst expectations by 5.53%. It was a good quarter for the company, with an exceptional revenue growth and guidance for the next quarter roughly in line with what analysts were expecting.

The stock is down 39.2% since the results and currently trades at $29.

Read our full, actionable report on UiPath here, it's free.

Appian (NASDAQ:APPN)

Founded by Matt Calkins and his three friends out of an apartment in Northern Virginia, Appian (NASDAQ:APPN) sells a software platform that lets its users build applications without using much code, allowing them to create new software more quickly.

Appian reported revenues of $104.9 million, up 28.6% year on year, beating analyst expectations by 10.1%. It was a very strong quarter for the company, with an impressive beat of analyst estimates and guidance for the next quarter above expectations.

Appian pulled off the strongest analyst estimates beat among the peers. The stock is up 22.3% since the results and currently trades at $60.30.

Read our full, actionable report on Appian here, it's free.

The author has no position in any of the stocks mentioned