E-signature company DocuSign (NASDAQ:DOCU) reported Q1 FY2022 results that beat analyst expectations, with revenue up 57.9% year on year to $469 million. DocuSign made a GAAP loss of $8.35 million, improving on its loss of $47.8 million, in the same quarter last year.

What do these results signal for the future of DocuSign? Get early access our full analysis here

DocuSign (NASDAQ:DOCU) Q1 FY2022 Highlights:

- Revenue: $469 million vs analyst estimates of $437.6 million (7.17% beat)

- EPS (non-GAAP): $0.44 vs analyst estimates of $0.28 ($0.16 beat)

- Revenue guidance for Q2 2022 is $482 million at the midpoint, above analyst estimates of $474.7 million

- The company lifted revenue guidance for the full year, from $1.96 billion to $2.03 billion at the midpoint, a 3.3% increase

- Free cash flow of $123 million, up 179% from previous quarter

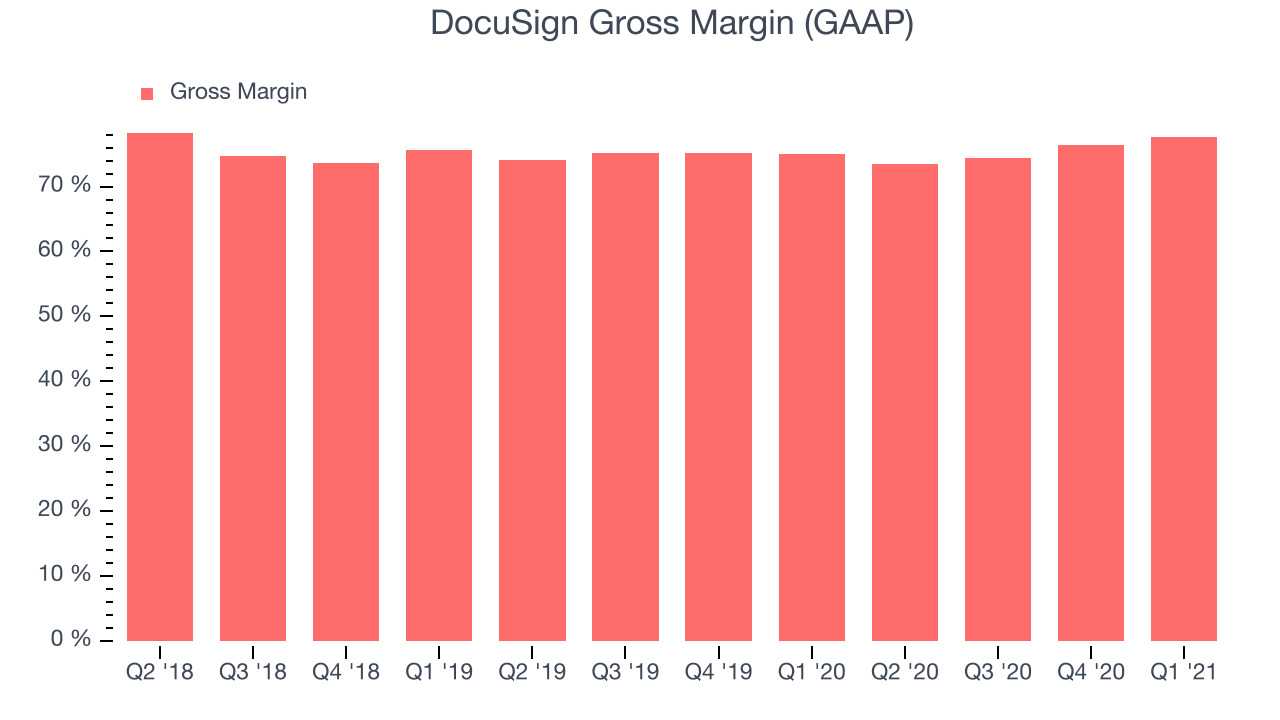

- Gross Margin (GAAP): 77.5%, up from 76.4% previous quarter

- Updated valuation: DocuSign is up at $203 and accounting for the revenue added in Q1 it now trades at 23.3x price-to-sales (LTM), compared to 25.3x just before the results.

"We've increasingly become the way people agree in this emerging anywhere economy—and that's not only helping organizations continue operations during the pandemic, but helping them realize new and more efficient ways of doing business in the future," said DocuSign CEO Dan Springer.

Frictionless Agreements

Founded in 2003, DocuSign (NASDAQ:DOCU) is the pioneer of e-signature and offers software as a service that allows people and organisations to sign legally binding documents electronically. The platforms digitizes the whole signing process from preparing the agreement, making sure that correct people received it, to storing it after it is signed. DocuSign makes the overall process of signing a document a lot faster and significantly reduces error rates, it also integrates with many other software platforms such as Google Drive or Salesforce, which for example allows companies to generate and send new agreements to their customers at the click of the button.

DocuSign can be an interesting company to watch because it is profiting from the overall digitization of the economy as the product is useful to any company, large or small, across a wide range of industries. The Covid pandemic has accelerated the digital transformation of how we work and do business and the e-signature products like DocuSign, Dropbox’s HelloSign or Adobe’s Sign have been clear beneficiaries of it.

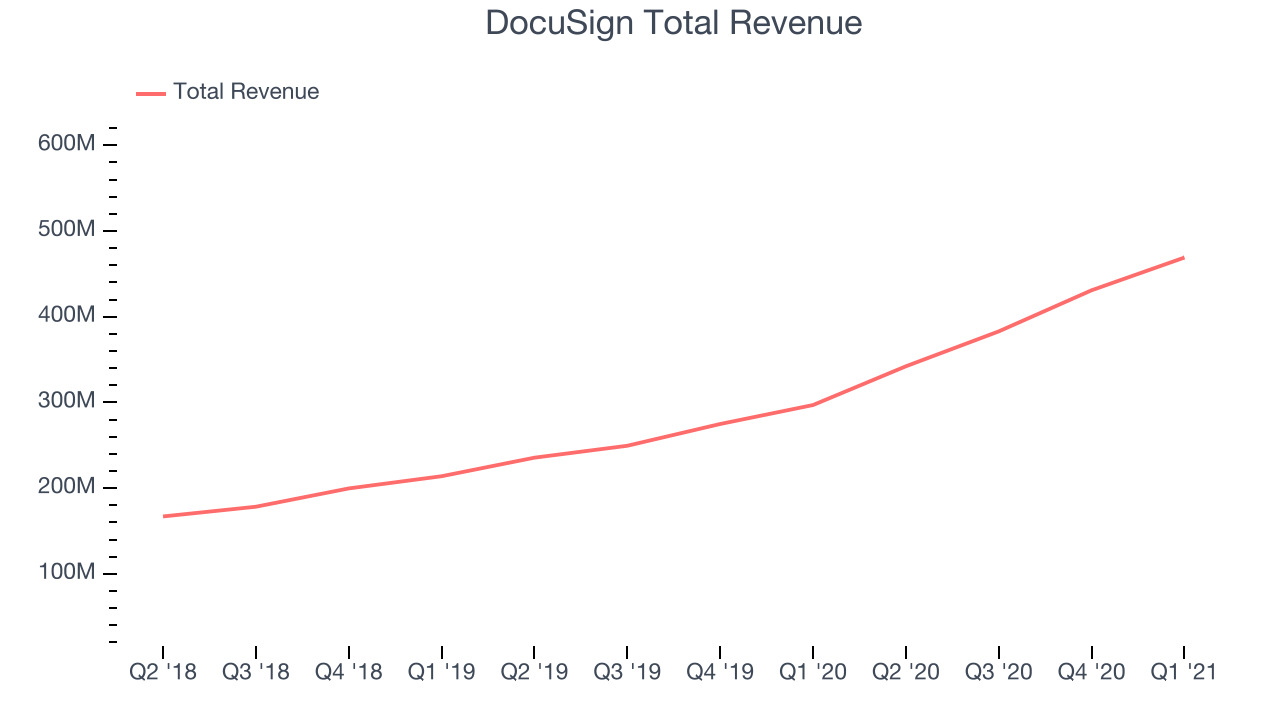

As you can see below, DocuSign's revenue growth has been impressive over the last twelve months, growing from $297 million to $469 million.

This was another standout quarter with the revenue up a splendid 57.9% year on year. But the growth did slow down compared to last quarter, as the revenue increased by just $38.1 million in Q1, compared to $47.9 million in Q4 2021. A one-off fluctuation is usually not concerning, but it is worth keeping in mind.

There are others doing even better. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 80% year on year and is already up more than 400% since the IPO in December. You can find it on our platform for free.

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers.

DocuSign's gross profit margin, an important metric measuring how much money there is left after paying for servers, licences, technical support and other necessary running expenses was at 77.5% in Q1. That means that for every $1 in revenue the company had $0.77 left to spend on developing new products, marketing & sales and the general administrative overhead. Significantly up from the last quarter, this is a good gross margin that will allow DocuSign to fund large investments in product and sales during periods of rapid growth and be profitable when it reaches maturity.

Key Takeaways from DocuSign's Q1 Results

With market capitalisation of $39 billion, more than $780.6 million in cash and with free cash flow over the last twelve months being positive, the company is in a very strong position to invest in growth.

We were impressed by the exceptional revenue growth DocuSign delivered this quarter. And we were also excited to see it that it outperformed Wall St’s revenue expectations. Zooming out, we think this impressive quarter should have shareholders feeling very positive. Therefore, we think DocuSign will continue to stand out as a very compelling growth stock, arguably even more so than before.

PS. If you found this analysis useful, you will love our earnings alerts! We publish so fast, you often have the opportunity to buy or sell before the market has fully absorbed the information. Never miss out on the right time to invest again. Signup here for free early access.

The author has no position in any of the stocks mentioned.