As we reflect back on the just completed Q3 productivity software sector earnings season, we dig into the relative performance of DocuSign (NASDAQ:DOCU) and its peers.

Rising employee costs and the shift to more remote work has increased the ever-present pressure to improve corporate productivity, which in turn has driven rising demand for productivity software that enables remote work, streamline project management and automate business tasks.

The 16 productivity software stocks we track reported a solid Q3; on average, revenues beat analyst consensus estimates by 3.89%, while on average next quarter revenue guidance was 2.94% above consensus. Tech stocks have had a rocky start in 2022 and productivity software stocks have not been spared, with share price down 27.2% since earnings, on average.

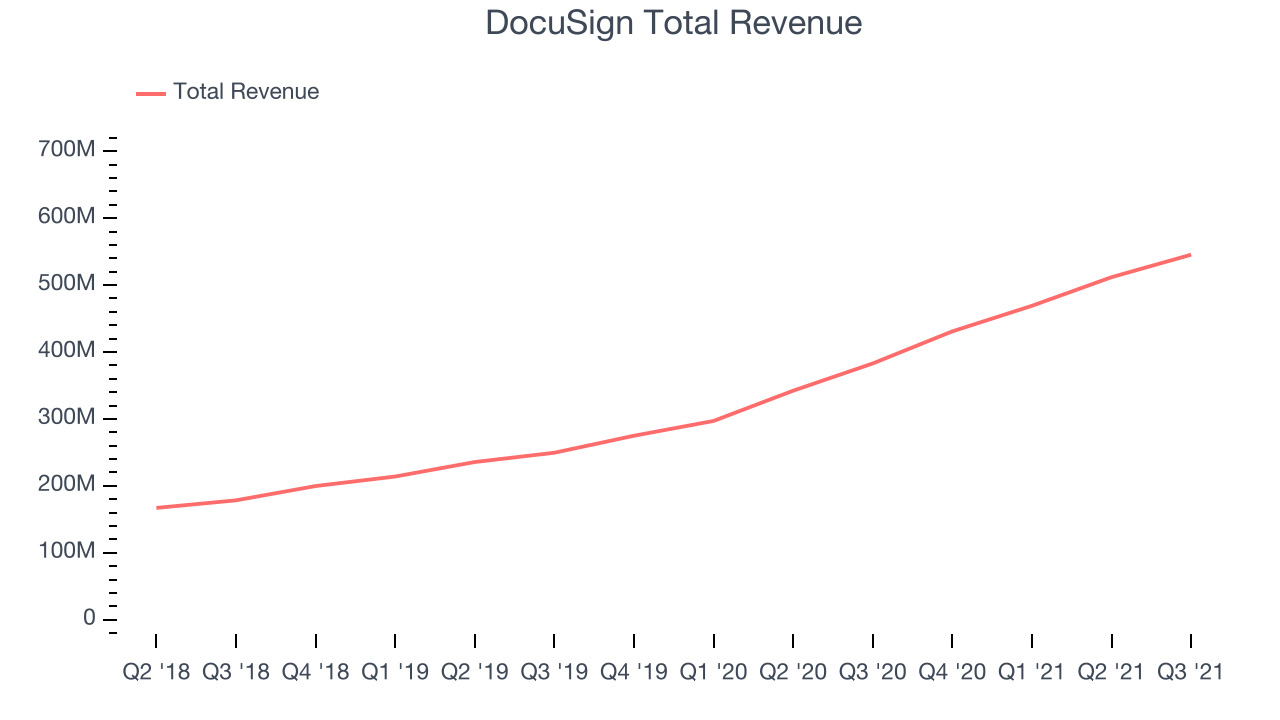

DocuSign (NASDAQ:DOCU)

Founded by Seattle-based entrepreneur Tom Gonser, DocuSign (NASDAQ:DOCU) is the pioneer of e-signature and offers software as a service that allows people and organisations to sign legally binding documents electronically.

DocuSign reported revenues of $545.4 million, up 42.4% year on year, beating analyst expectations by 2.67%. It was a tough quarter for the company, with an exceptional revenue growth but an underwhelming revenue guidance for the next quarter missing analyst expectations.

"Third quarter revenue growth of 42% year-over-year and operating margin of 22% exceeded our expectations. After six quarters of accelerated growth, we saw customers return to more normalized buying patterns, resulting in 28% year-over-year billings growth," said Dan Springer, CEO of DocuSign.

DocuSign also delivered the weakest full year guidance update of the whole group. The stock plunged in reaction to the earnings, is down 44.2% since the results and currently trades at $130.30.

Is now the time to buy DocuSign? Access our full analysis of the earnings results here, it's free.

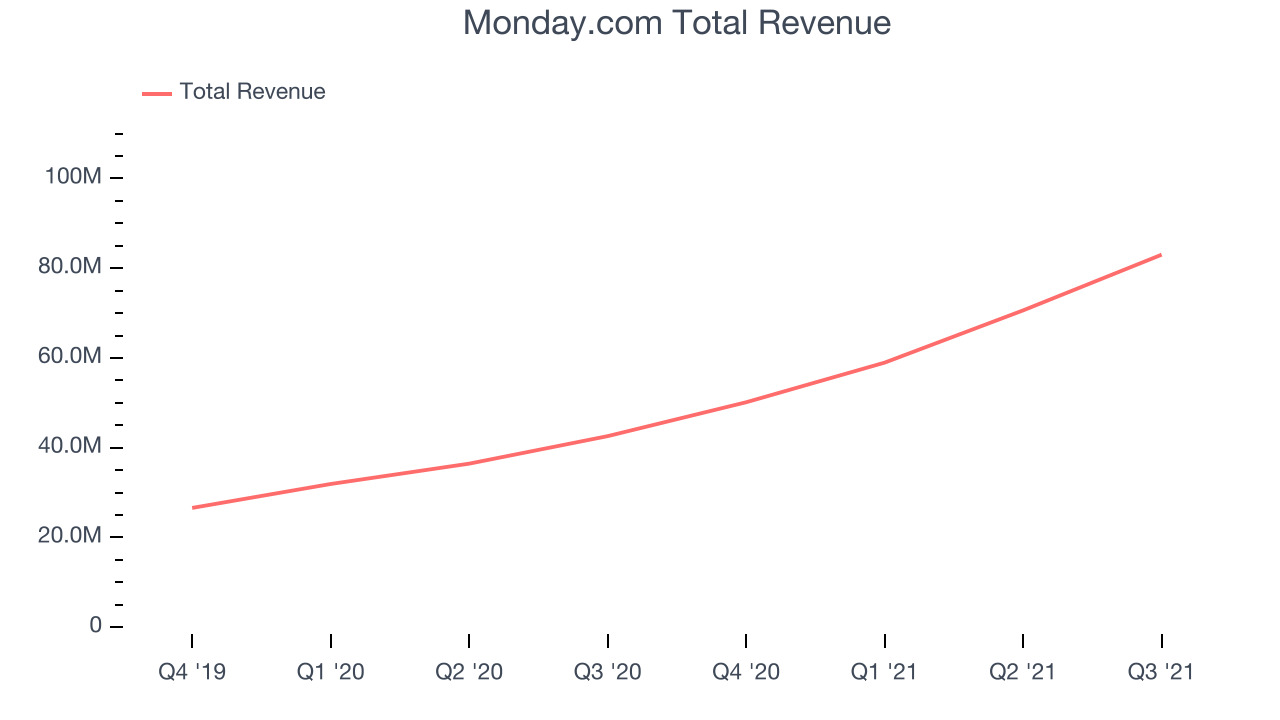

Best Q3: Monday.com (NASDAQ:MNDY)

Founded in Israel in 2014, and named after the dreaded first day of the work week, Monday.com (NASDAQ:MNDY) makes software as a service platforms that helps teams plan and track work efficiently.

Monday.com reported revenues of $83 million, up 94.9% year on year, beating analyst expectations by 11.1%. It was an exceptional quarter for the company, with an impressive beat of analyst estimates and a very optimistic guidance for the next quarter.

Monday.com delivered the strongest analyst estimates beat, fastest revenue growth, and highest full year guidance raise among its peers. The company added 143 enterprise customers paying more than $50,000 annually to a total of 613. The stock is down 51.9% since the results and currently trades at $214.

Is now the time to buy Monday.com? Access our full analysis of the earnings results here, it's free.

Weakest Q3: 8x8 (NYSE:EGHT)

Founded in 1987, 8x8 (NYSE:EGHT) provides software for organizations to efficiently communicate and collaborate with their customers, employees, and partners.

8x8 reported revenues of $151.5 million, up 17.3% year on year, beating analyst expectations by 2.39%. It was a weaker quarter for the company, with guidance slightly under analyst expectations and decelerating growth in large customers.

The stock is down 28.7% since the results and currently trades at $16.49.

Read our full analysis of 8x8's results here.

Five9 (NASDAQ:FIVN)

Started in 2001, Five9 (NASDAQ: FIVN) offers software as a service that makes it easier for companies to set up and efficiently run call centers, and offer more tailored customer support.

In early 2021 Zoom Communications (ZM) attempted to buy Five9 in an all stock deal, but the acquisition fell through. Five9 reported revenues of $154.3 million, up 37.6% year on year, beating analyst expectations by 5.21%. It was a very strong quarter for the company, with an optimistic guidance for the next quarter and a solid revenue growth.

The stock is down 11.6% since the results and currently trades at $128.20.

Read our full, actionable report on Five9 here, it's free.

UiPath (NYSE:PATH)

Started in 2005 in Romania as a tech outsourcing company, UiPath (NYSE:PATH) makes software that helps companies automate repetitive computer tasks.

UiPath reported revenues of $220.8 million, up 49.9% year on year, beating analyst expectations by 5.53%. It was a strong quarter for the company, with an exceptional revenue growth.

The stock is down 22.7% since the results and currently trades at $36.88.

Read our full, actionable report on UiPath here, it's free.

The author has no position in any of the stocks mentioned