As Q2 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers amongst the productivity software stocks, including DocuSign (NASDAQ:DOCU) and its peers.

Rising employee costs and the shift to more remote work has increased the ever-present pressure to improve corporate productivity, which in turn has driven rising demand for productivity software that enables remote work, streamline project management and automate business tasks.

The 16 productivity software stocks we track reported a mixed Q2; on average, revenues beat analyst consensus estimates by 2.6%, while on average next quarter revenue guidance was 0.56% under consensus. There has been a stampede out of high valuation technology stocks as raising interest rates encourages investors to value profits over growth again and while some of the productivity software stocks have fared somewhat better than others, they have not been spared, with share prices declining 9.54% since the previous earnings results, on average.

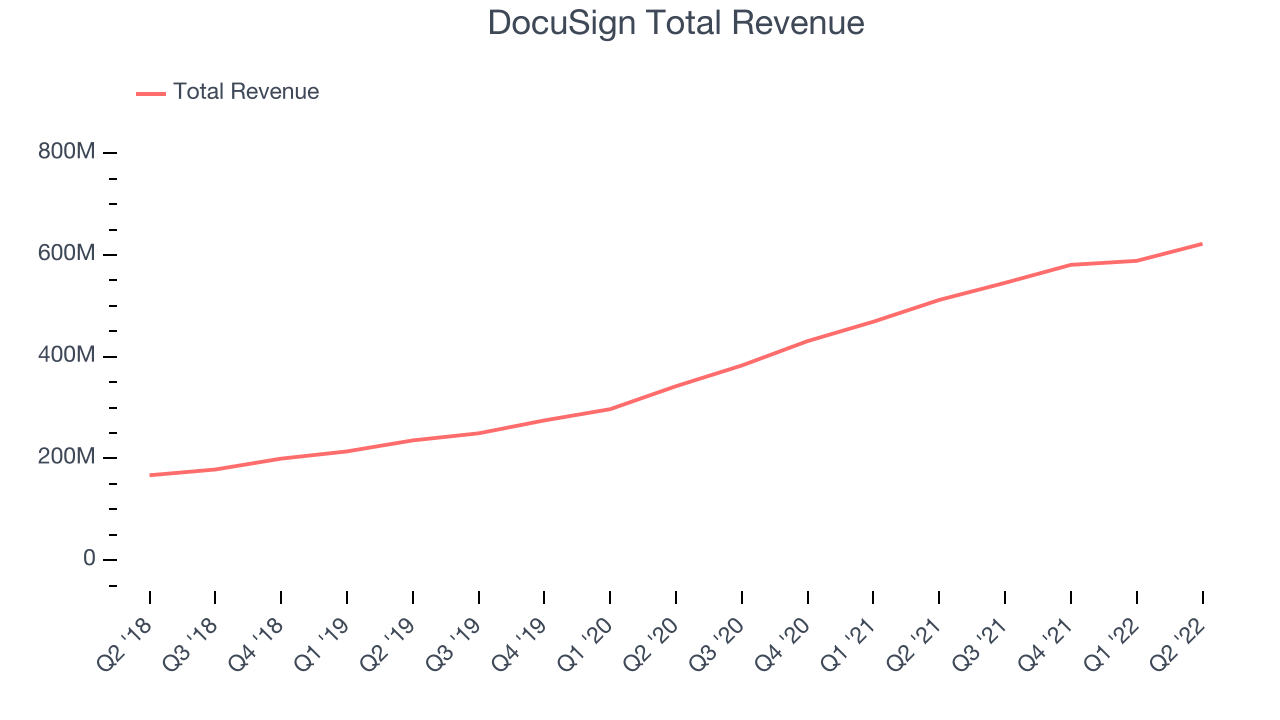

DocuSign (NASDAQ:DOCU)

Founded by Seattle-based entrepreneur Tom Gonser, DocuSign (NASDAQ:DOCU) is the pioneer of e-signature and offers software as a service that allows people and organisations to sign legally binding documents electronically.

DocuSign reported revenues of $622.1 million, up 21.5% year on year, beating analyst expectations by 3.3%. It was a solid quarter for the company, with a decent beat of analyst estimates.

"We delivered solid Q2 results, with a strong finish to the first half of the year. These results reflect the focus and dedication of our team on execution during this transition period, with a stronger foundation in place to deliver in the second half of the year. We enter this next phase with a clear set of vital few deliverables for our people initiatives and product roadmap, while driving sustainable and profitable growth at scale," said Maggie Wilderotter, DocuSign's Interim CEO and Board Chair.

The stock is down 4.86% since the results and currently trades at $55.15.

Is now the time to buy DocuSign? Access our full analysis of the earnings results here, it's free.

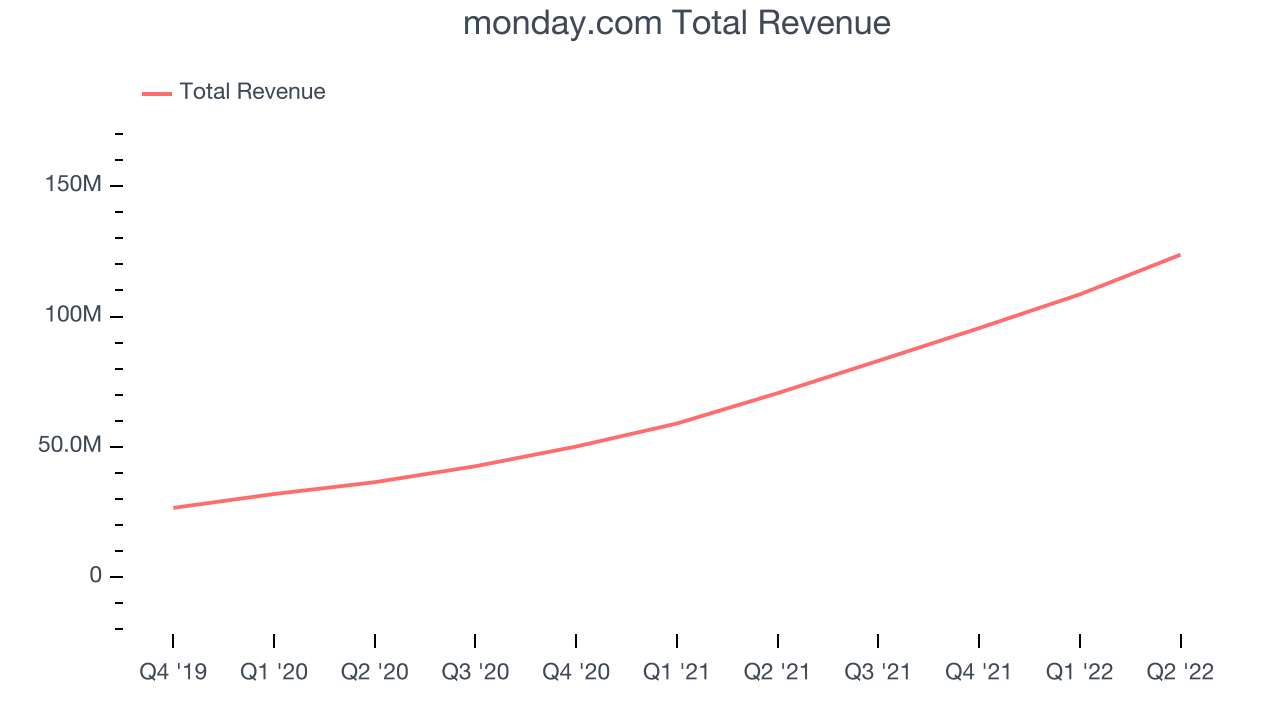

Best Q2: monday.com (NASDAQ:MNDY)

Founded in Israel in 2014, and named after the dreaded first day of the work week, Monday.com (NASDAQ:MNDY) makes software as a service platforms that helps teams plan and track work efficiently.

monday.com reported revenues of $123.7 million, up 75.2% year on year, beating analyst expectations by 4.65%. It was a strong quarter for the company, with an exceptional revenue growth and a very optimistic guidance for the next quarter.

monday.com achieved the fastest revenue growth among its peers. The company added 200 enterprise customers paying more than $50,000 annually to a total of 1,160. The stock is up 0.87% since the results and currently trades at $129.

Is now the time to buy monday.com? Access our full analysis of the earnings results here, it's free.

Weakest Q2: Zoom Video (NASDAQ:ZM)

Started by Eric Yuan who once ran engineering for Cisco’s video conferencing business, Zoom (NASDAQ:ZM) offers an easy to use, cloud-based platform for video conferencing, audio conferencing and screen sharing.

Zoom Video reported revenues of $1.09 billion, up 7.63% year on year, missing analyst expectations by 1.57%. It was a weak quarter for the company, with revenue guidance for both the next quarter and the full year missing analysts' expectations.

Zoom Video had the weakest performance against analyst estimates and slowest revenue growth in the group. The company added 200 enterprise customers paying more than $100,000 annually to a total of 3,116. The stock is down 22.3% since the results and currently trades at $75.75.

Read our full analysis of Zoom Video's results here.

UiPath (NYSE:PATH)

Started in 2005 in Romania as a tech outsourcing company, UiPath (NYSE:PATH) makes software that helps companies automate repetitive computer tasks.

UiPath reported revenues of $242.2 million, up 23.8% year on year, beating analyst expectations by 5%. It was a weak quarter for the company, with revenue guidance for both the next quarter and the full year missing analysts' expectations.

UiPath had the weakest full year guidance update among the peers. The stock is down 17.3% since the results and currently trades at $12.88.

Read our full, actionable report on UiPath here, it's free.

Jamf (NASDAQ:JAMF)

Founded in 2002 by Zach Halmstad and Chip Pearson, right around the time when Apple began to dominate the personal computing market, Jamf (NASDAQ:JAMF) provides software for companies to manage Apple devices such as Macs, iPads, and iPhones.

Jamf reported revenues of $115.6 million, up 34% year on year, beating analyst expectations by 2.26%. It was a decent quarter for the company, with a strong top line growth and revenue guidance for the next quarter roughly in line with analysts' expectations.

The stock is down 15.3% since the results and currently trades at $22.90.

Read our full, actionable report on Jamf here, it's free.

The author has no position in any of the stocks mentioned