Data visualization and business intelligence company Domo (NASDAQ:DOMO) reported Q2 CY2024 results exceeding Wall Street analysts’ expectations, with revenue down 1.6% year on year to $78.41 million. The company expects next quarter’s revenue to be around $77.5 million, in line with analysts’ estimates. It made a non-GAAP loss of $0.07 per share, down from its loss of $0.02 per share in the same quarter last year.

Is now the time to buy Domo? Find out in our full research report.

Domo (DOMO) Q2 CY2024 Highlights:

- Revenue: $78.41 million vs analyst estimates of $76.6 million (2.4% beat)

- Adjusted Operating Income: $1.93 million vs analyst estimates of -$5.62 million (134% beat)

- EPS (non-GAAP): -$0.07 vs analyst estimates of -$0.28

- Revenue Guidance for the full year is $314 million at the midpoint, roughly in line with what analysts were expecting

- EPS (non-GAAP) guidance for the full year is $0.73 at the midpoint, beating analyst estimates

- Gross Margin (GAAP): 74.3%, down from 76% in the same quarter last year

- Free Cash Flow was -$5.59 million, down from $496,000 in the previous quarter

- Billings: $68.6 million at quarter end, down 2.8% year on year

- Market Capitalization: $294.3 million

“We've made great progress with ecosystem partnerships and consumption customers in Q2, and are already seeing these strategic initiatives deliver exciting new opportunities for Domo,” said Josh James, founder and CEO, Domo.

Founded by Josh James after selling his former business Omniture to Adobe, Domo (NASDAQ:DOMO) provides business intelligence software that allows managers to access and visualize critical business metrics in real-time, using their smartphones.

Data Analytics

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the siloed data.

Sales Growth

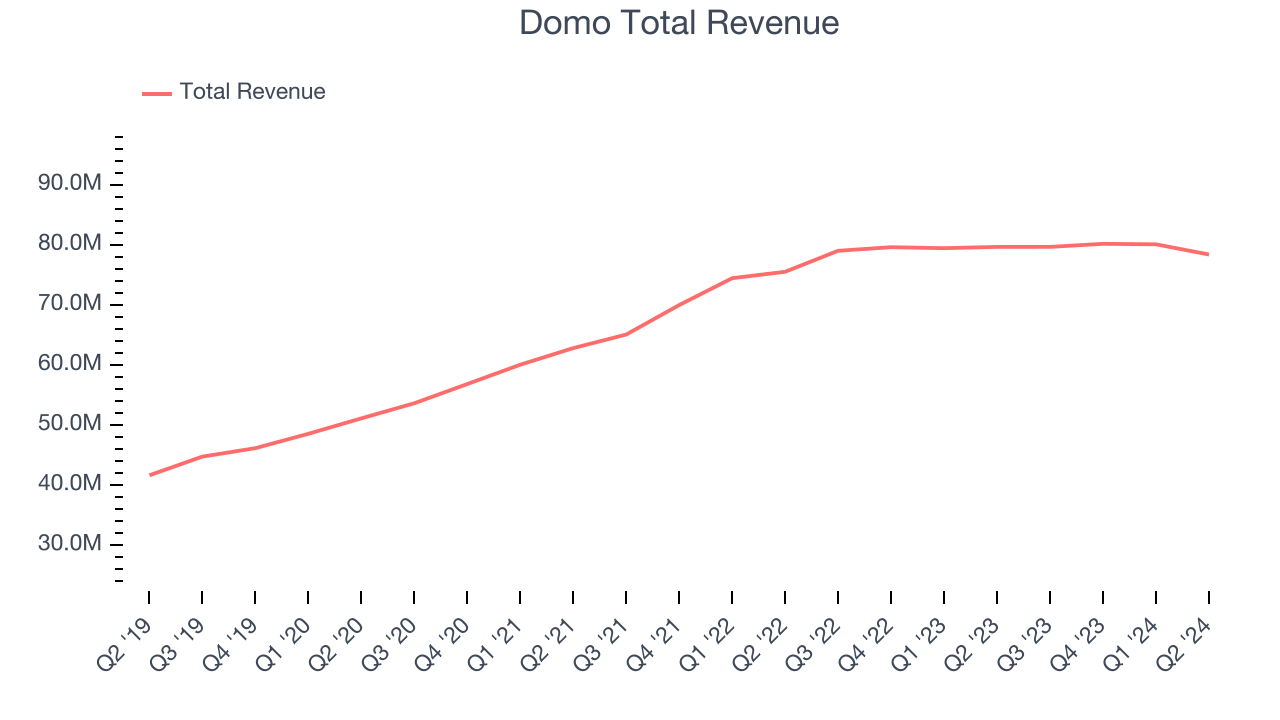

As you can see below, Domo’s 10.9% annualized revenue growth over the last three years has been weak, and its sales came in at $78.41 million this quarter.

This quarter, Domo’s revenue was down 1.6% year on year, which might disappointment some shareholders.

Next quarter, Domo is guiding for a 2.7% year-on-year revenue decline to $77.5 million, a further deceleration from the 0.8% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street was expecting revenue to decline 2.2% over the next 12 months before the earnings results announcement.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

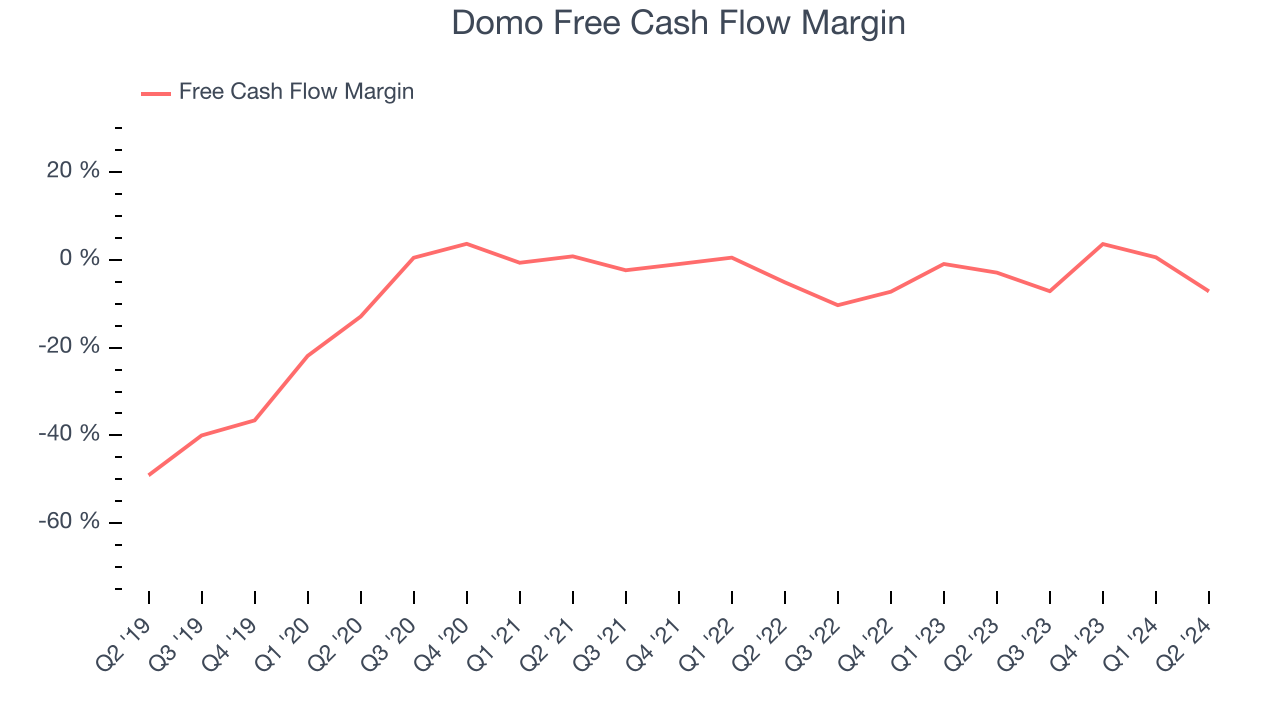

Domo’s demanding reinvestments have consumed many resources over the last year, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 2.5%, weak for a software business.

Domo burned through $5.59 million of cash in Q2, equivalent to a negative 7.1% margin. The company’s cash burn increased meaningfully year on year while its cash conversion fell 4.3 percentage points. This relationship shows Domo’s management team spent more cash this quarter but was less efficient at generating sales with that cash.

Over the next year, analysts predict Domo’s cash conversion will improve to break even. Their consensus estimates imply its free cash flow margin of negative 2.5% for the last 12 months will increase by 2.1 percentage points.

Key Takeaways from Domo’s Q2 Results

It was good to see Domo beat analysts’ revenue expectations this quarter. Operating income was also slightly positive, ahead of expectations of an operating loss this quarter. We were also glad next quarter’s revenue guidance came in higher than Wall Street’s estimates. On the other hand, its billings unfortunately missed analysts’ expectations. Overall, this was a solid quarter. The stock traded up 6.4% to $8.20 immediately after reporting.

So should you invest in Domo right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.