As the Q2 earnings season wraps, let’s dig into this quarter’s best and worst performers in the online marketplace industry, including eBay (NASDAQ:EBAY) and its peers.

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

The 16 online marketplace stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 4.9% while next quarter’s revenue guidance was 5.1% above.

Big picture, the Federal Reserve has a dual mandate of inflation and employment. The former had been running hot throughout 2021 and 2022 but cooled towards the central bank's 2% target as of late. This prompted the Fed to cut its policy rate by 50bps (half a percent) in September 2024. Given recent employment data that suggests the US economy could be wobbling, the markets will be assessing whether this rate and future cuts (the Fed signaled more to come in 2024 and 2025) are the right moves at the right time or whether they're too little, too late for a macro that has already cooled.

Thankfully, online marketplace stocks have been resilient with share prices up 8.6% on average since the latest earnings results.

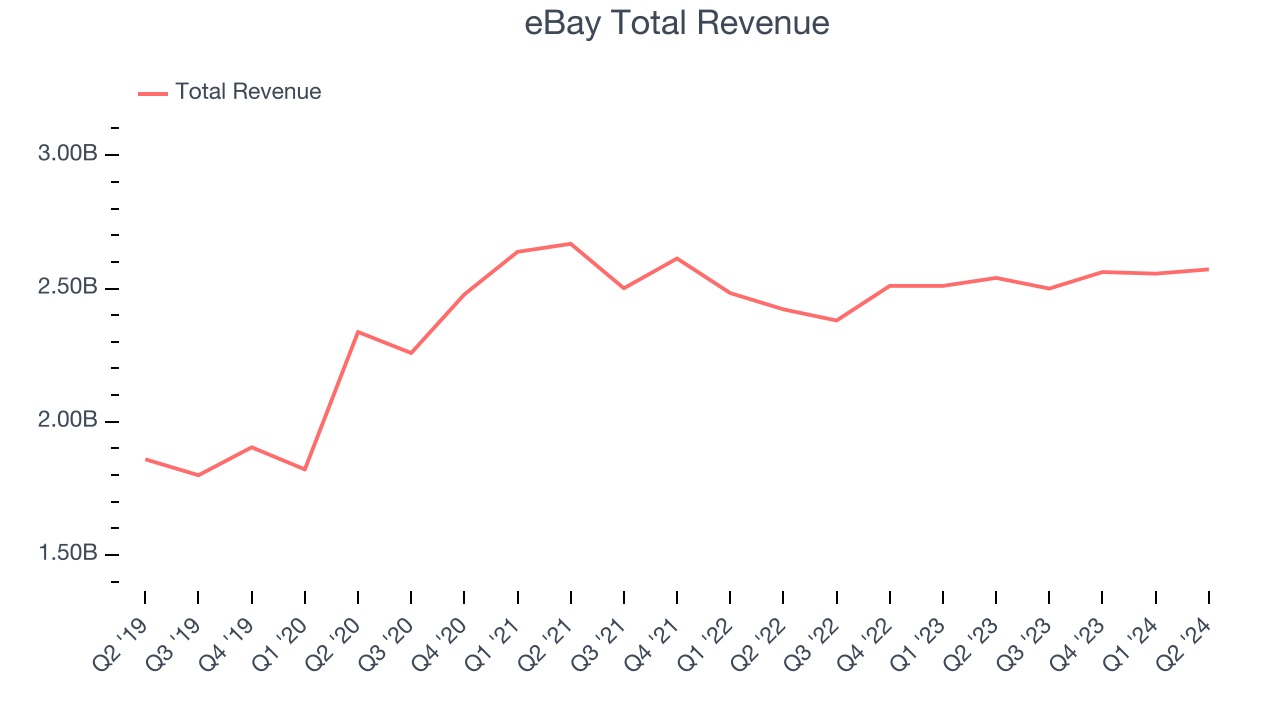

eBay (NASDAQ:EBAY)

Originally known as the first online auction site, eBay (NASDAQ:EBAY) is one of the world’s largest online marketplaces.

eBay reported revenues of $2.57 billion, up 1.3% year on year. This print exceeded analysts’ expectations by 1.8%. Despite the top-line beat, it was still a weaker quarter for the company with slow revenue growth and underwhelming revenue guidance for the next quarter.

"eBay's strong Q2 results mark another step toward achieving sustainable, long-term growth," said Jamie Iannone, Chief Executive Officer at eBay.

Interestingly, the stock is up 17.7% since reporting and currently trades at $65.43.

Read our full report on eBay here, it’s free.

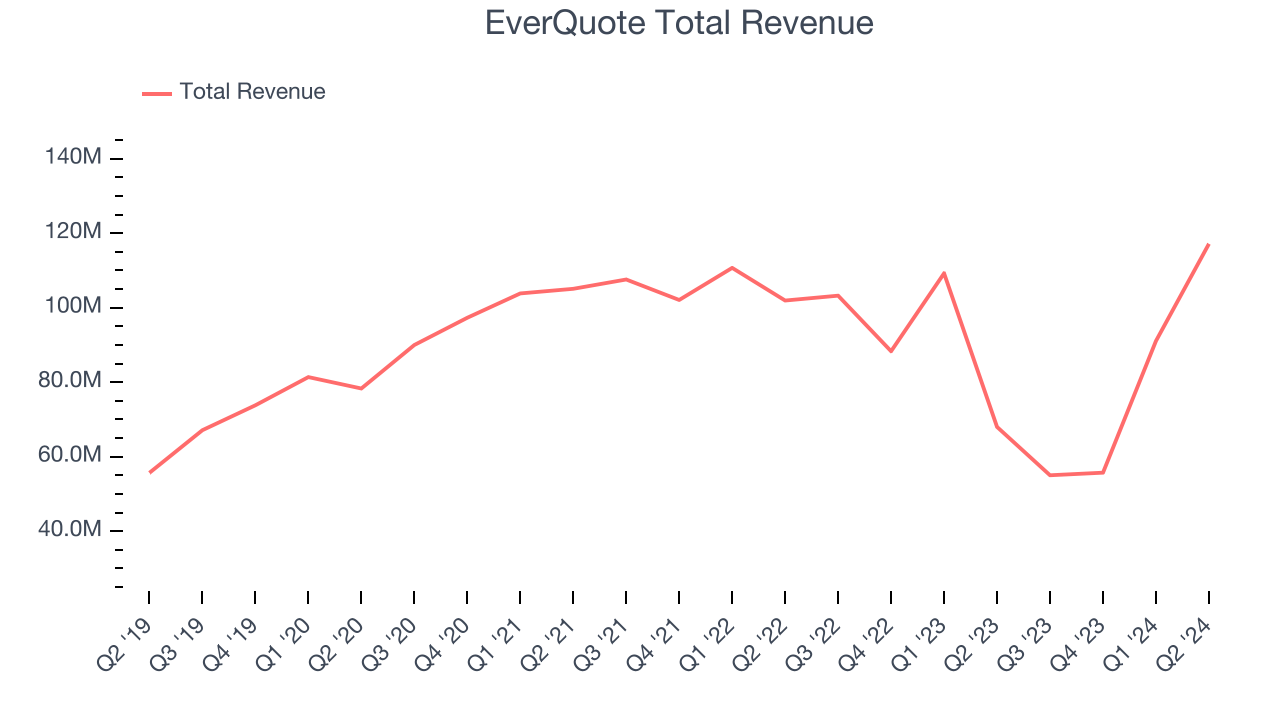

Best Q2: EverQuote (NASDAQ:EVER)

Aiming to simplify a once complicated process, EverQuote (NASDAQ:EVER) is an online insurance marketplace where consumers can compare and purchase various types of insurance from different providers

EverQuote reported revenues of $117.1 million, up 72.3% year on year, outperforming analysts’ expectations by 13.9%. The business had an incredible quarter with optimistic revenue guidance for the next quarter and exceptional revenue growth.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 10.7% since reporting. It currently trades at $21.43.

Is now the time to buy EverQuote? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Teladoc (NYSE:TDOC)

Founded to help people in rural areas get online medical consultations, Teladoc Health (NYSE:TDOC) is a telemedicine platform that facilitates remote doctor’s visits.

Teladoc reported revenues of $642.4 million, down 1.5% year on year, falling short of analysts’ expectations by 1.1%. It was a softer quarter as it posted slow revenue growth.

As expected, the stock is down 6.5% since the results and currently trades at $8.83.

Read our full analysis of Teladoc’s results here.

Remitly (NASDAQ:RELY)

With Amazon founder Jeff Bezos as an early investor, Remitly (NASDAQ:RELY) is an online platform that enables consumers to safely and quickly send money globally.

Remitly reported revenues of $306.4 million, up 30.9% year on year. This number surpassed analysts’ expectations by 1.5%. Overall, it was a strong quarter as it also produced impressive growth in its buyers and strong top-line growth.

The company reported 6.85 million active buyers, up 36.1% year on year. The stock is up 5.5% since reporting and currently trades at $13.97.

Read our full, actionable report on Remitly here, it’s free.

MercadoLibre (NASDAQ:MELI)

Originally started as an online auction platform, MercadoLibre (NASDAQ:MELI) is a one-stop e-commerce marketplace and fintech platform in Latin America.

MercadoLibre reported revenues of $5.07 billion, up 41.5% year on year. This result beat analysts’ expectations by 8.3%. Overall, it was a stunning quarter as it also put up impressive growth in its users and exceptional revenue growth.

The company reported 156.7 million daily active users, up 43.8% year on year. The stock is up 31.2% since reporting and currently trades at $2,104.

Read our full, actionable report on MercadoLibre here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.