Carbonate fuel cell technology developer FuelCell Energy (NASDAQ:FCEL) reported Q2 CY2024 results exceeding Wall Street analysts’ expectations, with revenue down 7.1% year on year to $23.7 million. It made a GAAP loss of $0.07 per share, down from its loss of $0.06 per share in the same quarter last year.

Is now the time to buy FuelCell Energy? Find out by accessing our full research report, it’s free.

FuelCell Energy (FCEL) Q2 CY2024 Highlights:

- Revenue: $23.7 million vs analyst estimates of $22.54 million (5.1% beat)

- Adj. EBITDA: ($20.1) million vs analyst estimates of ($20.2) million (in line)

- EPS: -$0.07 vs analyst expectations of -$0.07 (in line)

- Gross Margin (GAAP): -26.2%, up from -32.2% in the same quarter last year

- EBITDA Margin: -85%, up from -124% in the same quarter last year

- Backlog: $1.20 billion at quarter end, up 12.6% year on year

- Market Capitalization: $204.3 million

“In the third quarter, our team achieved solid performance and continued cost management, while advancing our Powerhouse strategy,” said Mr. Jason Few, President and Chief Executive Officer.

Founded in 1969, FuelCell Energy (NASDAQ: FCEL) is a leading manufacturer and developer of carbonate fuel cell technology for stationary power generation.

Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

Sales Growth

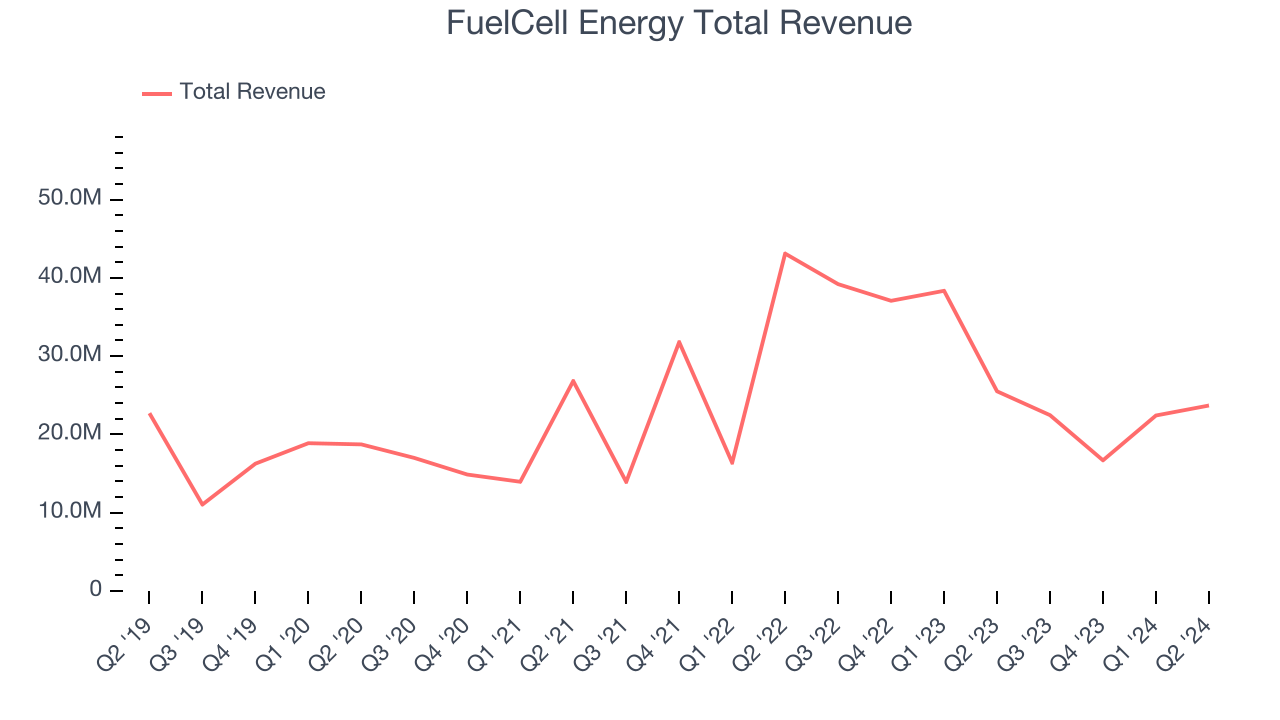

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one tends to sustain growth for years. Unfortunately, FuelCell Energy’s 4.8% annualized revenue growth over the last five years was sluggish. This shows it failed to expand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. FuelCell Energy’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 10% annually.

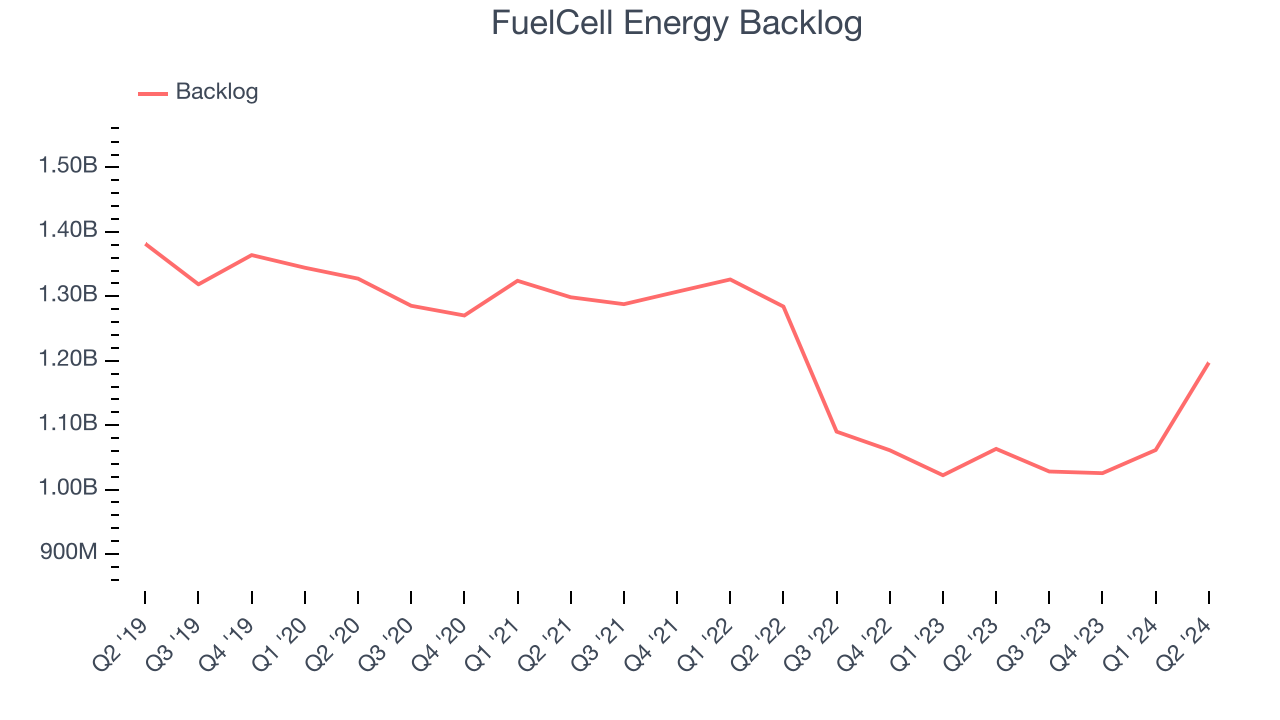

We can dig further into the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. FuelCell Energy’s backlog reached $1.20 billion in the latest quarter and averaged 8.4% year-on-year declines over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for FuelCell Energy’s products and services but raises concerns about capacity constraints.

This quarter, FuelCell Energy’s revenue fell 7.1% year on year to $23.7 million but beat Wall Street’s estimates by 5.1%. Looking ahead, Wall Street expects sales to grow 97.9% over the next 12 months, an acceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Operating Margin

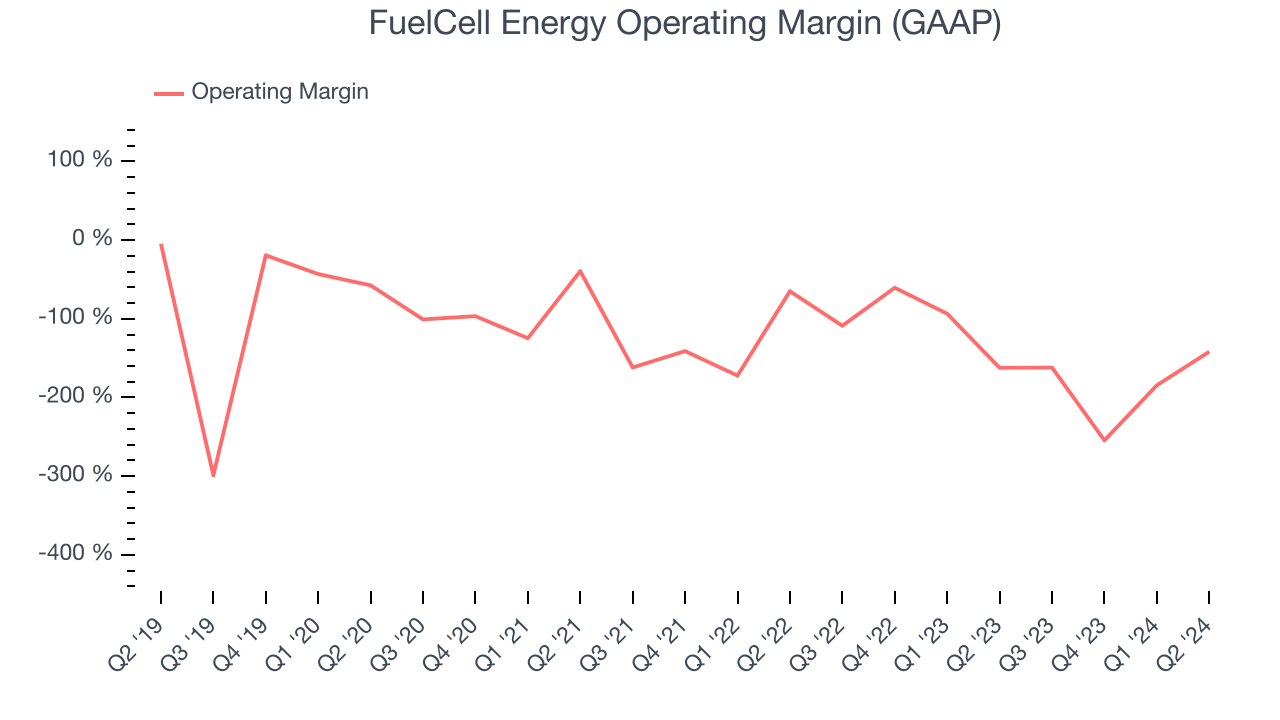

Unprofitable industrials companies require extra attention because they could get caught swimming naked if the tide goes out. It’s hard to trust that FuelCell Energy can endure a full cycle as its high expenses have contributed to an average operating margin of negative 114% over the last five years. This result isn’t too surprising given its low gross margin as a starting point.

Analyzing the trend in its profitability, FuelCell Energy’s annual operating margin decreased by 95.6 percentage points over the last five years. The company’s performance was poor no matter how you look at it. It shows operating expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, FuelCell Energy generated an operating profit margin of negative 142%, up 20.4 percentage points year on year. This increase was solid, and since the company’s operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as sales, marketing, R&D, and administrative overhead.

EPS

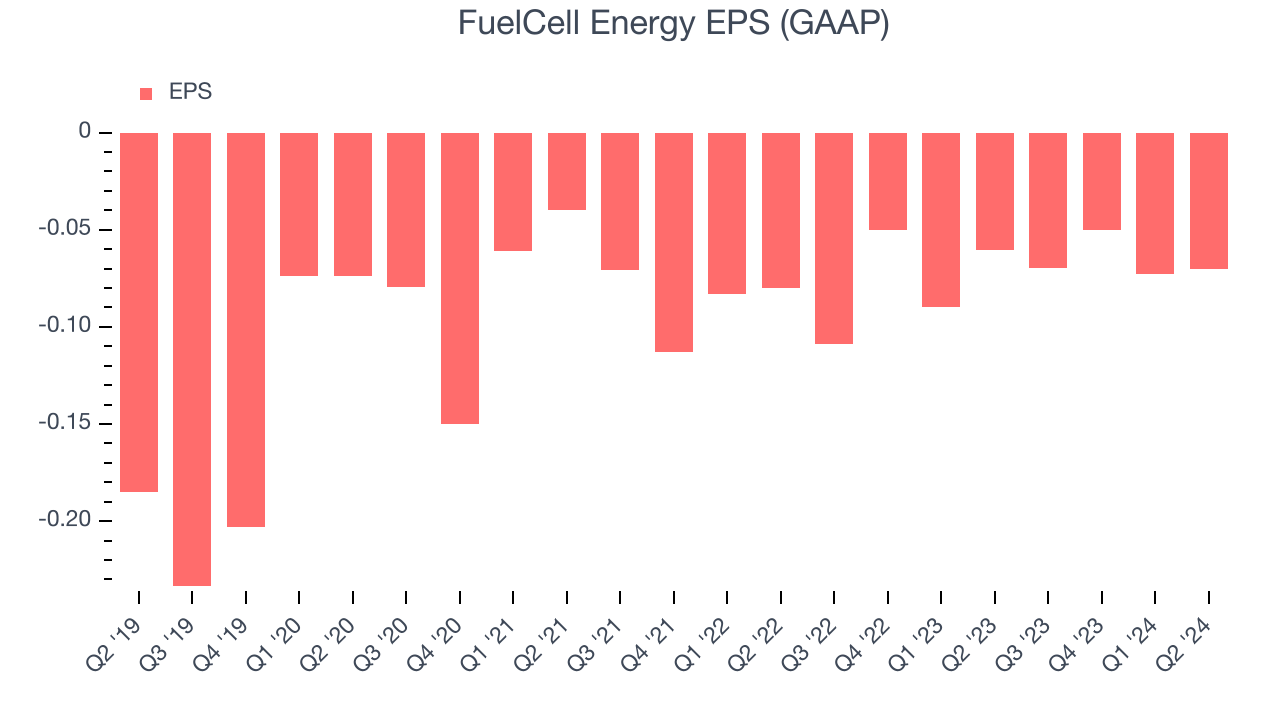

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Although FuelCell Energy’s full-year earnings are still negative, it reduced its losses and improved its EPS by 50.1% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

In Q2, FuelCell Energy reported EPS at negative $0.07, in line with the same quarter last year. This print beat analysts’ estimates by 4.1%. Over the next 12 months, Wall Street is optimistic. Analysts are projecting FuelCell Energy’s EPS of negative $0.26 in the last year to reach break even.

Key Takeaways from FuelCell Energy’s Q2 Results

We were impressed by how significantly FuelCell Energy blew past analysts’ revenue expectations this quarter. That adjusted EBITDA and EPS came in line with expectations was comforting. On the other hand, its backlog missed. Overall, this quarter seemed fine. The stock remained flat at $0.41 immediately after reporting.

So should you invest in FuelCell Energy right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.