Heading into the new earnings season, we look at the numbers and key takeaways for the video conferencing stocks in Q4, including Five9 (NASDAQ:FIVN) and its peers.

Work is becoming more distributed, both across geographies and devices. In order for businesses to keep functioning efficiently, they need to be able to communicate as well as they did when the teams were co-located, which drives the demand for integrated communication platforms.

The 4 video conferencing stocks we track reported a decent Q4; on average, revenues beat analyst consensus estimates by 2.93%, while on average next quarter revenue guidance was 3.2% above consensus. The whole tech sector has been facing a sell-off since late last year and video conferencing stocks have not been spared, with share price down 22.9% since earnings, on average.

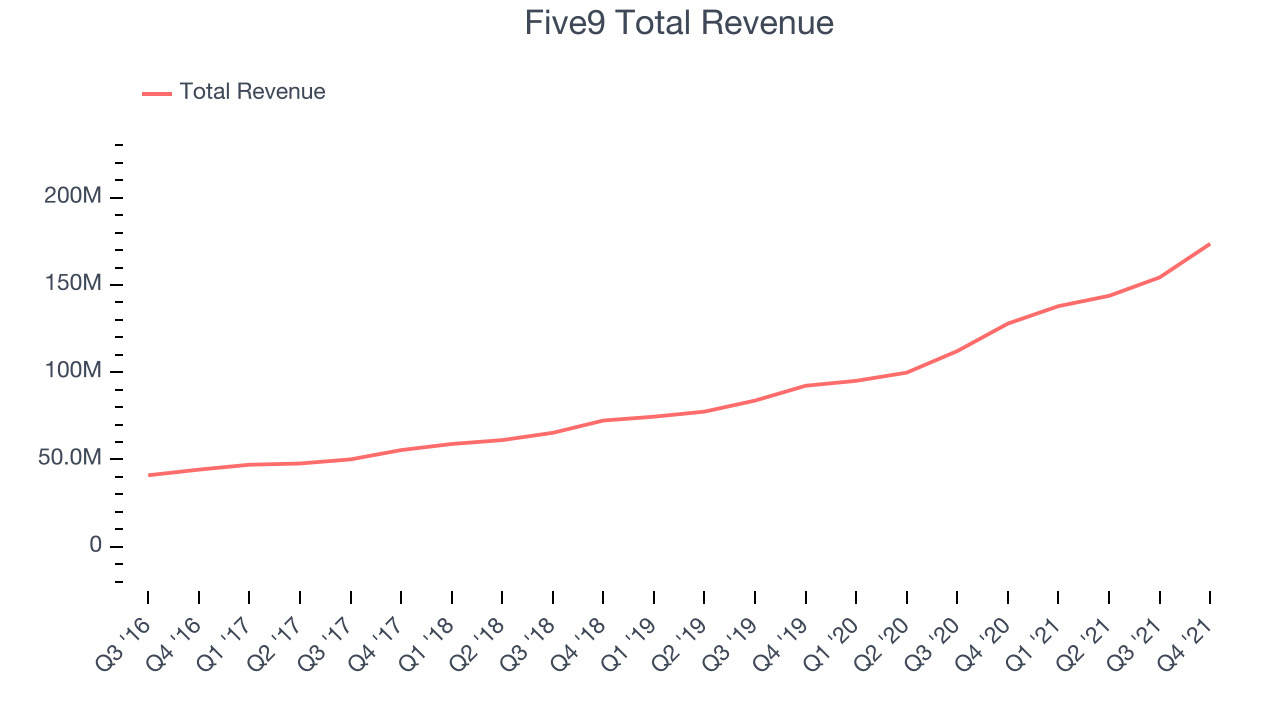

Five9 (NASDAQ:FIVN)

Started in 2001, Five9 (NASDAQ: FIVN) offers software as a service that makes it easier for companies to set up and efficiently run call centers, and offer more tailored customer support.

Five9 reported revenues of $173.5 million, up 35.7% year on year, beating analyst expectations by 4.94%. It was a mixed quarter for the company, with an underwhelming guidance for the next year and a decline in gross margin.

“We are pleased to report that we finished the year with excellent results for the fourth quarter. Our results were driven by the growing market adoption of our AI and Automation offerings, in addition to the success we have made in our march up market, as prospective enterprise customers turn to Five9 for the reliable and innovative platform we have built as a company. We continue to build out our leadership position while delivering on a massive and barely penetrated opportunity, and we plan to continue investing in key strategic initiatives around AI, product innovation, traction with larger enterprises and global expansion to drive growth in the year ahead.” - Rowan Trollope, CEO, Five9

Five9 achieved the strongest analyst estimates beat and fastest revenue growth of the whole group. The stock is up 1.06% since the results and currently trades at $105.25.

Read our full report on Five9 here, it's free.

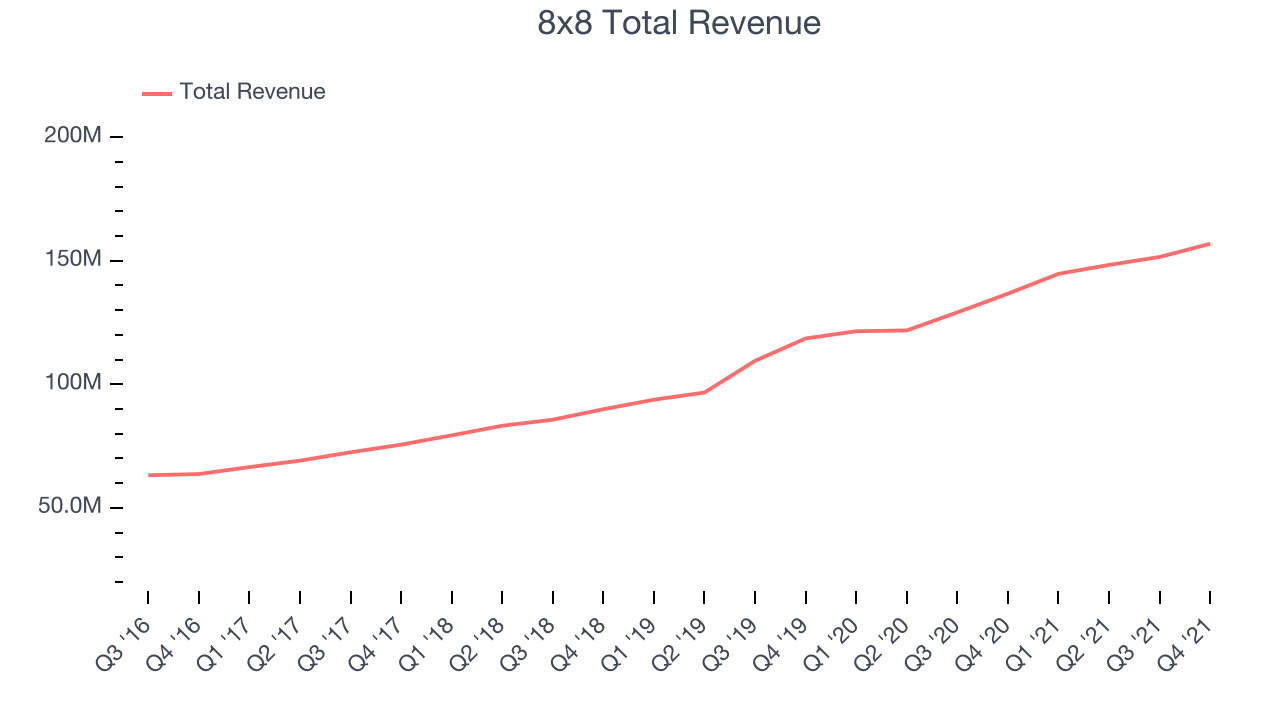

Best Q4: 8x8 (NYSE:EGHT)

Founded in 1987, 8x8 (NYSE:EGHT) provides software for organizations to efficiently communicate and collaborate with their customers, employees, and partners.

8x8 reported revenues of $156.8 million, up 14.7% year on year, beating analyst expectations by 2.07%. It was a solid quarter for the company, with a very optimistic guidance for the next quarter.

8x8 pulled off the highest full year guidance raise but had the slowest revenue growth among its peers. The company added 36 enterprise customers paying more than $100,000 annually to a total of 907. The stock is down 32.2% since the results and currently trades at $10.17.

Is now the time to buy 8x8? Access our full analysis of the earnings results here, it's free.

Weakest Q4: Zoom Video (NASDAQ:ZM)

Started by Eric Yuan who once ran engineering for Cisco’s video conferencing business, Zoom (NASDAQ:ZM) offers an easy to use, cloud-based platform for video conferencing, audio conferencing and screen sharing.

Zoom Video reported revenues of $1.07 billion, up 21.4% year on year, beating analyst expectations by 1.56%. It was a weak quarter for the company, with the guidance for both the next quarter and the full year missing analyst estimates.

Zoom Video had the smallest earning surprise and weakest full year guidance update in the group. The company lost 2,300 enterprise customers with more than 10 employees and ended up with a total of 509,800. The stock is down 23.6% since the results and currently trades at $101.24.

Read our full analysis of Zoom Video's results here.

RingCentral (NYSE:RNG)

Founded in 1999 during the dot-com era, RingCentral (NYSE:RNG) provides software as a service that unifies phone, text, fax, video calls and chat in one platform.

RingCentral reported revenues of $448.4 million, up 34% year on year, beating analyst expectations by 3.14%. It was a mixed quarter for the company, with solid top-line growth but underwhelming guidance for the next year.

The stock is down 37.1% since the results and currently trades at $93.

Read our full, actionable report on RingCentral here, it's free.

The author has no position in any of the stocks mentioned