Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at 1-800-FLOWERS (NASDAQ:FLWS) and the best and worst performers in the specialized consumer services industry.

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

The 11 specialized consumer services stocks we track reported a slower Q2. As a group, revenues missed analysts’ consensus estimates by 0.6% while next quarter’s revenue guidance was in line.

Big picture, the Federal Reserve has a dual mandate of inflation and employment. The former had been running hot throughout 2021 and 2022 but cooled towards the central bank's 2% target as of late. This prompted the Fed to cut its policy rate by 50bps (half a percent) in September 2024. Given recent employment data that suggests the US economy could be wobbling, the markets will be assessing whether this rate and future cuts (the Fed signaled more to come in 2024 and 2025) are the right moves at the right time or whether they're too little, too late for a macro that has already cooled.

While some specialized consumer services stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.5% since the latest earnings results.

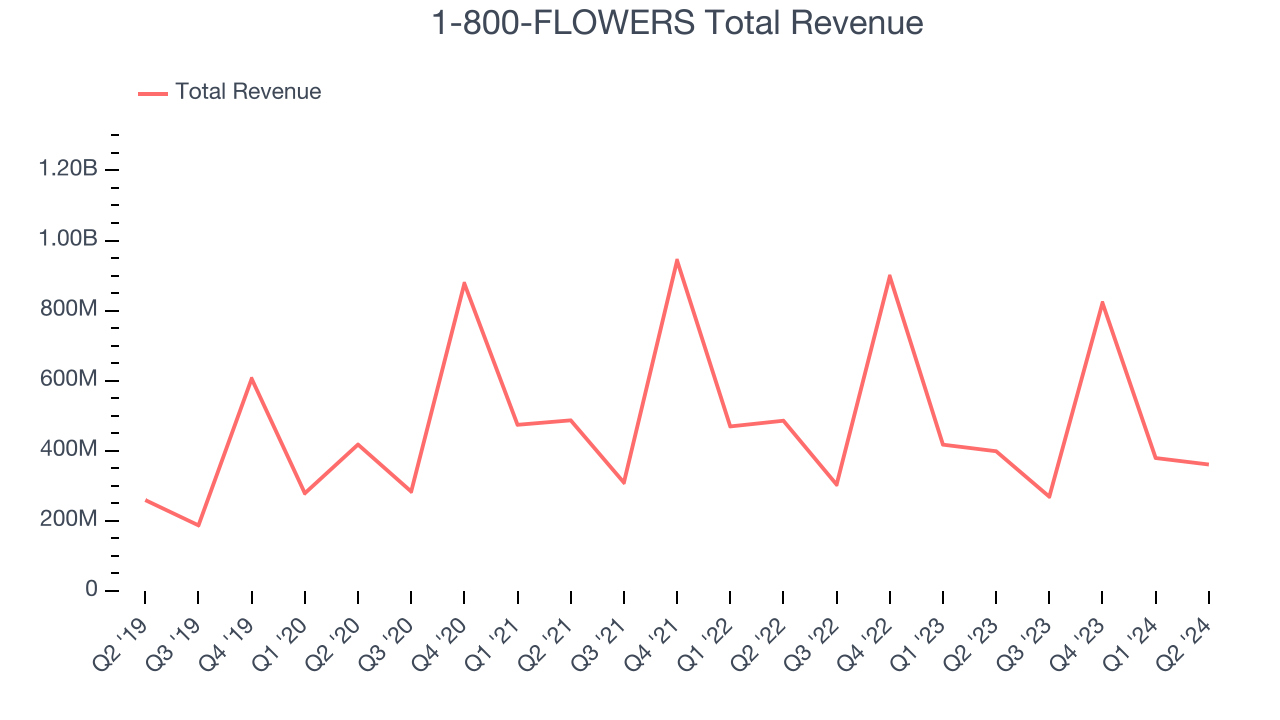

1-800-FLOWERS (NASDAQ:FLWS)

Founded in 1976, 1-800-FLOWERS (NASDAQ:FLWS) is an online retailer of flowers, gifts, and gourmet foods, serving customers globally.

1-800-FLOWERS reported revenues of $360.9 million, down 9.5% year on year. This print fell short of analysts’ expectations by 3.6%. Overall, it was a disappointing quarter for the company with a miss of analysts’ earnings estimates.

“In a dynamic consumer environment that impacted discretionary consumer spending, especially amongst lower income households, our organization was able to grow year-over-year adjusted EBITDA, which benefitted from our significant gross margin recovery and our expense optimization efforts that more than offset the top line decline,” said Jim McCann, Chairman and Chief Executive Officer of 1-800-FLOWERS.COM,

Unsurprisingly, the stock is down 9.9% since reporting and currently trades at $8.09.

Read our full report on 1-800-FLOWERS here, it’s free.

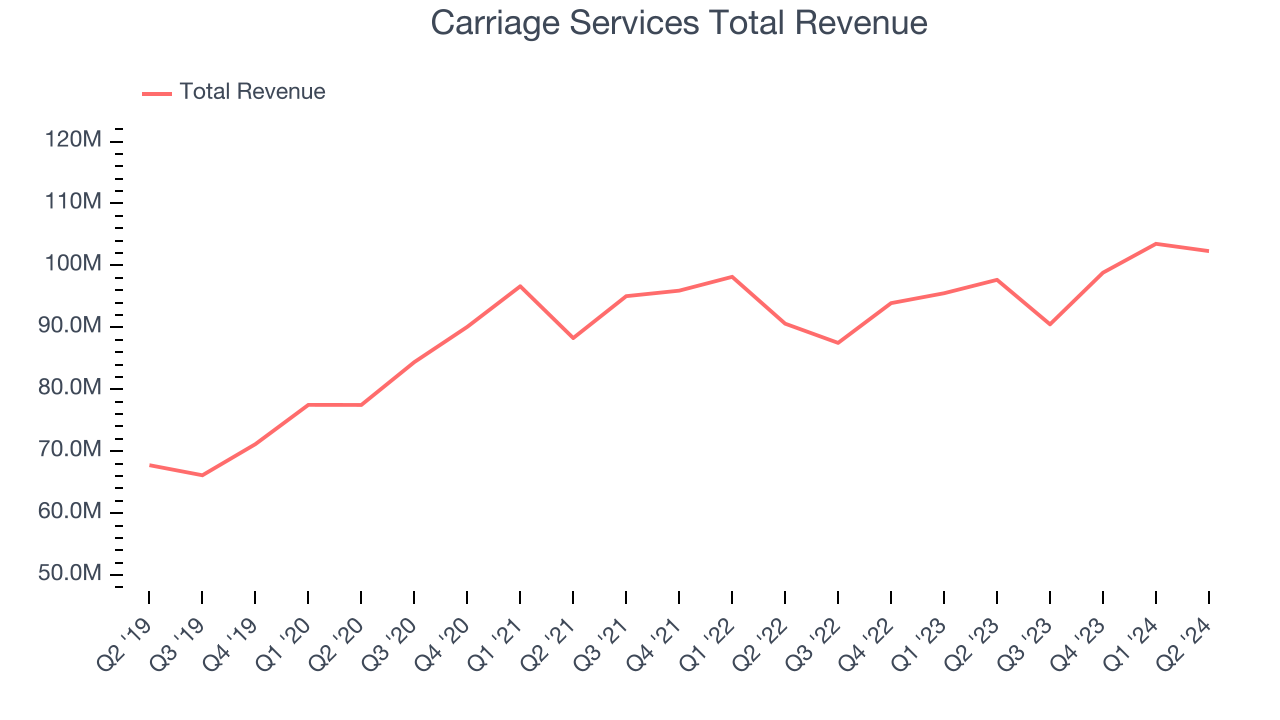

Best Q2: Carriage Services (NYSE:CSV)

Established in 1991, Carriage Services (NYSE:CSV) is a provider of funeral and cemetery services in the United States.

Carriage Services reported revenues of $102.3 million, up 4.8% year on year, outperforming analysts’ expectations by 7.7%. The business had a strong quarter with full-year revenue guidance exceeding analysts’ expectations.

Carriage Services achieved the biggest analyst estimates beat and highest full-year guidance raise among its peers. The market seems content with the results as the stock is up 3.9% since reporting. It currently trades at $33.38.

Is now the time to buy Carriage Services? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Matthews (NASDAQ:MATW)

Originally a death care company, Matthews International (NASDAQ:MATW) is a diversified company offering ceremonial services, brand solutions and industrial technologies.

Matthews reported revenues of $427.8 million, down 10.9% year on year, falling short of analysts’ expectations by 10%. It was a disappointing quarter as it posted a miss of analysts’ earnings estimates.

Matthews delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 13.5% since the results and currently trades at $24.27.

Read our full analysis of Matthews’s results here.

Pool (NASDAQ:POOL)

Founded in 1993 and headquartered in Louisiana, Pool (NASDAQ:POOL) is one of the largest wholesale distributors of swimming pool supplies, equipment, and related leisure products.

Pool reported revenues of $1.77 billion, down 4.7% year on year. This print beat analysts’ expectations by 1.5%. Overall, it was a satisfactory quarter as it also put up a solid beat of analysts’ organic revenue estimates.

The stock is up 14.1% since reporting and currently trades at $372.09.

Read our full, actionable report on Pool here, it’s free.

LKQ (NASDAQ:LKQ)

A global distributor of vehicle parts and accessories, LKQ (NASDAQ:LKQ) offers its customers a comprehensive selection of high-quality, affordably priced automobile products.

LKQ reported revenues of $3.71 billion, up 7.6% year on year. This number lagged analysts' expectations by 4%. It was a softer quarter as it also recorded a miss of analysts’ organic revenue estimates and underwhelming earnings guidance for the full year.

The stock is down 8.3% since reporting and currently trades at $40.77.

Read our full, actionable report on LKQ here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.