The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how finance and HR software stocks fared in Q2, starting with Flywire (NASDAQ:FLYW).

Organizations are constantly looking to improve organizational efficiencies, whether it is financial planning, tax management or payroll. Finance and HR software benefit from the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software.

The 15 finance and HR software stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was 0.5% below.

The Fed cut its policy rate by 50bps (half a percent) in September 2024, the first in roughly four years. This marks the end of its most pointed inflation-busting campaign since the 1980s. While CPI (inflation) readings have been supportive lately, employment measures have bordered on worrisome. The markets will be assessing whether this rate cut's timing (and more potential ones in 2024 and 2025) is ideal for supporting the economy or a bit too late for a macro that has already cooled too much.

Thankfully, finance and HR software stocks have been resilient with share prices up 5.7% on average since the latest earnings results.

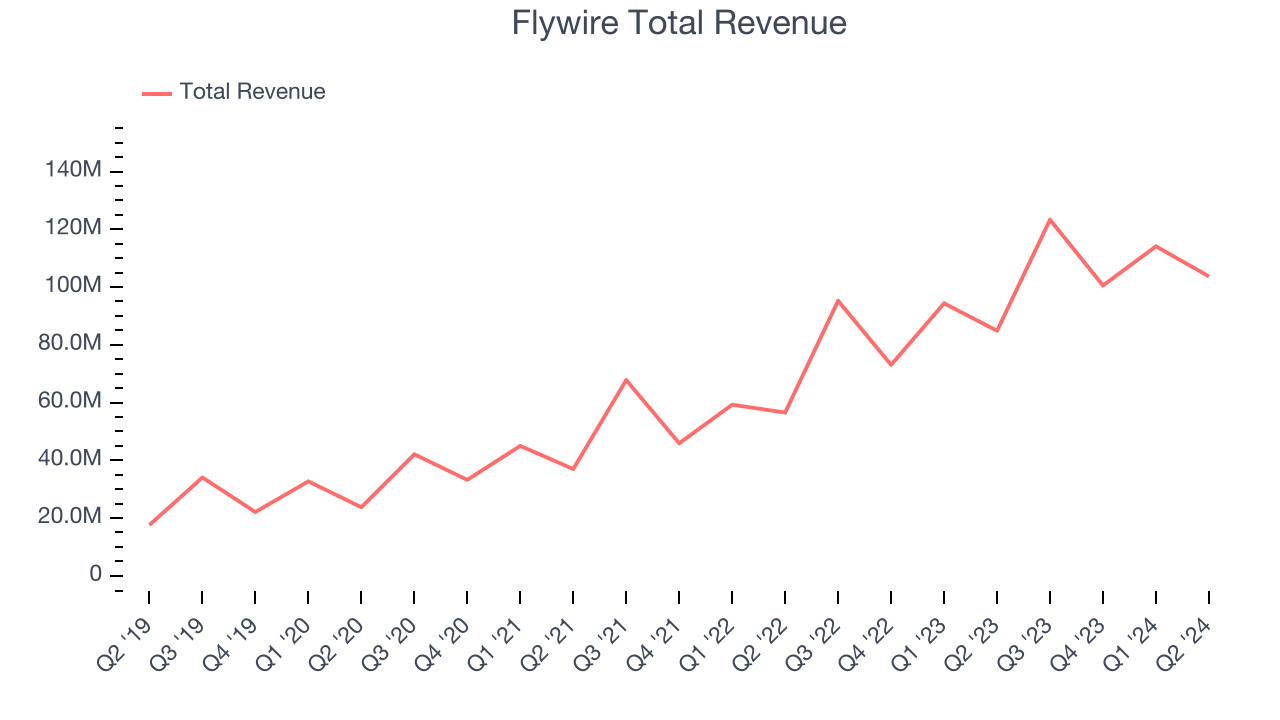

Flywire (NASDAQ:FLYW)

Originally created to process international tuition payments for universities, Flywire (NASDAQ:FLYW) is a cross border payments processor and software platform focusing on complex, high-value transactions like education, healthcare and B2B payments.

Flywire reported revenues of $103.7 million, up 22.2% year on year. This print exceeded analysts’ expectations by 3.3%. Overall, it was a strong quarter for the company with full-year revenue guidance exceeding analysts’ expectations.

“Our second quarter results demonstrate resilient performance across the business where we signed more than 200 new clients and grew revenue by 22% and revenue less ancillary services by 26% year-over-year, despite revenue headwinds related to the ongoing Canadian government actions involving student study permits,” said Mike Massaro, CEO of Flywire.

Flywire scored the fastest revenue growth of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 7.3% since reporting and currently trades at $16.49.

Is now the time to buy Flywire? Access our full analysis of the earnings results here, it’s free.

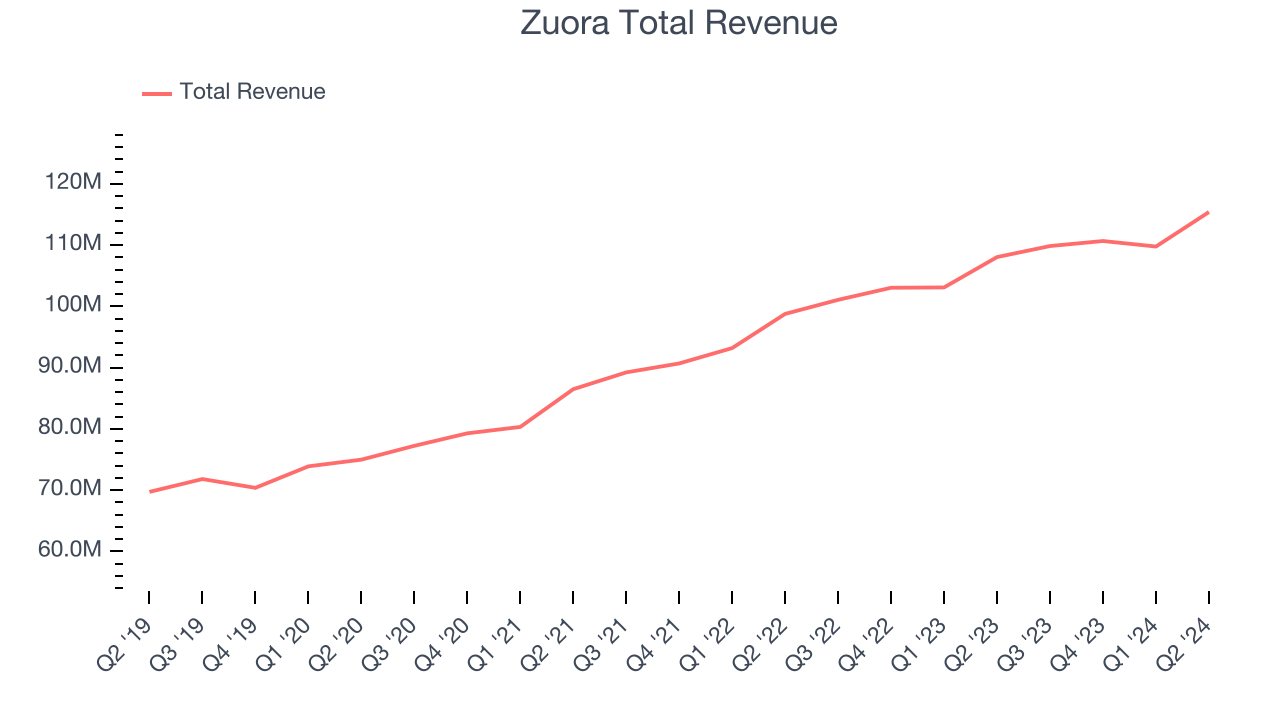

Best Q2: Zuora (NYSE:ZUO)

Founded in 2007, Zuora (NYSE:ZUO) offers software as a service platform that allows companies to bill and accept payments for recurring subscription products.

Zuora reported revenues of $115.4 million, up 6.8% year on year, outperforming analysts’ expectations by 2.5%. The business had a very strong quarter with an impressive beat of analysts’ billings estimates and full-year revenue guidance exceeding analysts’ expectations.

The market seems content with the results as the stock is up 3.6% since reporting. It currently trades at $8.82.

Is now the time to buy Zuora? Access our full analysis of the earnings results here, it’s free.

Slowest Q2: Global Business Travel (NYSE:GBTG)

Holding close ties to American Express, Global Business Travel (NYSE:GBTG) is a comprehensive travel and expense management services provider to corporations worldwide.

Global Business Travel reported revenues of $625 million, up 5.6% year on year, falling short of analysts’ expectations by 1.1%. It was a mixed quarter as it posted full-year revenue guidance exceeding analysts’ expectations.

Interestingly, the stock is up 25.4% since the results and currently trades at $7.56.

Read our full analysis of Global Business Travel’s results here.

Marqeta (NASDAQ:MQ)

Founded by CEO Jason Gardner in 2009, Marqeta (NASDAQ: MQ) is an innovative card issuer that provides companies with the ability to issue and process virtual, physical, and tokenized credit and debit cards.

Marqeta reported revenues of $125.3 million, down 45.8% year on year. This result topped analysts’ expectations by 3.1%. Aside from that, it was a satisfactory quarter as it also recorded a decent beat of analysts’ total payment volume estimates but a decline in its gross margin.

Marqeta had the slowest revenue growth among its peers. The stock is up 2% since reporting and currently trades at $5.03.

Read our full, actionable report on Marqeta here, it’s free.

BlackLine (NASDAQ:BL)

Started in 2001 by software engineer Therese Tucker, one of the very few women founders who took their companies public, BlackLine (NASDAQ:BL) provides software for organizations to automate accounting and finance tasks.

BlackLine reported revenues of $160.5 million, up 11% year on year. This number surpassed analysts’ expectations by 1.4%. Overall, it was a very strong quarter as it also produced accelerating customer growth and full-year revenue guidance exceeding analysts’ expectations.

The company added 24 customers to reach a total of 4,435. The stock is up 26% since reporting and currently trades at $55.57.

Read our full, actionable report on BlackLine here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.