Software development tools maker JFrog (NASDAQ:FROG) beat analysts' expectations in Q4 FY2023, with revenue up 27.1% year on year to $97.26 million. Guidance for next quarter's revenue was also better than expected at $98.5 million at the midpoint, 1.2% above analysts' estimates. It made a non-GAAP profit of $0.19 per share, improving from its profit of $0.04 per share in the same quarter last year.

Is now the time to buy JFrog? Find out by accessing our full research report, it's free.

JFrog (FROG) Q4 FY2023 Highlights:

- Revenue: $97.26 million vs analyst estimates of $92.85 million (4.7% beat)

- EPS (non-GAAP): $0.19 vs analyst estimates of $0.12 ($0.07 beat)

- Revenue Guidance for Q1 2024 is $98.5 million at the midpoint, above analyst estimates of $97.32 million

- Management's revenue guidance for the upcoming financial year 2024 is $426 million at the midpoint, beating analyst estimates by 1% and implying 21.8% growth (vs 24.9% in FY2023)

- Free Cash Flow of $31.98 million, up 25.9% from the previous quarter

- Net Revenue Retention Rate: 119%, in line with the previous quarter

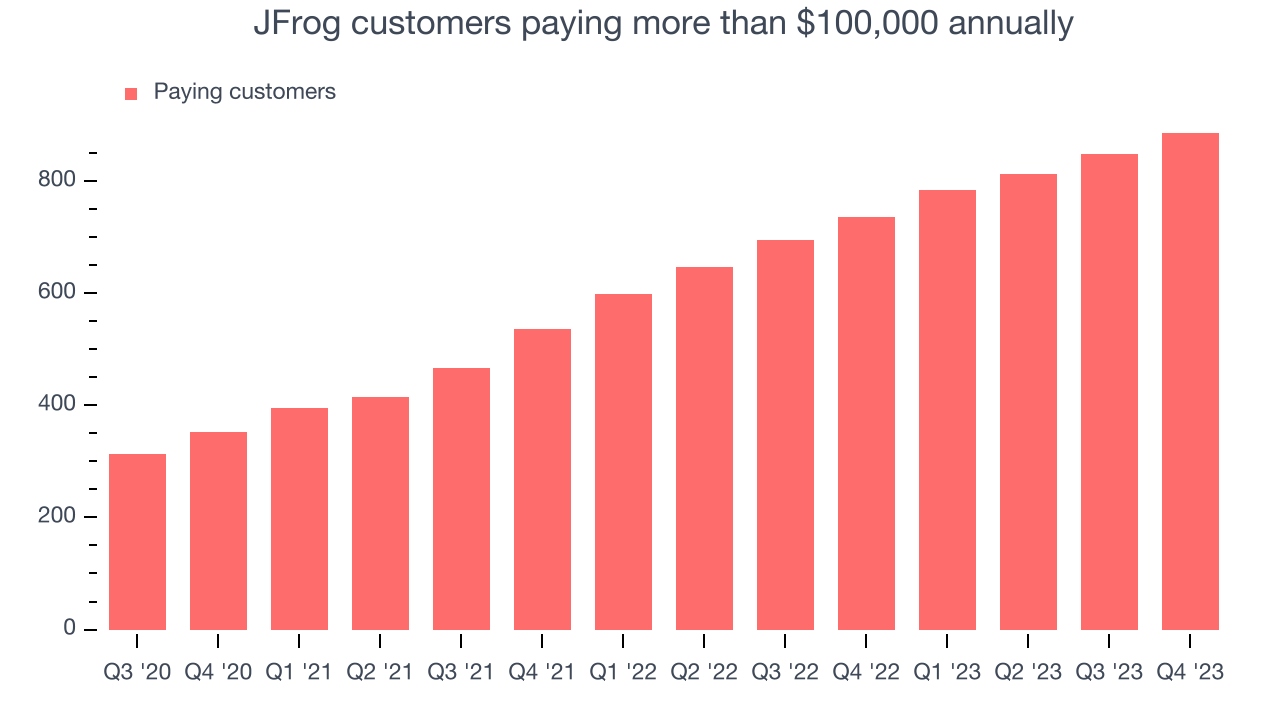

- Customers: 886 customers paying more than $100,000 annually

- Gross Margin (GAAP): 79%, up from 77.4% in the same quarter last year

- Market Capitalization: $3.75 billion

“Our 2023 performance showcases JFrog’s solid execution across our strategic pillars; driving growth in the cloud, leveraging complete software supply chain capabilities, and enhancing our security offerings - all supported by our focused transition to enterprise sales while building an efficient business,” stated Shlomi Ben Haim, JFrog CEO and Co-founder.

Named after the founders' affinity for frogs, JFrog (NASDAQ:FROG) provides a software-as-a-service platform that makes developing and releasing software easier and faster, especially for large teams.

Developer Operations

As Marc Andreessen says, "software is eating the world" which means the volume of software produced is exploding. But building software is complex and difficult work which drives demand for software tools that help increase the speed, quality, and security of software deployment.

Sales Growth

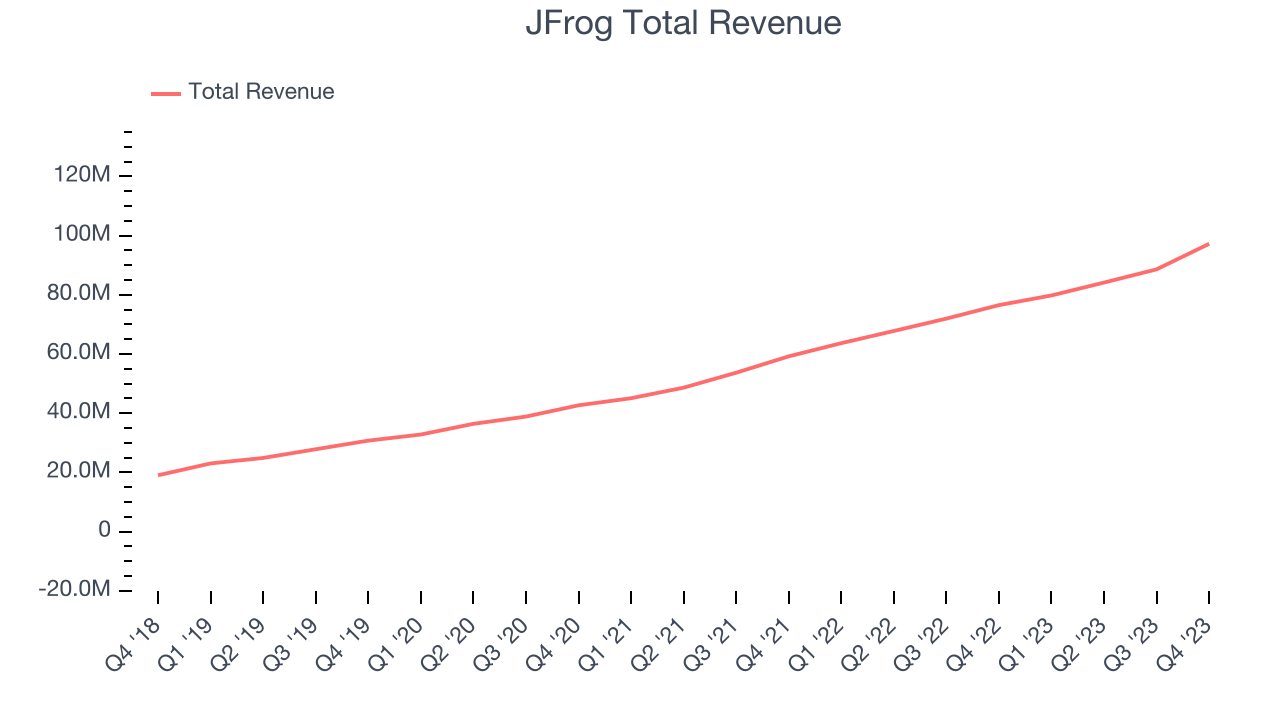

As you can see below, JFrog's revenue growth has been very strong over the last two years, growing from $59.24 million in Q4 FY2021 to $97.26 million this quarter.

This quarter, JFrog's quarterly revenue was once again up a very solid 27.1% year on year. On top of that, its revenue increased $8.62 million quarter on quarter, a very strong improvement from the $4.47 million increase in Q3 2023. This is a sign of re-acceleration of growth and great to see.

Next quarter's guidance suggests that JFrog is expecting revenue to grow 23.4% year on year to $98.5 million, in line with the 25.3% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $426 million at the midpoint, growing 21.8% year on year compared to the 24.9% increase in FY2023.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Large Customers Growth

This quarter, JFrog reported 886 enterprise customers paying more than $100,000 annually, an increase of 38 from the previous quarter. That's in line with the number of contracts wins we've observed over the last year, suggesting that the company can maintain its current sales momentum.

Key Takeaways from JFrog's Q4 Results

We were also excited its revenue outperformed Wall Street's estimates. Overall, we think this was still a really good quarter that should please shareholders. The stock is up 11.8% after reporting and currently trades at $41.5 per share.

JFrog may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.