As the Q2 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the consumer internet industry, including Alphabet (NASDAQ:GOOGL) and its peers.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 49 consumer internet stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 2.5% while next quarter’s revenue guidance was in line.

The Fed cut its policy rate by 50bps (half a percent) in September 2024, the first in roughly four years. This marks the end of its most pointed inflation-busting campaign since the 1980s. While CPI (inflation) readings have been supportive lately, employment measures have bordered on worrisome. The markets will be assessing whether this rate cut's timing (and more potential ones in 2024 and 2025) is ideal for supporting the economy or a bit too late for a macro that has already cooled too much.

Luckily, consumer internet stocks have performed well with share prices up 10.8% on average since the latest earnings results.

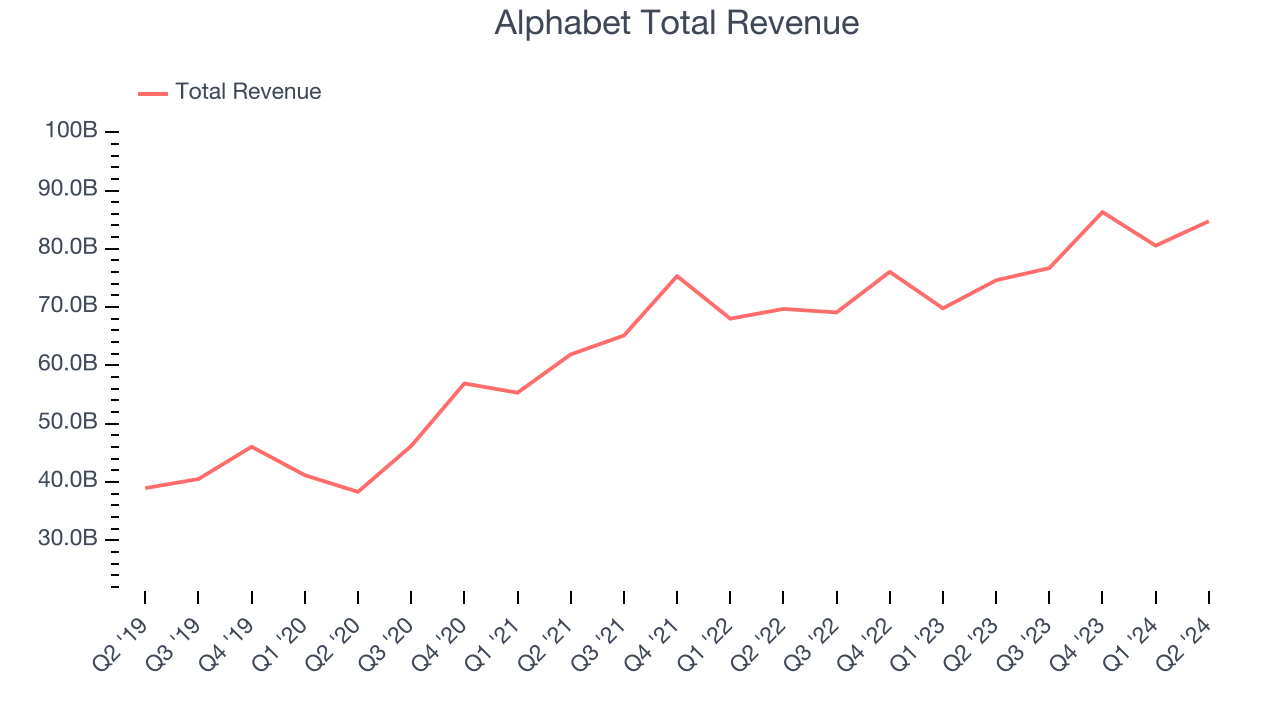

Alphabet (NASDAQ:GOOGL)

Started by Stanford students Larry Page and Sergey Brin in a Menlo Park garage, Alphabet (NASDAQ:GOOGL) is the parent company of the eponymous Google Search engine, Google Cloud Platform, and YouTube.

Alphabet reported revenues of $84.74 billion, up 13.6% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company: Revenue slightly beat expectations despite a miss in the YouTube segment revenue. In addition, operating income and EPS beat by more convincing amounts.

Unsurprisingly, the stock is down 10.1% since reporting and currently trades at $163.38.

Is now the time to buy Alphabet? Access our full analysis of the earnings results here, it’s free.

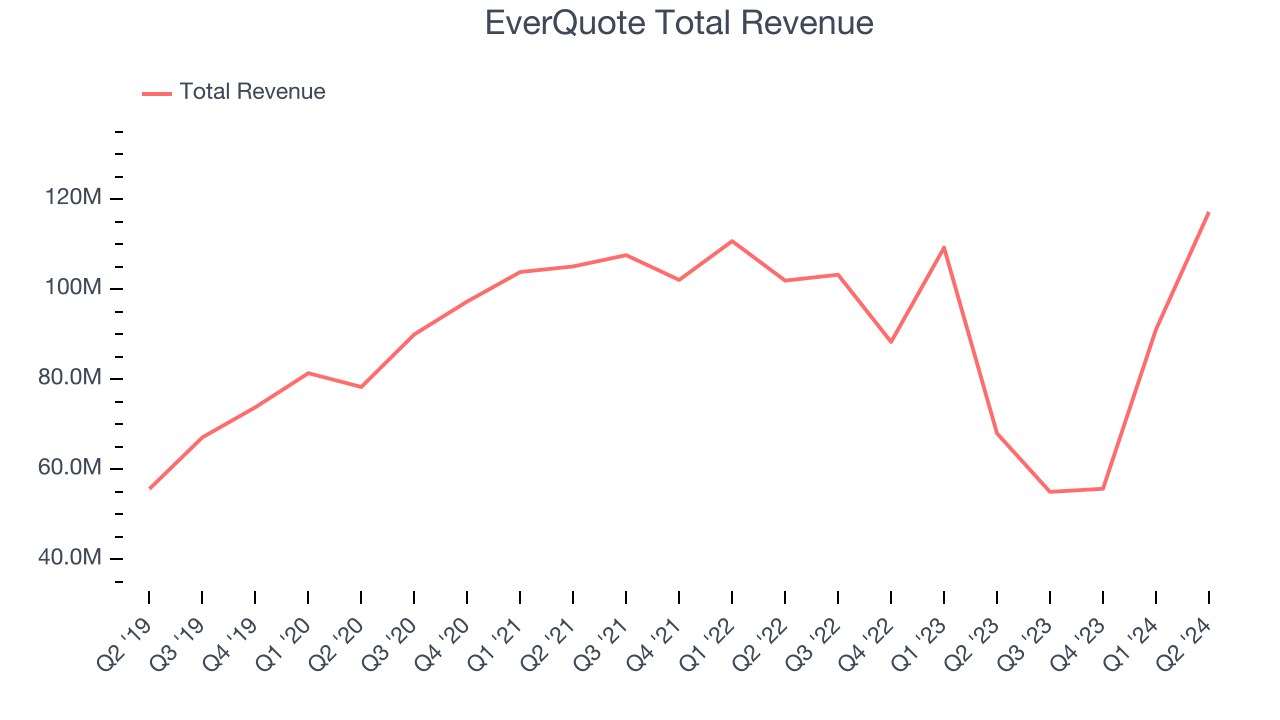

Best Q2: EverQuote (NASDAQ:EVER)

Aiming to simplify a once complicated process, EverQuote (NASDAQ:EVER) is an online insurance marketplace where consumers can compare and purchase various types of insurance from different providers

EverQuote reported revenues of $117.1 million, up 72.3% year on year, outperforming analysts’ expectations by 13.9%. The business had an incredible quarter with optimistic revenue guidance for the next quarter and exceptional revenue growth.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 18.3% since reporting. It currently trades at $19.60.

Is now the time to buy EverQuote? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Skillz (NYSE:SKLZ)

Taking a new twist at video gaming, Skillz (NYSE:SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

Skillz reported revenues of $25.3 million, down 37% year on year, falling short of analysts’ expectations by 4.3%. It was a disappointing quarter as it posted a decline in its users and a miss of analysts’ user estimates.

Skillz delivered the weakest performance against analyst estimates and slowest revenue growth in the group. The company reported 122,000 monthly active users, down 37.8% year on year. As expected, the stock is down 11.5% since the results and currently trades at $5.60.

Read our full analysis of Skillz’s results here.

The RealReal (NASDAQ:REAL)

Founded by consignment store aficionado Julie Wainwright, The RealReal (NASDAQ: REAL) is an online marketplace for buying and selling secondhand luxury goods.

The RealReal reported revenues of $144.9 million, up 10.8% year on year. This print surpassed analysts’ expectations by 3.6%. Aside from that, it was a slower quarter as it logged a miss of analysts’ user estimates and slow revenue growth.

The company reported 381,000 users, up 8.5% year on year. The stock is up 8.4% since reporting and currently trades at $3.35.

Read our full, actionable report on The RealReal here, it’s free.

eBay (NASDAQ:EBAY)

Originally known as the first online auction site, eBay (NASDAQ:EBAY) is one of the world’s largest online marketplaces.

eBay reported revenues of $2.57 billion, up 1.3% year on year. This number beat analysts’ expectations by 1.8%. Zooming out, it was a weaker quarter as it produced slow revenue growth and underwhelming revenue guidance for the next quarter.

The stock is up 19.3% since reporting and currently trades at $66.33.

Read our full, actionable report on eBay here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.