Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Icahn Enterprises (NASDAQ:IEP) and the best and worst performers in the general industrial machinery industry.

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand for general industrial machinery companies. Those who innovate and create digitized solutions can spur sales and speed up replacement cycles, but all general industrial machinery companies are still at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 14 general industrial machinery stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.8% while next quarter’s revenue guidance was 4% below.

Inflation progressed towards the Fed’s 2% goal at the end of 2023, leading to strong stock market performance. On the other hand, 2024 has been a bumpier ride as the market switches between optimism and pessimism around rate cuts and inflation, and while some general industrial machinery stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.8% since the latest earnings results.

Icahn Enterprises (NASDAQ:IEP)

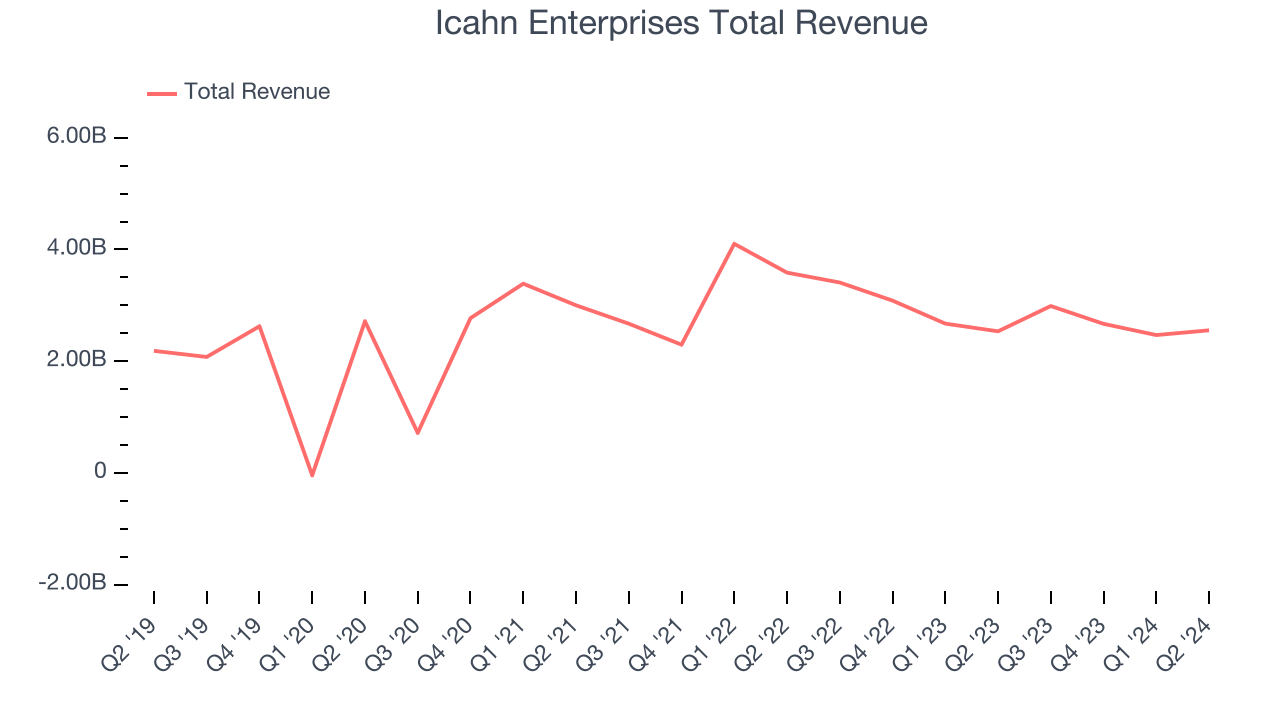

Founded in 1987, Icahn Enterprises (NASDAQ: IEP) is a diversified holding company primarily engaged in investment and asset management across various sectors.

Icahn Enterprises reported revenues of $2.55 billion, flat year on year. This print exceeded analysts’ expectations by 13.9%. Despite the top-line beat, it was still a mixed quarter for the company.

Unsurprisingly, the stock is down 5% since reporting and currently trades at $15.89.

Is now the time to buy Icahn Enterprises? Access our full analysis of the earnings results here, it’s free.

Best Q2: 3M (NYSE:MMM)

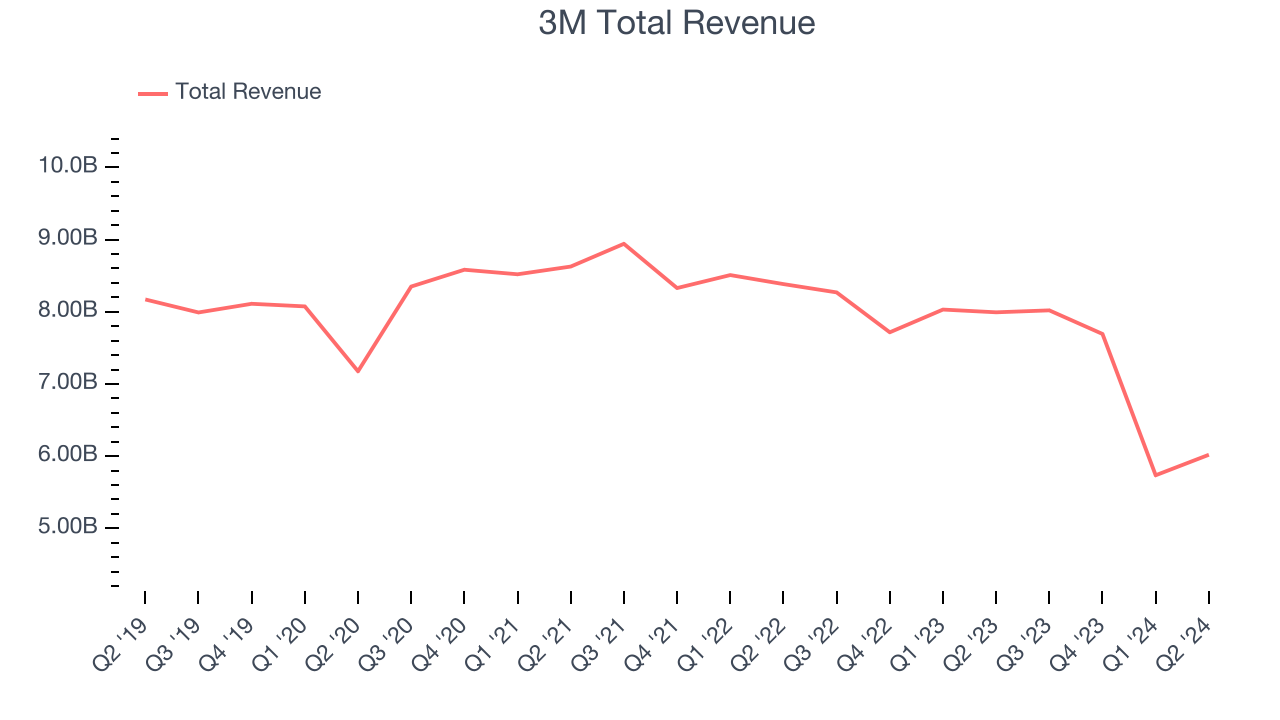

Producers of the first asthma inhaler, 3M Company (NYSE:MMM) is a global conglomerate known for products in industries like healthcare, safety, electronics, and consumer goods.

3M reported revenues of $6.02 billion, down 24.7% year on year, outperforming analysts’ expectations by 3.3%. It was an impressive quarter for the company with a solid beat of analysts’ organic revenue estimates.

The market seems happy with the results as the stock is up 24.5% since reporting. It currently trades at $128.78.

Is now the time to buy 3M? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Hillenbrand (NYSE:HI)

Hillenbrand, Inc. (NYSE: HI) is an industrial company that designs, manufactures, and sells highly engineered processing equipment and solutions for various industries.

Hillenbrand reported revenues of $786.6 million, up 9.8% year on year, falling short of analysts’ expectations by 3.9%. It was a weak quarter for the company with full-year revenue guidance missing analysts’ expectations and a miss of analysts’ earnings estimates.

Hillenbrand posted the weakest full-year guidance update in the group. As expected, the stock is down 13.7% since the results and currently trades at $32.81.

Read our full analysis of Hillenbrand’s results here.

Kadant (NYSE:KAI)

Headquartered in Massachusetts, Kadant (NYSE:KAI) is a global supplier of high-value, critical components and engineered systems used in process industries worldwide.

Kadant reported revenues of $274.8 million, up 12.1% year on year, surpassing analysts’ expectations by 4.3%. Revenue aside, it was a good quarter for the company with a solid beat of analysts’ earnings estimates.

The stock is down 10.1% since reporting and currently trades at $320.25.

Read our full, actionable report on Kadant here, it’s free.

General Electric (NYSE:GE)

One of the original 12 companies on the Dow Jones Industrial Average, General Electric (NYSE:GE) is a multinational conglomerate providing technologies for various sectors including aviation, power, renewable energy, and healthcare.

General Electric reported revenues of $18.11 billion, up 14.2% year on year, surpassing analysts’ expectations by 112%. Taking a step back, it was a mixed quarter for the company with an impressive beat of analysts’ earnings estimates but a miss of analysts’ organic revenue estimates.

General Electric scored the biggest analyst estimates beat and fastest revenue growth among its peers. The stock is up 5.2% since reporting and currently trades at $171.26.

Read our full, actionable report on General Electric here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.