Fragrance and perfume company Inter Parfums (NASDAQ:IPAR) reported Q2 CY2024 results exceeding Wall Street analysts' expectations, with revenue up 10.7% year on year to $342.2 million. The company expects the full year's revenue to be around $1.45 billion, in line with analysts' estimates. It made a GAAP profit of $1.14 per share, improving from its profit of $1.09 per share in the same quarter last year.

Is now the time to buy Inter Parfums? Find out by accessing our full research report, it's free.

Inter Parfums (IPAR) Q2 CY2024 Highlights:

- Revenue: $342.2 million vs analyst estimates of $337.7 million (1.3% beat)

- EPS: $1.14 vs analyst estimates of $1.05 (8.5% beat)

- The company reconfirmed its revenue guidance for the full year of $1.45 billion at the midpoint

- EPS (GAAP) guidance for the full year is $5.15 at the midpoint, roughly in line with what analysts were expecting

- Gross Margin (GAAP): 64.5%, up from 53.2% in the same quarter last year

- Market Capitalization: $4.10 billion

With licenses to produce colognes and perfumes under brands such as Kate Spade, Van Cleef & Arpels, and Abercrombie & Fitch, Inter Parfums (NASDAQ:IPAR) manufactures and distributes fragrances worldwide.

Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Sales Growth

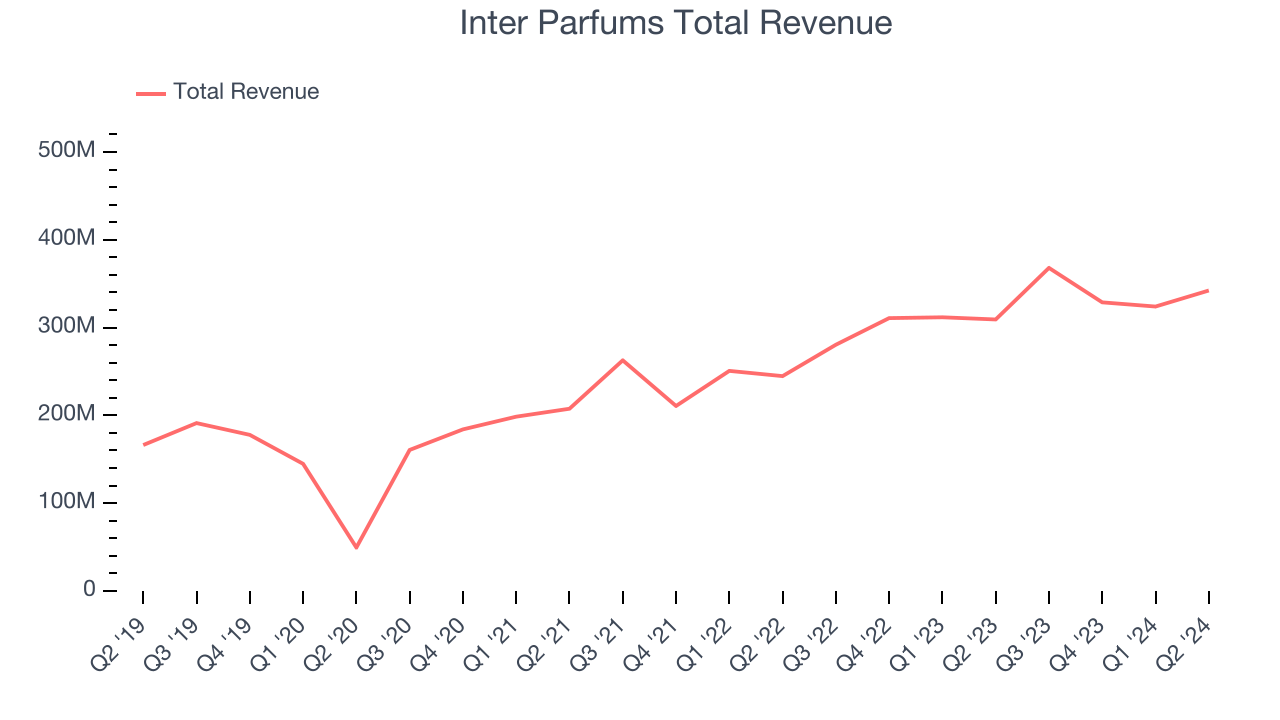

Inter Parfums is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale. On the other hand, one advantage is that its growth rates can be higher because it's growing off a small base.

As you can see below, the company's annualized revenue growth rate of 22% over the last three years was excellent for a consumer staples business.

This quarter, Inter Parfums reported robust year-on-year revenue growth of 10.7%, and its $342.2 million in revenue exceeded Wall Street's estimates by 1.3%. Looking ahead, Wall Street expects sales to grow 12% over the next 12 months, an acceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

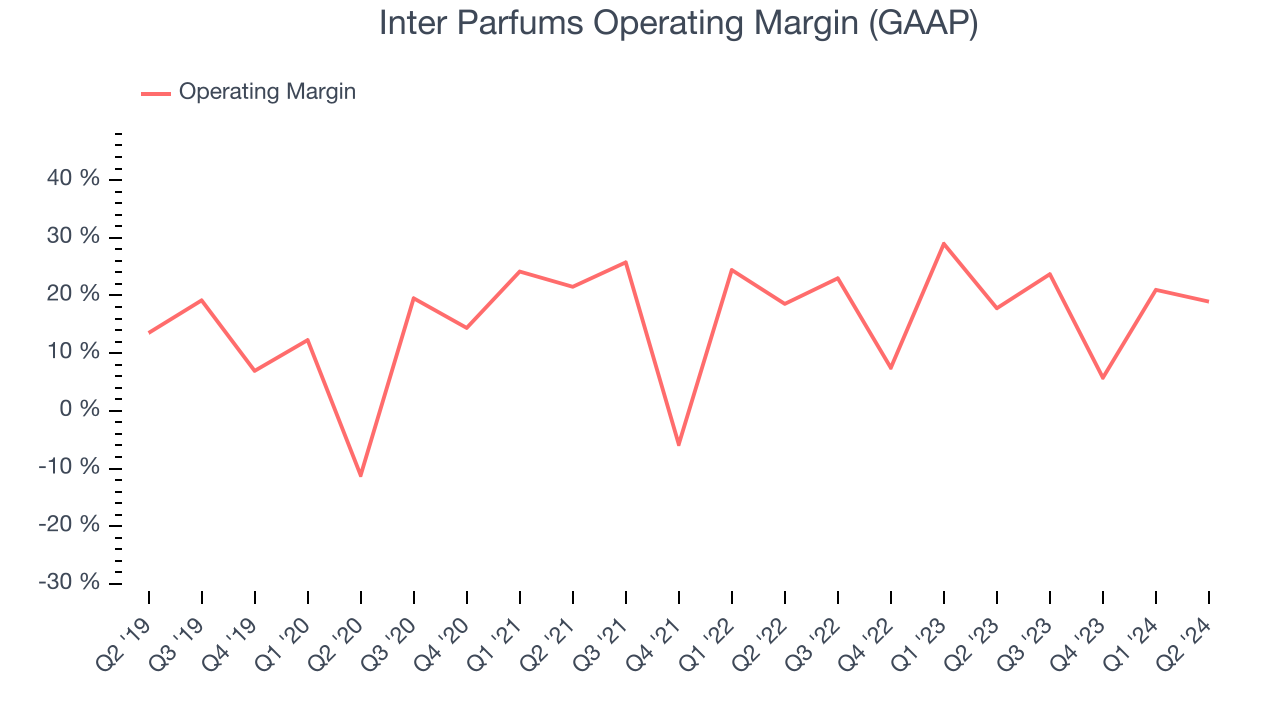

Operating Margin

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

Inter Parfums has been an optimally-run company over the last two years. It was one of the more profitable businesses in the consumer staples sector, boasting an average operating margin of 18.3%. This result isn't surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Inter Parfums's annual operating margin decreased by 1.7 percentage points over the last two years. Even though its margin is still high, shareholders will want to see Inter Parfums become more profitable in the future.

In Q2, Inter Parfums generated an operating profit margin of 18.9%, up 1.2 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

Key Takeaways from Inter Parfums's Q2 Results

It was good to see Inter Parfums beat analysts' gross margin expectations this quarter. We were also glad its revenue outperformed Wall Street's estimates. On the other hand, its full-year revenue guidance was underwhelming. Zooming out, we think this was still a decent, albeit mixed, quarter, showing the company is staying on track. The stock remained flat at $130.28 immediately following the results.

So should you invest in Inter Parfums right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.