The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Micron (NASDAQ:MU) and the rest of the semiconductors stocks fared in Q3.

The semiconductor industry is driven by cyclical demand for advanced electronic products like smartphones, PCs, servers, and data storage. While analog chips serve as the building blocks of most electronic goods and equipment, processors (CPUs) and graphics chips serve as their brains. The growth of data and technologies like artificial intelligence, 5G, the Internet of Things, and smart cars are creating the next wave of secular growth for the industry.

The 41 semiconductors stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was 2.4% below.

While some semiconductors stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.3% since the latest earnings results.

Micron (NASDAQ:MU)

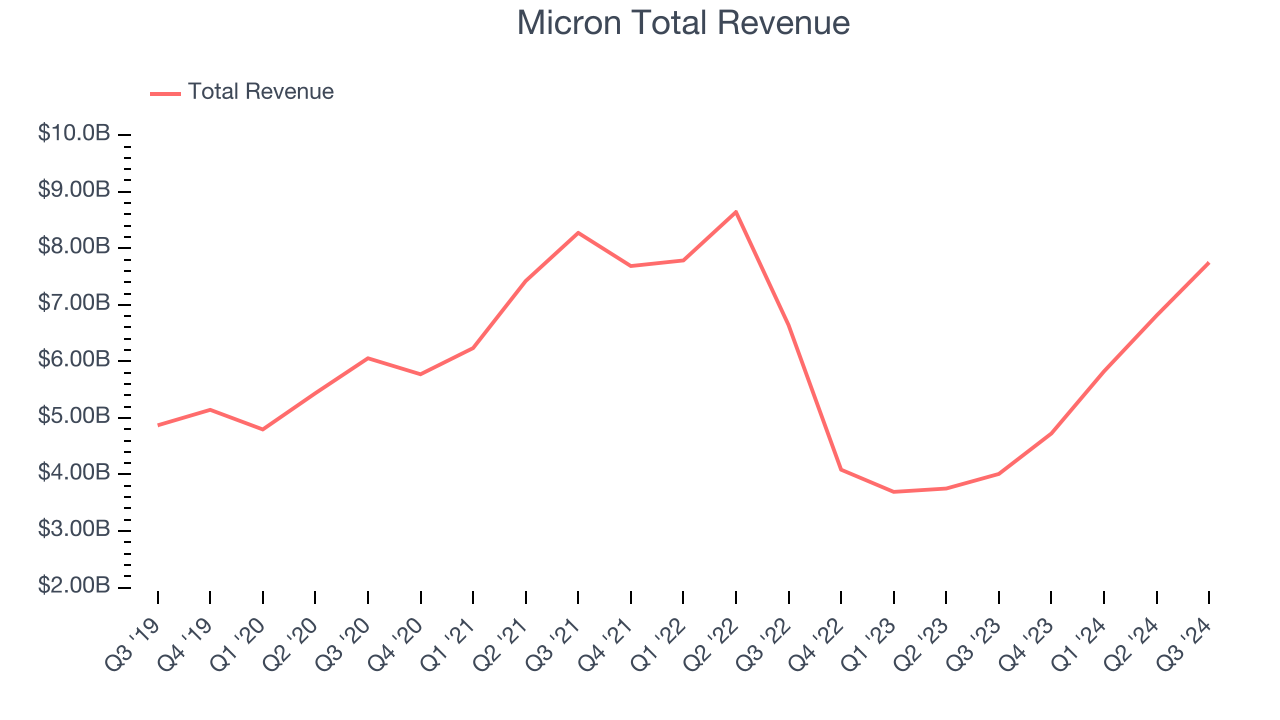

Founded in the basement of a Boise, Idaho dental office in 1978, Micron (NYSE:MU) is a leading provider of memory chips used in thousands of devices across mobile, data centers, industrial, consumer, and automotive markets.

Micron reported revenues of $7.75 billion, up 93.3% year on year. This print exceeded analysts’ expectations by 1.4%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ adjusted operating income estimates and revenue guidance for next quarter exceeding analysts’ expectations.

Interestingly, the stock is up 7.2% since reporting and currently trades at $102.78.

Is now the time to buy Micron? Access our full analysis of the earnings results here, it’s free.

Best Q3: Marvell Technology (NASDAQ:MRVL)

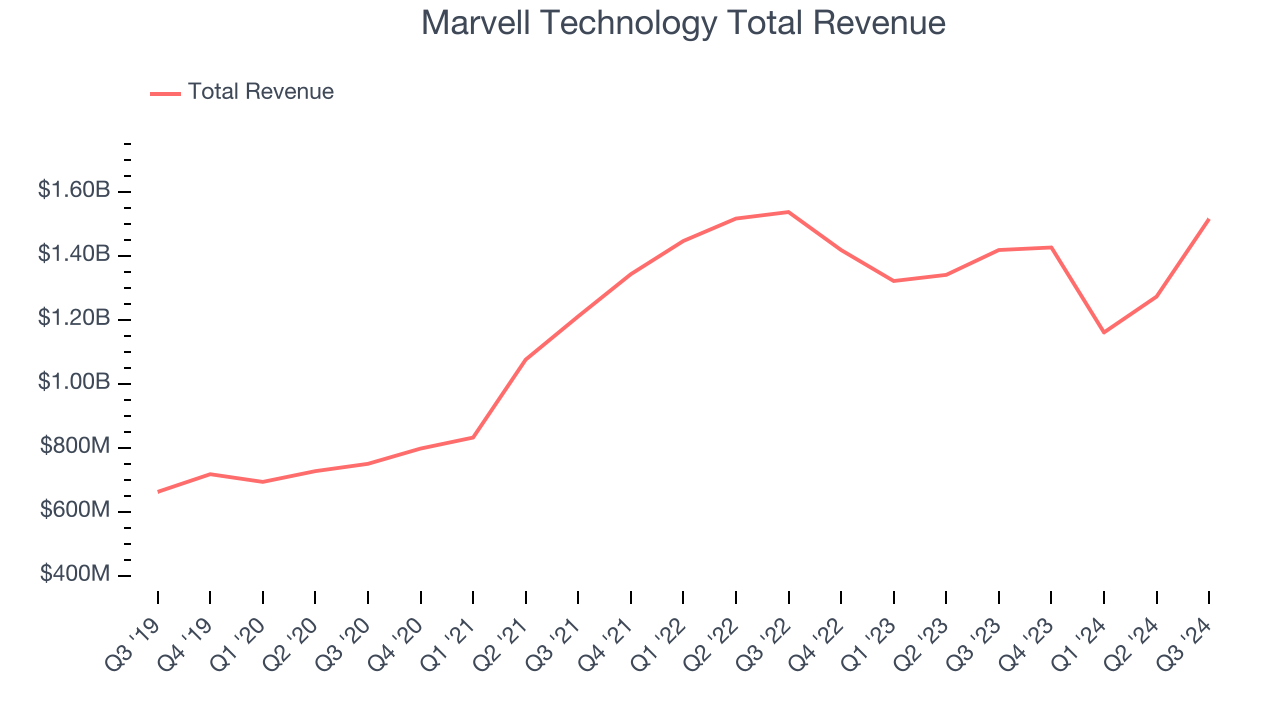

Moving away from a low margin storage device management chips in one of the biggest semiconductor business model pivots of the past decade, Marvell Technology (NASDAQ: MRVL) is a fabless designer of special purpose data processing and networking chips used by data centers, communications carriers, enterprises, and autos.

Marvell Technology reported revenues of $1.52 billion, up 6.9% year on year, outperforming analysts’ expectations by 4%. The business had an exceptional quarter with a significant improvement in its inventory levels and revenue guidance for next quarter exceeding analysts’ expectations.

The market seems happy with the results as the stock is up 25.9% since reporting. It currently trades at $120.85.

Is now the time to buy Marvell Technology? Access our full analysis of the earnings results here, it’s free.

Slowest Q3: Vishay Intertechnology (NYSE:VSH)

Named after the founder's ancestral village in present-day Lithuania, Vishay Intertechnology (NYSE:VSH) manufactures simple chips and electronic components that are building blocks of virtually all types of electronic devices.

Vishay Intertechnology reported revenues of $735.4 million, down 13.9% year on year, falling short of analysts’ expectations by 1.8%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

Vishay Intertechnology delivered the weakest full-year guidance update in the group. Interestingly, the stock is up 5.3% since the results and currently trades at $17.95.

Read our full analysis of Vishay Intertechnology’s results here.

Impinj (NASDAQ:PI)

Founded by Caltech professor Carver Mead and one of his students Chris Diorio, Impinj (NASDAQ:PI) is a maker of radio-frequency identification (RFID) hardware and software.

Impinj reported revenues of $95.2 million, up 46.4% year on year. This number beat analysts’ expectations by 2.5%. It was a very strong quarter as it also logged an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

The stock is down 31.7% since reporting and currently trades at $151.

Read our full, actionable report on Impinj here, it’s free.

Monolithic Power Systems (NASDAQ:MPWR)

Founded in 1997 by its longtime CEO Michael Hsing, Monolithic Power Systems (NASDAQ:MPWR) is an analog and mixed signal chipmaker that specializes in power management chips meant to minimize total energy consumption.

Monolithic Power Systems reported revenues of $620.1 million, up 30.6% year on year. This number topped analysts’ expectations by 3.3%. Overall, it was a strong quarter as it also put up a significant improvement in its inventory levels and a decent beat of analysts’ adjusted operating income estimates.

The stock is down 33.6% since reporting and currently trades at $610.02.

Read our full, actionable report on Monolithic Power Systems here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), has fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty heading into 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.