Wellness products company Nature’s Sunshine Products (NASDAQ:NATR) missed analysts' expectations in Q2 CY2024, with revenue down 5.1% year on year to $110.6 million. The company's full-year revenue guidance of $440.5 million at the midpoint also came in 3.4% below analysts' estimates. It made a non-GAAP profit of $0.07 per share, down from its profit of $0.12 per share in the same quarter last year.

Is now the time to buy Nature's Sunshine? Find out in our full research report.

Nature's Sunshine (NATR) Q2 CY2024 Highlights:

- Revenue: $110.6 million vs analyst estimates of $112.3 million (1.6% miss)

- EPS (non-GAAP): $0.07 vs analyst estimates of $0.18 (-$0.11 miss)

- The company dropped its revenue guidance for the full year from $467.5 million to $440.5 million at the midpoint, a 5.8% decrease

- EBITDA guidance for the full year is $40.5 million at the midpoint, below analyst estimates of $42.1 million

- Gross Margin (GAAP): 71.4%, down from 72.6% in the same quarter last year

- EBITDA Margin: 9.4%, in line with the same quarter last year

- Free Cash Flow was -$2.05 million compared to -$1.50 million in the previous quarter

- Market Capitalization: $276.6 million

“In the second quarter of 2024, we continued to make progress on our global growth strategies, addressing near-term challenges, while driving change and creating new opportunities for the future,” said Terrence Moorehead, Chief Executive Officer of Nature’s Sunshine.

Started on a kitchen table in Utah, Nature’s Sunshine Products (NASDAQ:NATR) manufactures and sells nutritional and personal care products.

Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Sales Growth

Nature's Sunshine is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

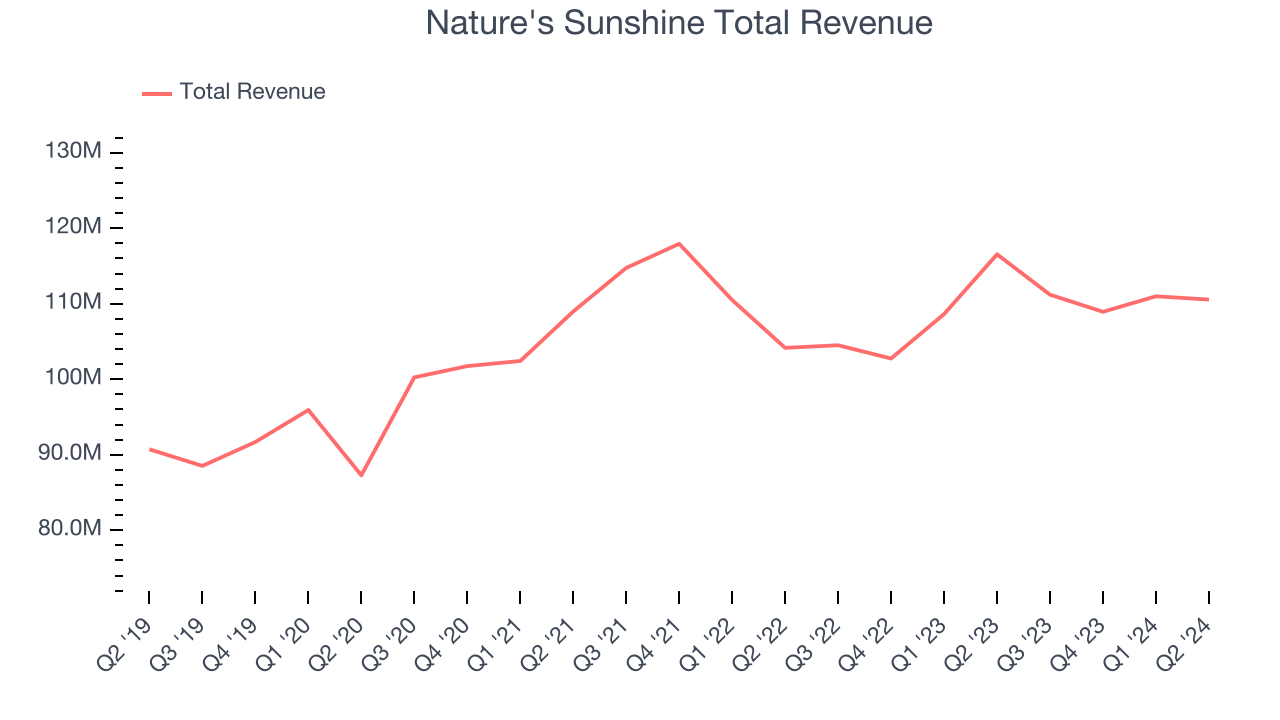

As you can see below, the company's annualized revenue growth rate of 2.2% over the last three years was weak for a consumer staples business.

This quarter, Nature's Sunshine missed Wall Street's estimates and reported a rather uninspiring 5.1% year-on-year revenue decline, generating $110.6 million in revenue. Looking ahead, Wall Street expects sales to grow 6.2% over the next 12 months, an acceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

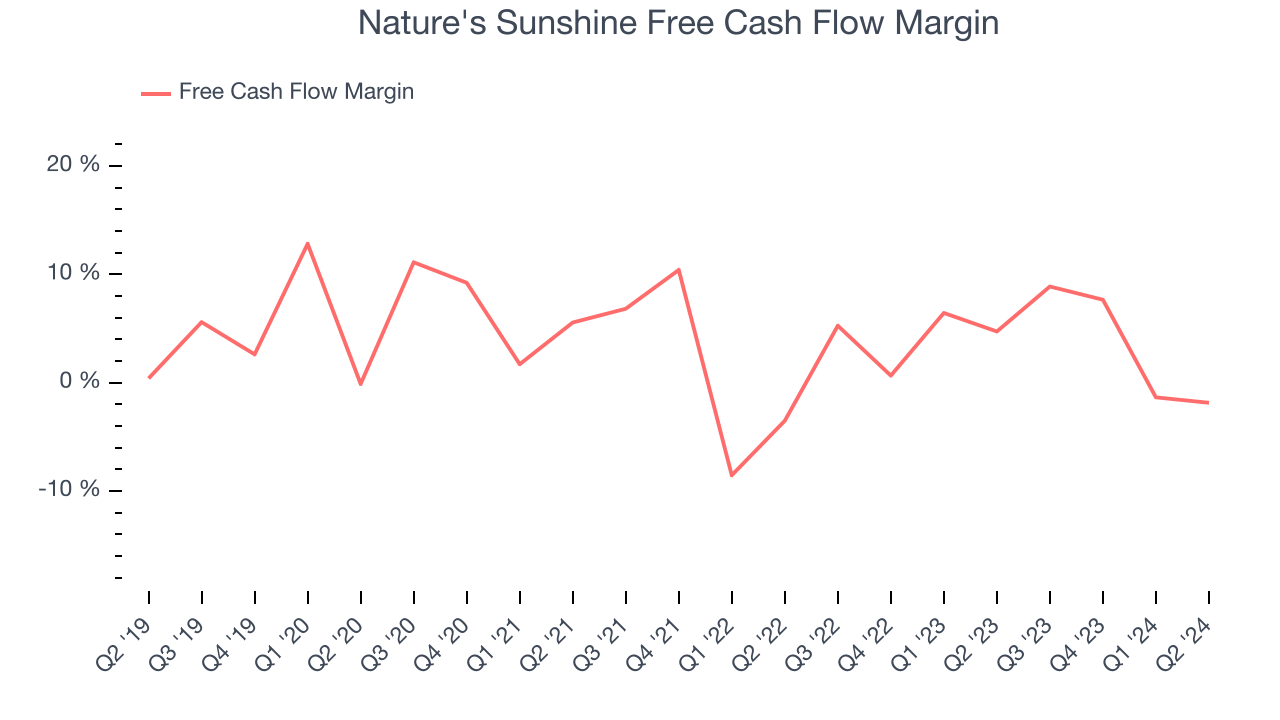

Nature's Sunshine has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.8%, subpar for a consumer staples business.

Taking a step back, we can see that Nature's Sunshine failed to improve its margin during that time. Its unexciting margin and trend likely have shareholders hoping for a change.

Nature's Sunshine burned through $2.05 million of cash in Q2, equivalent to a negative 1.9% margin. The company's quarterly cash flow turned negative after being positive in the same quarter last year. This warrants extra attention because consumer staples companies typically produce more consistent and defensive performance.

Key Takeaways from Nature's Sunshine's Q2 Results

We struggled to find many strong positives in these results. Its full-year revenue guidance missed analysts' expectations and its EPS missed Wall Street's estimates. This quarter featured some positives but overall could have been better. The stock remained flat at $14.66 immediately after reporting.

So should you invest in Nature's Sunshine right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.