Maker of operating system for banks nCino (NCNO) reported Q4 FY2021 results topping analyst expectations, with revenue up 46.9% year on year to $56.5 million. nCino made a GAAP loss of $12.4 million, down on its loss of $9.72 million, in the same quarter last year.

nCino (NCNO) Q4 FY2021 Highlights:

- Revenue: $56.5 million vs analyst estimates of $53.3 million (6.1% beat)

- EPS (non-GAAP): -$0.06 vs analyst estimates of -$0.09

- Revenue guidance for Q1 2022 is $59.5 million at the midpoint, above analyst estimates of $56.4 million

- Management's revenue guidance for FY2022 of $254 million at the midpoint, predicting 24.3% growth (vs 48.1% in FY2021)

- Free cash flow was negative -$12.51 million, compared to negative free cash flow of -$11.58 million in previous quarter

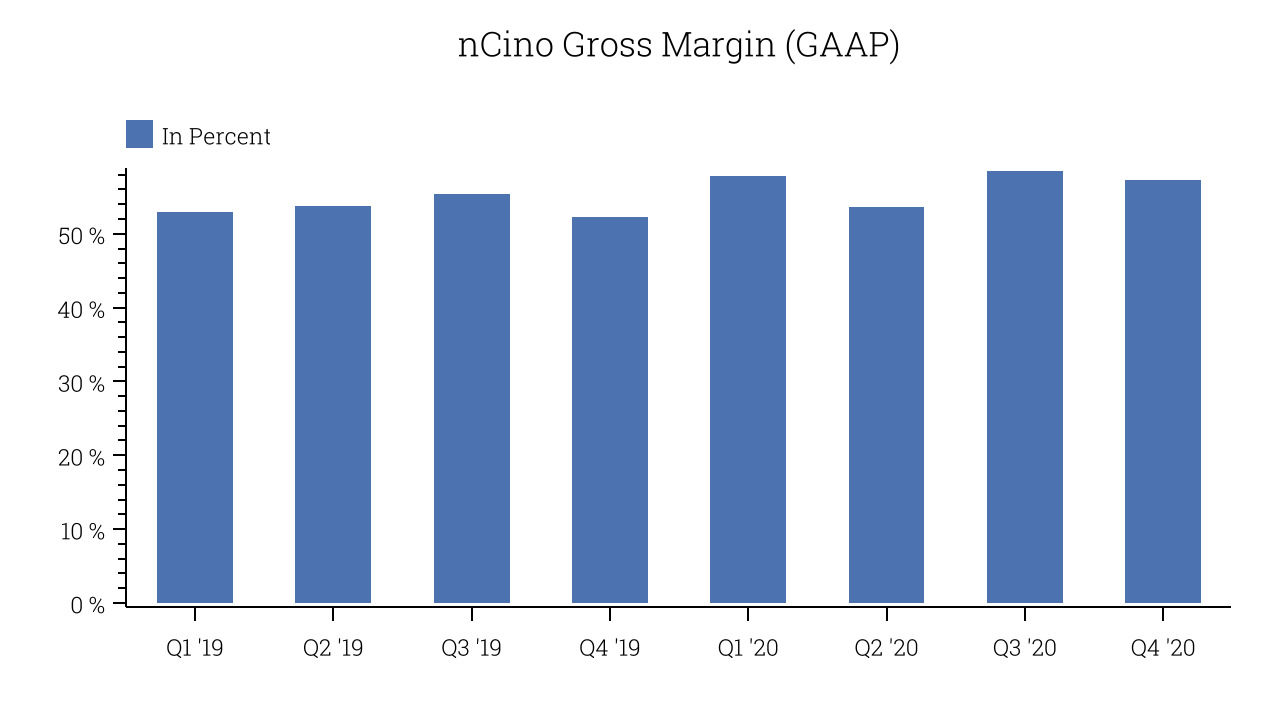

- Gross Margin (GAAP): 57.2%, down from 58.4% previous quarter

Cloud Banking

Founded in 2011 in North Carolina, nCino (NCNO) makes cloud-based operating systems for banks and provides that software as a service. Banks are complex to run, heavily regulated and often lag far behind the curve in adopting cloud technologies, instead relying on decades old on-premise software. nCino offers cloud-based software that promises to replace the functionalities of the banks legacy systems, making it easier and cheaper to operate the bank. The company built its software on top of the Salesforce platform and as a result has a very close partnership with Salesforce (CRM).

nCino works as a central system for banks and credit unions allowing them to onboard new customers by offering them loans or checking and savings accounts, all online and in compliance with regulatory requirements. The platform becomes the single central location where all the data about customers and decisions are stored, which improves effectiveness of banking operations and allows banks to offer more personalised services to their clients.

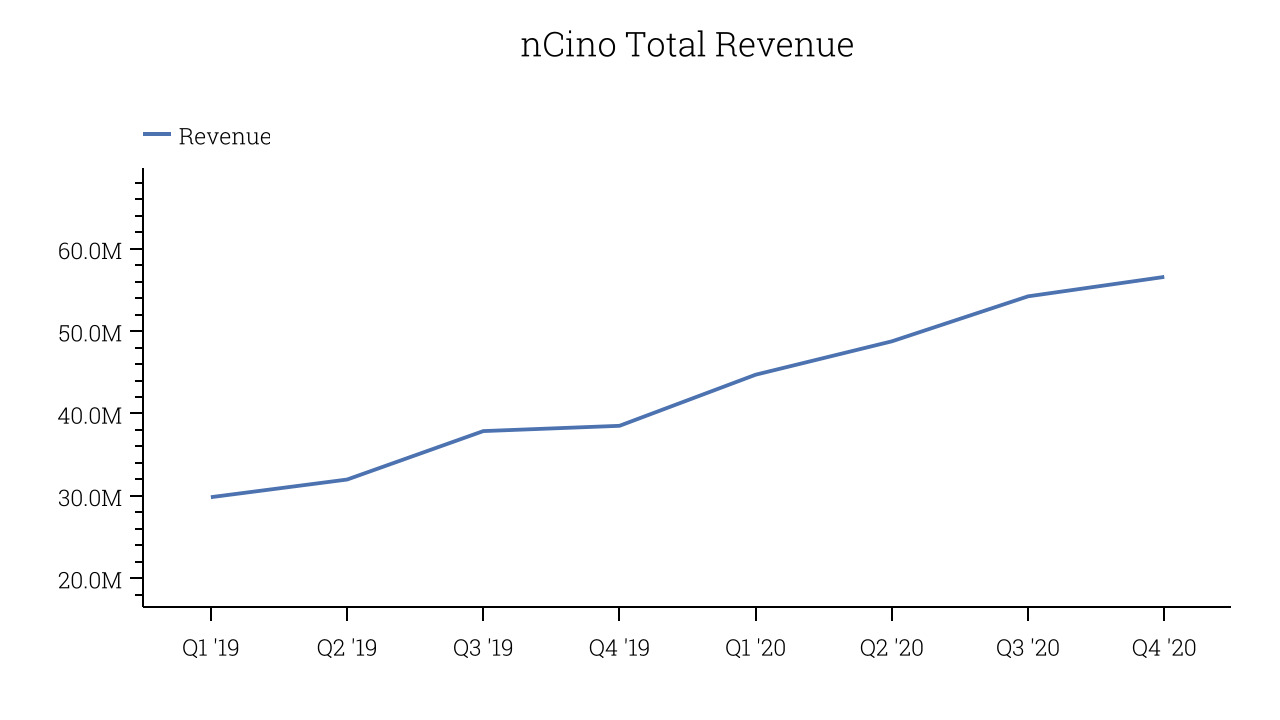

As you can see below, nCino's revenue growth has been impressive over the last twelve months, growing from $38.5 million to $56.5 million.

And unsurprisingly, this was another great quarter for nCino with revenue up an absolutely stunning 46.9% year on year. But the growth did slow down compared to last quarter, as the revenue increased by just $2.35 million in Q4, compared to $5.46 million in Q3 2021. A one-off fluctuation is usually not concerning, but it is worth keeping in mind.

Nothing In Banking Happens Quickly

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. But nothing in banking happens quickly and getting a financial institution to adopt new software initially means a lot of expensive work supporting the implementation.

nCino's gross profit margin, an important metric measuring how much money there is left after paying for servers, licences, technical support and other necessary running expenses was at 57.2% in Q4. That means that from every $1 in revenue the company had $0.57 left to spend on developing new products, marketing & sales and the general administrative overhead. This is a low gross margin for a SaaS company and it has dropped significantly from the previous quarter, which exactly the opposite we would want it to do.

Key Takeaways from nCino's Q4 Results

With market capitalisation of $5.91 billion nCino is among smaller companies, but its more than $371 million in cash and positive free cash flow over the last twelve months give us confidence that nCino has the resources it needs to pursue a high growth business strategy.

We were impressed by the very optimistic revenue guidance nCino provided for the next quarter. And we were also excited to see the really strong revenue growth. On the other hand, it was disappointing that the revenue guidance for next year indicates a significant slowdown and that the gross margin deteriorated a little. Overall, this quarter's results still seemed pretty positive and shareholders can feel optimistic.

The author has no position in any of the stocks mentioned.