Wrapping up Q2 earnings, we look at the numbers and key takeaways for the processors and graphics chips stocks, including Nvidia (NASDAQ:NVDA) and its peers.

The biggest demand drivers for processors (CPUs) and graphics chips at the moment are secular trends related to 5G and Internet of Things, autonomous driving, and high performance computing in the data center space, specifically around AI and machine learning. Like all semiconductor companies, digital chip makers exhibit a degree of cyclicality, driven by supply and demand imbalances and exposure to PC and Smartphone product cycles.

The 9 processors and graphics chips stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 0.9% while next quarter’s revenue guidance was 12.9% below.

Stocks, especially growth stocks with cash flows further into the future, had a good end of 2023. On the other hand, this year has seen more volatile stock market swings due to mixed inflation data, and processors and graphics chips stocks have had a rough stretch. On average, share prices are down 7.5% since the latest earnings results.

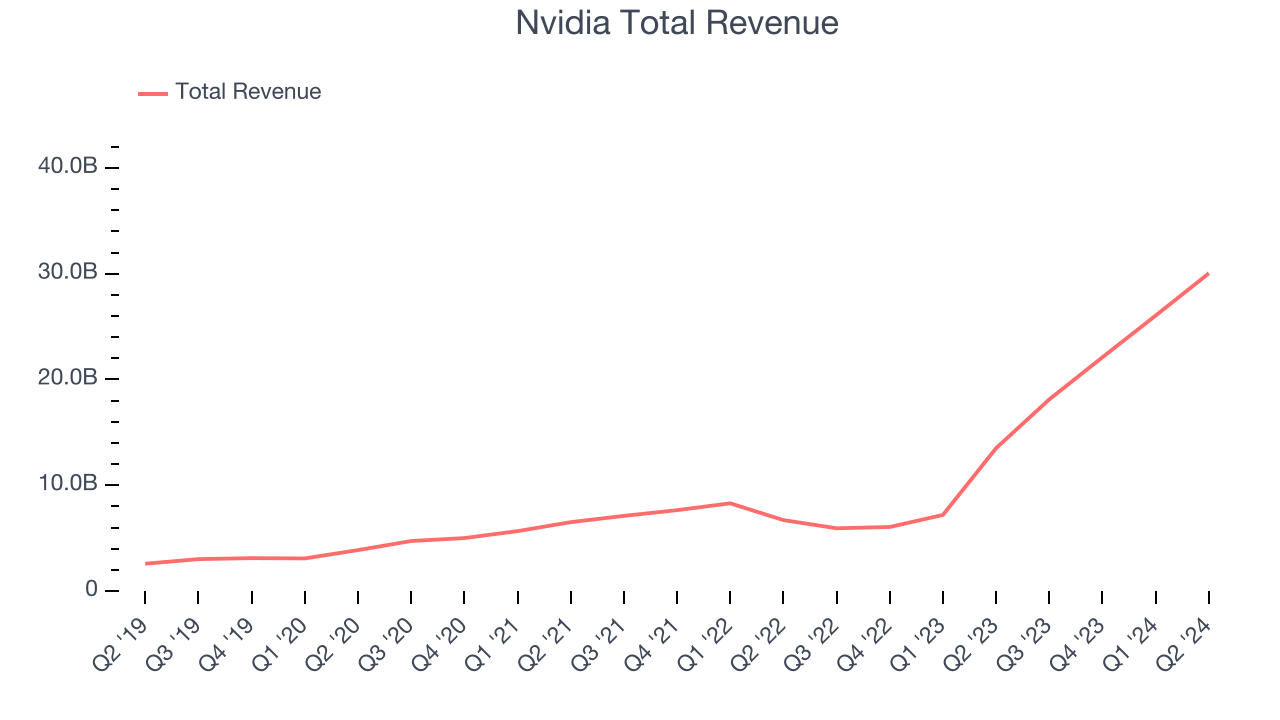

Best Q2: Nvidia (NASDAQ:NVDA)

Founded in 1993 by Jensen Huang and two former Sun Microsystems engineers, Nvidia (NASDAQ:NVDA) is a leading fabless designer of chips used in gaming, PCs, data centers, automotive, and a variety of end markets.

Nvidia reported revenues of $30.04 billion, up 122% year on year. This print exceeded analysts’ expectations by 4.5%. Overall, it was an exceptional quarter for the company with a significant improvement in its inventory levels and an impressive beat of analysts’ EPS estimates.

“Hopper demand remains strong, and the anticipation for Blackwell is incredible,” said Jensen Huang, founder and CEO of NVIDIA.

Nvidia achieved the biggest analyst estimates beat and fastest revenue growth of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 6.7% since reporting and currently trades at $117.28.

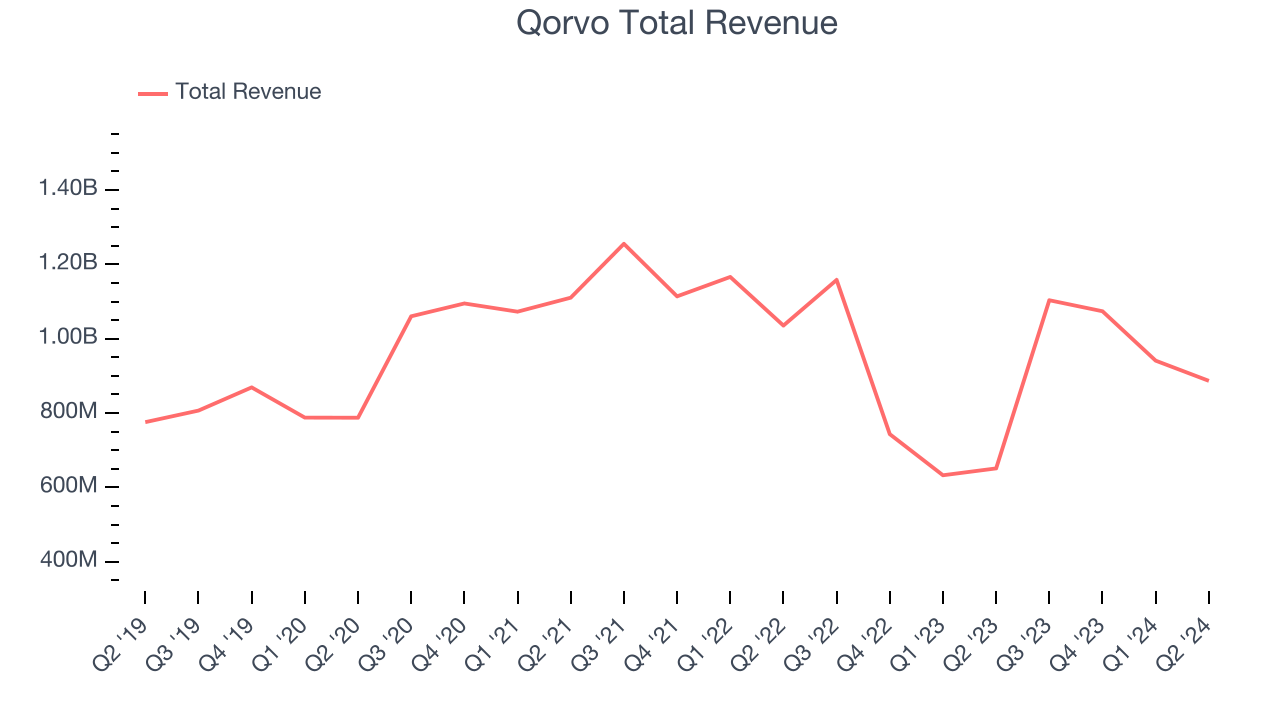

Qorvo (NASDAQ:QRVO)

Formed by the merger of TriQuint and RF Micro Devices, Qorvo (NASDAQ: QRVO) is a designer and manufacturer of RF chips used in almost all smartphones globally, along with a variety of chips used in networking equipment and infrastructure.

Qorvo reported revenues of $886.7 million, up 36.2% year on year, outperforming analysts’ expectations by 4.1%. The business had a strong quarter with an impressive beat of analysts’ EPS estimates and a significant improvement in its operating margin.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 15.9% since reporting. It currently trades at $100.46.

Is now the time to buy Qorvo? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Lattice Semiconductor (NASDAQ:LSCC)

A global leader in its category, Lattice Semiconductor (NASDAQ:LSCC) is a semiconductor designer specializing in customer-programmable chips that enhance CPU performance for intensive tasks such as machine learning.

Lattice Semiconductor reported revenues of $124.1 million, down 34.7% year on year, falling short of analysts’ expectations by 4.7%. It was a disappointing quarter as it posted underwhelming revenue guidance for the next quarter and a decline in its operating margin.

Lattice Semiconductor delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 6.6% since the results and currently trades at $51.32.

Read our full analysis of Lattice Semiconductor’s results here.

SMART (NASDAQ:SGH)

Based in the US, SMART Global Holdings (NASDAQ:SGH) is a diversified semiconductor company offering memory, digital, and LED products.

SMART reported revenues of $300.6 million, down 12.7% year on year. This number was in line with analysts’ expectations. Aside from that, it was a mixed quarter as it produced a significant improvement in its gross margin but underwhelming revenue guidance for the next quarter.

The stock is down 20.1% since reporting and currently trades at $18.56.

Read our full, actionable report on SMART here, it’s free.

Broadcom (NASDAQ:AVGO)

Originally the semiconductor division of Hewlett Packard, Broadcom (NASDAQ:AVGO) is a semiconductor conglomerate that spans wireless, networking, data storage, and industrial end markets along with an infrastructure software business focused on mainframes and cybersecurity.

Broadcom reported revenues of $13.07 billion, up 47.3% year on year. This number was in line with analysts’ expectations. Zooming out, it was a mixed quarter as it also produced a decent beat of analysts’ EPS estimates but underwhelming revenue guidance for the next quarter.

The stock is up 7.6% since reporting and currently trades at $164.62.

Read our full, actionable report on Broadcom here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.