Local broadcasting and digital media company Nexstar (NASDAQ:NXST) missed analysts' expectations in Q2 CY2024, with revenue up 2.3% year on year to $1.27 billion. It made a GAAP profit of $3.54 per share, improving from its profit of $2.64 per share in the same quarter last year.

Is now the time to buy Nexstar Media? Find out in our full research report.

Nexstar Media (NXST) Q2 CY2024 Highlights:

- Revenue: $1.27 billion vs analyst estimates of $1.28 billion (1% miss)

- EPS: $3.54 vs analyst expectations of $3.65 (2.9% miss)

- Gross Margin (GAAP): 56.5%, in line with the same quarter last year

- EBITDA Margin: 31.4%, up from 26.9% in the same quarter last year

- Free Cash Flow of $78 million, down 80.6% from the previous quarter

- Market Capitalization: $5.64 billion

IRVING, Texas--(BUSINESS WIRE)--Nexstar Media Group, Inc. (NASDAQ: NXST) (“Nexstar” or the “Company”) today reported financial results for the second quarter ended June 30, 2024 as summarized below.

Founded in 1996, Nexstar (NASDAQ:NXST) is an American media company operating numerous local television stations and digital media outlets across the country.

Broadcasting

Broadcasting companies have been facing secular headwinds in the form of consumers abandoning traditional television and radio in favor of streaming services. As a result, many broadcasting companies have evolved by forming distribution agreements with major streaming platforms so they can get in on part of the action, but will these subscription revenues be as high quality and high margin as their legacy revenues? Only time will tell which of these broadcasters will survive the sea changes of technological advancement and fragmenting consumer attention.

Sales Growth

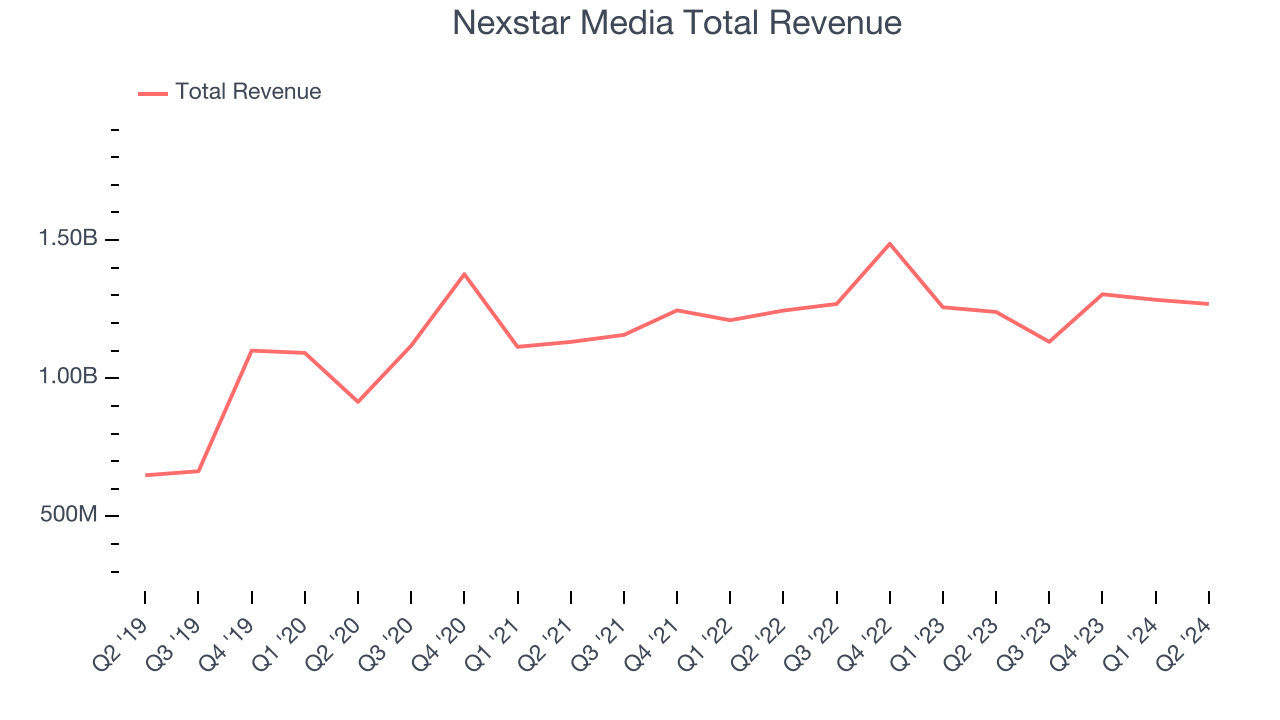

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Nexstar Media's 12.5% annualized revenue growth over the last five years was mediocre. This shows it couldn't expand in any major way and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. Nexstar Media's recent history shows its demand slowed as its annualized revenue growth of 1.3% over the last two years is below its five-year trend.

We can better understand the company's revenue dynamics by analyzing its most important segments, Distribution and Core Advertising, which are 57.8% and 41.1% of revenue. Over the last two years, Nexstar Media's Distribution revenue (licensing and affiliate fees) averaged 4.7% year-on-year growth while its Core Advertising revenue (TV and radio ads) averaged 2.5% growth.

This quarter, Nexstar Media's revenue grew 2.3% year on year to $1.27 billion, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 11% over the next 12 months, an acceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

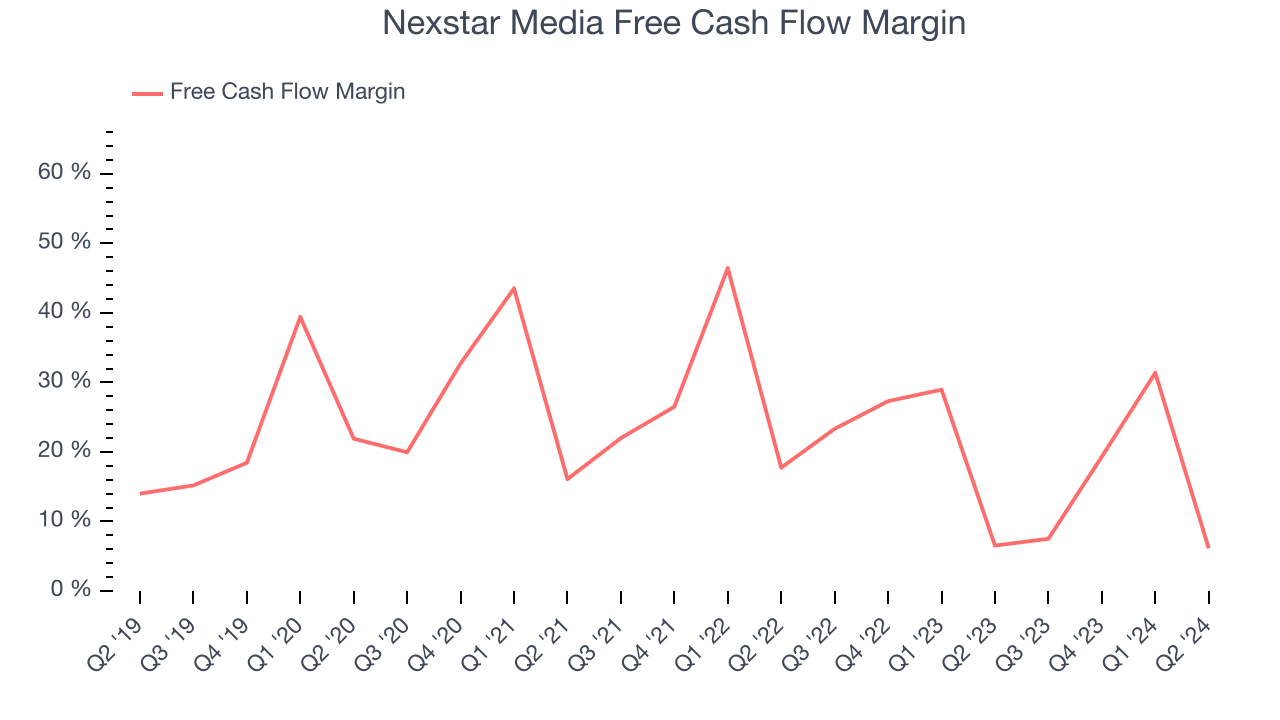

Nexstar Media has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company's free cash flow margin averaged 19.2% over the last two years, quite impressive for a consumer discretionary business.

Nexstar Media's free cash flow clocked in at $78 million in Q2, equivalent to a 6.1% margin. This quarter's cash profitability was in line with the comparable period last year but below its two-year average. In a silo, this isn't a big deal because investment needs can be seasonal, but we'll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts predict Nexstar Media's cash conversion will improve. Their consensus estimates imply its free cash flow margin of 16.4% for the last 12 months will increase to 23.6%, giving it more optionality.

Key Takeaways from Nexstar Media's Q2 Results

It was good to see Nexstar Media beat analysts' Core Advertising revenue expectations this quarter. On the other hand, its EPS missed and its revenue fell short of Wall Street's estimates. Overall, this was a weaker quarter for Nexstar Media. The stock remained flat at $171.17 immediately after reporting.

Nexstar Media may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.