Earnings results often give us a good indication what direction will the company will take in the months ahead. With Q2 now behind us, let’s have a look at Okta (NASDAQ:OKTA) and its peers.

As software penetrates corporate life, employees are using more apps every day, on more devices, in more locations. This in effect drives the need for identity and access management platforms that help companies efficiently manage who has access to what, and ensure that access privileges are secure from cyber criminals.

The 10 cybersecurity stocks we track reported a a strong Q2; on average, revenues beat analyst consensus estimates by 6.65%, while on average next quarter revenue guidance was 3.97% above consensus. The market rewarded the results with the average return the day after earnings coming in at 1.18%.

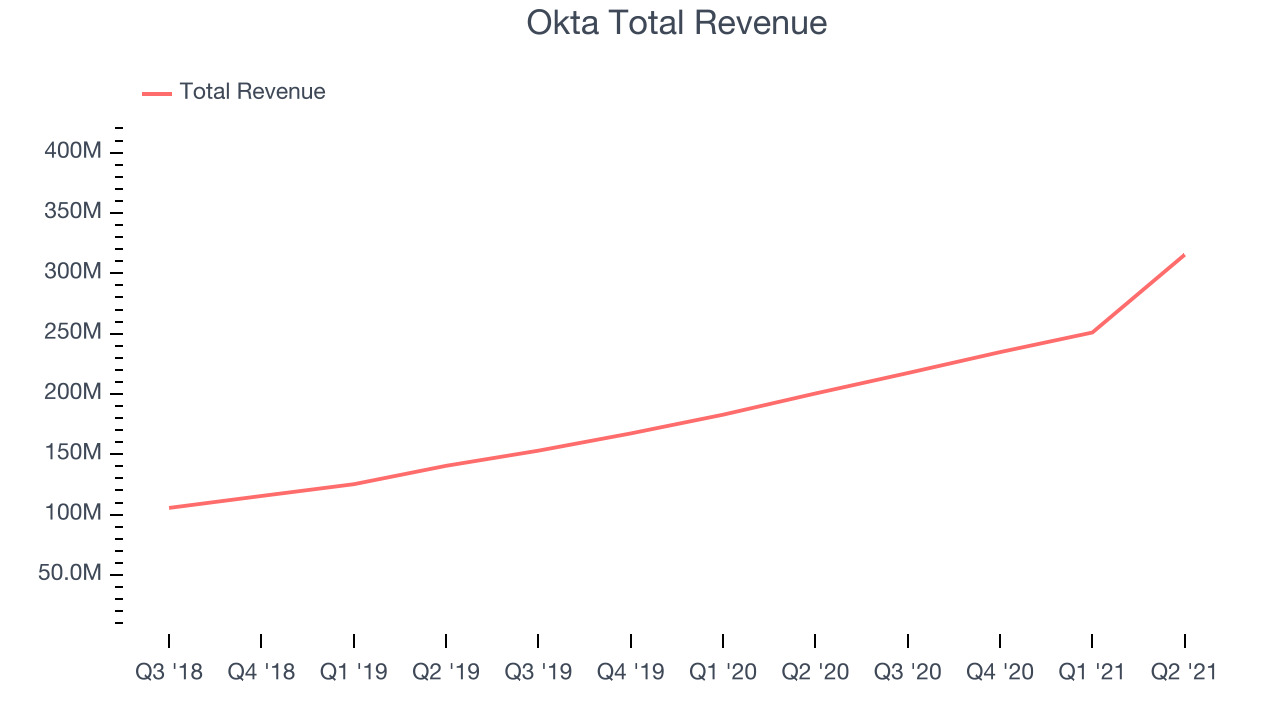

Okta (NASDAQ:OKTA)

Founded during the aftermath of the financial crisis in 2009, Okta is a cloud-based software as a service platform that helps companies manage identity for their employees and customers.

Okta reported revenues of $315.5 million, up 57.3% year on year, beating analyst expectations by 7.61%. It was a solid quarter for the company, with an exceptional revenue growth and an impressive beat of analyst estimates.

"In our first quarter as a combined company with Auth0, we're off to a fantastic start," said Todd McKinnon, Chief Executive Officer and co-founder of Okta.

The stock is up 2.69% since the results and currently trades at $226.41.

We think Okta is a good business, but is it a buy today? Read our full report here, it's free.

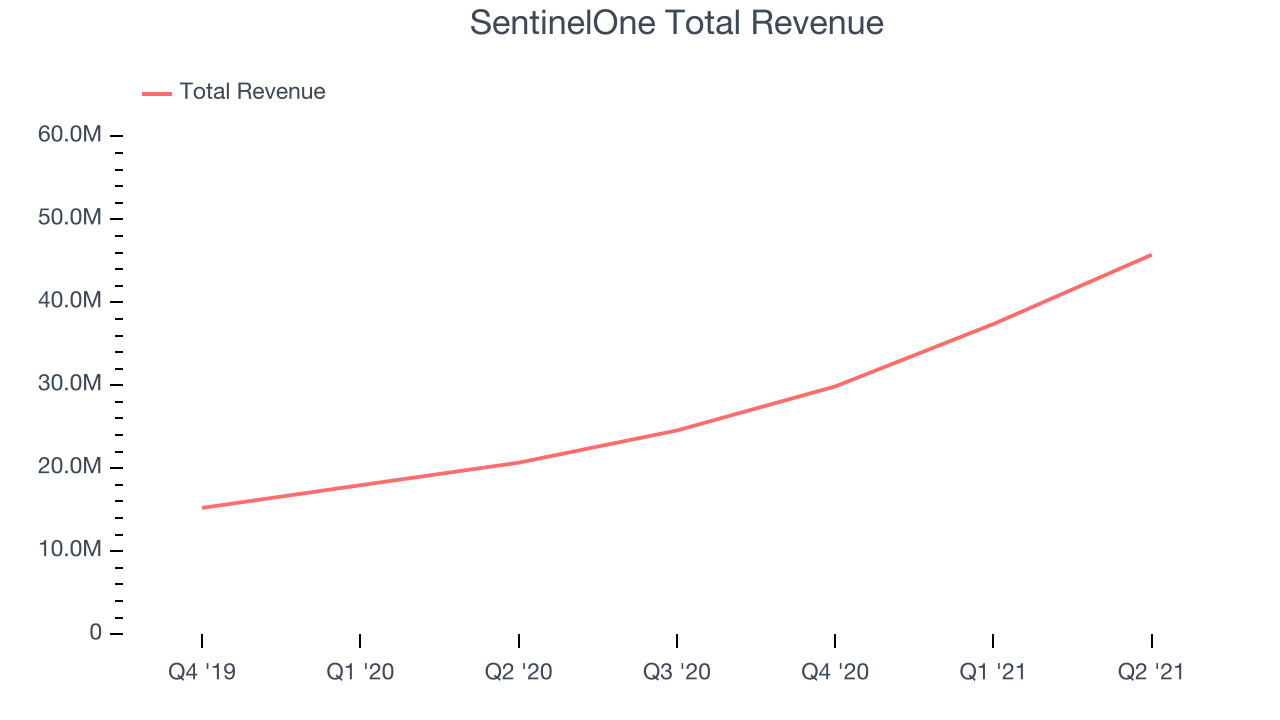

Best Q2: SentinelOne (NYSE:S)

With roots in the Israeli cyber intelligence community, SentinelOne (NYSE:S) provides software to help organizations efficiently detect, prevent, and investigate cyber attacks.

SentinelOne reported revenues of $45.7 million, up 121% year on year, beating analyst expectations by 13.3%. It was a great quarter for the company, with an impressive beat of analyst estimates and an exceptional revenue growth.

SentinelOne delivered the strongest analyst estimates beat, fastest revenue growth, and highest full year guidance raise among its peers. The stock is down 3.11% since the results and currently trades at $52.78.

Is now the time to buy SentinelOne? Access our full analysis of the earnings results here, it's free.

Weakest Q2: SailPoint (NYSE:SAIL)

Founded in 2005 by Kevin Cunningham and Mark McClain, SailPoint (NYSE:SAIL) provides software for organizations to manage the digital identity of employees, customers, and partners.

SailPoint reported revenues of $102.4 million, up 10.8% year on year, beating analyst expectations by 3.2%. It was a weaker quarter for the company, with an underwhelming revenue guidance for the next quarter and a slow revenue growth.

SailPoint had the slowest revenue growth and weakest full year guidance update in the group. The stock is down 8.92% since the results and currently trades at $42.50.

Read our full analysis of SailPoint's results here.

Palo Alto Networks (NYSE:PANW)

Founded in 2005, Palo Alto Networks makes hardware and software cybersecurity products that protect companies from cyberattacks, breaches and malware threats.

Palo Alto Networks reported revenues of $1.21 billion, up 28.2% year on year, beating analyst expectations by 3.95%. It was an impressive quarter for the company, with a very strong guidance for the next year.

The stock is up 18.6% since the results and currently trades at $469.62.

Read our full, actionable report on Palo Alto Networks here, it's free.

Zscaler (NASDAQ:ZS)

Founded in 2007 by Jay Chaudhry, Zscaler (NASDAQ:ZS) offers software as a service that helps companies securely connect to applications and networks in the cloud.

Zscaler reported revenues of $197 million, up 56.5% year on year, beating analyst expectations by 5.13%. It was a very strong quarter for the company, with an exceptional revenue growth.

The stock is down 3.35% since the results and currently trades at $252.

Read our full, actionable report on Zscaler here, it's free.

The author has no position in any of the stocks mentioned