Semiconductor photomask manufacturer Photronics (NASDAQ:PLAB) beat analysts' expectations in Q4 FY2023, with revenue up 8.2% year on year to $227.5 million. The company expects next quarter's revenue to be around $221 million, in line with analysts' estimates. It made a GAAP profit of $0.72 per share, improving from its profit of $0.60 per share in the same quarter last year.

Key Takeaways from Photronics's Q4 Results

Sporting a market capitalization of $1.35 billion, Photronics is among smaller companies, but its more than $512.2 million in cash on hand and positive free cash flow over the last 12 months put it in an attractive position to invest in growth.

We were impressed by Photronics's strong improvement in inventory levels. We were also excited its EPS handily outperformed Wall Street's estimates despite a smaller revenue beat. Guidance was fine, with fiscal Q1 revenue and EPS guidance roughly in line with expectations. Zooming out, we think this was a solid quarter that should have shareholders feeling comfortable with the trajectory of the company's performance. The stock is up 1.2% after reporting and currently trades at $21.91 per share.

Is now the time to buy Photronics? Find out in our full research report.

Photronics (PLAB) Q4 FY2023 Highlights:

- Market Capitalization: $1.35 billion

- Revenue: $227.5 million vs analyst estimates of $224 million (1.6% beat)

- EPS (non-GAAP): $0.60 vs analyst estimates of $0.53 (13.2% beat)

- Revenue Guidance for Q1 2024 is $221 million at the midpoint, roughly in line with what analysts were expecting (EPS guidance of $0.49 at the midpoint also in line)

- Free Cash Flow of $54.14 million, down 16.4% from the previous quarter

- Inventory Days Outstanding: 32, down from 37 in the previous quarter

- Gross Margin (GAAP): 37.3%, down from 38.2% in the same quarter last year

“We delivered our sixth consecutive year of record revenue with growth in fourth quarter amidst a prolonged industry downturn,” said Frank Lee, chief executive officer.

Sporting a global footprint of facilities, Photronics (NASDAQ:PLAB) is a manufacturer of photomasks, templates used to transfer patterns onto semiconductor wafers.

Semiconductor Manufacturing

The semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers, and data storage. The need for technologies like artificial intelligence, 5G networks, and smart cars is also creating the next wave of growth for the industry. Keeping up with this dynamism requires new tools that can design, fabricate, and test chips at ever smaller sizes and more complex architectures, creating a dire need for semiconductor capital manufacturing equipment.

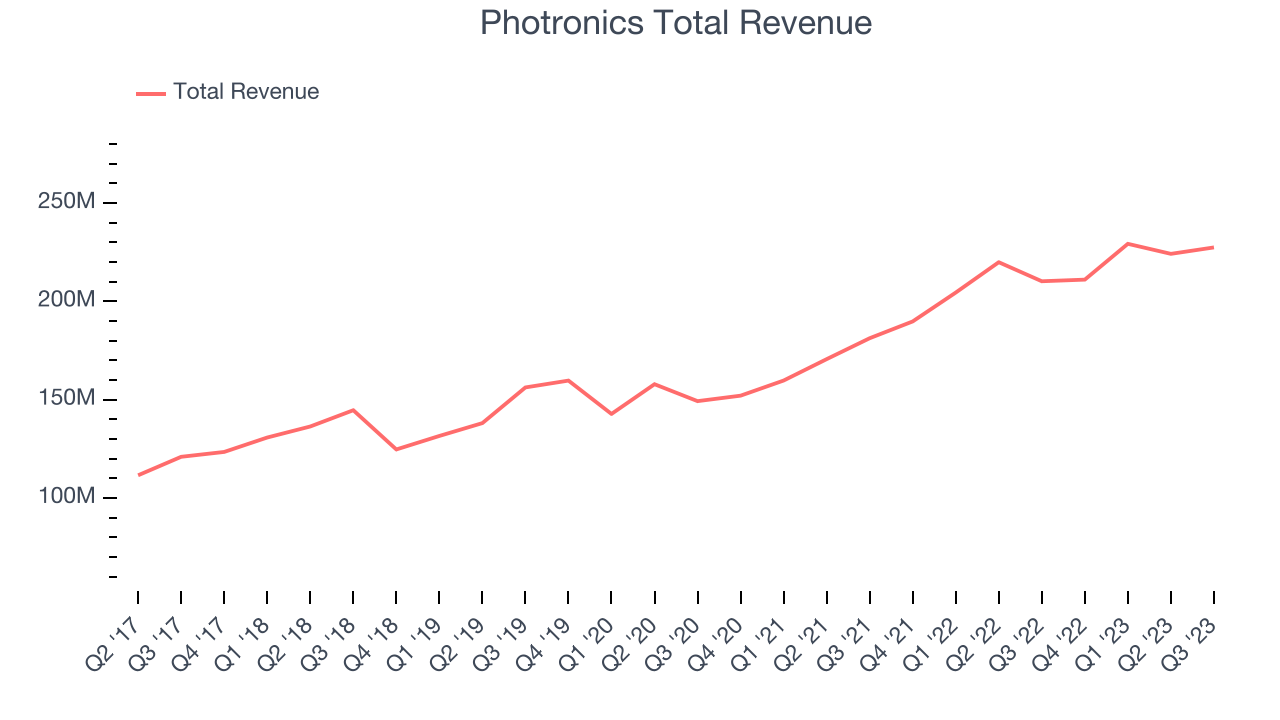

Sales Growth

Photronics's revenue growth over the last three years has been mediocre, averaging 14% annually. As you can see below, this was a weaker quarter for the company, with revenue growing from $210.3 million in the same quarter last year to $227.5 million. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

While Photronics beat analysts' revenue estimates, this was a sluggish quarter for the company as its revenue only grew 8.2% year on year. This marks 11 straight quarters of growth, showing that the current upcycle has had a good run, as a typical upcycle usually lasts 8-10 quarters.

Photronics's revenue is projected to contract next quarter, with the company guiding to a 4.5% year-on-year decline. On the other hand, analysts seem to disagree and forecast 3.2% revenue growth over the next 12 months.

While most things went back to how they were before the pandemic, a few consumer habits fundamentally changed. One founder-led company is benefiting massively from this shift and is set to beat the market for years to come. The business has grown astonishingly fast, with 40%+ free cash flow margins, and its fundamentals are undoubtedly best-in-class. Still, its total addressable market is so big that the company has room to grow many times in size. See it here.

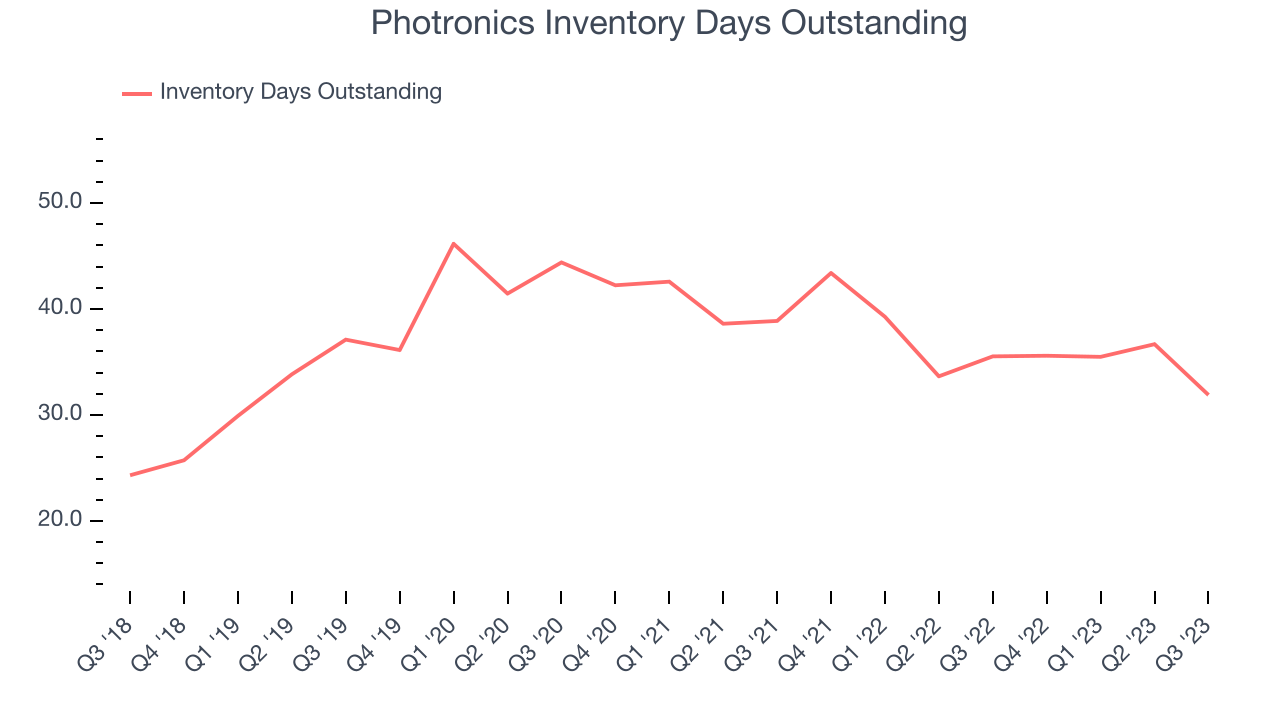

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business' capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Photronics's DIO came in at 32, which is 6 days below its five-year average. At the moment, these numbers show no indication of an excessive inventory buildup.

Photronics may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.