Fuel cell technology Plug Power (NASDAQ:PLUG) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 12.6% year on year to $173.7 million. The company’s full-year revenue guidance of $750 million at the midpoint came in 8.1% below analysts’ estimates. Its GAAP loss of $0.25 per share was also 2.4% below analysts’ consensus estimates.

Is now the time to buy Plug Power? Find out by accessing our full research report, it’s free.

Plug Power (PLUG) Q3 CY2024 Highlights:

- Revenue: $173.7 million vs analyst estimates of $210 million (17.3% miss)

- EPS: -$0.25 vs analyst expectations of -$0.24 (2.4% miss)

- The company dropped its revenue guidance for the full year to $750 million at the midpoint from $875 million, a 14.3% decrease

- Gross Margin (GAAP): -57.6%, down from -48.5% in the same quarter last year

- Operating Margin: -124%, up from -138% in the same quarter last year

- Free Cash Flow was -$234.2 million compared to -$403.6 million in the same quarter last year

- Market Capitalization: $1.75 billion

Plug Power CEO Andy Marsh stated: “Plug Power's performance this quarter underscores our commitment to building a sustainable and profitable hydrogen future. Our progress in electrolyzer deployments, advancements in hydrogen production, and expansion into new markets reflect our team's dedication to leading the build out of the hydrogen economy.”

Company Overview

Powering forklifts for Walmart’s distribution centers, Plug Power (NASDAQ:PLUG) provides hydrogen fuel cells used to power electric motors.

Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

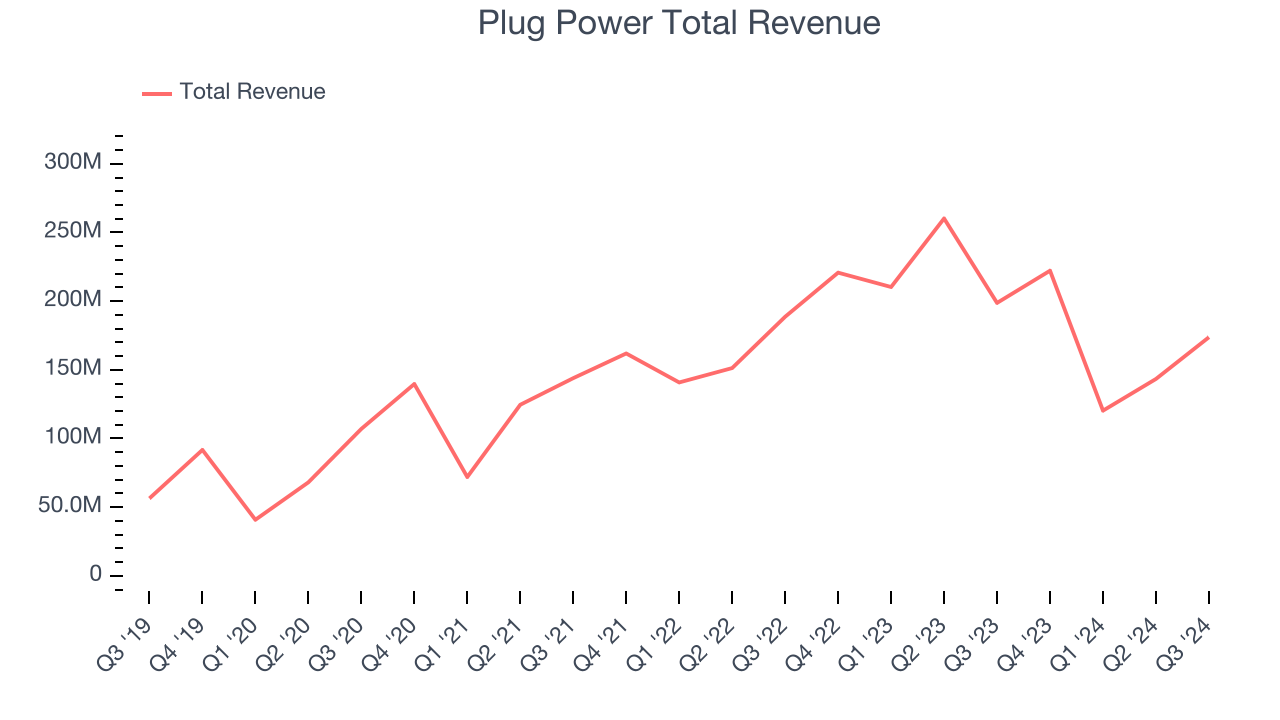

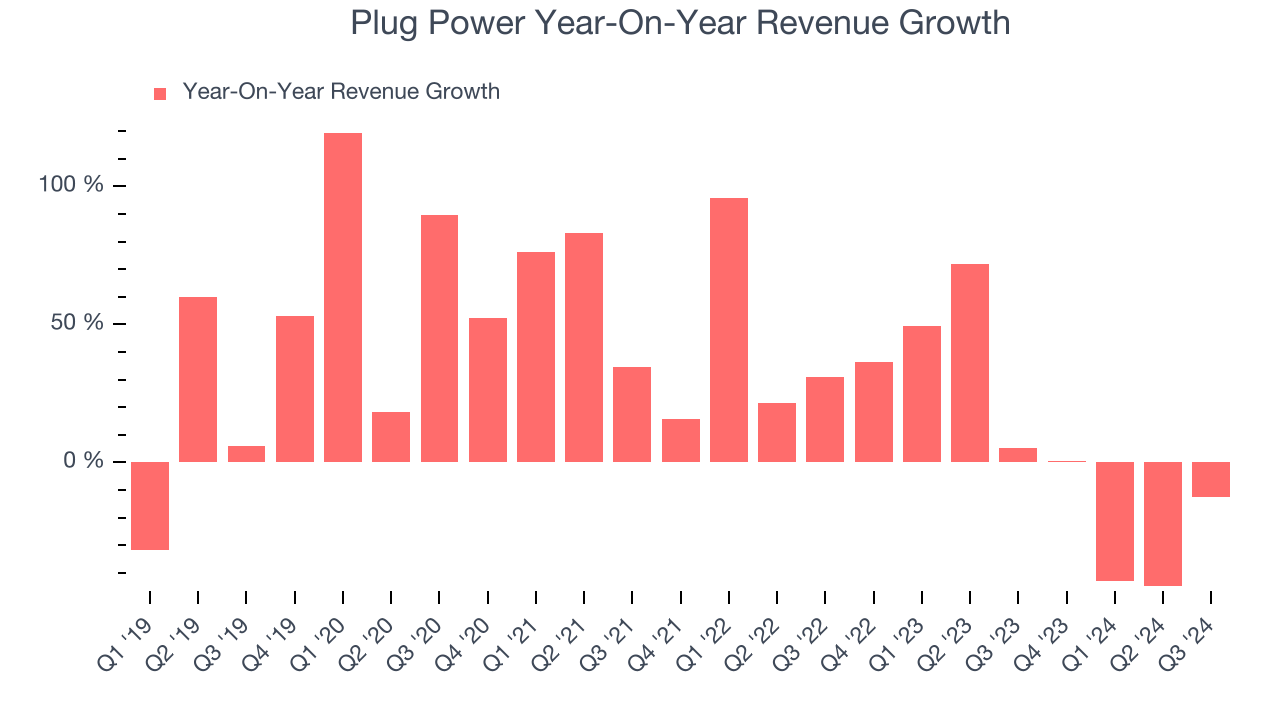

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Plug Power’s 27.9% annualized revenue growth over the last five years was incredible. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Plug Power’s recent history shows its demand slowed significantly as its annualized revenue growth of 1.3% over the last two years is well below its five-year trend.

We can better understand the company’s revenue dynamics by analyzing its three most important segments: Product, Power Purchase Agreements, and Fuel, which are 61.7%, 11.8%, and 17.1% of revenue. Over the last two years, Plug Power’s revenues in all three segments increased. Its Product revenue (equipment and infrastructure sales) averaged year-on-year growth of 2.8% while its Power Purchase Agreements (renewable energy contracts) and Fuel (delivering fuel to customers) revenues averaged 47.3% and 37.1%.

This quarter, Plug Power missed Wall Street’s estimates and reported a rather uninspiring 12.6% year-on-year revenue decline, generating $173.7 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 73.7% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and implies its newer products and services will fuel higher growth rates.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

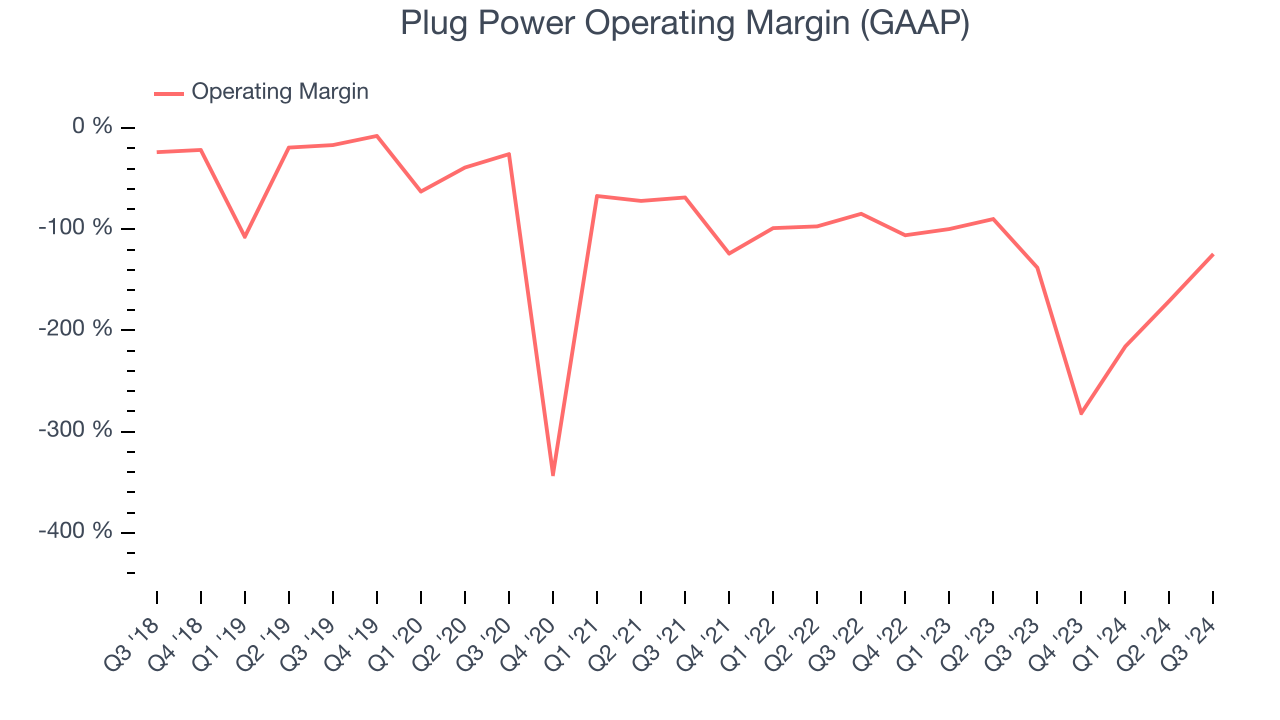

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Plug Power’s high expenses have contributed to an average operating margin of negative 126% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Analyzing the trend in its profitability, Plug Power’s annual operating margin decreased significantly over the last five years. The company’s performance was poor no matter how you look at it. It shows operating expenses were rising and it couldn’t pass those costs onto its customers.

In Q3, Plug Power generated a negative 124% operating margin. The company's lack of profits raise a flag.

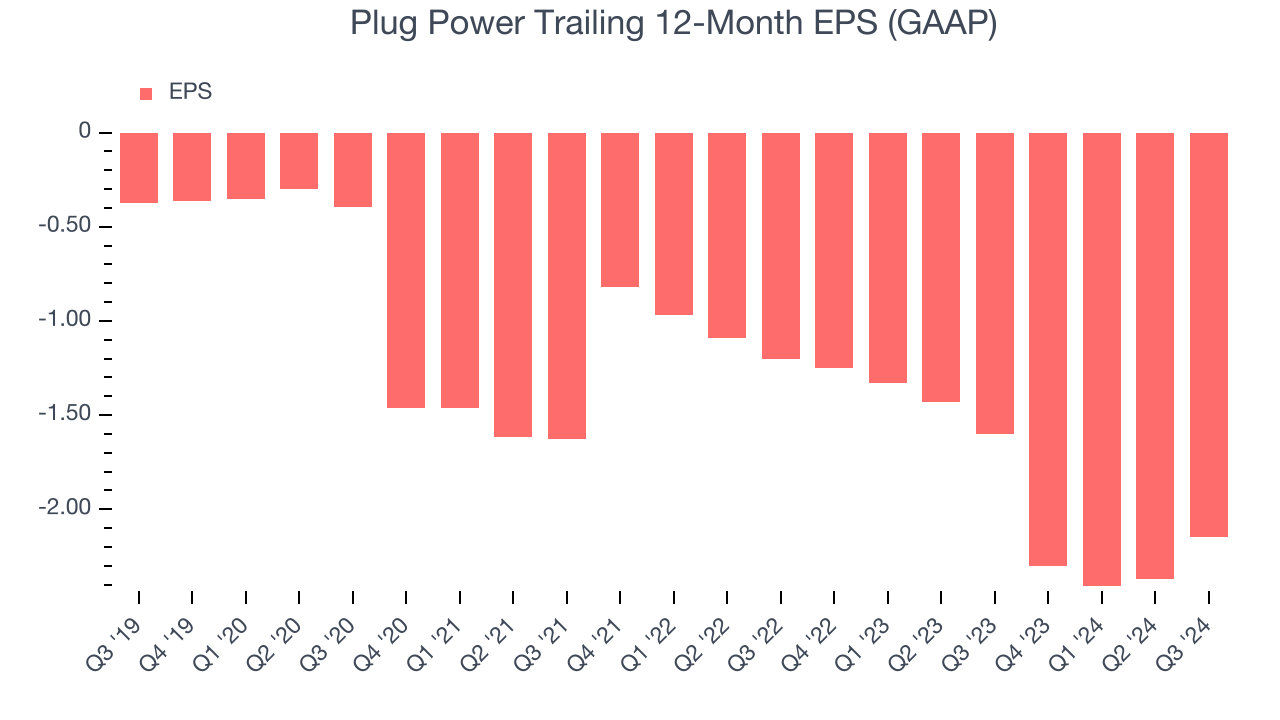

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Plug Power’s earnings losses deepened over the last five years as its EPS dropped 41.8% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Plug Power’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Plug Power, its two-year annual EPS declines of 33.9% show it’s still underperforming. These results were bad no matter how you slice the data.In Q3, Plug Power reported EPS at negative $0.25, up from negative $0.47 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects Plug Power to improve its earnings losses. Analysts forecast its full-year EPS of negative $2.15 will advance to negative $0.65.

Key Takeaways from Plug Power’s Q3 Results

We struggled to find many resounding positives in these results as it missed across all key metrics and lowered its full-year revenue guidance. Overall, this was a weaker quarter. The stock traded down 1.3% to $1.96 immediately following the results.

Plug Power underperformed this quarter, but does that create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.