Cloud security and compliance software provider Qualys (NASDAQ:QLYS) reported results in line with analysts' expectations in Q4 FY2023, with revenue up 10.5% year on year to $144.6 million. The company expects next quarter's revenue to be around $145.5 million, in line with analysts' estimates. It made a non-GAAP profit of $1.40 per share, improving from its profit of $1.01 per share in the same quarter last year.

Is now the time to buy Qualys? Find out by accessing our full research report, it's free.

Qualys (QLYS) Q4 FY2023 Highlights:

- Revenue: $144.6 million vs analyst estimates of $144.6 million (small miss)

- EPS (non-GAAP): $1.40 vs analyst estimates of $1.24 (12.5% beat)

- Revenue Guidance for Q1 2024 is $145.5 million at the midpoint, roughly in line with what analysts were expecting

- Management's revenue guidance for the upcoming financial year 2024 is $605 million at the midpoint, missing analyst estimates by 2% and implying 9.1% growth (vs 13.3% in FY2023)

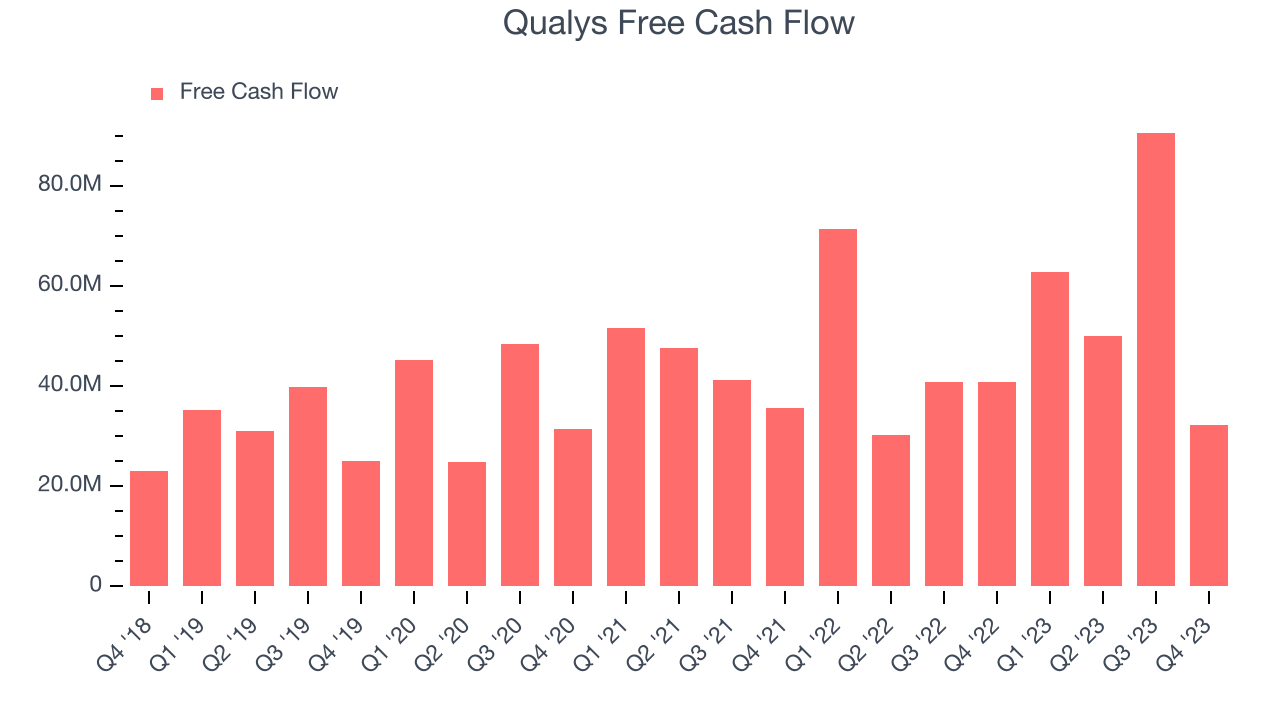

- Free Cash Flow of $32.32 million, down 64.3% from the previous quarter

- Gross Margin (GAAP): 81.2%, up from 78.8% in the same quarter last year

- Market Capitalization: $6.50 billion

"In 2023, we continued to execute against our strategic vision of helping organizations consolidate security tools on a natively integrated platform to measure, communicate, and eliminate cyber risk," said Sumedh Thakar, president and CEO of Qualys.

Founded in 1999 as one of the first subscription security companies, Qualys (NASDAQ:QLYS) provides organizations with software to assess their exposure to cyber-attacks.

Vulnerability Management

The demand for cybersecurity is growing as more and more businesses are moving their data and processes into the cloud, which along with a major increase in employees working remotely, has increased their exposure to attacks and malware. Additionally, the growing array of corporate IT systems, applications and internet connected devices has increased the complexity of network security, all of which has substantially increased the demand for software meant to protect data breaches.

Sales Growth

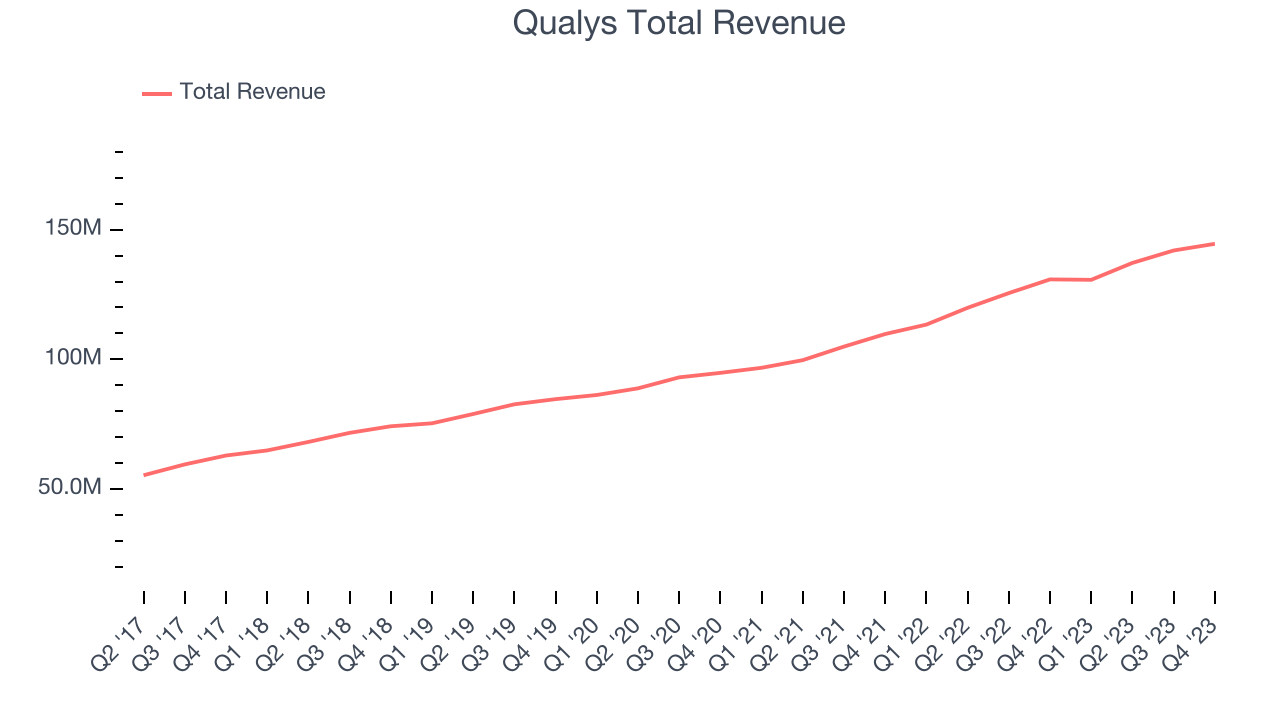

As you can see below, Qualys's revenue growth has been mediocre over the last two years, growing from $109.8 million in Q4 FY2021 to $144.6 million this quarter.

Even though Qualys fell short of analysts' revenue estimates, its quarterly revenue growth was still up 10.5% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $2.57 million in Q4 compared to $4.79 million in Q3 2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Qualys is expecting revenue to grow 11.3% year on year to $145.5 million, slowing down from the 15.2% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $605 million at the midpoint, growing 9.1% year on year compared to the 13.2% increase in FY2023.

It’s not often you find a high-quality company at a significant discount to its historical P/E multiple, but that’s exactly what we found. Click here for your FREE report on this attractive Network Effect stock at a very silly price.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Qualys's free cash flow came in at $32.32 million in Q4, down 20.9% year on year.

Qualys has generated $235.8 million in free cash flow over the last 12 months, an eye-popping 42.7% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from Qualys's Q4 Results

We struggled to find many strong positives in these results. Its full-year revenue guidance was below expectations and its suggests a slowdown in demand. Overall, this was a mixed quarter for Qualys. The company is down 7.4% on the results and currently trades at $163.99 per share.

Qualys may not have had the best quarter, but does that create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.