Electronics distributor Richardson Electronics (NASDAQ:RELL) missed Wall Street’s revenue expectations in Q4 CY2024, but sales rose 12.1% year on year to $49.49 million. Its GAAP loss of $0.05 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Richardson Electronics? Find out by accessing our full research report, it’s free.

Richardson Electronics (RELL) Q4 CY2024 Highlights:

- Revenue: $49.49 million vs analyst estimates of $51.31 million (12.1% year-on-year growth, 3.5% miss)

- Adjusted EPS: -$0.05 vs analyst estimates of -$0.02 (miss)

- Adjusted EBITDA: -$40,000 vs analyst estimates of $565,000 (-0.1% margin, relatively in line)

- Operating Margin: -1.3%, up from -4.4% in the same quarter last year

- Free Cash Flow was $4.95 million, up from -$715,000 in the same quarter last year

- Backlog: $142.6 million at quarter end

- Market Capitalization: $213.8 million

“Our second quarter results included new program wins and continued improvement in demand across our GES and PMT markets. These trends drove a 129%, or $3.4 million year-over-year increase in GES sales and an 85% increase in sales to our semi-conductor wafer fab customers. While Canvys sales declined by $0.4 million year-over-year, we expect a pick-up in Canvys sales for the remainder of fiscal 2025," said Edward J. Richardson, Chairman, CEO, and President.

Company Overview

Founded in 1947, Richardson Electronics (NASDAQ:RELL) is a distributor of power grid and microwave tubes as well as consumables related to those products.

Specialty Equipment Distributors

Historically, specialty equipment distributors have boasted deep selection and expertise in sometimes narrow areas like single-use packaging or unique lighting equipment. Additionally, the industry has evolved to include more automated industrial equipment and machinery over the last decade, driving efficiencies and enabling valuable data collection. Specialty equipment distributors whose offerings keep up with these trends can take share in a still-fragmented market, but like the broader industrials sector, this space is at the whim of economic cycles that impact the capital spending and manufacturing propelling industry volumes.

Sales Growth

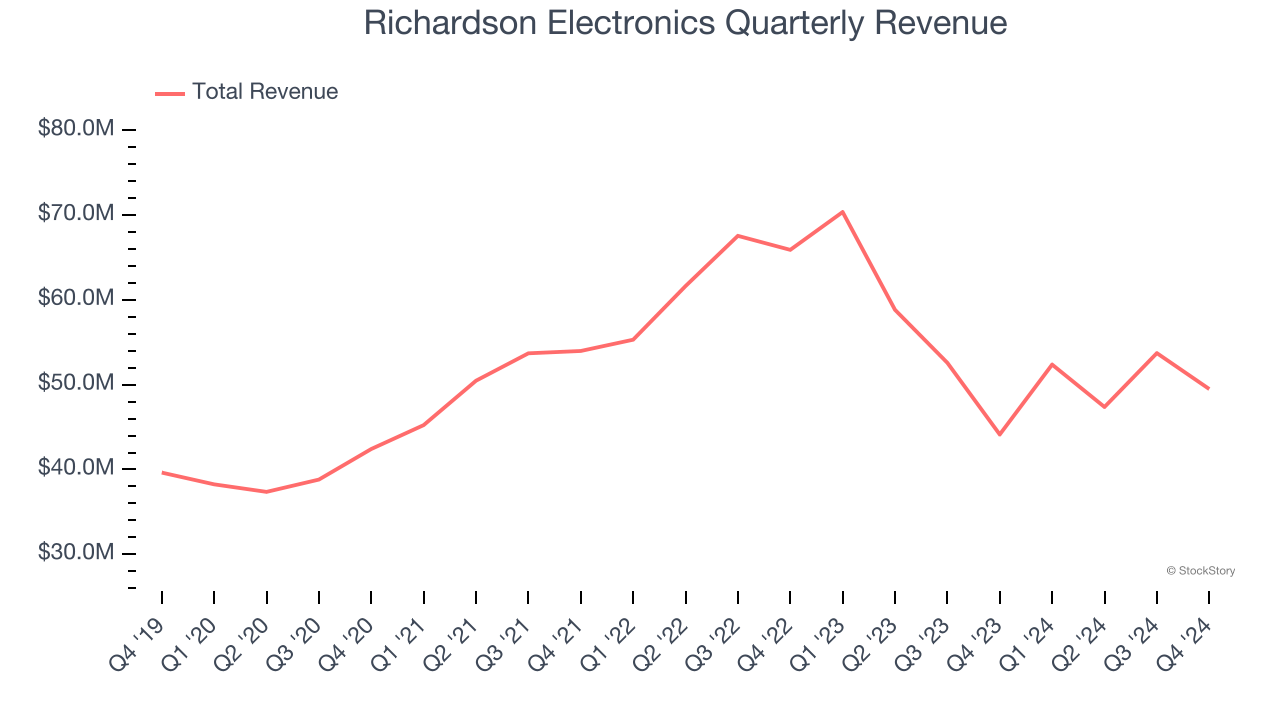

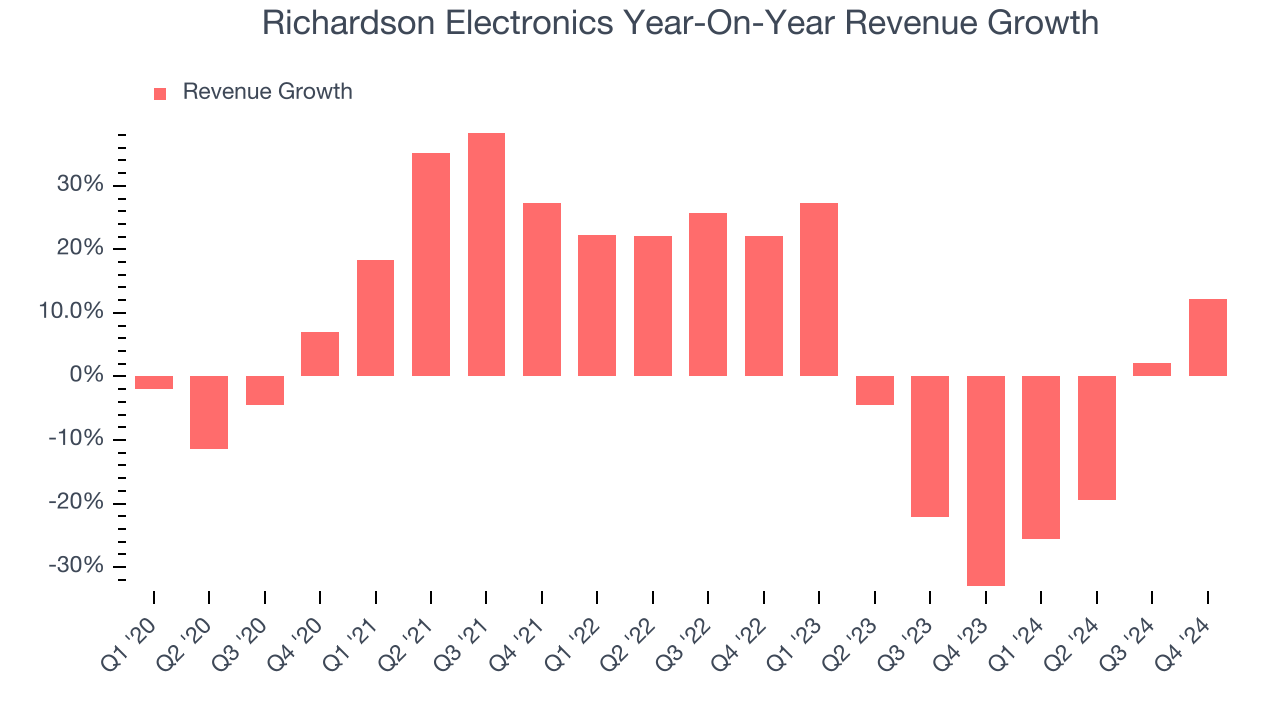

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Richardson Electronics grew its sales at a tepid 4.7% compounded annual growth rate. This fell short of our benchmark for the industrials sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Richardson Electronics’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 10% annually. Richardson Electronics isn’t alone in its struggles as the Specialty Equipment Distributors industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, Richardson Electronics’s revenue grew by 12.1% year on year to $49.49 million but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 18.8% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and implies its newer products and services will catalyze better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

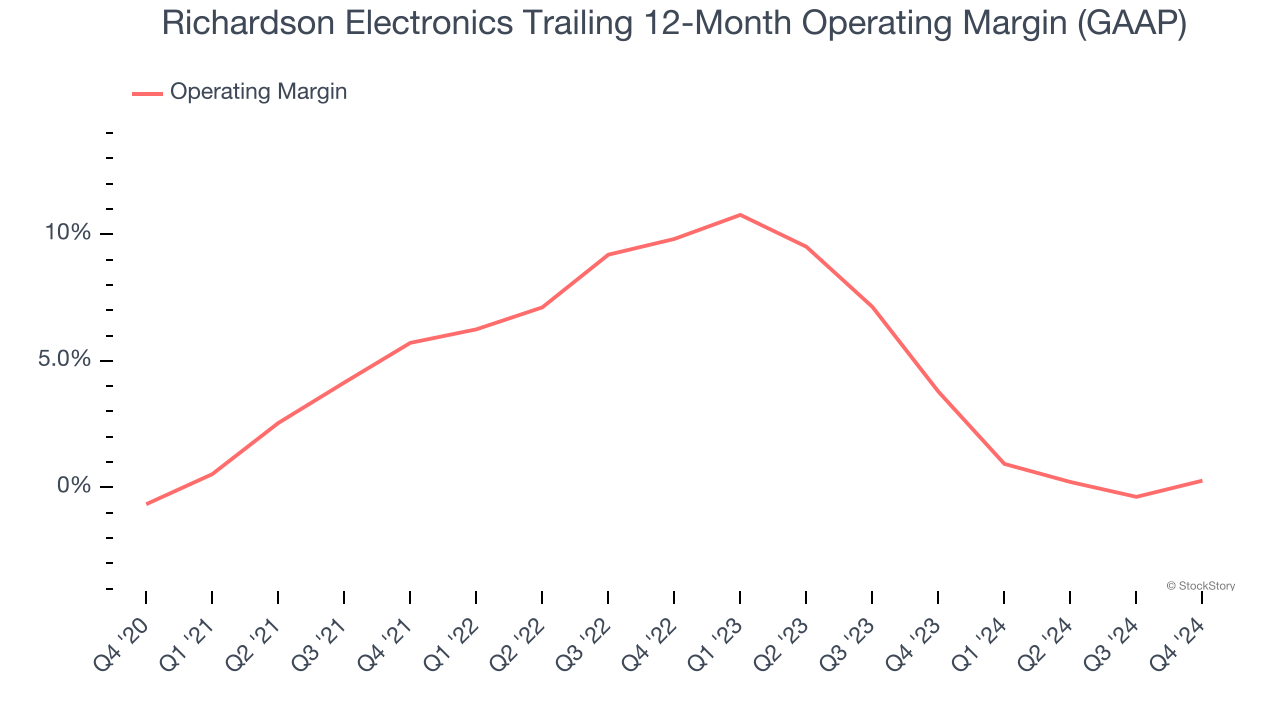

Richardson Electronics was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.3% was weak for an industrials business.

Analyzing the trend in its profitability, Richardson Electronics’s operating margin might have seen some fluctuations but has generally stayed the same over the last five years, meaning it will take a fundamental shift in the business to change.

In Q4, Richardson Electronics generated an operating profit margin of negative 1.3%, up 3.1 percentage points year on year. The increase was encouraging, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

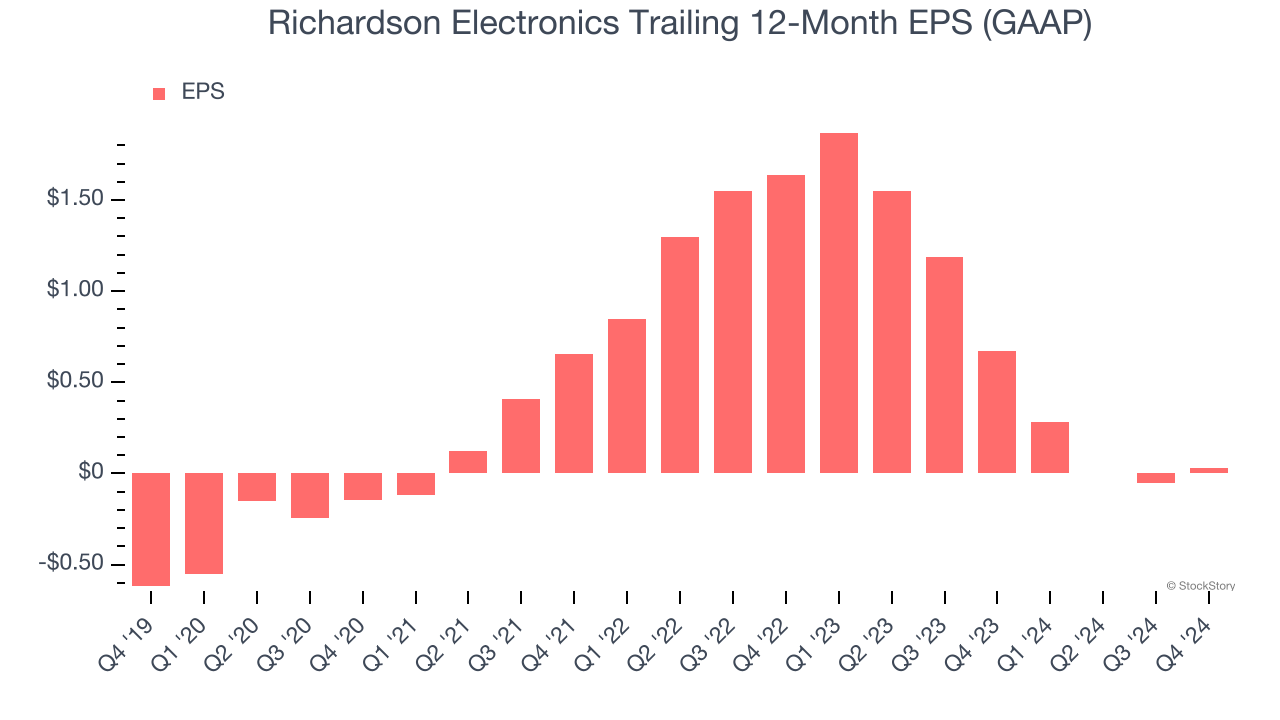

Richardson Electronics’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Sadly for Richardson Electronics, its EPS declined by more than its revenue over the last two years, dropping 86.5%. This tells us the company struggled to adjust to shrinking demand.

We can take a deeper look into Richardson Electronics’s earnings to better understand the drivers of its performance. While we mentioned earlier that Richardson Electronics’s operating margin improved this quarter, a two-year view shows its margin has declined by 12.2 percentage points. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Richardson Electronics reported EPS at negative $0.05, up from negative $0.13 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Richardson Electronics’s full-year EPS of $0.03 to grow 2,350%.

Key Takeaways from Richardson Electronics’s Q4 Results

We struggled to find many resounding positives in these results. Its revenue missed significantly and its EBITDA fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 6.5% to $13.75 immediately following the results.

Richardson Electronics’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.