Cybersecurity software maker Rapid7 (NASDAQ:RPD) beat analysts' expectations in Q2 CY2024, with revenue up 9.2% year on year to $208 million. The company expects next quarter's revenue to be around $210 million, in line with analysts' estimates. It made a non-GAAP profit of $0.58 per share, improving from its profit of $0.18 per share in the same quarter last year.

Is now the time to buy Rapid7? Find out by accessing our full research report, it's free.

Rapid7 (RPD) Q2 CY2024 Highlights:

- Revenue: $208 million vs analyst estimates of $204.1 million (1.9% beat)

- Adjusted Operating Income: $39.28 million vs analyst estimates of $36.04 million (9% beat)

- EPS (non-GAAP): $0.58 vs analyst estimates of $0.52 (12.4% beat)

- Revenue Guidance for Q3 CY2024 is $210 million at the midpoint, roughly in line with what analysts were expecting

- The company slightly lifted its revenue guidance for the full year from $833 million to $835 million at the midpoint

- Gross Margin (GAAP): 70.7%, up from 69.5% in the same quarter last year

- Free Cash Flow of $29.21 million, similar to the previous quarter

- Annual Recurring Revenue: $815.6 million at quarter end, up 8.6% year on year

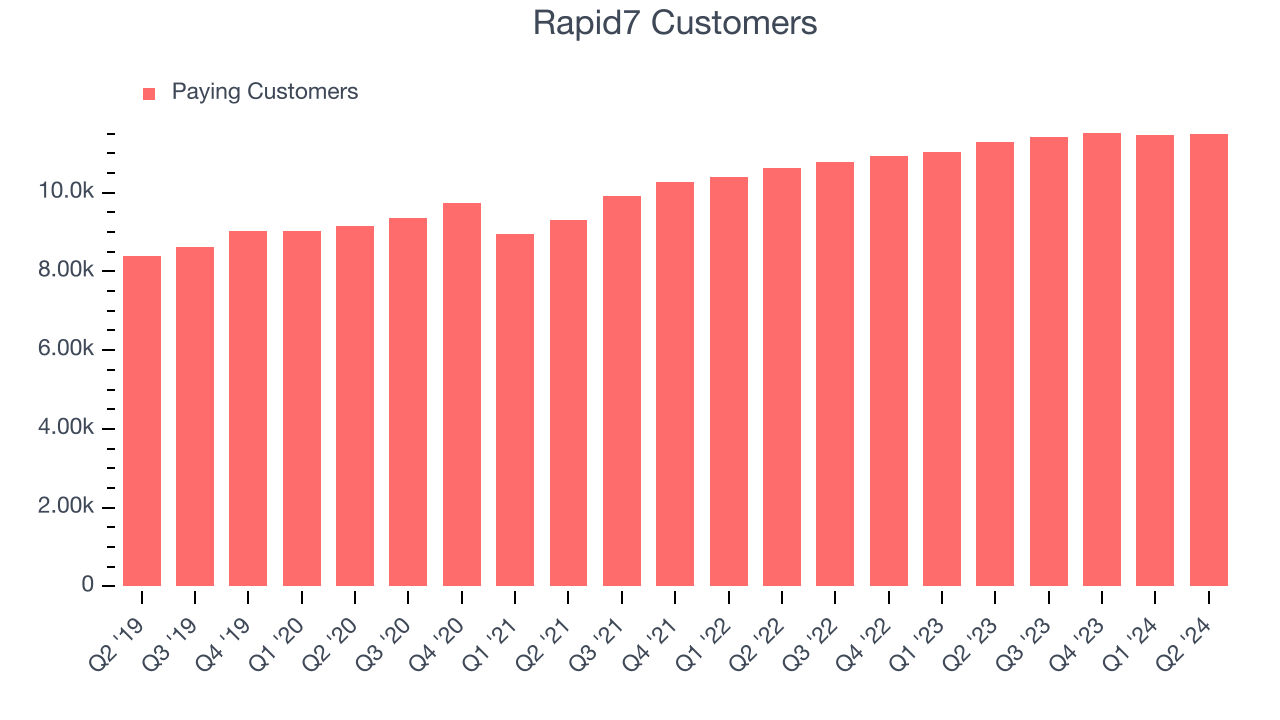

- Customers: 11,484, up from 11,462 in the previous quarter

- Market Capitalization: $2.08 billion

“Rapid7 delivered solid second quarter results in line with our expectations, growing ARR by 9% year-over-year to $816 million, and continuing to innovate to bring customers the strongest security operations data platform,” said Corey Thomas, Chairman and CEO of Rapid7.

Founded in 2000 with the idea that network security comes before endpoint security, Rapid7 (NASDAQ:RPD) provides software as a service that helps companies understand where they are exposed to cyber security risks, quickly detect breaches and respond to them.

Vulnerability Management

The demand for cybersecurity is growing as more and more businesses are moving their data and processes into the cloud, which along with a major increase in employees working remotely, has increased their exposure to attacks and malware. Additionally, the growing array of corporate IT systems, applications and internet connected devices has increased the complexity of network security, all of which has substantially increased the demand for software meant to protect data breaches.

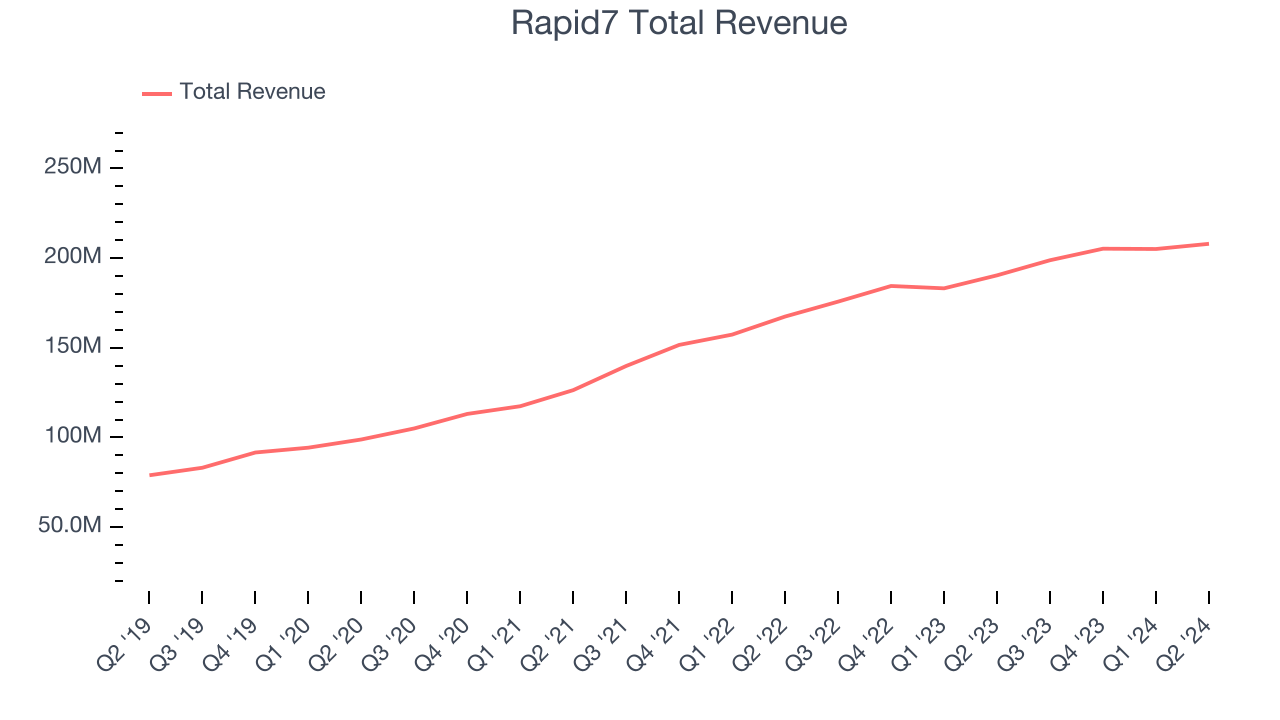

Sales Growth

As you can see below, Rapid7's revenue growth has been decent over the last three years, growing from $126.4 million in Q2 2021 to $208 million this quarter.

Rapid7's quarterly revenue was only up 9.2% year on year, which might disappoint some shareholders. However, its revenue increased $2.89 million quarter on quarter, a strong improvement from the $167,000 decrease in Q1 CY2024. This is a sign of acceleration of growth and very nice to see indeed.

Next quarter's guidance suggests that Rapid7 is expecting revenue to grow 5.6% year on year to $210 million, slowing down from the 13.1% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 6.3% over the next 12 months before the earnings results announcement.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Customer Growth

Rapid7 reported 11,484 customers at the end of the quarter, an increase of 22 from the previous quarter. That's a little better customer growth than last quarter but a bit below what we've typically seen over the last year, suggesting that the company may be reinvigorating growth. Rapid7 updated its customer count methodology in Q1 2021, which is the reason for the related drop in the number of customers.

Key Takeaways from Rapid7's Q2 Results

We were impressed by Rapid7's strong growth in customers this quarter. We were also happy its revenue narrowly outperformed Wall Street's estimates. Overall, this quarter seemed fairly positive and shareholders should feel optimistic. The stock traded up 2.9% to $34 immediately after reporting.

Rapid7 may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.