Semiconductor company Semtech (NASDAQ:SMTC) beat analysts’ expectations in Q2 CY2024, with revenue down 9.7% year on year to $215.4 million. Guidance for next quarter’s revenue was also optimistic at $233 million at the midpoint, 2.4% above analysts’ estimates. It made a non-GAAP profit of $0.11 per share, improving from its loss of $5.97 per share in the same quarter last year.

Is now the time to buy Semtech? Find out by accessing our full research report, it’s free.

Semtech (SMTC) Q2 CY2024 Highlights:

- Revenue: $215.4 million vs analyst estimates of $212.3 million (1.5% beat)

- Adjusted Operating Income: $30.54 million vs analyst estimates of $28.67 million (6.5% beat)

- EPS (non-GAAP): $0.11 vs analyst estimates of $0.10 (15.8% beat)

- Revenue Guidance for Q3 CY2024 is $233 million at the midpoint, above analyst estimates of $227.5 million

- EPS (non-GAAP) guidance for Q3 CY2024 is $0.23 at the midpoint, above analyst estimates of $0.20

- EBITDA guidance for Q3 CY2024 is $48.7 million] at the midpoint, above analyst estimates of $41.6 million

- Gross Margin (GAAP): 50%, up from 46.8% in the same quarter last year

- Inventory Days Outstanding: 132, up from 130 in the previous quarter

- EBITDA Margin: 18.8%, down from 23.6% in the same quarter last year

- Free Cash Flow was -$8.41 million compared to -$18.93 million in the same quarter last year

- Market Capitalization: $2.78 billion

"Semtech continues to execute on an established strategy to grow our business, as demonstrated by solid second quarter financial performance and a favorable outlook for our third quarter that forecasts acceleration of this growth," said Hong Hou, Semtech's President and CEO.

A public company since the late 1960s, Semtech (NASDAQ:SMTC) is a provider of analog and mixed-signal semiconductors used for Internet of Things systems and cloud connectivity.

Semiconductor Manufacturing

The semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers, and data storage. The need for technologies like artificial intelligence, 5G networks, and smart cars is also creating the next wave of growth for the industry. Keeping up with this dynamism requires new tools that can design, fabricate, and test chips at ever smaller sizes and more complex architectures, creating a dire need for semiconductor capital manufacturing equipment.

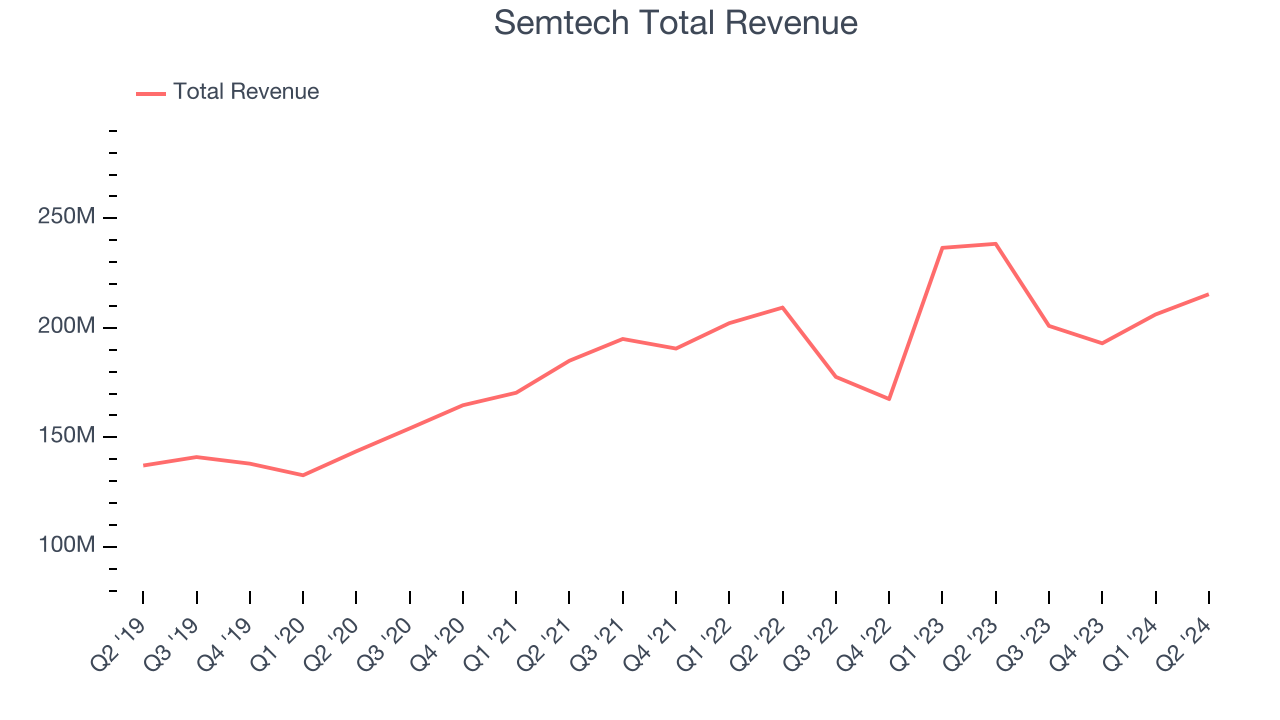

Sales Growth

Semtech’s revenue growth over the last three years has been unimpressive, averaging 7.5% annually. This quarter, its revenue declined from $238.4 million in the same quarter last year to $215.4 million. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

Even though Semtech surpassed analysts’ revenue estimates, this was a slow quarter for the company as its revenue dropped 9.7% year on year. This could mean that the current downcycle is deepening.

Semtech looks like it’s on the cusp of a rebound, as it’s guiding to 16% year-on-year revenue growth for the next quarter. Analysts seem to agree as consesus estimates call for 19% growth over the next 12 months.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

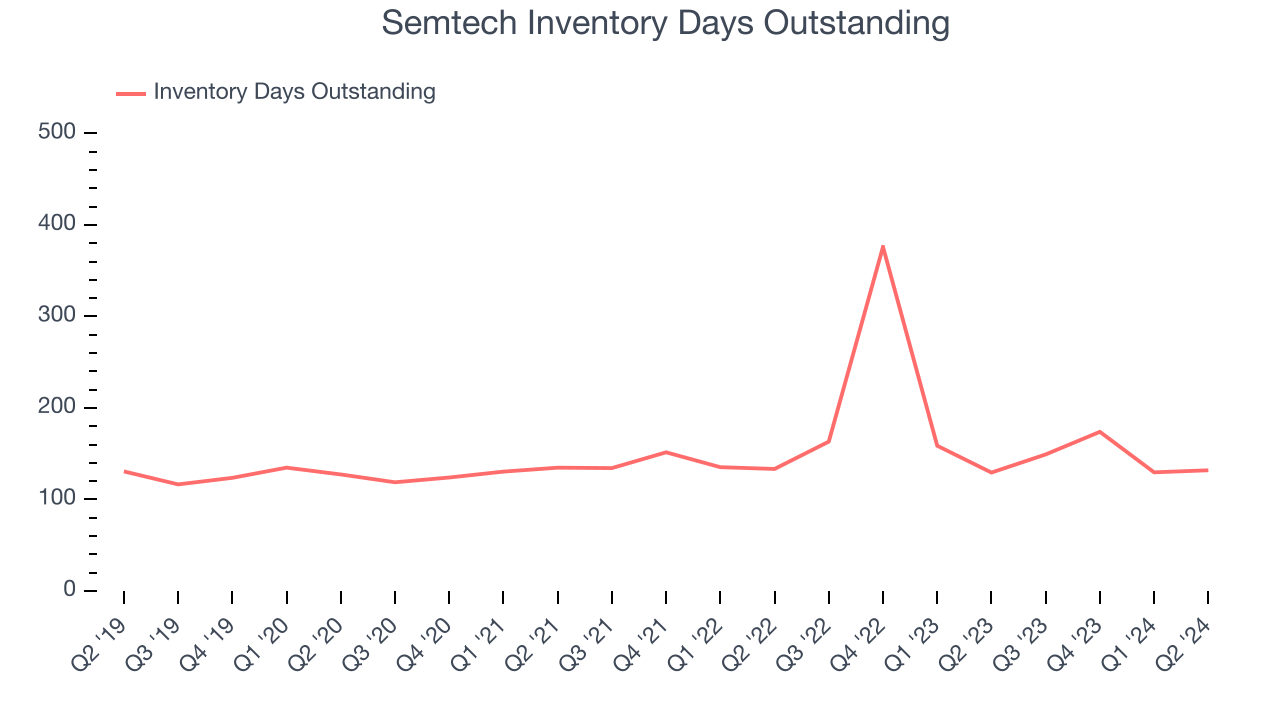

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Semtech’s DIO came in at 132, which is 17 days below its five-year average. These numbers show that despite the recent increase, there’s no indication of an excessive inventory buildup.

Key Takeaways from Semtech’s Q2 Results

We were impressed by how significantly Semtech blew past analysts’ EPS expectations this quarter. We were also glad next quarter's revenue, adjusted operating income, and EPS guidance beat Wall Street's estimates. Overall, we think this was a good quarter with some key metrics above expectations. The stock traded up 6.4% to $40.59 immediately following the results.

Semtech may have had a good quarter, but does that mean you should invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.