Bedding manufacturer and retailer Sleep Number (NASDAQ:SNBR) missed analysts' expectations in Q2 CY2024, with revenue down 11% year on year to $408.4 million. It made a GAAP loss of $0.22 per share, down from its profit of $0.03 per share in the same quarter last year.

Is now the time to buy Sleep Number? Find out by accessing our full research report, it's free.

Sleep Number (SNBR) Q2 CY2024 Highlights:

- Revenue: $408.4 million vs analyst estimates of $416.2 million (1.9% miss)

- EPS: -$0.22 vs analyst estimates of -$0.35 (37.3% beat)

- Gross Margin (GAAP): 59.1%, up from 57.6% in the same quarter last year

- Locations: 646 at quarter end, down from 672 in the same quarter last year

- Same-Store Sales fell 11% year on year (2% in the same quarter last year)

- Market Capitalization: $254.5 million

“The implementation of our transformative initiatives is improving gross margin, operating expenses and free cash flow, as our teams continue to execute sustainable changes across the business. In the second quarter, we delivered gross margin rate expansion and adjusted EBITDA slightly ahead of expectations, despite facing a more challenging industry sales environment than anticipated,” said Shelly Ibach, Chair, President and CEO.

Known for mattresses that can be adjusted with regards to firmness, Sleep Number (NASDAQ:SNBR) manufactures and sells its own brand of bedding products such as mattresses, bed frames, and pillows.

Home Furniture Retailer

Furniture retailers understand that ‘home is where the heart is’ but that no home is complete without that comfy sofa to kick back on or a dreamy bed to rest in. These stores focus on providing not only what is practically needed in a house but also aesthetics, style, and charm in the form of tables, lamps, and mirrors. Decades ago, it was thought that furniture would resist e-commerce because of the logistical challenges of shipping large furniture, but now you can buy a mattress online and get it in a box a few days later; so just like other retailers, furniture stores need to adapt to new realities and consumer behaviors.

Sales Growth

Sleep Number is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

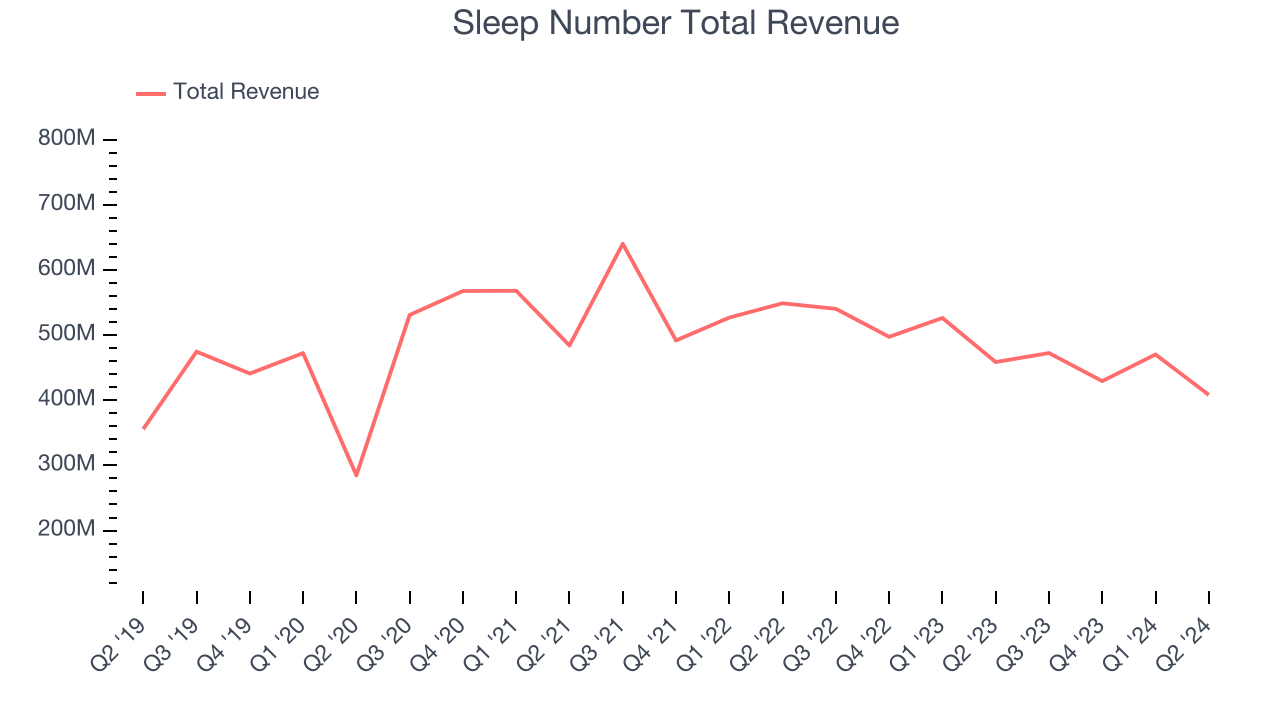

As you can see below, the company's annualized revenue growth rate of 2.1% over the last five years was weak as its store footprint remained relatively unchanged.

This quarter, Sleep Number missed Wall Street's estimates and reported a rather uninspiring 11% year-on-year revenue decline, generating $408.4 million in revenue. Looking ahead, Wall Street expects sales to grow 1.6% over the next 12 months, an acceleration from this quarter.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Same-Store Sales

Same-store sales growth is an important metric that tracks demand for a retailer's established brick-and-mortar stores and e-commerce platform.

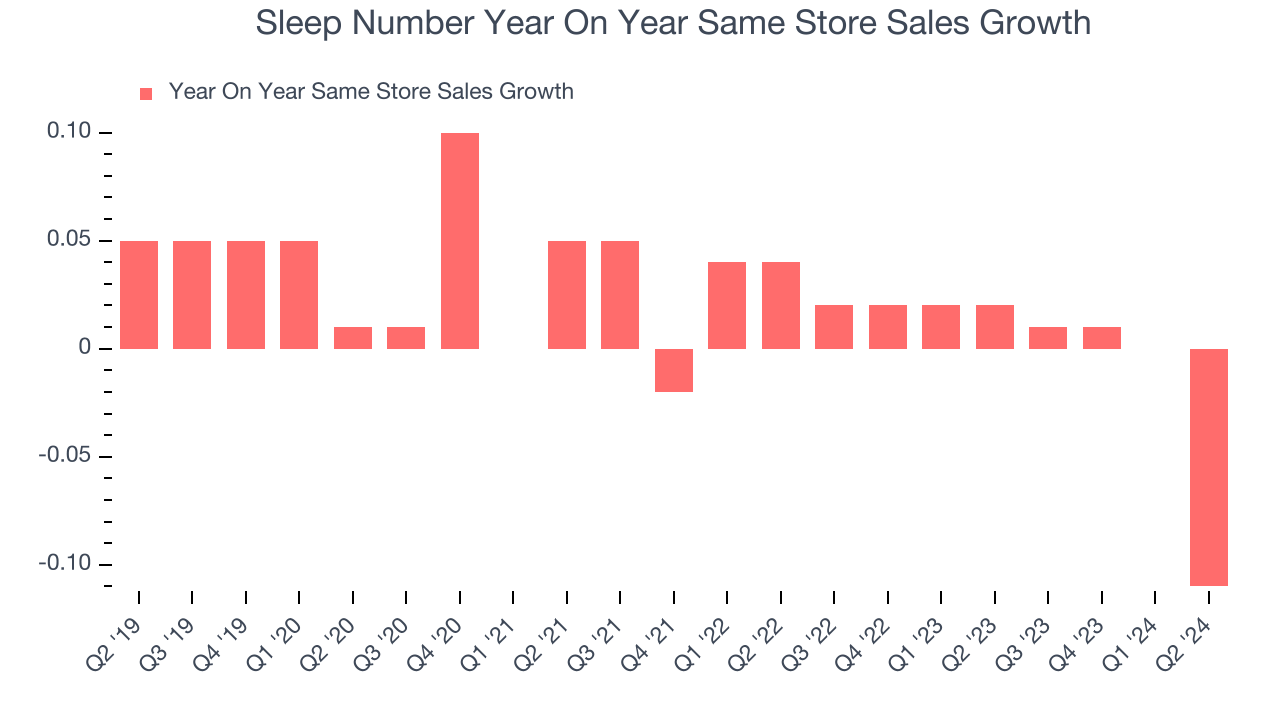

Sleep Number's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 0.1% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, Sleep Number's same-store sales fell 11% year on year. This decline was a reversal from the 2% year-on-year increase it posted 12 months ago. We'll be keeping a close eye on the company to see if this turns into a longer-term trend.

Key Takeaways from Sleep Number's Q2 Results

We were impressed by how significantly Sleep Number blew past analysts' EPS expectations this quarter. We were also excited its gross margin outperformed Wall Street's estimates. On the other hand, its revenue unfortunately missed analysts' expectations. Overall, we think this was a mixed quarter with weak topline trends. The stock traded down 3.6% to $11.40 immediately following the results.

So should you invest in Sleep Number right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.