3D printing company Stratasys (NASDAQ:SSYS) missed analysts’ expectations in Q2 CY2024, with revenue down 13.6% year on year to $138 million. The company’s full-year revenue guidance of $575 million at the midpoint also came in 9% below analysts’ estimates. It made a non-GAAP loss of $0.04 per share, down from its profit of $0.04 per share in the same quarter last year.

Is now the time to buy Stratasys? Find out by accessing our full research report, it’s free.

Stratasys (SSYS) Q2 CY2024 Highlights:

- Revenue: $138 million vs analyst estimates of $146.3 million (5.7% miss)

- EPS (non-GAAP): -$0.04 vs analyst estimates of -$0.05

- The company dropped its revenue guidance for the full year to $575 million at the midpoint from $637.5 million, a 9.8% decrease

- EPS (non-GAAP) guidance for the full year is $0.03 at the midpoint, missing analyst estimates by 79.8%

- EBITDA guidance for the full year is $25.5 million at the midpoint, below analyst estimates of $40.03 million

- Gross Margin (GAAP): 43.8%, in line with the same quarter last year

- Market Capitalization: $541 million

Dr. Yoav Zeif, Stratasys’s Chief Executive Officer, stated, “For the Company to maintain its industry leadership, we continuously evaluate and assess our business model to ensure we are optimally aligned with evolving market conditions. We are confident that our efforts will enable our customers to more effectively address their biggest manufacturing challenges, which should lead to increased adoption of our additive technologies. This realignment is critical to ensure that we can achieve our objectives to deliver sustained profitability and cash flow, while remaining ready to capture opportunities when the spending cycle improves, positioning Stratasys to deliver outsized shareholder value.”

Born from the Founder’s idea of making a toy frog with a glue gun, Stratasys (NASDAQ:SSYS) offers 3D printers and related materials, software, and services to many industries.

Custom Parts Manufacturing

Onshoring and inventory management–themes that grew in focus after COVID wreaked havoc on global supply chains–are tailwinds for companies that combine economies of scale with reliable service. Many in the space have adopted 3D printing to efficiently address the need for bespoke parts and components, but all companies are still at the whim of economic cycles. For example, consumer spending and interest rates can greatly impact the industrial production that drives demand for these companies’ offerings.

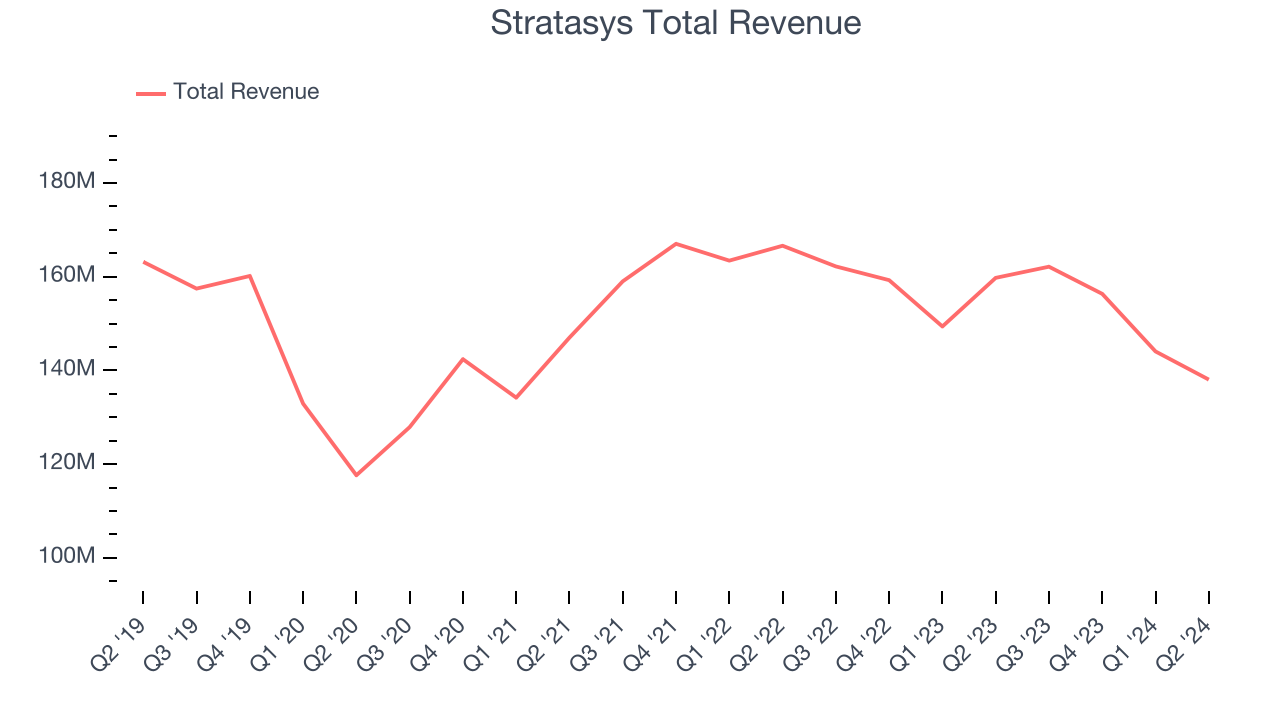

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one tends to grow for years. Over the last five years, Stratasys’s revenue declined by 1.8% per year. This shows demand was weak, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Stratasys’s recent history shows its demand has stayed suppressed as its revenue has declined by 4.3% annually over the last two years.

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Products and Services, which are 67.8% and 32.2% of revenue. Over the last two years, Stratasys’s Products revenue (hard goods like 3D printers) averaged 4.4% year-on-year declines while its Services revenue (service contracts, consulting) averaged 4.1% declines.

This quarter, Stratasys missed Wall Street’s estimates and reported a rather uninspiring 13.6% year-on-year revenue decline, generating $138 million of revenue. Looking ahead, Wall Street expects sales to grow 10.4% over the next 12 months, an acceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

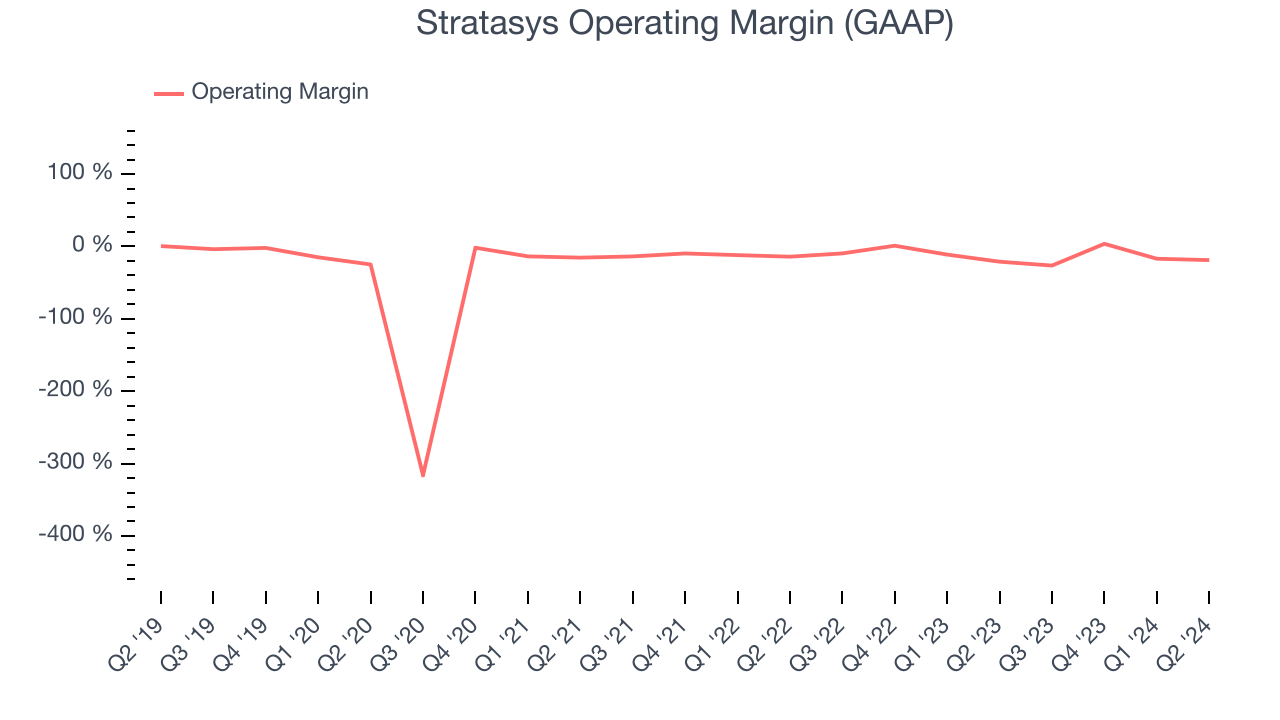

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Unprofitable industrials companies require extra attention because they could get caught swimming naked if the tide goes out. It’s hard to trust that Stratasys can endure a full cycle as its high expenses have contributed to an average operating margin of negative 24.6% over the last five years. This result is surprising given its high gross margin as a starting point.

Looking at the trend in its profitability, Stratasys’s annual operating margin decreased by 4.3 percentage points over the last five years. The company’s performance was poor no matter how you look at it. It shows operating expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Stratasys generated an operating profit margin of negative 18.9%, up 2.2 percentage points year on year. This increase was encouraging, and since the company’s operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as sales, marketing, R&D, and administrative overhead.

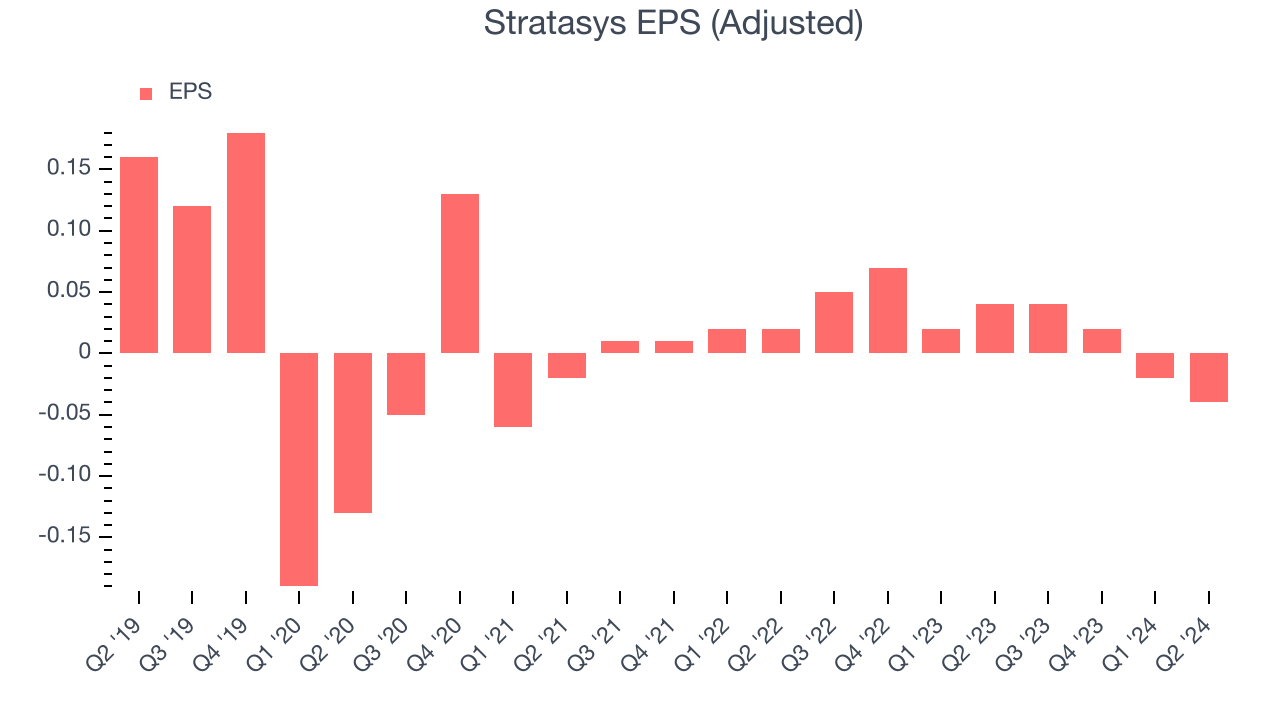

EPS

Analyzing long-term revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Stratasys, its EPS declined more than its revenue over the last five years, dropping by 100% annually. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

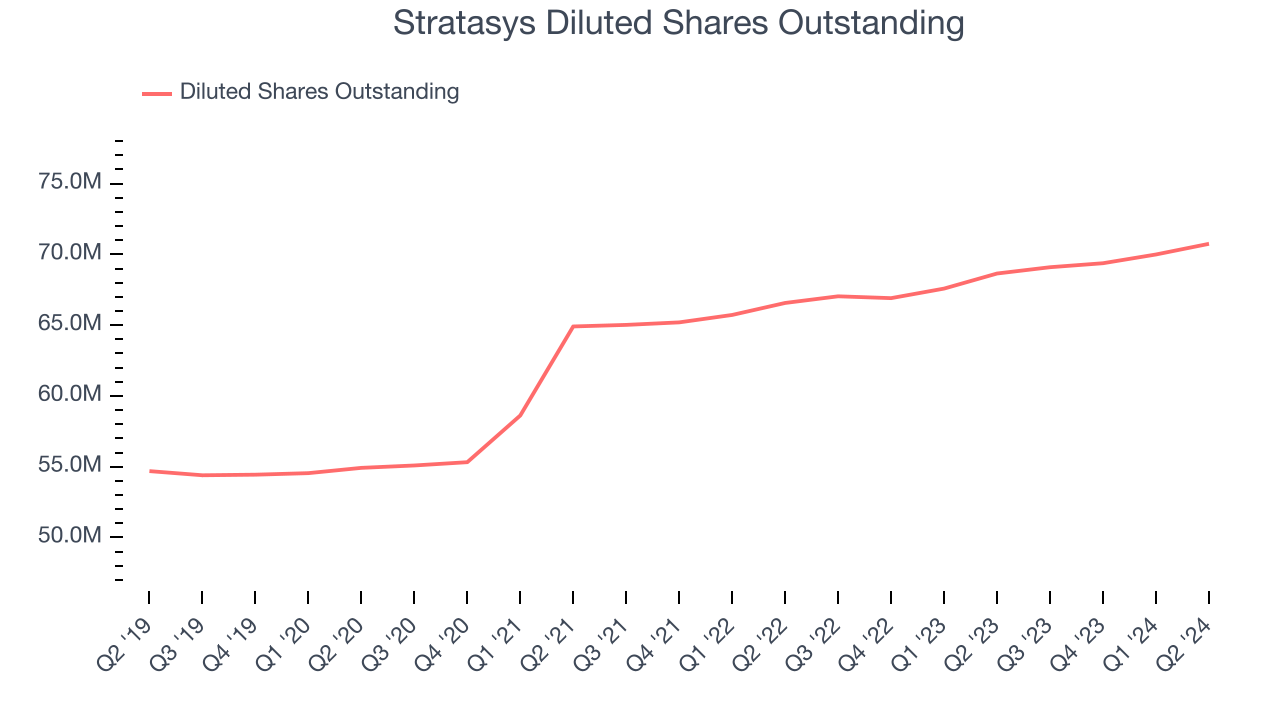

We can take a deeper look into Stratasys’s earnings to better understand the drivers of its performance. As we mentioned earlier, Stratasys’s operating margin improved this quarter but declined by 4.3 percentage points over the last five years. Its share count also grew by 29.4%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we also analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business. For Stratasys, its two-year annual EPS declines of 100% are similar to its five-year trend. These results were bad no matter how you slice the data.

In Q2, Stratasys reported EPS at negative $0.04, down from $0.04 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Stratasys to perform poorly. Analysts are projecting its EPS of $0 in the last year to hit $0.28.

Key Takeaways from Stratasys’s Q2 Results

We enjoyed seeing Stratasys exceed analysts’ EPS expectations this quarter. On the other hand, its full-year revenue, EPS, and EBITDA guidance fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 7% to $7.15 immediately following the results.

Stratasys may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.