Let’s dig into the relative performance of Stratasys (NASDAQ:SSYS) and its peers as we unravel the now-completed Q2 custom parts manufacturing earnings season.

Onshoring and inventory management–themes that grew in focus after COVID wreaked havoc on global supply chains–are tailwinds for companies that combine economies of scale with reliable service. Many in the space have adopted 3D printing to efficiently address the need for bespoke parts and components, but all companies are still at the whim of economic cycles. For example, consumer spending and interest rates can greatly impact the industrial production that drives demand for these companies’ offerings.

The 4 custom parts manufacturing stocks we track reported a softer Q2. As a group, revenues missed analysts’ consensus estimates by 5.1% while next quarter’s revenue guidance was 6.7% below.

Luckily, custom parts manufacturing stocks have performed well with share prices up 10.2% on average since the latest earnings results.

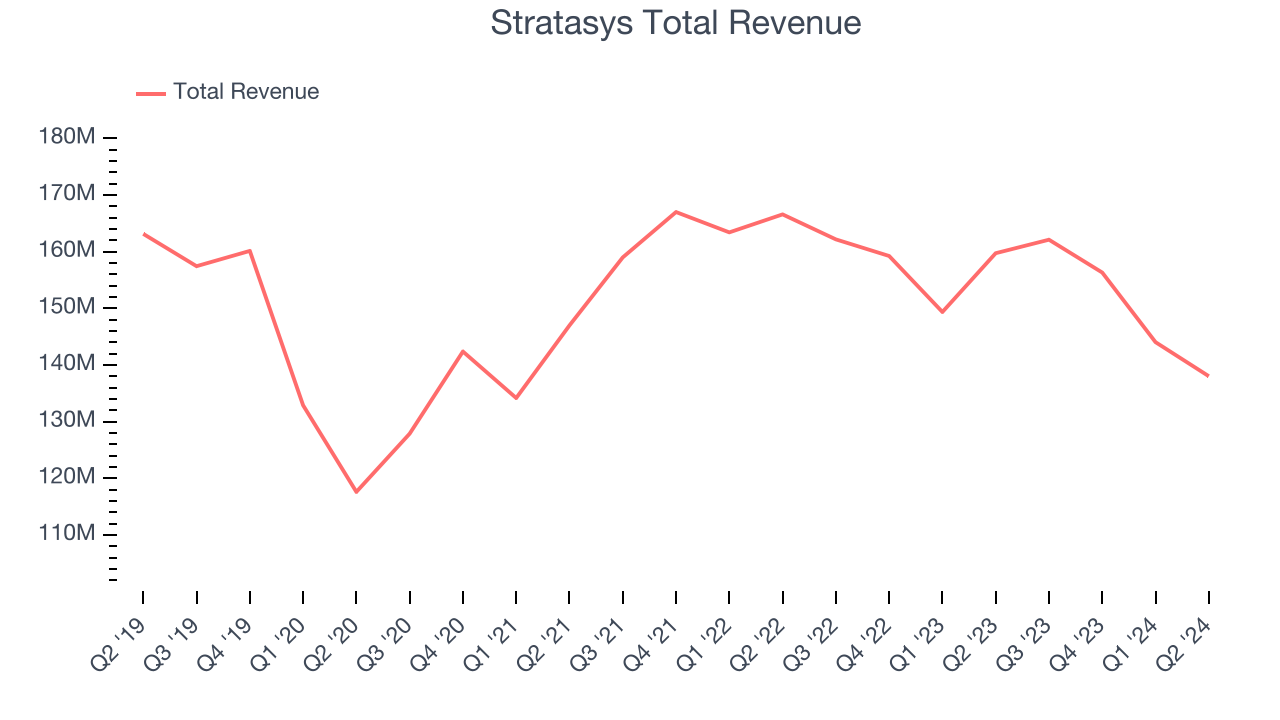

Stratasys (NASDAQ:SSYS)

Born from the Founder’s idea of making a toy frog with a glue gun, Stratasys (NASDAQ:SSYS) offers 3D printers and related materials, software, and services to many industries.

Stratasys reported revenues of $138 million, down 13.6% year on year. This print fell short of analysts’ expectations by 5.7%. Overall, it was a disappointing quarter for the company with full-year revenue guidance missing analysts’ expectations.

Dr. Yoav Zeif, Stratasys’ Chief Executive Officer, stated, “For the Company to maintain its industry leadership, we continuously evaluate and assess our business model to ensure we are optimally aligned with evolving market conditions. We are confident that our efforts will enable our customers to more effectively address their biggest manufacturing challenges, which should lead to increased adoption of our additive technologies. This realignment is critical to ensure that we can achieve our objectives to deliver sustained profitability and cash flow, while remaining ready to capture opportunities when the spending cycle improves, positioning Stratasys to deliver outsized shareholder value.”

Stratasys delivered the weakest full-year guidance update of the whole group. Unsurprisingly, the stock is down 8.8% since reporting and currently trades at $7.01.

Read our full report on Stratasys here, it’s free.

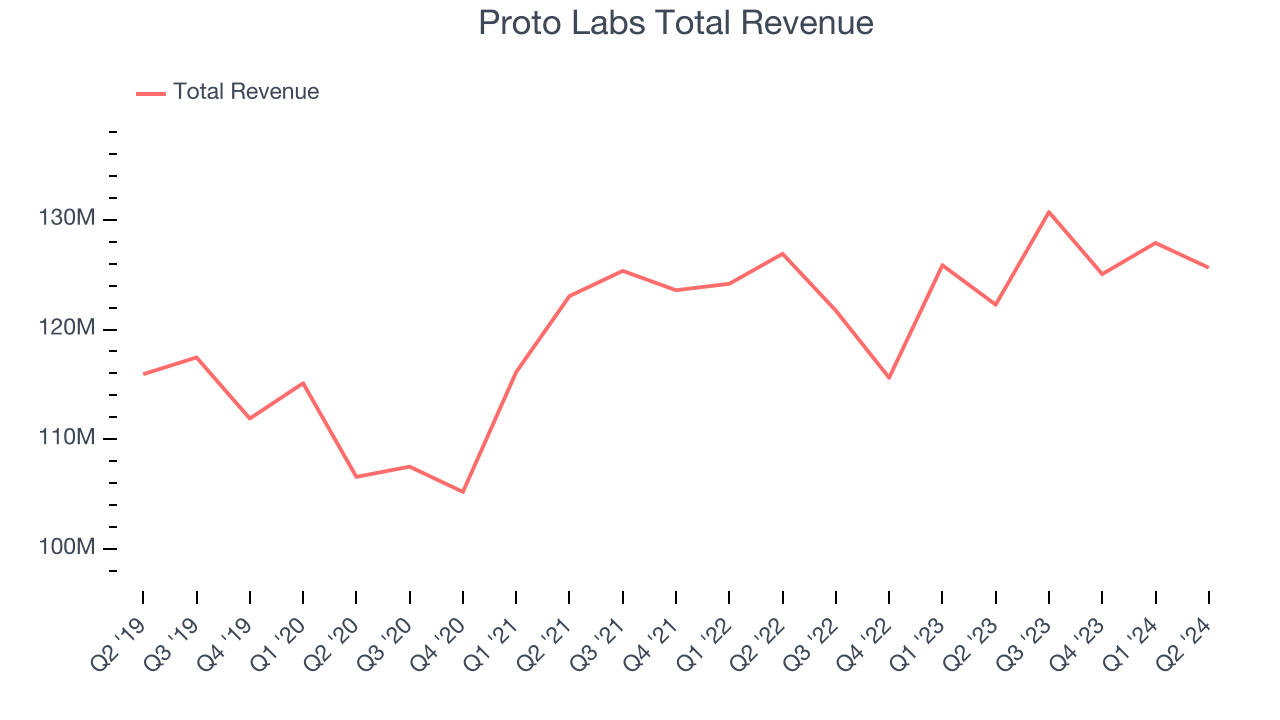

Best Q2: Proto Labs (NYSE:PRLB)

Pioneering the concept of online quoting and manufacturing for custom prototypes and low-volume production parts, Proto Labs (NYSE:PRLB) offers injection molding, 3D printing, and sheet metal fabrication for manufacturers in various industries.

Proto Labs reported revenues of $125.6 million, up 2.8% year on year, in line with analysts’ expectations. The business performed better than its peers, but it was unfortunately a mixed quarter with a decent beat of analysts’ EBITDA estimates but revenue guidance for next quarter missing analysts’ expectations.

Proto Labs delivered the fastest revenue growth among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 16.5% since reporting. It currently trades at $27.98.

Is now the time to buy Proto Labs? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Desktop Metal (NYSE:DM)

Originating from a research lab at MIT, Desktop Metal (NYSE:DM) offers 3D printers, production materials, and software to many industries.

Desktop Metal reported revenues of $38.93 million, down 26.9% year on year, falling short of analysts’ expectations by 14.4%. It was a disappointing quarter as it posted a miss of analysts’ EBITDA and earnings estimates.

Desktop Metal delivered the weakest performance against analyst estimates and slowest revenue growth in the group. The stock is flat since the results and currently trades at $4.90.

Read our full analysis of Desktop Metal’s results here.

Markforged (NYSE:MKFG)

Beginning as a start-up at SolidWorks World–an annual design and engineering conference, Markforged (NYSE:MKFG) offers 3D printers and softwares to manufacturers of various industries.

Markforged reported revenues of $21.69 million, down 14.8% year on year. This number met analysts’ expectations. However, it was a slower quarter as it produced full-year revenue guidance missing analysts’ expectations.

Markforged scored the biggest analyst estimates beat and highest full-year guidance raise among its peers. The stock is up 66.3% since reporting and currently trades at $4.49.

Read our full, actionable report on Markforged here, it’s free.

Market Update

Big picture, the Federal Reserve has a dual mandate of inflation and employment. The former had been running hot throughout 2021 and 2022 but cooled towards the central bank's 2% target as of late. This prompted the Fed to cut its policy rate by 50bps (half a percent) in September 2024. Given recent employment data that suggests the US economy could be wobbling, the markets will be assessing whether this rate and future cuts (the Fed signaled more to come in 2024 and 2025) are the right moves at the right time or whether they're too little, too late for a macro that has already cooled.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.