Online survey platform SurveyMonkey (NASDAQ:SVMK) reported Q1 FY2021 results beating Wall St's expectations, with revenue up 15.8% year on year to $102.2 million. SurveyMonkey made a GAAP loss of $29.6 million, down on it's loss of $24.2 million, in the same quarter last year.

Get access to the fastest analysis of earnings results on the market. Get investing superpowers with StockStory. Signup here for early access.

SurveyMonkey (NASDAQ:SVMK) Q1 FY2021 Highlights:

- Revenue: $102.2 million vs analyst estimates of $100.8 million (1.39% beat)

- EPS (non-GAAP): -$0.02 vs analyst estimates of -$0.02

- Revenue guidance for Q2 2021 is $107 million at the midpoint, above analyst estimates of $106 million

- The company reconfirmed revenue guidance for the full year, at $443.5 million at the midpoint

- Free cash flow of $15 million, up 59% from previous quarter

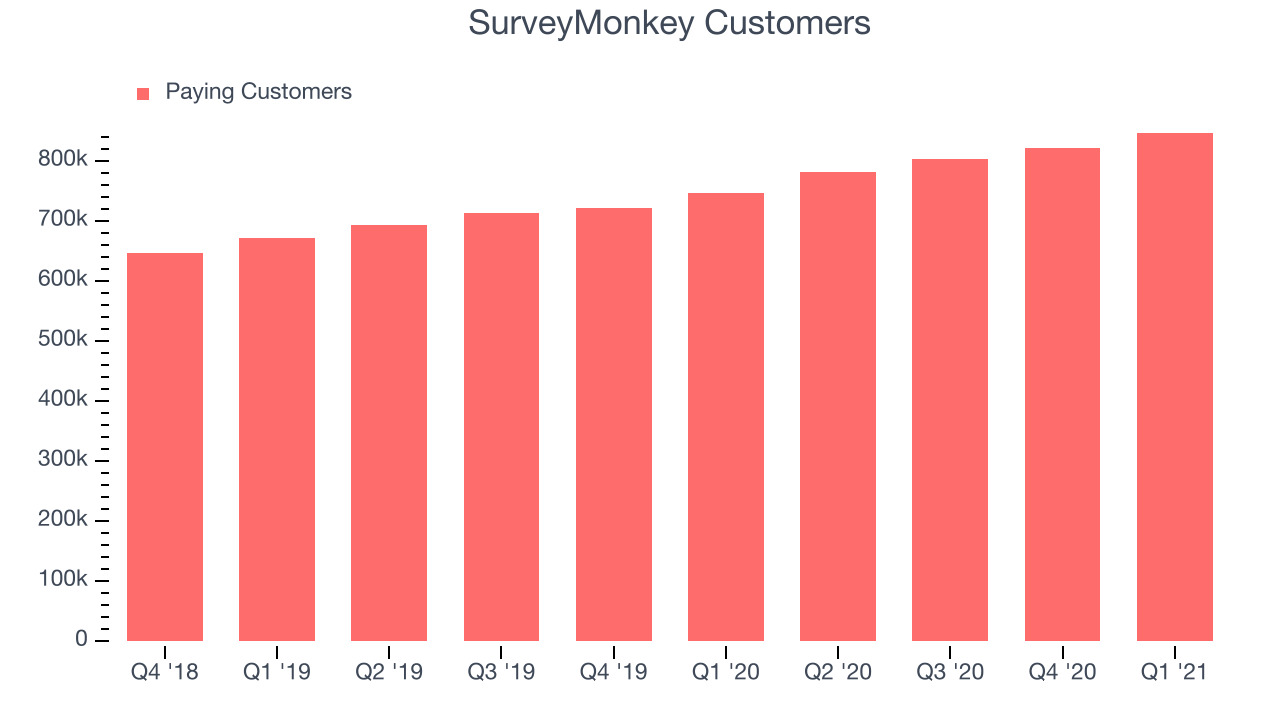

- Customers: 845,800, up from 820,300 in previous quarter

- Gross Margin (GAAP): 79.6%, in line with previous quarter

“Our first quarter can be summarized in one word: execution,” said Zander Lurie, chief executive officer of SurveyMonkey. “We are moving up-market through agile, AI-powered solutions that help customers like Cedars Sinai, Glassdoor, Kawasaki Motors, and The Very Group manage their stakeholders’ experiences."

A Leader In Survey Software

The story of SurveyMonkey starts in the the '90s when the co-founder Ryan Finley got tasked by the marketing department of the company he was working for to create a survey and send it to their customers. The frustrating experience of using the tools then available led him to quit his job and start a new company. Founded in 1999, SurveyMonkey (NASDAQ:SVMK) offers software as a service that makes it easy for users create, manage and distribute online surveys.

Is the software we are building something people actually want? How will customers respond to our new marketing campaign? Are my employees satisfied? Answers to questions like these are critical to success of many businesses and SurveyMonkey makes it easy for people to get feedback by enabling them to create surveys, quizzes, and polls and automatically analyze the results. The company offers hundreds of templates with focus on product, market and employee feedback and also allows customers to design their own survey. SurveyMonkey can source the survey respondents and provide guidance with research methodology to make sure that the results will be useful.

A lot of research used to be done in person using pen and paper, so SurveyMonkey might somewhat benefit from an environment where work is done remotely. But the biggest driver of the business is an increased pressure on efficiency of marketing budgets, as more teams now do the research in-house using DIY tools rather than hiring an outside agency to do it. SurveyMonkey competes with Qualtrics (NASDAQ:XM), Google Forms and a range of smaller companies like Typeform.

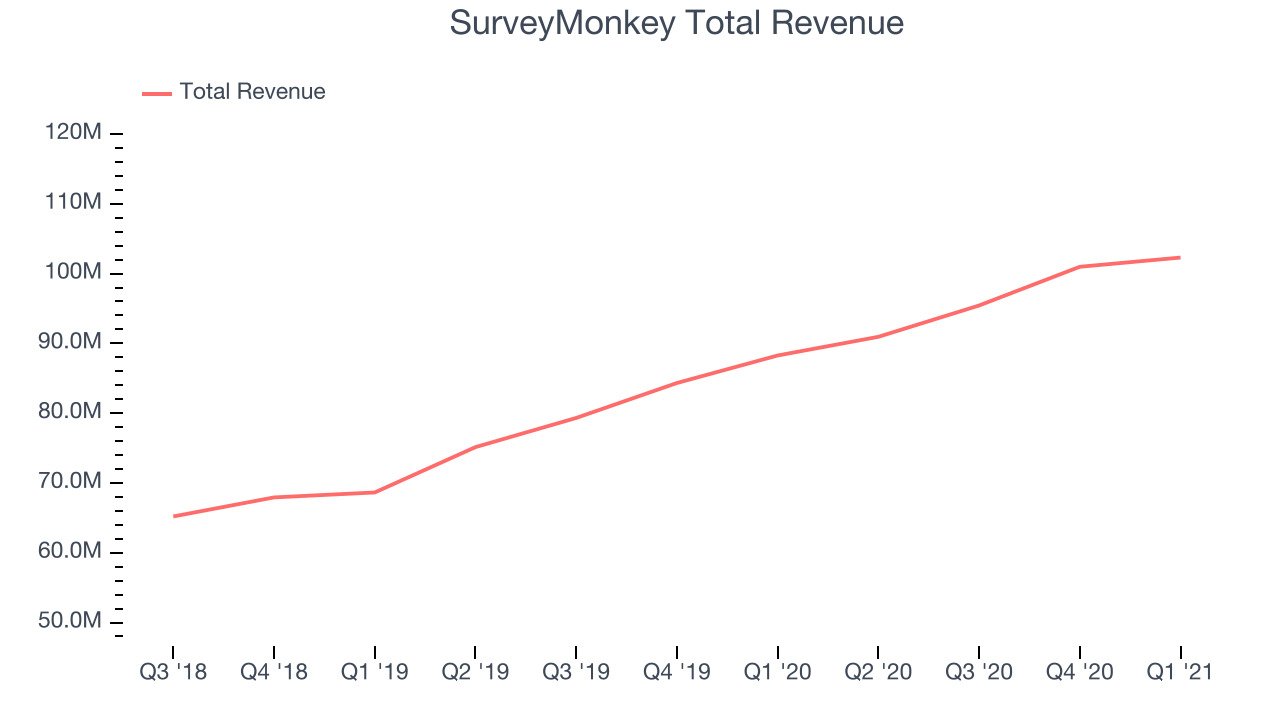

As you can see below, SurveyMonkey's revenue growth has been strong over the last twelve months, growing from $88.2 million to $102.2 million.

This quarter, SurveyMonkey's quarterly revenue was once again up 15.8% year on year. We can see that revenue increased by just $1.32 million in Q1, down from $5.54 million in Q4 2020. Having said that, we wouldn't be too concerned about the slowdown in a single quarter, because macroeconomic and luck can easily impact a company's growth in the short term, but it's nonetheless worth keeping in mind.

Go To Market

Surveys are naturally a viral product and SurveyMonkey actively leverages that as a part of their customer acquisition strategy. The company adds its branding into the surveys, with the aim of turning some of the survey respondents into SurveyMonkey customers themselves.

You can see below that SurveyMonkey reported 845,800 customers at the end of the quarter, an increase of 25,500 on last quarter. That is quite a bit better customer growth than last quarter and in line with what we have seen in previous quarters, demonstrating the company has the sales momentum required to drive continued growth. We've no doubt shareholders will take this as an indication that the company's go-to-market strategy is running smoothly.

Key Takeaways from SurveyMonkey's Q1 Results

With market capitalisation of $2.47 billion SurveyMonkey is among smaller companies, but its more than $247.4 million in cash and positive free cash flow over the last twelve months give us confidence that SurveyMonkey has the resources it needs to pursue a high growth business strategy.

We were very impressed by SurveyMonkey’s very strong acceleration in customer growth this quarter. And we were also glad that the revenue guidance for the next quarter exceeded analysts' expectations. On the other hand, SurveyMonkey is growing a bit slower compared to the top SaaS companies. Overall, this quarter's results seemed pretty positive and shareholders can feel optimistic. Therefore, we think SurveyMonkey will become more attractive to investors, compared to before these results.

Get access to insights until now only reserved for the top hedge funds. Discover great tech investments the market is overlooking. Get investing superpowers with StockStory. Signup here for early access.

The author has no position in any of the stocks mentioned.