IT project management software company, Atlassian (NASDAQ:TEAM) reported Q3 FY2021 results that beat analyst expectations, with revenue up 38.1% year on year to $568 million. Atlassian made a GAAP profit of $159 million, improving on its loss of $158 million, in the same quarter last year.

Atlassian (NASDAQ:TEAM) Q3 FY2021 Highlights:

- Revenue: $568 million vs analyst estimates of $531 million (6.92% beat)

- EPS (non-GAAP): $0.48 vs analyst estimates of $0.29 ($0.19 beat)

- Revenue guidance for Q4 2021 is $520 million at the midpoint, above analyst estimates of $505 million

- Free cash flow of $360 million

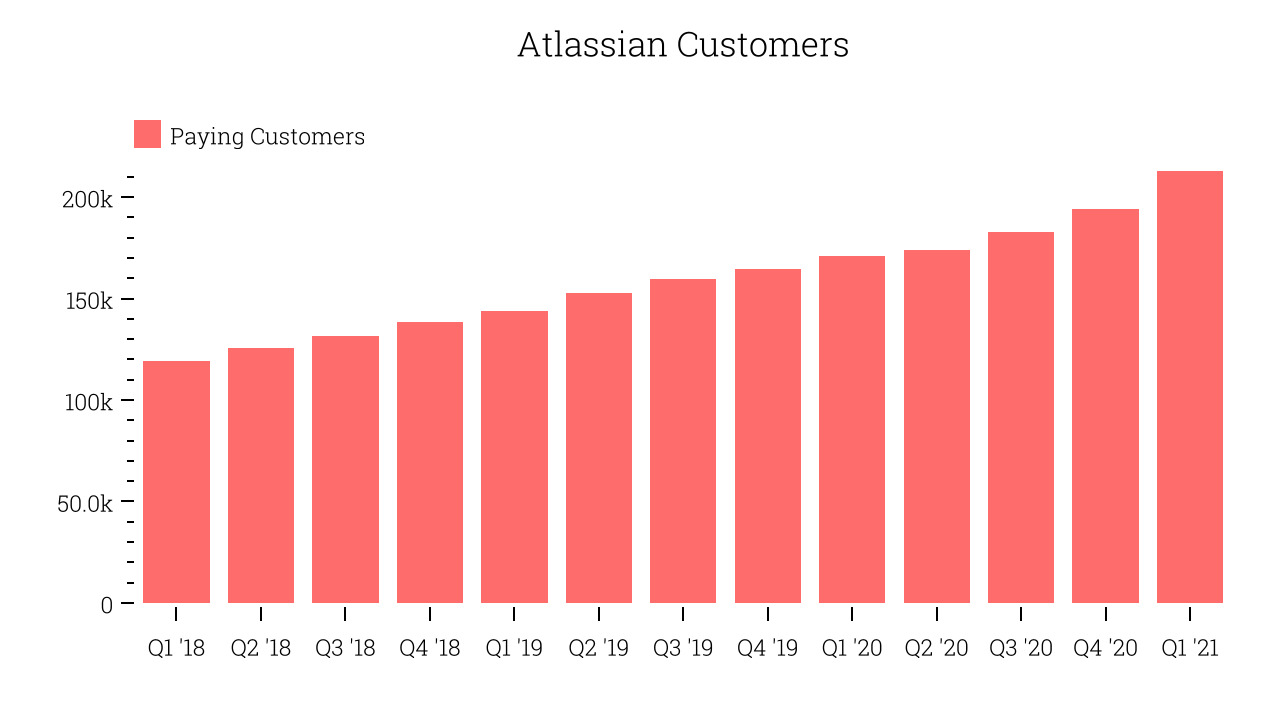

- Customers: 212,807, up from 194,334 in previous quarter

- Gross Margin (GAAP): 85%, up from 84.1% previous quarter

Cloud Software From The Land Down Under

Atlassian was founded by Australian co-CEOs Mike Cannon-Brookes and Scott Farquhar in 2002. The pair, who attended university together in Sydney, used $10,000 in credit card debt to get the company going. Atlassian (NASDAQ:TEAM) provides software as a service that makes it easier for large teams of software developers to manage projects, especially in software development.Atlassian’s software platforms such as Jira, Confluence, Trello and Bitbucket, help staff at diverse organisations manage, maintain and develop their technology stacks, as well as drive and track collaboration more generally. For example, Jira Core is a project and task management solution that anyone in an organization can use to plan, track, and report on projects, splitting each task up into multiple steps, and facilitating code review and testing. Meanwhile, Confluence provides a workspace on the cloud for individuals to collaborate on their projects and Bitbucket is used to store and deploy codebase. If software is eating the world, as Marc Andreessen says, then Atlassian is very well positioned to benefit, since it provides the software that software developers use to do their jobs. Because Atlassian has a number of products, it has a wide array of competitors, even if few offer an equally comprehensive suite. Notable competitors include Microsoft (NASDAQ:MSFT), which owns Github, a competitor to Jira, and Asana (NYSE:ASAN) which is arguably a competitor to Confluence and Trello.

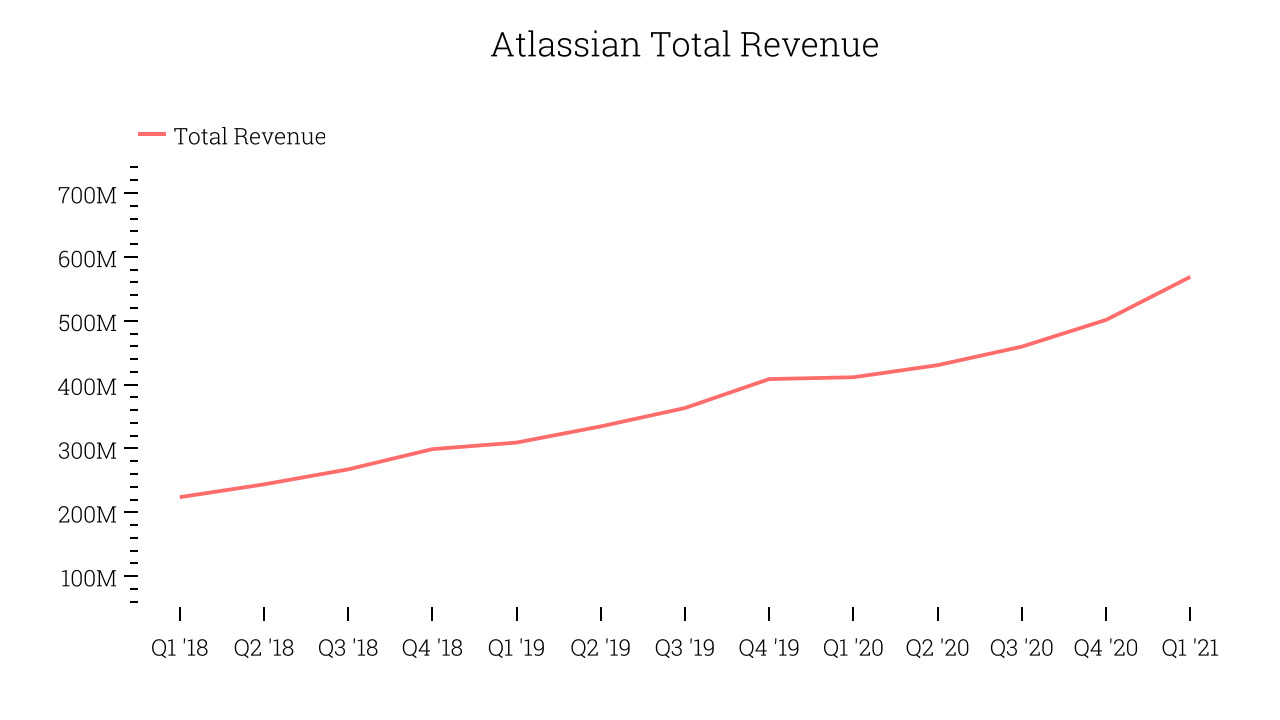

As you can see below, Atlassian's revenue growth has been very strong over the last twelve months, growing from $411 million to $568 million.

And unsurprisingly, this was another great quarter for Atlassian with revenue up an absolutely stunning 38.1% year on year. On top of that, revenue increased $67.3 million quarter on quarter, a very strong improvement on the $41.8 million increase in Q2 2021, and a sign of re-acceleration of growth.

Atlassian has won some of the world's best known companies as customers, such as IBM, Twitter and Zoom, to name just a few. Atlassian is somewhat remarkable amongst software companies for its low touch, or self serve sales process. Although the company now has enterprise advocates to help its larger customers, it operated for many years by relying heavily on word of mouth marketing. With time, its ubiquity has become a strength, as so many technology workers have become accustomed to its products.

You can see below that Atlassian reported 212,807 customers at the end of the quarter, an increase of 18,473 on last quarter. That is quite a bit better customer growth than last quarter and quite a bit above the typical customer growth we have seen lately, demonstrating that the business itself has good sales momentum. We've no doubt shareholders will take this as an indication that the company's go-to-market strategy is working very well.

Key Takeaways from Atlassian's Q3 Results

With market capitalisation of $59 billion, more than $1.56 billion in cash and with free cash flow over the last twelve months being positive, the company is in a very strong position to invest in growth.

We were very impressed by Atlassian’s very strong acceleration in customer growth this quarter. And we were also excited to see it that it outperformed Wall St’s revenue expectations. Zooming out, we think this impressive quarter should have shareholders feeling very positive. Therefore, we think Atlassian will continue to stand out as a very compelling growth stock, arguably even more so than before.

The author has no position in any of the stocks mentioned.