Workforce housing company Target Hospitality (NASDAQ:TH) reported results ahead of analysts' expectations in Q2 CY2024, with revenue down 29.9% year on year to $100.7 million. On the other hand, the company's full-year revenue guidance of $380 million at the midpoint came in 1.3% below analysts' estimates. It made a GAAP profit of $0.18 per share, down from its profit of $0.44 per share in the same quarter last year.

Is now the time to buy Target Hospitality? Find out in our full research report.

Target Hospitality (TH) Q2 CY2024 Highlights:

- Revenue: $100.7 million vs analyst estimates of $98.6 million (2.2% beat)

- EPS: $0.18 vs analyst estimates of $0.17 (8% beat)

- The company dropped its revenue guidance for the full year from $417.5 million to $380 million at the midpoint, a 9% decrease

- Gross Margin (GAAP): 46.5%, down from 57.3% in the same quarter last year

- EBITDA Margin: 51.8%, down from 63.3% in the same quarter last year

- Free Cash Flow of $32.01 million, down 23.4% from the previous quarter

- Utilized Beds: 14,370 at quarter end

- Market Capitalization: $893.5 million

"The second quarter performance illustrates the benefits of our efficient operating model and network capabilities which allow us to provide premium solutions to our world-class customers, while simultaneously delivering strong financial results," stated Brad Archer, President and Chief Executive Officer.

Essentially a builder of mini communities, Target Hospitality (NASDAQ:TH) is a provider of specialty workforce lodging accommodations and services.

Hotels, Resorts and Cruise Lines

Hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Sales Growth

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Target Hospitality's 8.4% annualized revenue growth over the last five years was sluggish. This shows it failed to expand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or emerging trend. Target Hospitality's annualized revenue growth of 15.3% over the last two years is above its five-year trend, suggesting some bright spots.

This quarter, Target Hospitality's revenue fell 29.9% year on year to $100.7 million but beat Wall Street's estimates by 2.2%. We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates. This signals Target Hospitality could be a hidden gem because it doesn't get attention from professional brokers.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

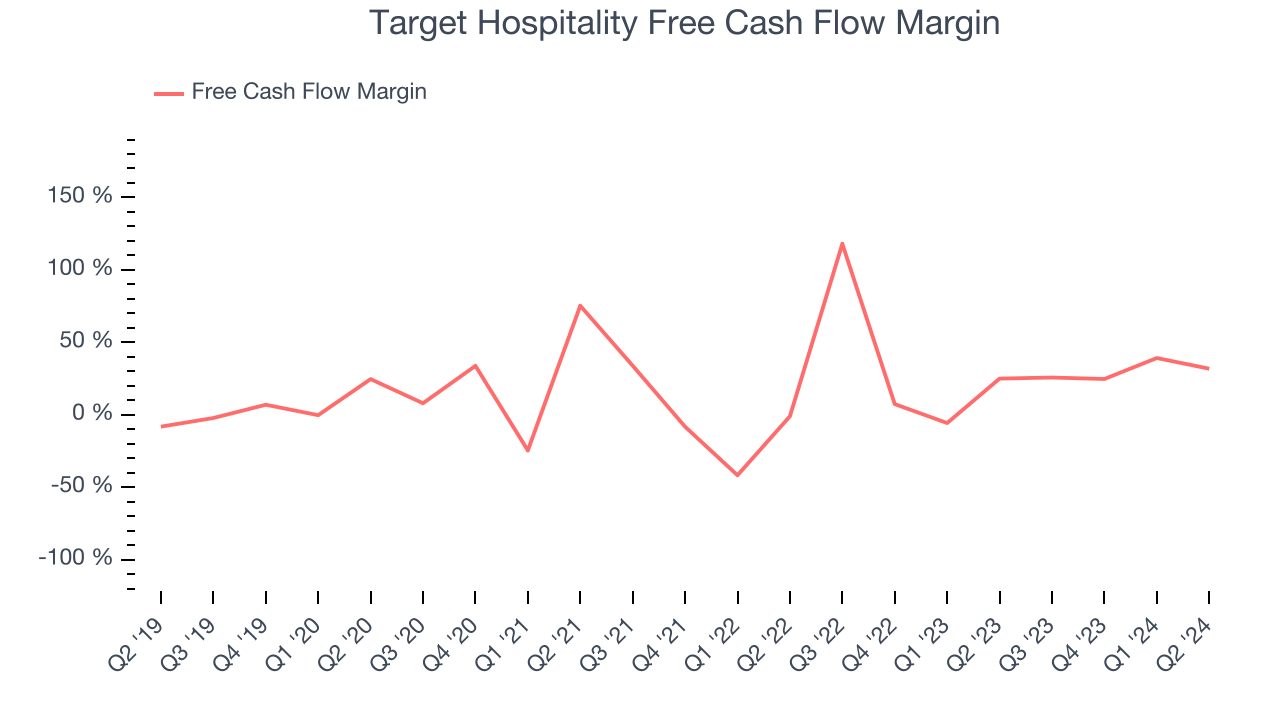

Target Hospitality has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cash cushion. The company's free cash flow margin was among the best in the consumer discretionary sector, averaging an eye-popping 34.1% over the last two years.

Target Hospitality's free cash flow clocked in at $32.01 million in Q2, equivalent to a 31.8% margin. This quarter's result was good as its margin was 6.8 percentage points higher than in the same quarter last year, but we note it was lower than its two-year cash profitability. Nevertheless, we wouldn't read too much into a single quarter because investment needs can be seasonal, leading to short-term swings. Long-term trends are more important.

Key Takeaways from Target Hospitality's Q2 Results

It was good to see Target Hospitality beat analysts' revenue expectations this quarter. We were also glad its EPS outperformed Wall Street's estimates. On the other hand, its full-year revenue guidance was underwhelming. Overall, this was a mixed quarter for Target Hospitality. The stock traded up 5.4% to $9.40 immediately following the results.

So should you invest in Target Hospitality right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.